Potassium Hydroxide Market Size, Share, Trends, & Industry Analysis Report

By Form (Liquid, Pellets, Flakes, and Powder), By Grade, By Application, and By Region – Market Forecast, 2025–2034

- Published Date:Jul-2025

- Pages: 120

- Format: PDF

- Report ID: PM6028

- Base Year: 2024

- Historical Data: 2020-2023

Overview

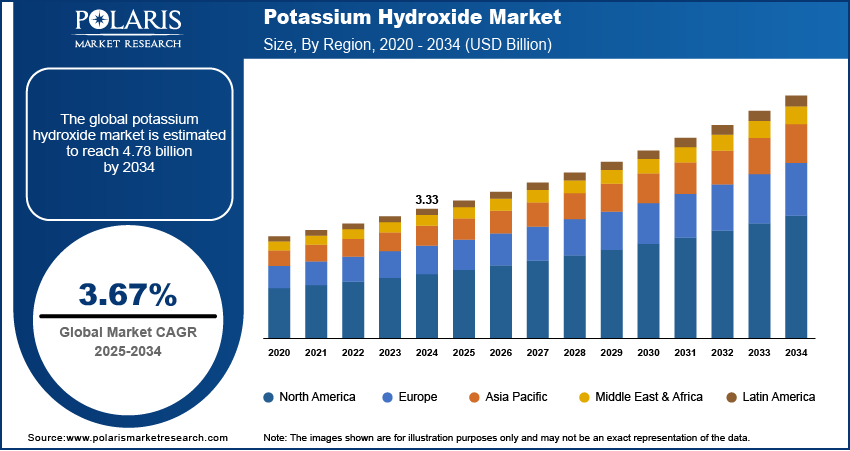

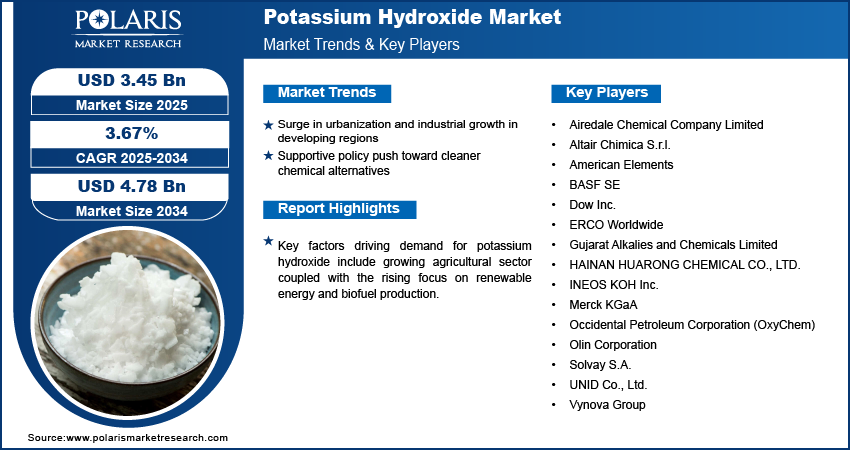

The global potassium hydroxide market size was valued at USD 3.33 billion in 2024, growing at a CAGR of 3.67% from 2025–2034. Surge in urbanization and industrial growth coupled with supportive policy push toward cleaner chemical alternatives is driving the demand for potassium hydroxide globally.

Key Insights

- The liquid form segment accounted for largest market share in 2024.

- The pharmaceutical grade segment is projected to grow at the fastest rate over the forecast period, due to stringent quality requirements in drug formulation and rising demand for high-purity KOH in medical and personal care applications.

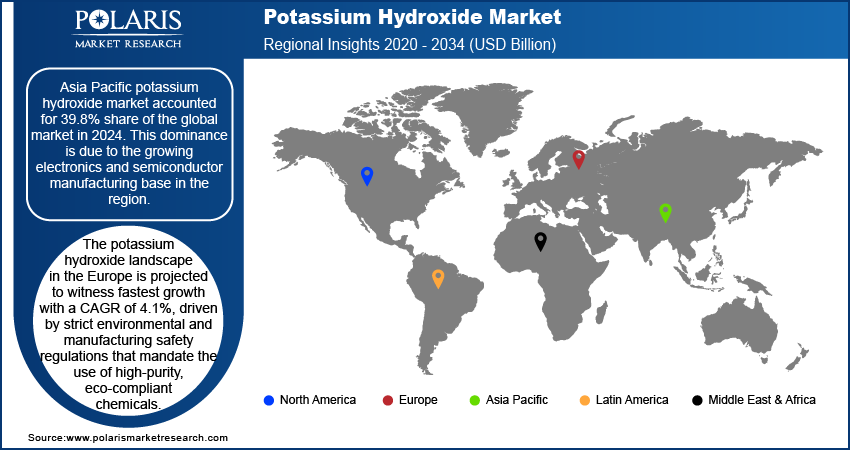

- The Asia Pacific potassium hydroxide market accounted for 39.8% of the global market share in 2024.

- The China potassium hydroxide market held largest regional share of the Asia Pacific market in 2024, driven by rapid industrial growth and infrastructure development, resulting in widespread usage of potassium hydroxide across multiple manufacturing sectors.

- The market in North America is projected to grow at a CAGR of 29.9% from 2025-2034, due to its increasing role in energy storage technologies and environmentally focused manufacturing.

- The market in the US is expanding due to the growing agricultural and chemical industry.

Potassium hydroxide (KOH) is an inorganic compound commonly known as caustic potash, it is widely utilized in the production of potassium-based chemicals, soaps, detergents, fertilizers and alkaline batteries. KOH is a key reactant and processing agent across multiple industrial applications due to its high solubility, strong alkalinity and ability to absorb carbon dioxide and moisture. Its versatility in organic synthesis and formulation of specialty chemicals further enhances its demand across regional markets.

The growing agricultural sector is driving the growth of the potassium hydroxide market globally. These compounds help improve soil pH, enhance nutrient uptake, and support higher crop yields. According to the China's Agricultural and Rural Development Trends 2024 report, China’s agricultural industry generated approximately USD 1.24 trillion in 2023, reflecting a 4.1% year-on-year growth and accounting for 7.12% of the nation’s total GDP. This highlights the increasing demand for potassium-based inputs to maintain soil health and crop productivity. Rising crop yields and soil quality enhancement are among the top priorities in regions such as Asia Pacific, Latin America, and Sub-Saharan Africa. Thus, the growing focus on fertilizer efficiency is boosting the demand for KOH as a key intermediate compound in agriculture.

Additionally, the rising focus on renewable energy and biofuel production is fueling the demand for KOH in the energy sector. The compound is commonly used in transesterification reactions for biodiesel production. This demand is driven by supportive policy frameworks for clean energy in the US, EU, Brazil, and parts of Asia, where biofuels are integrated into national energy strategies. Favorable government mandates and tax incentives to boost clean energy capacity are pushing refineries and biodiesel producers to adopt KOH in large-scale operations.

Industry Dynamics

- Rapid urbanization and industrial expansion in developing regions is accelerating the demand for potassium hydroxide, in applications such as chemical manufacturing, textiles, fertilizers, and industrial cleaning.

- Rising government policy support for cleaner, safer, and low-toxicity chemical alternatives is pushing end-users to shift toward potassium hydroxide over traditional harsher substances in environmental, agrochemical, and industrial applications.

- Environmental concerns related to improper disposal and potential soil and water contamination are restraining the widespread adoption of potassium hydroxide, in small and less-regulated production facilities.

- Increasing focus on bio-based plastics and eco-friendly surfactants presents an emerging opportunity for potassium hydroxide, as it plays a key role in the synthesis of biodegradable compounds and green formulations.

Surge in Urbanization and Industrial Growth in Developing Regions

The increasing urbanization and industrialization across emerging economies is significantly boosting the growth of the potassium hydroxide (KOH) market. For example, United Nations (UN) report estimates that urban areas are projected to grow by an additional 2.5 billion people by 2050, driven by the ongoing global transition from rural to urban living. Rapid infrastructure development is increasing the usage of KOH-based construction chemicals, including alkaline cleaners, paint removers and pH regulators used in cement formulations. In addition, growing demand for industrial cleaning agents in manufacturing and food processing sectors is boosting consumption of KOH across these high-growth geographies.

Supportive Policy Push Toward Cleaner Chemical Alternatives

Rising supportive policy for sustainable industrial practices is fueling the adoption of potassium hydroxide in environmental and chemical sectors. Governments across the US, Europe, and Asia are shifting toward biodegradable, low-toxicity and recyclable reagents for improved compliance with safety and environmental standards. The US Environmental Protection Agency (EPA) is expanding its significant new alternatives policy (SNAP) program to phase down high-global-warming-potential hydrofluorocarbon, accelerating the use of low-impact alternatives in cooling and aerosol applications. Also, in July 2025, the European Union announced new measures to boost sustainability in the chemical sector, promoting green innovation and safer alternatives in line with the EU Green Deal. This regulatory shift is accelerating the adoption of potassium hydroxide for emission control and sustainable product development.

Segmental Insights

Form Analysis

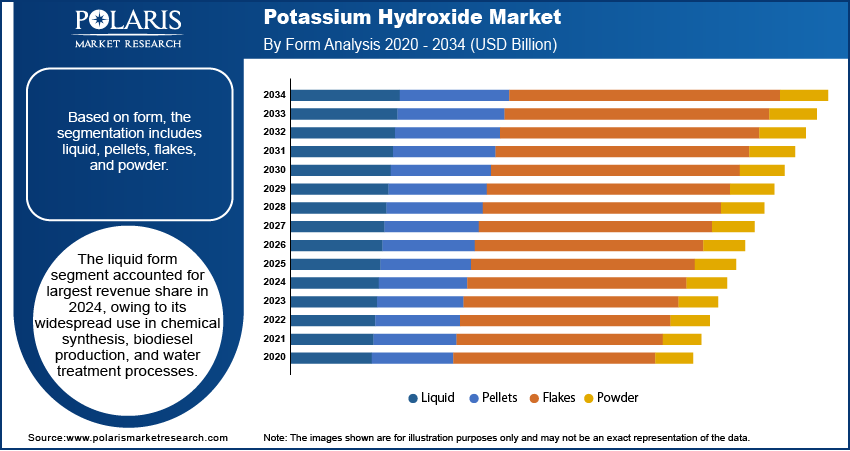

Based on form, the segmentation includes liquid, pellets, flakes, and powder. The liquid form segment accounted for largest revenue share in 2024, owing to its widespread use in chemical synthesis, biodiesel production, and water treatment processes. Liquid potassium hydroxide is easier to handle in industrial applications that require continuous flow systems, in large-scale chemical manufacturing and alkaline battery production. It is favored for its high reactivity and uniform concentration, which ensures process efficiency and safety across high-volume applications.

The powder form segment is projected to grow at the fastest CAGR during the forecast period, due to rising adoption in specialty chemical formulations and laboratory-scale applications. Its long shelf life, ease of storage and compatibility with controlled dosing in pharmaceutical and food processing sectors are contributing to increasing demand. Powdered potassium hydroxide is commonly used in formulations that require high dosing accuracy, making it suitable for controlled industrial applications.

Grade Analysis

Based on grade, the segmentation includes industrial grade, food grade, and pharmaceutical grade. The industrial grade segment held the largest revenue share in 2024, due to the extensive demand from manufacturing industries involved in cleaning agents, fertilizers, textile processing, and chemical synthesis. Industrial-grade potassium hydroxide offers cost efficiency and a high level of purity suitable for bulk industrial operations. It is primarily utilized in saponification reactions, pH control and production of potassium-based salts across a wide range of end-use sectors.

The pharmaceutical grade segment is expected to register the fastest growth rate through 2034, due to stringent quality requirements in drug formulation and rising demand for high-purity KOH in medical and personal care applications. Growth in pharmaceutical manufacturing particularly in Asia Pacific and North America is accelerating the adoption of pharmaceutical-grade potassium hydroxide.

Application Analysis

In terms of application, the segmentation includes soap & detergent manufacturing, fertilizer production, biodiesel production, chemical manufacturing, water treatment, textile processing, food processing, and other applications. The soap and detergent manufacturing segment dominated the market in 2024, attributed to its long-standing use in saponification and formulation of liquid and soft soaps. Potassium hydroxide is preferred for producing personal care items, industrial cleaners and disinfectants due to its ability to yield soft and soluble soaps ideal for various conditions.

The biodiesel production segment is anticipated to grow at the fastest CAGR from 2025 to 2034, driven by expanding investments in renewable energy and increasing consumption of biofuels. According to data from the International Energy Agency, renewable energy investment in 2023 reached USD 378 billion in the US and USD 594 billion in China. KOH is crucial in biodiesel synthesis, offering higher conversion efficiency compared to alternatives, which is fueling its adoption by refineries and small-scale producers.

Regional Analysis

Asia Pacific potassium hydroxide market accounted for 39.8% share of the global market in 2024. This dominance is due to the growing electronics and semiconductor manufacturing base in the region. This is due to KOH utilization in silicon wafer processing, etching, and surface treatment, making it essential in integrated circuit production and display technologies. Moreover, the rising demand for electronic devices and consumer appliances across economies such as South Korea, Taiwan, and Japan is propelling the market growth. Additionally, surge in biodiesel and renewable energy projects is further increasing the demand for potassium hydroxide. Government programs supporting clean energy integration are accelerating KOH adoption in chemical processes related to biofuel manufacturing.

China Potassium Hydroxide Market Insight

China held largest regional share in the Asia Pacific potassium hydroxide landscape in 2024, driven by rapid industrial growth and infrastructure development, resulting in widespread usage of potassium hydroxide across multiple manufacturing sectors. According to the Green Finance & Development Center, China’s Belt and Road Initiative recorded its highest level of engagement in 2024, with construction contracts valued at USD 70.7 billion and investments totaling approximately USD 51 billion. This growing infrastructure footprint is boosting demand for chemical compounds such as potassium hydroxide that are crucial in construction materials, water treatment and industrial processing.

North America Potassium Hydroxide Market

The market in North America captured 29.9% share in 2024, due to its increasing role in energy storage technologies and environmentally focused manufacturing. The compound is widely used in alkaline batteries and energy storage systems that support grid reliability and electric vehicle performance. This is due to rising demand for long-cycle battery chemistries is contributing to KOH consumption in commercial and residential sectors. Furthermore, the region’s regulatory focus on sustainable production methods is pushing chemical companies to adopt cleaner technologies in KOH synthesis. These sustainability targets along with investments in domestic battery manufacturing and energy transition policies are driving the adoption of potassium hydroxide in high-efficiency and eco-friendly applications.

The US Potassium Hydroxide Market Overview

The market in the US is expanding due to the growing agricultural and chemical industries. According to the International Trade Administration, the US chemical industry is one of the country’s largest manufacturing and export sectors, with exports reaching over USD 494 billion in 2022. In 2023, total foreign direct investment in the industry stood at USD 766.7 billion, with majority foreign-owned companies contributing USD 60.2 billion to exports in 2022 and spending USD 28.2 billion on research and development. The compound is essential in fertilizer production, where it serves as a precursor for potassium-based nutrients aimed at enhancing crop yield and soil health. The country’s expansive farming operations along with increasing use of high-efficiency fertilizers are accelerating the market growth.

Europe Potassium Hydroxide Market

The potassium hydroxide landscape in the Europe is projected to witness fastest growth with a CAGR of 4.1%, driven by strict environmental and manufacturing safety regulations that mandate the use of high-purity, eco-compliant chemicals. For instance, the registration, evaluation, authorization and restriction of chemicals (REACH) regulation from European Commission is aimed at enhancing chemical safety, focusing on faster identification of harmful substances and stricter usage controls to support sustainable industrial practices. These regulatory frameworks are pushing producers to adopt advanced manufacturing technologies for cleaner and safer production of KOH. Additionally, increasing consumption of KOH in niche industries such as pulp and paper, detergents, and water treatment is further propelling the market growth in the region. These applications require strong alkaline agents for bleaching, cleaning and pH control processes, thus boosting the demand for potassium hydroxide.

Key Players & Competitive Analysis Report

The potassium hydroxide (KOH) market is moderately consolidated, with competition focused on process efficiency, product purity, and application-specific customization. Leading manufacturers are investing in advanced electrolysis technologies, such as membrane cell systems, to optimize energy consumption, reduce environmental impact and enhance product consistency across industrial-grade and food-grade variants. Rising global demand from agriculture, biofuels, pharmaceuticals and water treatment is pushing manufacturers to scale up production and expand regional supply networks. The key players are responding to sustainability mandates by adopting green manufacturing practices and improving chemical recovery and waste management systems. Additionally, digital monitoring and automated quality control systems are integrated into production lines to ensure high-performance standards and regulatory compliance.

Prominent players in the global potassium hydroxide market include, Airedale Chemical Company Limited, Altair Chimica S.r.l., American Elements, BASF SE, Dow Inc., ERCO Worldwide, Gujarat Alkalies and Chemicals Limited, HAINAN HUARONG CHEMICAL CO., LTD., INEOS KOH Inc., Merck KGaA, Occidental Petroleum Corporation (OxyChem), Olin Corporation, Solvay S.A., UNID Co., Ltd., and Vynova Group.

Key Players

- Airedale Chemical Company Limited

- Altair Chimica S.r.l.

- American Elements

- BASF SE

- Dow Inc.

- ERCO Worldwide

- Gujarat Alkalies and Chemicals Limited

- HAINAN HUARONG CHEMICAL CO., LTD.

- INEOS KOH Inc.

- Merck KGaA

- Occidental Petroleum Corporation (OxyChem)

- Olin Corporation

- Solvay S.A.

- UNID Co., Ltd.

- Vynova Group

Industry Developments

- February 2024: INEOS Inovyn introduced an Ultra-Low-Carbon chlor-alkali product line, including caustic potash, aimed at significantly lowering carbon emissions. The range is produced using renewable energy at key facilities and certified under the ISCC PLUS scheme, supporting downstream users in achieving their sustainability goals.

Potassium Hydroxide Market Segmentation

By Form Outlook (Revenue, USD Billion, 2020–2034)

- Liquid

- Pellets

- Flakes

- Powder

By Grade Outlook (Revenue, USD Billion, 2020–2034)

- Industrial Grade

- Food Grade

- Pharmaceutical Grade

By Application Outlook (Revenue, USD Billion, 2020–2034)

- Soap & Detergent Manufacturing

- Fertilizer Production

- Biodiesel Production

- Chemical Manufacturing

- Water Treatment

- Textile Processing

- Food Processing

- Other Applications

By Regional Outlook (Revenue, USD Billion, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Potassium Hydroxide Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 3.33 Billion |

|

Market Size in 2025 |

USD 3.45 Billion |

|

Revenue Forecast by 2034 |

USD 4.78 Billion |

|

CAGR |

3.67% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 3.33 billion in 2024 and is projected to grow to USD 4.78 billion by 2034.

The global market is projected to register a CAGR of 3.67% during the forecast period.

Asia Pacific dominated the market in 2024, holding 39.8% share.

A few of the key players in the market are Airedale Chemical Company Limited, Altair Chimica S.r.l., American Elements, BASF SE, Dow Inc., ERCO Worldwide, Gujarat Alkalies and Chemicals Limited, HAINAN HUARONG CHEMICAL CO., LTD., INEOS KOH Inc., Merck KGaA, Occidental Petroleum Corporation (OxyChem), Olin Corporation, Solvay S.A., UNID Co., Ltd., and Vynova Group.

The liquid form segment dominated the market in 2024.

The pharmaceutical grade segment is expected to witness the fastest growth during the forecast period.