Stainless Steel Market Size, Share, Trends, & Industry Analysis Report

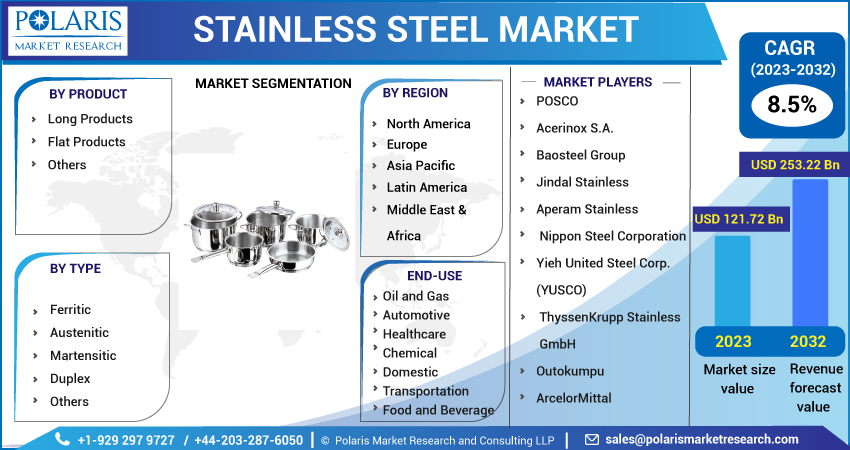

By Product (Long Products, Flat Products), By Type, By End-Use, By Region – Market Forecast, 2025–2034

- Published Date:Oct-2025

- Pages: 119

- Format: PDF

- Report ID: PM1151

- Base Year: 2024

- Historical Data: 2020-2023

What is Stainless Steel Market Size?

The global stainless steel market was valued at USD 124.08 billion in 2024 and is expected to grow at a CAGR of 6.9% during the forecast period. The growth is driven by expansion of construction industry and rising demand from the automotive industry.

Key Insights

- The long product segment is expected to witness significant growth during the forecast period due to growing construction activities.

- The automotive dominated with largest share in 2024 due to its use in manufacturing of various automotive parts & components.

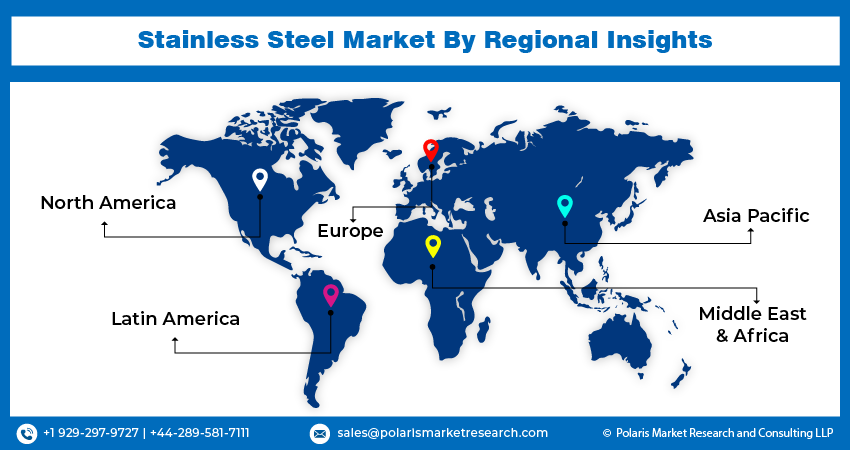

- Asia Pacific dominated with largest share in 2024 due to the increase in urbanization and industrialization.

- North America is projected to accounted for a significant share in the global market driven by rising focus on infrastructure modernization.

Industry Dynamics

- The growth of the automotive industry is fueling the market growth.

- The rising demand from construction sector is driving the growth.

- The increasing governmental and private expenditures on infrastructure is boosting the industry growth.

- High production cost due to volatile raw material prices, especially nickel and chromium is limiting the growth.

Market Statistics

- 2024 Market Size: USD 124.08 Billion

- 2034 Projected Market Size: USD 240.76 Billion

- CAGR (2025-2034): 6.9%

- Largest Market: Asia Pacific

To Understand More About this Research: Request a Free Sample Report

Stainless steel is an alloy primarily made of iron, with at least 10.5% chromium, which provides corrosion resistance. It often includes other elements like nickel, molybdenum, or manganese to enhance strength, durability, and resistance to extreme temperatures or chemicals. Commonly used in construction, medical instruments, kitchenware, and automotive parts, stainless steel is valued for its strength, hygiene, and long service life

Increase in demand for stainless steel in both household and business catering purposes owing to its corrosion resistance and ease of maintenance is driving market revenue growth. Various stainless steel grades are used for various applications depending on the demand for corrosion resistance. For instance, stainless steel grades 410 and 420 are typically used to make kitchen knives, while stainless steel grades 304 are used to make forks and spoons. Less ductile steels, which are used for items that require a lot of mounding, are used to make cookware such as pans, grills, sinks, and cookware.

Industry Dynamics

What are the Factors Driving the Stainless Steel Market?

The demand for the product is increasing due to the automobile industry's rapid growth. Corrosion resistance, great strength, and heat resistance are the best qualities provided by these types of metals. For instance, according to the World Steel Organization, stainless steel will soon be used in catalytic converters, fuel tanks, chassis, bodywork, and suspension systems. The acceptance of new products will also be aided by the growing technological development in the automotive sector and the expanding innovation in electric vehicles. As a result, growing product demand from automakers will fuel the expansion of the stainless steel market.

The market will have profitable potential to expand significantly as product consumption in the construction industry rises. This kind of steel was initially not frequently used for structural purposes in buildings due to its expensive price. However, during the past ten years, technological developments have reduced the cost and increased the availability of this steel, as well as its durability and resistance to corrosion, which is fueling the adoption in the construction industry. The demand for the product is rising to meet construction needs and provide improvements and aesthetic appeal for buildings. The construction industry is experiencing growth due to the rising number of commercial and residential structures as well as the rising commissioning of infrastructure projects. Therefore, during the predicted period, these variables will improve the product demand. Due to governmental and private expenditures being made in infrastructure along with residential housing, the demand for stainless steel is rising.

Report Segmentation

The market is primarily segmented based on product, type, end-use, and region.

|

By Product |

By Type |

By End-Use |

By Geography |

|

|

|

|

Why Automotive Segment Dominated with Largest Share in 2024?

The automotive segment dominated with largest share in 2024 due to its use in the manufacturing of various automotive parts & components which includes basic vehicle frames for mufflers, fuel tanks, hoods, and doors. Iron together with stainless steel contributes nearly 70% of the total vehicle weight which drives the demand. Moreover, the expansion of the automotive industry also drives the segment growth. For instance, in 2021, according to the world steel association, the automotive sector accounts for a 12% major share of global steel consumption. Furthermore, the demand for stainless steel, particularly in the transportation and domestic sector of industries, is expected to increase due to the ongoing industrial revolution and the growing number of manufacturing facilities in developing regions such as Asia Pacific region, further driving the segment growth.

Which Segment by Product is Expected to Witness Significant Growth?

The long product is expected to witness significant growth during the forecast period due to rising construction activities. The construction activities in major developing countries such as India, China, and Brazil. As a result, the demand for the long stainless-steel products such as bars, rods, wires, angles for reinforcement, structural strength, and corrosion resistance are rising. Moreover, the demand for long products from industrial sector is rising due to rising global demand for wide range of goods. These products are actively used in used in automotive, shipbuilding, railways, oil & gas, energy, and heavy machinery. These industries require high-strength and corrosion-resistant materials, making stainless steel long products ideal, thereby driving the segment growth.

How Asia Pacific Captured Largest Share in 2024?

The Asia Pacific dominated with largest share in 2024 due to rising urbanization and industrialization. The region is witnessing one of the most rapid urban migrations in countries such as India, China, and Japan. This rise in the urbanization is fueling the demand for the infrastructure such as residential, commercial buildings, roads, bridges. As a result, the demand for the stainless steel is rising. Moreover, this urbanization is fueling the demand for the personal vehicles and public transport fleets, which in turn is fueling the demand for the stainless steel from automotive industry, thereby driving the growth in the region.

What are the Reasons for North America’s Significant Growth?

The North America is expected to witness significant growth during the forecast period due to rising focus on infrastructure modernization. The region is actively investing in upgrading bridges, highways, public transit, and water systems, due to which the demand for the stainless steel is rising. Stainless steel is ideal for infrastructure due to its corrosion resistance, strength, and long life. Additionally, the demand for high-strength, lightweight automotive components is increasing in the region, which is further driving the demand for the stainless steel. The region is one of the largest manufacturer and seller of electric vehicle, thereby driving the demand for the stainless steel in the region.

Competitive Insight

Some of the prominent players in the stainless-steel market include Nippon Steel Corporation, Acerinox S.A., Jindal Stainless, ArcelorMittal, POSCO, Aperam Stainless, Baosteel Group, ThyssenKrupp Stainless GmbH, Yieh United Steel Corp. (YUSCO), Outokumpu.

Recent Developments

- October 2025, Jindal Stainless launched its first stainless steel fabrication unit in Patalganga, Mumbai, aiming to serve the bridge sector and achieve 18,000 tones annual capacity by FY27, strengthening its infrastructure solutions footprint.

- February 2021, VINCO introduced a new line of steel wires and slings. These goods are typically employed in the fishing, industrial, and height-raise sectors.

- December 2021, Aperam completed the acquisition of ELG. ELG is a global recycler of superalloys and stainless steel. The acquisition has improved the industry's leadership position in environmental, social, and government issues. Aperam's industry-leading environmental footprint is further enhanced by investing in sustainable recycling, which also helps the company's CO2 reduction goals.

- May 2022, Jindal Stainless started working with Alstom as a dealer to create cutting-edge trainsets for the Regional Transit System.

- April 2023: Jindal Stainless revealed major acquisition and expansion plans to augment its melting and downstream capacities. The company announced investments of USD ∼691.33 million (INR 5400 crore) to achieve its goal of becoming one of the largest steel producers globally.

- July 2023: Jindal Stainless Limited (JSL), India’s largest stainless steel manufacturing company, completed the acquisition of Jindal United Steel Limited (JUSL). With the transaction, JUSL has become a 100% owned subsidiary of JSL.

Stainless Steel Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 124.08 billion |

| Market size value in 2025 | USD 132.40 billion |

|

Revenue forecast in 2034 |

USD 240.76 billion |

|

CAGR |

6.9% from 2025 - 2034 |

|

Base year |

2024 |

|

Historical data |

2020 - 2023 |

|

Forecast period |

2025 - 2034 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Segments covered |

By Product, By Type, By End-Use, By Geography |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Key companies |

POSCO, Acerinox S.A., Baosteel Group, Jindal Stainless, Aperam Stainless, Nippon Steel Corporation, Yieh United Steel Corp. (YUSCO), ThyssenKrupp Stainless GmbH, Outokumpu, ArcelorMittal |

FAQ's

• The market size was valued at USD 124.08 Billion in 2024 and is projected to grow to USD 240.76 Billion by 2034.

• The market is projected to register a CAGR of 6.9% during the forecast period.

• A few of the key players in the market are POSCO, Acerinox S.A., Baosteel Group, Jindal Stainless, Aperam Stainless, Nippon Steel Corporation, Yieh United Steel Corp. (YUSCO), ThyssenKrupp Stainless GmbH, Outokumpu, ArcelorMittal.

• The automotive segment accounted for the largest market share in 2024.

• The long product is expected to record significant growth.