Bromine Market Size, Share, Trends, & Industry Analysis Report

By Derivative (Organobromine, Clear Brine Fluids, Hydrogen Bromide), By Application, By End User, and By Region – Market Forecast, 2025–2034

- Published Date:Jul-2025

- Pages: 129

- Format: PDF

- Report ID: PM6024

- Base Year: 2024

- Historical Data: 2020-2023

Overview

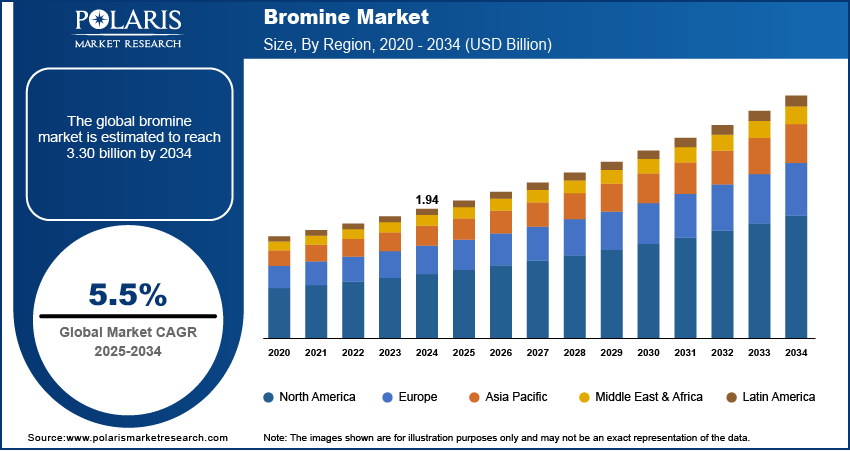

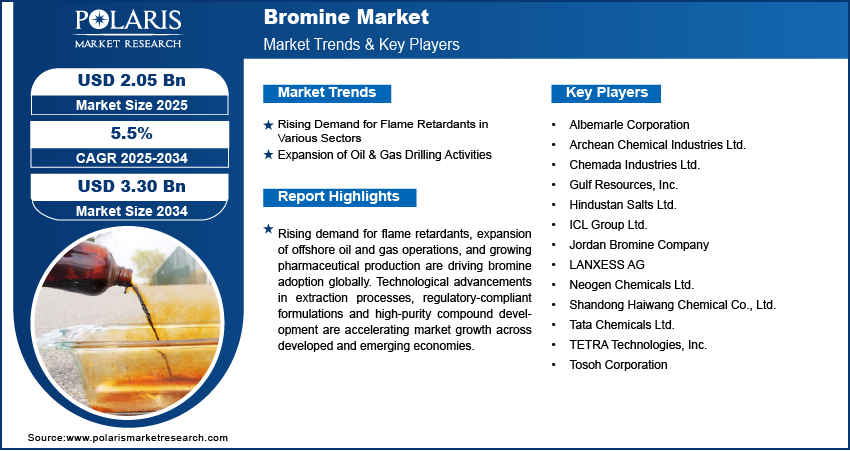

The global bromine market size was valued at USD 1.94 billion in 2024, growing at a CAGR of 5.5% from 2025–2034. Rising demand for flame retardants across key sectors and the expansion of oil and gas drilling activities are driving the consumption of bromine-based compounds globally.

Key Insights

- The organobromine segment accounted for largest revenue share in 2024.

- The clear brine fluids (CBF) segment is projected to grow at the fastest rate over the forecast period, driven by increasing offshore drilling activity and demand for high-density well completion fluids.

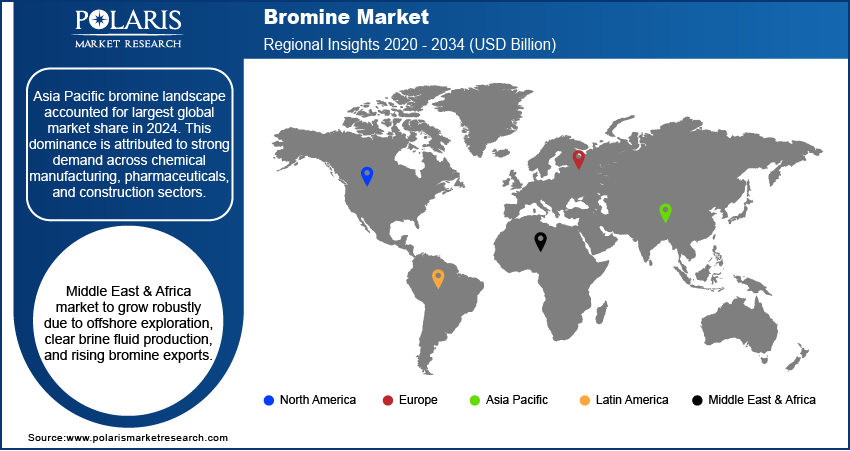

- The Asia Pacific bromine market accounted for largest global revenue share in 2024.

- The China bromine market held largest regional share of the Asia Pacific landscape in 2024, fueled by strong electronics output and rising bromine use in chemical manufacturing.

- The market in Middle East & Africa is projected to grow at a significant CAGR during the forecast period, owing to expanding bromine production in Israel and rising demand for drilling fluids across regional oilfields.

- The Israel market is expanding steadily, fueled by large Dead Sea reserves and rising exports of bromine derivatives for industrial and drilling applications.

Industry Dynamics

- Expansion of oil & gas drilling activities is increasing demand for bromine-based clear brine fluids used in well completion and pressure control operations.

- Rising demand for flame retardants in construction, electronics and automotive sectors is driving the use of brominated compounds to meet fire safety compliance.

- Growth in renewable energy storage including investment in zinc-bromine flow batteries creates opportunity for bromine in large-scale energy storage systems.

- Environmental regulations on hazardous substance handling and waste management are limiting bromine use in certain applications, impacting long-term adoption in regulated markets.

Market Statistics

- 2024 Market Size: USD 1.94 billion

- 2034 Projected Market Size: USD 3.30 billion

- CAGR (2025-2034): 5.5%

- Asia Pacific: Largest market in 2024

Bromine is widely used across flame retardants, oil & gas drilling, water treatment and pharmaceuticals among others to support chemical synthesis, contamination control and extraction processes. Industrial users prefer bromine-based compounds due to its high reactivity and effectiveness in high-temperature and high-pressure environments. Demand for clear brine fluids is rising in offshore and deepwater drilling operations due to the need for enhanced well control, operational safety, and high-performance fluid systems under extreme pressure conditions. For instance, in August 2025, TETRA Technologies completed the definitive feasibility study for its Arkansas bromine project, outlining plans for a Phase I facility with an annual production capacity of 75 million pounds. The study confirmed the project's economic feasibility and represented a key milestone in enhancing bromine production within the US. Bromine derivatives such as tetrabromobisphenol-A and calcium bromide are commonly supplied in bulk or as part of integrated chemical service contracts.

The bromine market is growing due to increasing demand for flame retardants in electronics and construction materials. Rapid industrialization in China, India, and Mexico is driving bromine use in chemical manufacturing and drilling applications. Environmental regulations on fire safety and emissions are fueling the adoption of brominated flame retardants in construction and consumer goods. Market participants are investing in capacity expansions and advanced extraction technologies to address the rising need for high-purity bromine. The shift toward specialty bromine compounds is driven by trends in energy, electronics water-intensive industries and many more.

The increasing demand for high-purity bromine and its derivatives is pushing producers to adopt modular production systems and flexible supply contracts. Chemical manufacturers are focusing on short-cycle production planning to meet fluctuating order volumes in electronics, pharmaceuticals and energy sectors. Leading suppliers are expanding their toll manufacturing and third-party processing capabilities to serve contract-based demand with shorter lead times. In February 2025, Turkmenistan’s state-owned Turkmenhimiya announced an international tender for the construction of a new production facility focused on iodine, bromine and bromine derivatives. The proposed plant aims to expand the country's chemical manufacturing capacity and enhance its export potential in the global halogen market. In addition, the rising initiatives to reduce inventory pressure, improved product customization and allowed faster delivery to regional clients across regions.

Drivers & Opportunities/Trends

Rising Demand for Flame Retardants in Various Sector: The demand for brominated flame retardants is increasing due to stricter fire safety regulations across construction, electronics and automotive sectors. As to Oxford Economics, global construction output is projected to increase from USD 9.7 trillion in 2022 to USD 13.9 trillion by 2037, with growth led by China, the US, and India due to rising urbanization and investments in green infrastructure. Bromine-based compounds are widely used in insulation materials, circuit boards, plastic housings and textiles to prevent the spread of fire. Rapid construction activities in Asia and the Middle East are boosting the use of flame-retardant building materials in residential and commercial projects. In addition, rising production of consumer electronics and electric vehicles is driving the use of tetrabromobisphenol-A and related additives. These compounds help manufacturers meet international flammability standards and improve overall product safety.

Expansion of Oil & Gas Drilling Activities: Growth in global oil & gas drilling operations is increasing the use of bromine-based clear brine fluids in well completion and maintenance activities. These fluids offer high thermal stability and density control, which are essential for safe and efficient drilling in high-pressure environments. Rising offshore and deepwater projects in the US, Middle East and Latin America are fueling strong demand for calcium bromide and zinc bromide. These compounds reduce formation damage and support wellbore stability. Bromine usage is rising to meet the technical requirements of modern drilling operations due to rising focus on deeper reserves and complex formations by energy companies.

Segmental Insights

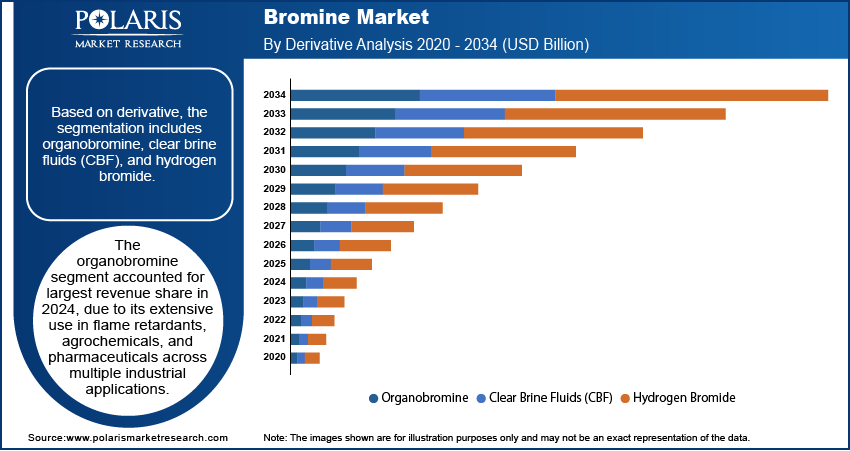

Derivative Analysis

Based on derivative, the segmentation includes organobromine, clear brine fluids, and hydrogen bromide. The organobromine segment accounted for largest revenue share in 2024, driven by strong demand in flame retardants, agrochemicals and pharmaceuticals. These compounds are widely used in fire-resistant materials, pesticides and drug formulations due to their chemical stability and high reactivity. Manufacturers prefer organobromine for its suitability in mass production and established regulatory acceptance. Growth in electronics, automotive components and plastic applications is driving segment dominance for consistent demand for fire-resistant and performance-enhancing materials. Additionally, increasing safety regulations and fire compliance standards are fueling its continued use across key industrial markets.

The clear brine fluids (CBF) segment is projected to grow at the fastest pace during the forecast period, fueled by rising offshore and high-pressure drilling activities. These fluids are essential in maintaining wellbore stability and controlling formation pressure during drilling and completion operations. Oilfield operators are adopting CBFs to reduce formation damage and improve well productivity. Increasing exploration in deepwater regions across the US, Middle East, and Latin America is driving the use of calcium bromide and zinc bromide for safe well completion and pressure control. The shift toward advanced recovery methods and complex well designs is further boosting segment growth.

Application Analysis

Based on application, the segmentation includes flame retardants, oil and gas drilling, water treatment, pharmaceutical intermediates, and agricultural chemicals. The flame retardants segment dominated the revenue share in 2024, owing to its widespread usage in construction, electronics and automotive applications. Brominated compounds are used to meet fire safety standards in insulation materials, plastic housings and circuit boards by reducing flammability. Regulatory pressure in developed and emerging countries is increasing the adoption of flame-retardant materials to meet fire safety standards in construction, electronics, and automotive applications. Manufacturers are using bromine-based additives to comply with safety certifications and reduce fire risk in consumer and industrial products.

The oil and gas drilling segment is projected to grow at the fastest pace during the forecast period, driven by increasing investments in offshore and unconventional energy projects. Bromine-based clear brine fluids are used in high-pressure wells to ensure safety and enhance performance. Operators prefer these fluids due to their ability to maintain formation stability and minimize drilling delays. Expansion of deepwater drilling in the US, Brazil, and the Middle East is generating strong demand. The segment is further driven by the growing focus on well integrity and operational efficiency.

End User Analysis

By end user, the market includes oil & gas, chemicals, pharmaceuticals and cosmetics, electronics and consumer goods, textile, medical, agricultural and pesticides, automotive, and others. The oil & gas segment held the largest revenue share in 2024, as bromine-based compounds are essential in drilling, completion and production processes. Clear brine fluids are used in well control in high-pressure and high-temperature environments. Rising offshore development and shale gas activities are boosting demand across major producing regions. Energy companies are relying on rental supply models and integrated chemical services to optimize cost and performance. Bromine’s compatibility with deep well conditions and its critical role in ensuring safe operations is fueling segment leadership.

The pharmaceuticals and cosmetics segment is anticipated to grow at the fastest rate, due to increasing use of brominated intermediates in drug manufacturing and personal care products. These compounds are used in the production of sedatives, antiseptics and specialty formulations. Growth in generic pharmaceutical production in Asia and rising cosmetic demand in Europe and Latin America are driving segment expansion. The key players are focusing on efficient synthesis and regulatory-compliant formulations using bromine derivatives to reduce production time and improve product consistency across global supply chains.

Regional Analysis

Asia Pacific bromine market accounted for largest global revenue share in 2024. This dominance is driven by strong demand from the electronics and construction sectors, with increasing use of brominated flame retardants in circuit boards, plastic housings, and insulation materials fueling consumption across China, India, Japan, and South Korea among others. As per the China State Council Information Office (SCIO), electronics manufacturing sector saw a 75.8% year-over-year profit rise to USD 20.3 billion from January to April 2024. Operating revenue of major firms grew 7.9% to USD 648.6 billion during the same period. In addition, rapid expansion in pharmaceutical and agrochemical production is increasing the use of bromine-based intermediates, while regional manufacturers are scaling up output to meet domestic and export demand.

China Bromine Market Insight

China held largest regional market share in Asia Pacific bromine landscape in 2024, driven by strong demand from the electronics and chemical manufacturing sectors, as the country extensively uses brominated flame retardants in printed circuit boards, plastics and insulation for domestic electronics production. Additionally, the presence of a large agrochemical and pharmaceutical manufacturing base is increasing the consumption of bromine derivatives. This is due to government support for industrial expansion and rising export demand for chemical products.

Middle East & Africa Bromine Market

The market in Middle East & Africa is projected to grow at a significant CAGR during the forecast period. This growth is owing to increasing offshore oil and gas exploration activities for clear brine fluids in countries such as Israel, Jordan, and Egypt to expand bromine production to support regional and international drilling operations. For instance, in September 2024, Egypt and China signed a USD 110 million contract to establish the country's first bromine production plant in the Suez Canal Economic Zone. The project is expected to strengthen Egypt’s position in the chemical industry and support domestic production of bromine ore. Additionally, the rising investment in specialty chemical manufacturing is increasing the use of brominated compounds in industrial water treatment and export-grade formulations. This is owing to high abundant bromine reserves and access to energy-intensive applications are pushing market expansion.

Israel Bromine Market Overview

The market in Israel is expanding due to large brine reserves from the Dead Sea. The country exports a significant volume of bromine and its derivatives to global markets for use in flame retardants, oilfield chemicals, and water treatment applications. Moreover, the growing investment in extraction technology and value-added chemical production is enhancing product quality and supply reliability, while strategic partnerships with European and Asian chemical companies are strengthening Israel’s position as a key exporter in the bromine market.

North America Bromine Market

The bromine landscape in North America is projected to hold a substantial share in 2034, fueled by its extensive use in oil and gas drilling operations, where bromine-based clear brine fluids are essential for maintaining well control in shale and offshore projects. According to International Energy Statistics, the US remained the leading crude oil producer globally for six consecutive years. In 2023, average daily output reached 12.9 million barrels, with a peak of over 13.3 million barrels per day in December. In addition, the implementation of strict fire safety regulations is driving the use of brominated flame retardants in construction materials and consumer electronics. This is due to strong domestic production capacity and technological expertise in specialty chemicals that fuels country’s strong position in the global bromine supply chain.

Key Players & Competitive Analysis Report

The bromine market is moderately competitive, with leading companies focusing on production capacity expansion, product diversification and strategic partnerships to increase market share. Key players are investing in advanced extraction technologies and specialty bromine derivatives to meet evolving customer requirements and regulatory standards. Rising collaborations with chemical manufacturers and energy companies are strengthening supply chain integration and service offerings. Additionally, companies are focusing on sustainable production methods and developing high-purity bromine compounds to enhance product quality. Innovation in customized formulations and long-term contracts is driving competitive differentiation across regional markets.

Major companies operating in the bromine industry include ICL Group Ltd., Albemarle Corporation, LANXESS AG, Tosoh Corporation, TETRA Technologies, Inc., Tata Chemicals Ltd., Hindustan Salts Ltd., Gulf Resources, Inc., Neogen Chemicals Ltd., Shandong Haiwang Chemical Co., Ltd., Jordan Bromine Company, Archean Chemical Industries Ltd., and Chemada Industries Ltd.

Key Players

- Albemarle Corporation

- Archean Chemical Industries Ltd.

- Chemada Industries Ltd.

- Gulf Resources, Inc.

- Hindustan Salts Ltd.

- ICL Group Ltd.

- Jordan Bromine Company

- LANXESS AG

- Neogen Chemicals Ltd.

- Shandong Haiwang Chemical Co., Ltd.

- Tata Chemicals Ltd.

- TETRA Technologies, Inc.

- Tosoh Corporation

Industry Developments

- January 2025: Arab Potash Company partnered with US-based Albemarle Corporation to invest USD 813 million to develop bromine and bromine derivative production facilities in Jordan. The partnership aims to strengthen Jordan’s position in the global bromine market and enhance value-added chemical manufacturing in the region.

- July 2024: Uzbekistan announced to establish a bromine production facility in Turkmenistan through a collaborative project aimed at expanding its chemical sector presence in the region. This initiative is part of broader efforts to strengthen cross-border industrial cooperation and secure long-term access to bromine resources.

Bromine Market Segmentation

By Derivative Outlook (Revenue, USD Billion, 2020–2034)

- Organobromine

- Clear Brine Fluids (CBF)

- Hydrogen Bromide

By Application Outlook (Revenue, USD Billion, 2020–2034)

- Flame Retardants

- Oil And Gas Drilling

- Water Treatment

- Pharmaceutical Intermediates

- Agricultural Chemicals

By End User Outlook (Revenue, USD Billion, 2020–2034)

- Oil & Gas

- Chemicals

- Pharmaceuticals and Cosmetics

- Electronics and Consumer Goods

- Textile

- Medical

- Agricultural and Pesticides

- Automotive

- Others

By Regional Outlook (Revenue, USD Billion, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Bromine Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 1.94 Billion |

|

Market Size in 2025 |

USD 2.05 Billion |

|

Revenue Forecast by 2034 |

USD 3.30 Billion |

|

CAGR |

5.5% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 1.94 billion in 2024 and is projected to grow to USD 3.30 billion by 2034.

The global market is projected to register a CAGR of 5.5% during the forecast period.

Asia Pacific dominated the market in 2024.

A few of the key players in the market are ICL Group Ltd., Albemarle Corporation, LANXESS AG, Tosoh Corporation, TETRA Technologies, Inc., Tata Chemicals Ltd., Hindustan Salts Ltd., Gulf Resources, Inc., Neogen Chemicals Ltd., Shandong Haiwang Chemical Co., Ltd., Jordan Bromine Company, Archean Chemical Industries Ltd., and Chemada Industries Ltd.

The flame retardants segment dominated the market in 2024. This dominance is attributed to strong demand from construction, electronics, and automotive industries for brominated compounds used in fire-resistant materials and plastic components.

The pharmaceuticals and cosmetics segment is expected to witness the fastest growth during the forecast period, driven by increasing use of bromine-based intermediates in drug synthesis, specialty formulations, and personal care products.