Flame Retardants Market Share, Size, Trends, Industry Analysis Report

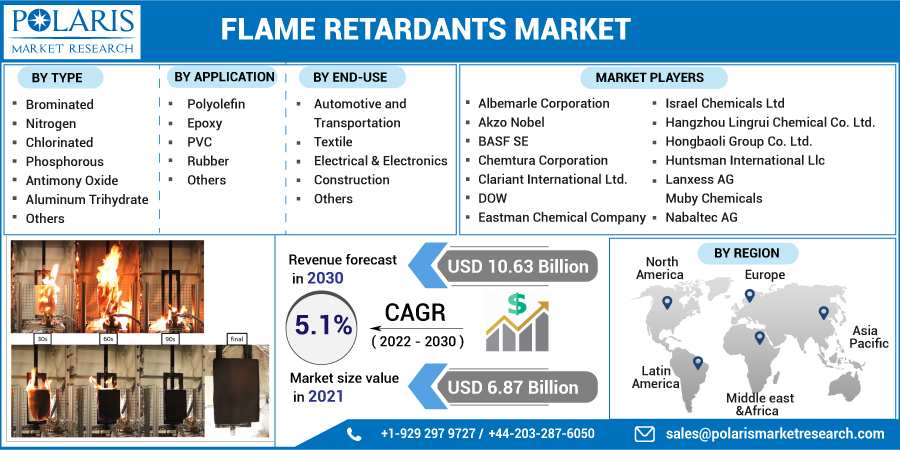

By Type (Brominated, Nitrogen, Chlorinated, Phosphorous, Antimony Oxide, Aluminum Trihydrate, Others); By Application; By End-Use; By Region; Segment Forecast, 2022 - 2030

- Published Date:Sep-2022

- Pages: 115

- Format: PDF

- Report ID: PM2550

- Base Year: 2021

- Historical Data: 2018-2020

Report Outlook

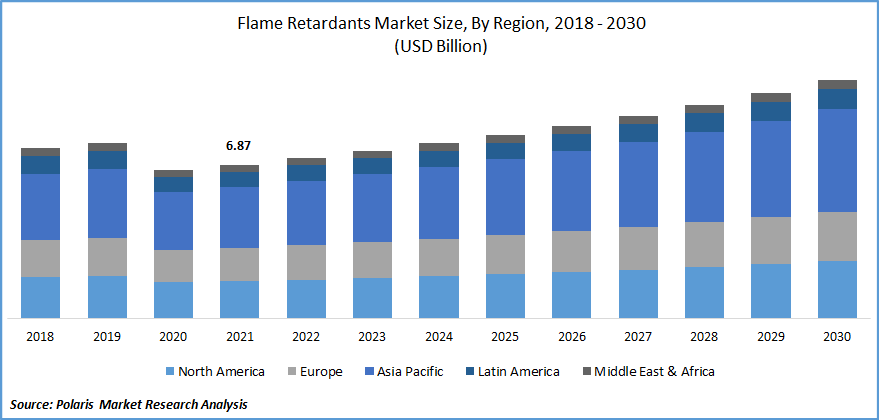

The global flame retardants market was valued at USD 6.87 billion in 2021 and is expected to grow at a CAGR of 5.1% during the forecast period. These are substances that enable the prevention and slowing down of the fire. These chemicals are integrated into materials to decrease heat release and smoke formation in case of fire. These retardants are required to undertake extensive testing and follow strict safety assessments and regulations to comply with standard guidelines to protect people and the environment.

Know more about this report: Request for sample pages

They are utilized in varied applications such as furniture foam, electrical enclosures, e-mobility solutions, electronic components, and building products, among others. They are increasingly being incorporated in batteries for e-mobility, consumer electronics, and energy storage for improved safety and stability. The use of retardants in polymer housings, components, and electrolytes also enhances the performance of battery systems. Several leading companies in the market offer a wide range of phosphorus and bromine-based retardants for applications in electric vehicles.

The environmental and health concerns associated with flame retardants restrict the growth of the conventional market. In 2021, New York introduced restrictions for organohalogen retardants to be used in electronic casings. The restrictions are to be implemented from 1st January 2024 for electronic displays in residential settings. The state of Washington is in the process of reviewing and considering a similar ban to align with its Safer Products for Washington law.

There has been reduced demand for flame retardants during the pandemic owing to a negative impact on industries such as automotive and construction, among others. The global market was affected by transportation delays and operational challenges across the globe. There was disruption of the supply chain and restriction on manufacturing activities owing to the introduction of lockdown restrictions and low availability of workforce.

However, the industry is expected to experience growth with the relaxation of lockdown restrictions and economic growth. Factors such as favorable safety regulations and the development of sustainable solutions would support the growth of the industry during the forecast period.

Know more about this report: Request for sample pages

Know more about this report: Request for sample pages

Industry Dynamics

Growth Drivers

Rising industrialization, an increase in concerns regarding fire safety, and greater awareness among consumers drive the growth of the industry. Halogenated flame retardants are increasingly being replaced by non-halogenated retardants owing to greater health and environmental concerns.

In May 2022, FRX Innovations revealed that its Nofia flame retardant was selected by Super B, Netherlands, for use in lithium-ion batteries. The products offered by the company offer high performance and sustainability. Nofia received green certifications from the ChemForward, Green Screen, and TCO organizations for environmental and fire safety.

Greater application in the building and construction sector, coupled with a rise in demand from the automotive sector, boosts the adoption of the flame retardants market. Implementation of stringent regulations to be followed for the safety of personnel and property has increased the use of flame retardants across industries such as electronics, healthcare, and textile, among others.

Report Segmentation

The market is primarily segmented based on type, application, end-use, and region.

|

By Type |

By Application |

By End-Use |

By Region |

|

|

|

|

Know more about this report: Request for sample pages

The Aluminum Trihydrate segment accounted for a significant market share

On the basis of type, the market is segmented into brominated, nitrogen, chlorinated, phosphorous, antimony oxide, aluminum trihydrate, and others. Aluminum trihydrate accounted for a significant share in 2021 owing to its capability of high flame retardance and smoke suppression. It offers properties such as non-corrosiveness, decreased toxicity, affordability, and high dispersibility.

Alumina trihydrate is used in varied applications as it does not emit toxic smoke upon combustion. It is used in applications such as automobiles, draperies, furniture, and wall coverings, among others. It is also incorporated in acrylic rubbers, PVC flooring, and thermoplastic cable sheathing, among others.

Epoxy segment accounted for the largest market share

The epoxy segment dominated the global flame retardants market in 2021. The wide use of epoxy in the marine, construction, aerospace, and automotive sectors boosts the growth of this segment. There is expected to be a rise in demand for epoxy from the automotive sector during the forecast period.

The development of high-performing and lightweight vehicles by market players and the introduction of fire safety regulations associated with automobiles accelerate the growth of this segment.

The Electrical & Electronics segment dominated the global market in 2021

Based on end-use, the global market has been segmented into automotive and transportation, textile, electrical & electronics, construction, and others. The electrical and electronics segment dominated the market in 2021 owing to wide use in mobile phones, laptops, computers, televisions, and cables, among other products. There have been several fire safety regulations and standards set across different regions to make electrical and electronic products safer for consumers.

Several companies are introducing new products to cater to the growing requirement of this segment. In January 2022, Lubrizol Engineered Polymers introduced a new non-halogenated flame retardants grade for wire and cable applications. The new product is manufactured to eliminate the use of halogens for enhanced performance and to meet the required regulations of the industry. The product has UL 94 V-0 and UL 105°C temperature ratings, along with superior mechanical properties.

The construction sector is expected to experience growth during the forecast period. Growth in urbanization, rise in construction activities, and development of infrastructure are some factors boosting the growth of this segment. In June 2022, Axalta introduced Plascoat PPA571 FR, which is a flame retardant. The new product is an anti-corrosion coating solution aimed at offering safety in buildings in case of a fire outbreak. Plascoat PPA571 is developed without the use of halogen to remove toxic fumes and their impact on the environment.

Asia-Pacific is expected to dominate the market

Implementation of strict fire safety regulations, strengthening the construction sector, and greater application in electrical and electronic sectors boost the adoption of flame retardants in the region. Growth in urbanization, industrialization and rising penetration of consumer electronics support the growth of the flame retardants market.

Increasing application in the automotive industry and greater adoption of electric and hybrid vehicles further boost the adoption of flame retardants in Asia-Pacific. Increasing investments in R&D, technological advancements, and rising inclination toward the use of environmentally friendly products are expected to increase the adoption of sustainable flame retardants during the forecast period.

Competitive Insight

Some leading companies profiled in the global flame retardants market include Albemarle Corporation, Akzo Nobel, BASF SE, Chemtura Corporation, Clariant International Ltd., DOW, Eastman Chemical Company, Israel Chemicals Ltd, Hangzhou Lingrui Chemical Co. Ltd., Hongbaoli Group Co. Ltd., Huntsman International Llc, Lanxess AG, Muby Chemicals, Nabaltec AG, and Sasol Limited.

These companies are introducing new products and solutions while offering enhanced customer services to cater to the growing demand across various industries. Partnerships and collaborations provide opportunities for these companies to enhance their market presence and enter new emerging markets.

Recent Developments

In August 2022, Imerys launched ImerShield performance minerals. The new products are produced to be used for flame retardant applications in polymers. The chemistry of these products improves the efficacy of flame retardants while decreasing their loading levels.

In April 2022, BASF enhanced its polyphthalamide portfolio through flame retardant grades offering greater thermal stability and electrical insulation. They also provide high electrical RTI values and avoid corrosion. The non-halogenated products prevent failure of electrical components, enhanced colorability, and stability. The company offers flame retardants to be used in consumer electronics, vehicles, e-mobility parts, and miniature circuit breakers among others.

In May 2022, LG Chem developed a new fire-retardant plastic to be utilized in batteries. The product is manufactured using polyphenylene oxide and polyamide resin. The company has started the process to acquire patents in United States, Korea, and some parts of Europe.

September 2022: Lanxess AG created a non-halogen flame retardant that is mainly intended for usage in glass fiber-reinforced polymers in order to provide goods for the electrical and electronics industries.

July 2022: BASF SE teamed up with THOR GmBH, a firm that makes firefighting products. BASF’s product line of non-halogenated flame-retardant chemicals will be strengthened by this strategic move.

Flame Retardants Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2021 |

USD 6.87 billion |

|

Revenue forecast in 2030 |

USD 10.63 billion |

|

CAGR |

5.1% from 2022 - 2030 |

|

Base year |

2021 |

|

Historical data |

2018 - 2020 |

|

Forecast period |

2022 - 2030 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2022 to 2030 |

|

Segments covered |

By Type, By Application, By End-Use, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Key companies |

Albemarle Corporation, Akzo Nobel, BASF SE, Chemtura Corporation, Clariant International Ltd., DOW, Eastman Chemical Company, Israel Chemicals Ltd, Hangzhou Lingrui Chemical Co. Ltd., Hongbaoli Group Co. Ltd., Huntsman International Llc, Lanxess AG, Muby Chemicals, Nabaltec AG, Sasol Limited |