Calcium Bromide Market Size, Share, & Industry Analysis Report

: By Grade (Technical Grade, Reagent Grade, and Food Grade), By Application, By End Use, and By Region – Market Forecast, 2025–2034

- Published Date:Jun-2025

- Pages: 129

- Format: PDF

- Report ID: PM5715

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

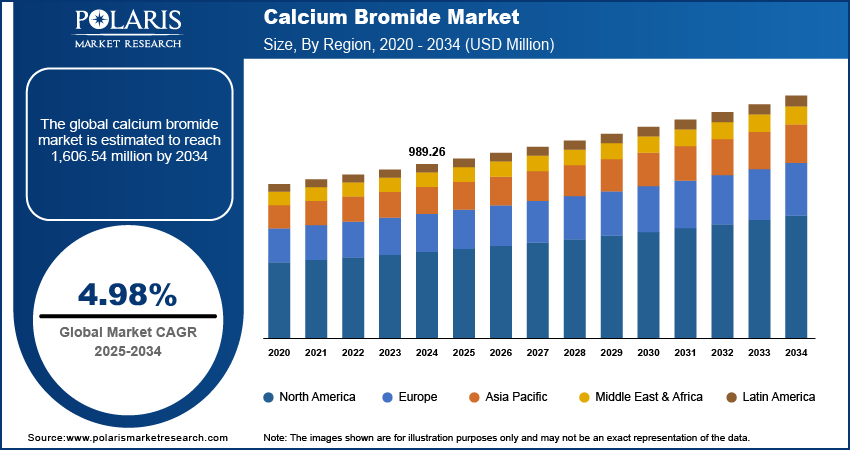

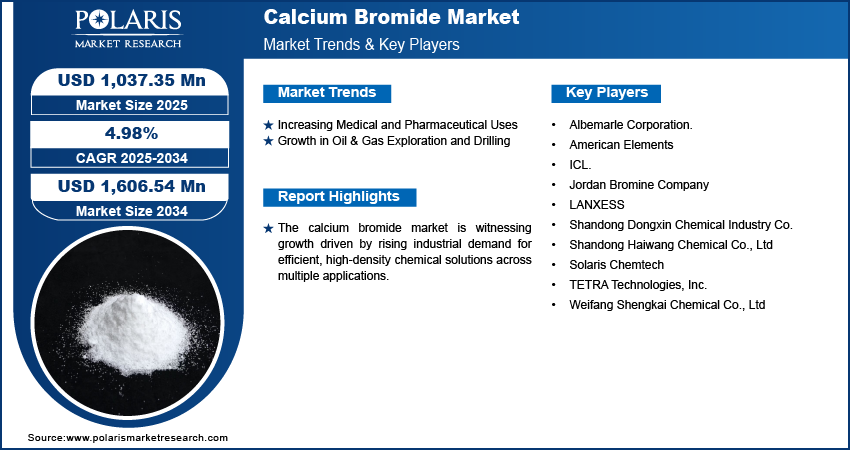

The global calcium bromide market size was valued at USD 989.26 million in 2024, growing at a CAGR of 4.98% during 2025–2034. The growth is driven by the increasing use in manufacturing and industrial applications.

Calcium bromide is a white crystalline salt primarily used as a dense, clear brine fluid in oil and gas drilling operations, as well as in various chemical and industrial processes. Among its diverse applications, one of the major growth areas is its role in flame retardant formulations. The rising demand for flame retardants has especially contributed to the market expansion for calcium bromide as regulatory authorities and industries alike strengthen their focus on fire safety standards. For instance, in October 2023, Clariant, a chemical company, opened a new USD 66.6 million halogen-free flame retardant plant in Huizhou, China, serving the e-mobility and electronics sectors. A second USD 44.4 million production line is under construction, further contributing to the bromide demand. The chemical properties make bromide an effective fire suppressant, particularly in applications where thermal stability and fire suppression system are critical. This has led to its increased integration in the manufacturing of plastics, electronics, and textiles, where fire resistance is a vital requirement.

To Understand More About this Research: Request a Free Sample Report

The growing need for improved fire safety across the construction and transportation sectors propels the demand for flame retardants. The consumption of calcium bromide has increased due to its synergistic effect when used with other flame-retardant compounds, as these industries adopt stricter safety regulations and launch fire-resistant materials. For instance, in January 2025, Burnblock expanded its fire-resistant material range to include Douglas fir, thermo tulipwood, and fiber-cement flat sheets, all achieving B-s1,d0 fire classification. Enhancing safe, sustainable solutions, further contributing to the growth opportunities for calcium bromide. Its compatibility with polymer-based systems and efficiency in reducing flammability make it a preferred choice for manufacturers seeking performance and compliance. Consequently, the consistent rise in safety consciousness and regulatory pressures across multiple end-use industries continues to drive the calcium bromide market growth.

Industry Dynamics

Increasing Medical and Pharmaceutical Uses

The effectiveness of calcium bromide as a sedative and anticonvulsant in specific formulations has led to its increased demand in medical and pharmaceutical applications. According to a November 2024 IFPMA report, the pharmaceutical sector added USD 2,295 billion to global GDP in 2022, further reflecting opportunities for the utilization of calcium bromide. Additionally, calcium bromide serves as a reagent or intermediate in the synthesis of various medicinal compounds, contributing to its rising importance in drug development processes. The ongoing advancements in pharmaceutical research and the need for reliable chemical agents in formulation chemistry further improve its demand. The consistent requirement for high-purity chemical compounds such as calcium bromide highlights this upward market trend as healthcare systems worldwide prioritize the development of more effective treatments. Hence, the growing utilization of calcium bromide in the medical and pharmaceutical sectors is driving the market growth.

Growth in Oil & Gas Exploration and Drilling

The expansion of oil and gas exploration and drilling activities is contributing to the market expansion. According to an April 2025 DPIIT report, India's Oil Exploration and Production sector is offering USD 100 billion in investment opportunities through 2030, further boosting demand for calcium bromide. Its role as a high-density brine concentrated minerals makes it indispensable in well completion and workover operations, helping to control formation pressures and prevent blowouts during drilling. Calcium bromide’s non-damaging nature to the reservoir and its compatibility with other drilling fluids further strengthen its utility in complex drilling environments. The demand for efficient and reliable fluid handling systems such as calcium bromide grows in parallel as oil & gas exploration moves into deeper and more challenging terrains. This ongoing growth in global energy exploration sustains and reinforces its position as a critical component in oilfield operations.

Segmental Insights

By Grade Analysis

The global calcium bromide market segmentation, based on grade, includes technical grade, reagent grade, and food grade. The technical grade segment is expected to witness substantial growth during the forecast period due to its broad utility in industrial applications such as oil and gas drilling, flame retardants, and chemical synthesis. This grade of calcium bromide offers sufficient purity for large-scale industrial use while being cost-effective compared to pharmaceutical or food grades. Its high solubility, stability, and compatibility with other compounds make it suitable for use in a wide range of technical formulations. Technical grade calcium bromide remains a preferred choice for operational efficiency and cost management as demand rises across the energy and manufacturing sectors.

By Application Analysis

The market segmentation, based on application, includes drilling fluids, enhanced oil recovery fluids and brines, oil well cementing, and others. The drilling fluids segment is expected to witness the fastest growth during the forecast period, driven by increasing exploration and production activities in the oil & gas sector. Calcium bromide is widely used in drilling fluids due to its high-density and non-damaging properties, which help maintain wellbore stability and control pressure in high-temperature and high-pressure formations. The rise in deep water and unconventional drilling projects further improves the demand for advanced fluid systems, positioning calcium bromide as a critical component. Its reliability in minimizing formation damage and supporting efficient drilling performance highlights the segment’s robust growth outlook.

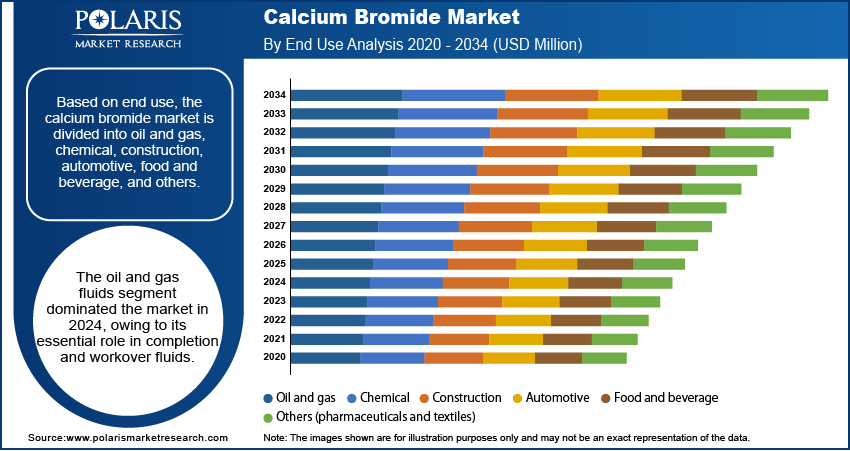

By End Use Analysis

The market segmentation, based on end use, includes oil and gas, chemical, construction, automotive, food and beverage, and others. The oil and gas fluids segment dominated the market in 2024, owing to its essential role in completion and workover fluids. The compound’s ability to prevent well blowouts and maintain pressure balance during complex drilling operations makes it essential in the energy sector. The demand for high-performance fluid systems continues to drive segment dominance as oilfield operators prioritize safety and efficiency. Additionally, its compatibility with other bromide-based brines reinforces its widespread use across various oilfield operations.

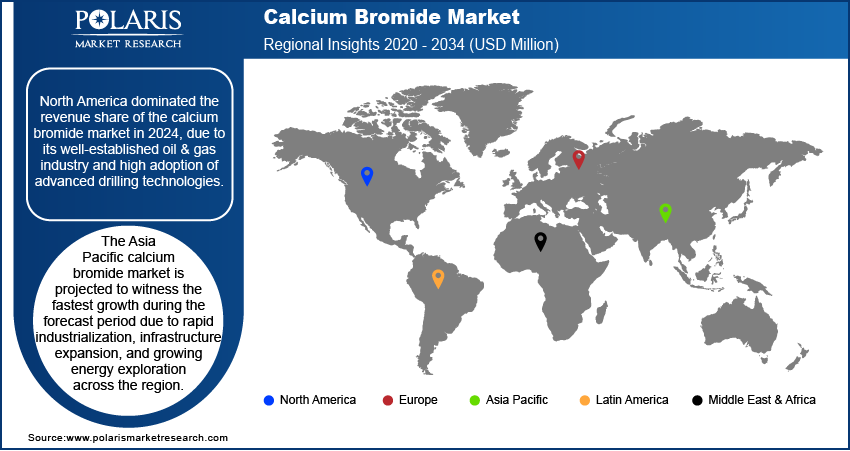

Regional Analysis

The report provides market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. The North America calcium bromide market dominated the revenue share in 2024, due to its well-established oil & gas industry and high adoption of advanced drilling technologies. The presence of major exploration sites and ongoing shale gas development has created sustained demand for calcium bromide as a drilling and completion fluid. For instance, in September 2024, the US EIA reported that shale formations accounted for 78% (37.87 Tcf) of total US dry natural gas production in 2023, creating demand for bromide as a fluid. Moreover, strict safety standards and technical innovations in good management have led to consistent usage of high-performance chemical solutions. The US calcium bromide market is a major contributor in North America, known for its extensive energy operations. The Canada calcium bromide market also contributes significantly, where oil sands development continues to expand.

The Asia Pacific calcium bromide market is projected to witness the fastest growth during the forecast period due to rapid industrialization, infrastructure expansion, and growing energy exploration across the region. Countries in this region are increasingly investing in offshore and onshore oilfield development, leading to higher demand for drilling and completion fluids. In March 2025, CNOOC announced the discovery of Huizhou 19-6 oilfield in the South China Sea, with over 100 million tons of oil equivalent in-place. The field produces 413 barrels of crude and 2.41 MMcf gas daily, further boosting the demand for drilling and completion fluids. Moreover, expanding pharmaceutical and chemical manufacturing activities also contribute to rising calcium bromide usage. Major growth contributors include China and India, driven by large-scale industrial initiatives, along with Southeast Asian nations such as Indonesia and Malaysia, focusing on energy security.

The Europe calcium bromide market is projected to witness substantial growth during the forecast period due to its increasing focus on sustainable and safe chemical solutions across industries. The region’s strict environmental regulations and advanced research capabilities support the use of calcium bromide in flame retardants and pharmaceutical intermediates. Additionally, investments in oil and gas operations in certain parts of Europe sustain demand for efficient drilling fluids. Countries such as Germany and France contribute through chemical manufacturing, while the North Sea operations in the UK and Norway support oilfield applications.

Key Players and Competitive Analysis Report

The calcium bromide industry is witnessing strategic investments and expansion opportunities driven by rising demand in oil & gas, water treatment, and pharmaceuticals. Players such as ICL, LANXESS, and TETRA Technologies dominate developed markets, while Chinese firms lead in emerging markets, leveraging cost advantages. Sustainable value chains and technological advancements in high-purity production fuel revenue growth. Disruptions and trends, such as stricter environmental regulations and geopolitical shifts, are reshaping competitive positioning. Smaller players focus on niche business segments, while giants prioritize mergers and acquisitions to strengthen regional footprints. Pricing insights reveal volatility due to raw material costs, but long-term demand remains robust, supported by oilfield applications. Expert insights highlight untapped potential in Asia Pacific and MENA, where latent demand aligns with industrial growth. Companies must adapt to supply chain disruptions and invest in future development strategies to sustain revenue opportunities. A few key players are American Polyfilm, Inc.; BASF; Covestro AG; Novotex Italiana S.p.A.; RTP Company; San Fang Chemical Industry Co., Ltd.; SWM International; The Lubrizol Corporation; Toray Industries, Inc.; and Wiman Corporation.

American Elements is a manufacturer and distributor of advanced materials headquartered in Los Angeles, California, with production and research facilities in the US, Mexico, China, and the United Kingdom. Founded in 1997, the company has built a reputation for supplying a vast catalog of over 35,000 products, such as metals, chemicals, ceramics, and high-purity materials, serving industries such as energy, electronics, aerospace, defense, automotive, and green technology. American Elements is particularly known for its expertise in scaling laboratory innovations to industrial-scale production, supporting both Fortune 50 companies and leading research institutions worldwide. Within its extensive product portfolio, American Elements manufactures and supplies calcium bromide, a specialty chemical used primarily in oil and gas drilling fluids, water treatment, and as a component in various industrial processes. The company’s calcium bromide is available in different grades and purities, tailored to meet the strict requirements of global customers.

TETRA Technologies, Inc. is a US-based energy services and solutions company specializing in the development and supply of environmentally conscious products for the oil & gas industry. Headquartered in The Woodlands, Texas, and founded in 1981, TETRA has built a strong reputation for its expertise in aqueous chemistry and its commitment to innovation, sustainability, and operational efficiency. One of TETRA’s core product lines is industrial chemicals, with a particular focus on brominated products such as calcium bromide. Calcium bromide produced by TETRA is primarily used in completion fluids, workover fluids, and drilling fluids for oil and gas wells, where it serves as a high-density, clear brine to control wellbore pressures and prevent blowouts during drilling and completion operations. TETRA’s calcium bromide is manufactured to strict quality standards, assuring consistent performance and safety in demanding field conditions. The company’s global infrastructure and integrated supply chain enable it to serve customers across major energy markets, providing reliable delivery and technical support.

Key Players

- Albemarle Corporation.

- American Elements

- ICL

- Jordan Bromine Company

- LANXESS

- Shandong Dongxin Chemical Industry Co.

- Shandong Haiwang Chemical Co., Ltd

- Solaris Chemtech

- TETRA Technologies, Inc.

- Weifang Shengkai Chemical Co., Ltd

Industry Developments

In January 2023, LANXESS partnered with TotalEnergies to source biocircular styrene derived from tall oil (a pulp byproduct). LANXESS uses this sustainable styrene to produce ion exchange resins for wastewater treatment, chemical processes, and food industry applications.

In September 2021, Aramco's Wa'ed invested USD 1.01 million in SICCO's Jubail calcium bromide plant, which will produce 4,000 tons annually for oil/gas drilling applications. The 15,000 sqm facility will supply pressure-regulating compounds for wellbores.

Calcium Bromide Market Segmentation

By Grade Outlook (Volume, Kilotons; Revenue, USD Million, 2020–2034)

- Technical Grade

- Reagent Grade

- Food Grade

By Application Outlook (Volume, Kilotons; Revenue, USD Million, 2020–2034)

- Drilling Fluids

- Enhanced Oil Recovery

- Fluids and Brines

- Oil Well Cementing

- Others (Water Treatment and Fire Retardants)

By End Use Outlook (Volume, Kilotons; Revenue, USD Million, 2020–2034)

- Oil and Gas

- Chemical

- Construction

- Automotive

- Food and Beverage

- Others (Pharmaceuticals and Textiles)

By Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2020–2034)

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

Calcium Bromide Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 989.26 million |

|

Market Size Value in 2025 |

USD 1,037.35 million |

|

Revenue Forecast by 2034 |

USD 1,606.54 million |

|

CAGR |

4.98% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Volume, Kilotons; Revenue in USD Million and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 989.26 million in 2024 and is projected to grow to USD 1,606.54 million by 2034.

The global market is projected to register a CAGR of 4.98% during the forecast period.

North America dominated the market share in 2024.

A few of the key players in the market are American Polyfilm, Inc.; BASF; Covestro AG; Novotex Italiana S.p.A.; RTP Company; San Fang Chemical Industry Co., Ltd.; SWM International; The Lubrizol Corporation; Toray Industries, Inc.; and Wiman Corporation.

The oil and gas fluids segment dominated the market in 2024.

The drilling fluids segment is expected to witness the fastest growth during the forecast period.