Automotive Brake System Market Share, Size, Trends & Industry Analysis Report

By Type (Disc, Drum); By Technology; By Vehicle Type; By Region; Segment Forecast, 2025 - 2034

- Published Date:Sep-2025

- Pages: 117

- Format: PDF

- Report ID: PM4291

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

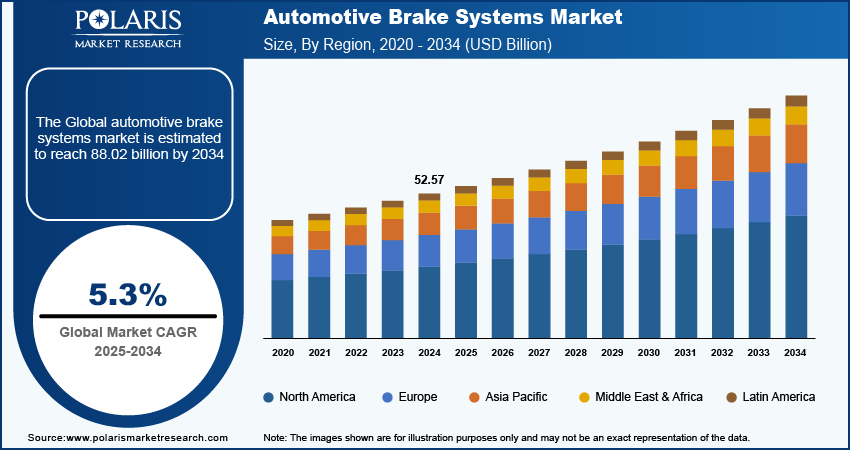

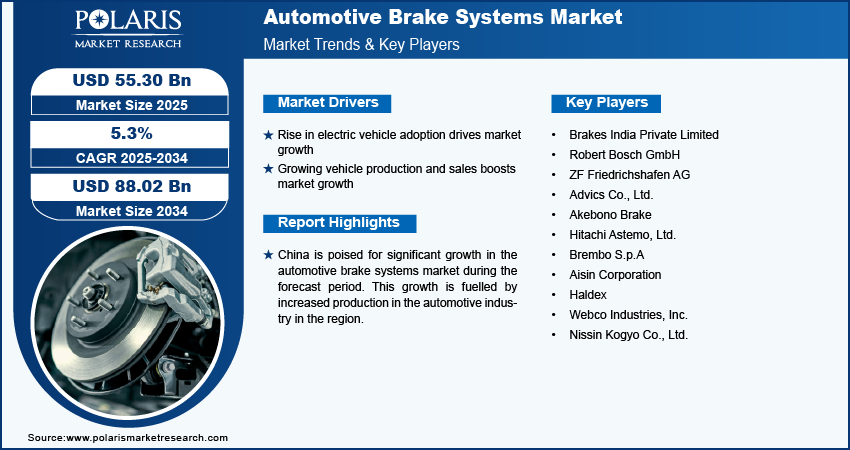

The global automotive brake system market was valued at USD 48.22 billion in 2024 and is projected to grow at a CAGR of 6.20% from 2025 to 2034. The shift towards electric vehicles, strict safety rules, and high demand for replacement parts are driving this growth.

Key Insights

- The disk segment held the largest market share because it performs well in extreme weather, without overheating or fading.

- The commercial vehicle segment is expanding at a rapid rate due to increasing demand in e-commerce, logistics, construction, and mining, which in turn increases the demand for dependable braking systems.

- The ESC segment held the highest market share, driven by the prevalence of ESC technology due to its effectiveness in regaining control of the vehicle in emergencies.

- Asia Pacific led the market, driven by high automotive production activity and increasing demand for advanced brakes throughout the region.

- North America is experiencing the highest market growth due to stringent safety mandates, rising demand for advanced braking technologies such as ESC and ABS, and the increasing adoption of hybrid and electric vehicles that require proprietary systems.

Industry Dynamics

- As the population and road accident rates grow, passenger and commercial vehicle demand increases, encouraging carmakers to integrate better braking facilities and safety features, thereby fueling market growth.

- Government-imposed stringent regulations and laws for controlling road accidents are bringing about a favorable market scenario.

- Material technologies, sensing systems, processing capabilities, and artificial intelligence have taken braking systems exponentially ahead, making them better, more responsive, and smarter for enhanced road safety.

- The market is facing a significant challenge because modern braking technologies come with high maintenance costs, which can make them less affordable for consumers and manufacturers.

Market Statistics

2024 Market Size: USD 48.22 billion

2034 Projected Market Size: USD 87.82 billion

CAGR (2025-2034): 6.20%

Asia Pacific: Largest Market Share

AI Impact on Automotive Brake System Market

- AI enhances braking system efficiency through real-time monitoring and predictive maintenance, thereby minimizing failures and improving safety.

- AI programs enhance the accuracy of advanced braking systems, such as automatic emergency braking (AEB) and adaptive cruise control, by analyzing data from cameras and sensors.

- The combination of AI with vehicle-to-vehicle (V2V) and vehicle-to-infrastructure (V2I) communication enables improved braking reactions in various road conditions.

- Machine learning, utilizing AI, enables the ongoing improvement of braking system performance by examining vast amounts of data to modify responses based on varying driving behaviors.

- AI helps to advance smarter, energy-saving braking technology, particularly for electric and autonomous vehicles, maximizing braking power and efficiency.

To Understand More About this Research: Request a Free Sample Report

The automotive brake system market is anticipated to experience significant growth due to the increased focus on safety solutions during the forecast period. The primary factor driving the development of automotive safety systems is the pursuit of improved vehicle safety. The growing demand for advanced safety technologies and features among consumers is contributing to an increase in demand for vehicle safety system enhancement.

An automotive brake system is a mechanical control apparatus that is designed to slow down or stop a vehicle's movement while emphasizing passenger safety. The system consists of several components, including a brake pedal, rotor, shoes, pads, drum, calipers, fluid lines, hoses, and master cylinder. For instance, in April 2022, Faraday Future Intelligent Electric Inc. announced that Brembo would be the main supplier of the brake caliper assembly for its latest electric vehicle, the FF 91. Brembo will be creating a customized caliper assembly for the FF 91, which will include components such as pistons, calipers, pads, and an electronic parking brake.

The growing global population is increasing the demand for passenger and commercial vehicles. This is a major factor driving the growth of the automotive market. Additionally, the rising number of road accidents across the globe is highlighting the need for automotive brake systems. As people become more concerned about road accidents and fatalities, auto manufacturers are incorporating stronger safety systems into their vehicles, which is further accelerating the growth of the market.

The rise in popularity of electric vehicles has resulted in an increased need for automotive braking systems. Due to the unique powertrain and regenerative braking features of electric vehicles, specialized braking systems are necessary. However, the high costs of such advanced systems like EBS and AEB are a major barrier to their widespread adoption. This cost factor is particularly limiting the potential market for these systems, especially in developing countries.

Governments and regulatory bodies in various countries have implemented strict regulations to reduce road accidents, which is creating a favorable market environment. The market is also experiencing growth due to ongoing technological advancements, including the use of anti-lock braking systems (ABS) and regenerative braking. These advanced braking technologies enable drivers to have better control and shorter stopping distances on slippery surfaces, which helps to reduce the likelihood of vehicle collisions. In addition, initiatives such as the New Car Assessment Program (NCAP), which promotes the use of electronic brake systems, are further contributing to the market's growth. Furthermore, the market is witnessing significant growth owing to the increasing adoption of electric vehicles and the production of self-driving cars.

COVID-19 has had a substantial impact on the automotive brake system market. The COVID-19 pandemic caused widespread disruptions such as lockdowns, supply chain disruptions, and economic uncertainty, which had a significant impact on both automotive production and demand. Automotive manufacturers needed help in maintaining their operations, leading to a drop in global vehicle production. This has affected the demand for automotive brake systems as the market is closely linked to vehicle production. As a result, the demand for automotive brake systems decreased during the pandemic.

Market Dynamics

Market Drivers

Technological advancements in the brake systems will drive the growth of the market

The continuous progress in materials, sensors, computational power, and connectivity has transformed the capabilities of braking systems. These advancements have made it possible to make braking systems that are more efficient, responsive, and intelligent. With the help of sensor technology, braking systems can be precisely controlled by monitoring different parameters like wheel speed, pressure, and vehicle dynamics. Furthermore, incorporating machine learning and artificial intelligence algorithms enhances the predictive capabilities of braking systems, enabling proactive responses to varying road conditions.

Advancements in materials science are contributing to the development of brake components with enhanced features such as reduced weight, increased strength, and higher resistance to heat. These improvements significantly improve the performance and lifespan of brakes. Additionally, the integration of braking systems with vehicle-to-vehicle (V2V) and vehicle-to-infrastructure (V2I) communication technologies allows for predictive brake responses, increasing safety and efficiency levels. The pursuit of technical innovation is evident in regenerative braking systems, which efficiently capture and convert kinetic energy into valuable electrical energy.

Market Restraints

High maintenance cost of elevated braking technology hamper on the growth of the market

The automotive industry is facing a significant challenge in the brake system market due to the high maintenance cost of advanced braking technology. As automakers continue to integrate sophisticated braking technologies, such as electronic brake systems (EBS) and regenerative braking systems, into their vehicles, the associated maintenance costs have skyrocketed. These advanced braking systems often require specialized tools, skilled technicians, and expensive components for repairs and replacements.

As a result, the high maintenance expenses act as a deterrent for both consumers and fleet operators, hindering the widespread adoption of these innovative brake systems. The reluctance to embrace these cutting-edge technologies due to concerns about long-term cost implications is a significant constraint on the overall growth potential of the automotive brake system market.

Report Segmentation

The market is primarily segmented based on type, vehicle type, technology, and region.

|

By Type |

By Vehicle Type |

By Technology |

By Region |

|

|

|

|

To Understand the Scope of this Report: Speak to Analyst

Segmental Analysis

By Product Analysis

- The disk segment held the largest revenue share in the automotive brake system market. Disc brakes have become increasingly popular in recent years owing to their excellent performance in harsh weather conditions without overheating or fading. Additionally, their smooth integration with other advanced systems has further contributed to the growth of the disc brake segment.

- The drum brake segment has witnessed the fastest growth in the market; it primarily consists of numerous gas extractors. Drum brakes are a type of braking system that uses circular elements, such as brake shoes, to create the necessary friction for stopping the vehicle. They are enclosed in a sealed configuration. Disc brakes, on the other hand, consist of a thin rotor and caliper to halt wheel movement, which results in better performance. However, despite their superior braking power, car manufacturers still prefer drum brakes because they are more cost-effective.

By Vehicle Type Analysis

- The passenger cars segment accounted for the highest market share during the forecast period. The rise in the number of passenger cars can be attributed to various factors such as population growth, increased disposable income, and urbanization. Manufacturers are focusing on improving the braking systems to prioritize safety features. Advanced Driver Assistance Systems (ADAS) play a crucial role in the passenger car market and its growth. A significant increase in ADAS investments is anticipated to drive the automotive brake systems market during the forecast period, driven by a growing demand for electromagnetic induction braking systems in various vehicles, including cars and motorcycles.

- The commercial vehicle segment has witnessed the fastest growth in the market. The demand for commercial vehicles, such as trucks, buses, and vans, has been continuously increasing. The surge can be attributed to the growth of e-commerce, increased demands in logistics and transportation, and the development of industries such as mining and construction. The growth of the commercial vehicle fleet relates to an increased demand for dependable and efficient braking systems.

By Technology Analysis

- Based on technology analysis, the market has been segmented on the basis of Anti-Lock Brake System (ABS), Traction Control System (TCS), Electronic Stability Control (ESC), Electronic Brake-Force Distribution (EBD). The electronic stability control (ESC) segment held the largest market share in the market. Electronic stability control technology is extensively adopted due to its recognized benefits in retrieving vehicle control in an emergency. The Electronic stability control technology constantly evaluates data from various sensors such as wheel speed, steering angle, yaw rate, and lateral acceleration sensors. It then compares this data to the driver's input to analyze the vehicle's real-time behavior.

- The traction control system (TCS) segment has witnessed the fastest growth in the automotive brake system market. TCS technology is designed to enhance safety by providing optimal traction in challenging driving conditions. Traction Control System (TCS) prevents wheel spin by applying brake pressure and regulating the throttle. It is mainly used together with an anti-lock braking system to achieve maximum efficiency. By incorporating advanced braking systems, automakers can obtain higher ratings for their vehicles in the New Car Assessment Program (NCAP).

Regional Insights

Asia-Pacific dominated the market with largest share in 2024

Asia-Pacific dominated the market. The demand for brake systems in the Asia-Pacific region has been driven by the significant presence of automobile manufacturing, particularly in countries such as China, Japan, South Korea, and India. An increasing middle-class population, rapid urbanization, and higher rates of vehicle ownership have facilitated this growth. Furthermore, the market has been positively influenced by stringent safety regulations and the integration of advanced braking systems in vehicles. The Asia-Pacific region is leading the expansion of the automotive braking system market, driven by its manufacturing capacity, surging demand for vehicles, and heightened focus on safety.

North America is witnessed for the fastest growth in the market. The stringent safety standards and regulations of North America are fueling the demand for advanced braking technologies such as ESC, ABS, and other braking systems. The rise of hybrid and electric vehicles is also leading to the creation of specialized brake systems.

Competitive Landscape

The market is characterized by intense competition, with established players relying on advanced technology, high-quality products, and a strong brand image to drive revenue growth. These companies employ various strategies such as research and development, mergers and acquisitions, and technological innovations to expand their product portfolios and maintain a competitive edge in the market.

Some of the major players operating in the global market include:

- ADVICS CO., LTD.

- AISIN CORPORATION

- AKEBONO BRAKE INDUSTRY CO., LTD.

- Brembo S.p.A

- Haldex

- Hitachi Astemo, Ltd.

- NISSIN KOGYO Co., Ltd.

- Robert Bosch GmbH

- The Web Co

- ZF Friedrichshafen AG

Recent Developments

- In October 2023, Brembo S.p.A. has launched the Greenance brake kit for light commercial vehicles. This kit offers an 80% reduction in particulate emissions and has a perfect balance between efficiency and durability. It exceeds the performance of current aftermarket alternatives threefold, with an 83% reduction in PM10 and an 80% reduction in PM2.5 particulate emissions.

- In June 2023, EBC Brakes Racing has launched fully-floating two-piece discs and high-performance brake pads designed for the G87 BMW M2. This makes them one of the first companies to offer aftermarket performance upgrades for the car. The launch of these advanced braking solutions demonstrates their commitment to serving enthusiasts by offering high-quality products that enhance their driving experience.

- In May 2023, Continental AG has launched its latest traditional electronic brake system, the MK 120 Electronic Stability Control. The company has started distributing the MK 120 ESC brake system to Changan, a leading car manufacturer in China.

Report Coverage

The automotive brake system market report emphasizes on key regions across the globe to provide better understanding of the product to the users. Also, the report provides market insights into recent developments, trends and analyzes the technologies that are gaining traction around the globe. Furthermore, the report covers in-depth qualitative analysis pertaining to various paradigm shifts associated with the transformation of these solutions.

The report provides detailed analysis of the market while focusing on various key aspects such as competitive analysis, type, vehicle type, technology, and their futuristic growth opportunities.

Report Scope

|

Report Attributes |

Details |

|

Market size value in 2025 |

USD 54.21 billion |

|

Revenue forecast in 2034 |

USD 87.82 billion |

|

CAGR |

6.20% from 2025 – 2034 |

|

Base year |

2024 |

|

Historical data |

2020 – 2023 |

|

Forecast period |

2025 – 2034 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Segments Covered |

By Type, By Vehicle Type, By Technology, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Customization |

Report customization as per your requirements with respect to countries, region and segmentation |

FAQ's

The automotive brake system market report covering key segments are type, vehicle type, technology, and region

Automotive Brake System Market Size Worth $78.32 Billion By 2032

Automotive Brake System Market exhibiting the CAGR of 5.2% during the forecast period

Asia-Pacific is leading the global market

key driving factors in automotive brake system market are technological advancements in the brake systems will drive the growth of the market