Next-Generation Sequencing Library Preparation Market Size, Share, Trends, Industry Analysis Report

By Sequencing Type (Targeted Genome Sequencing, Whole Genome Sequencing), By Product, By Application, By End User, By Region – Market Forecast, 2025–2034

- Published Date:Jul-2025

- Pages: 130

- Format: PDF

- Report ID: PM5044

- Base Year: 2024

- Historical Data: 2020-2023

Overview

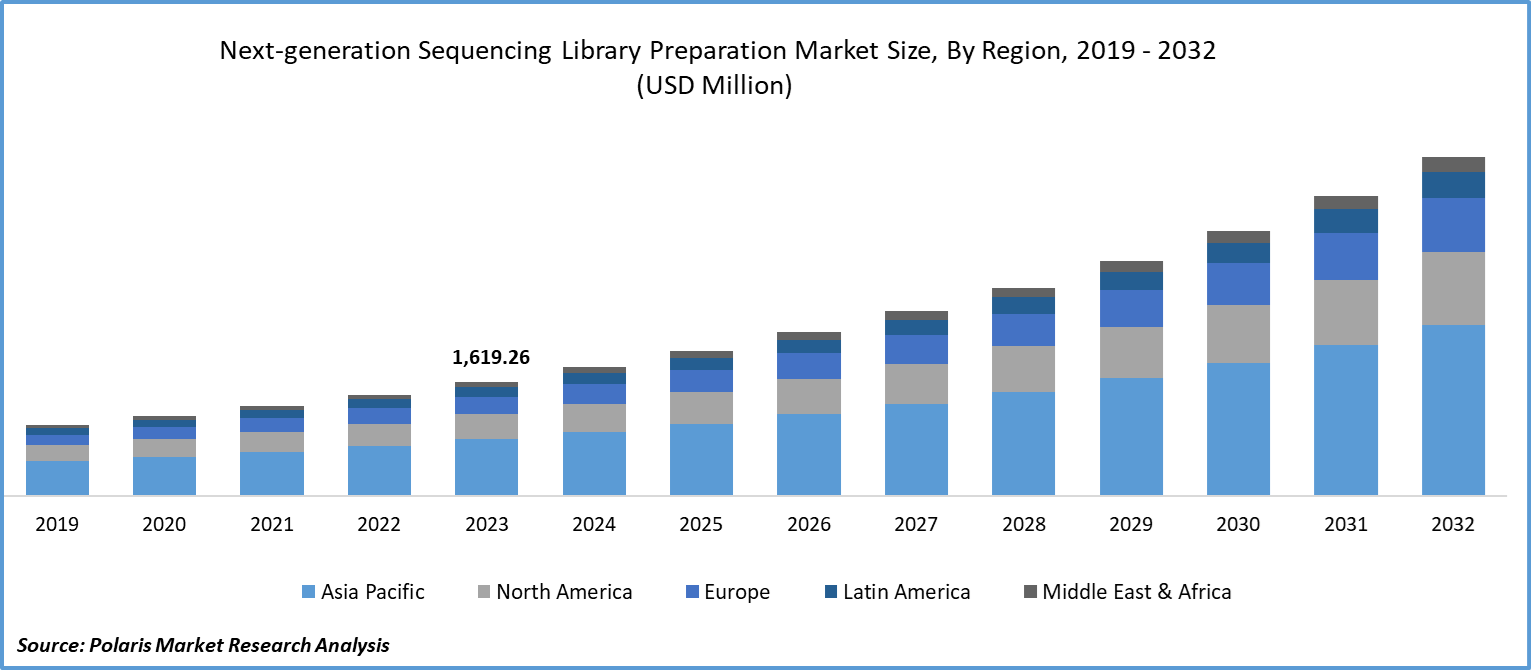

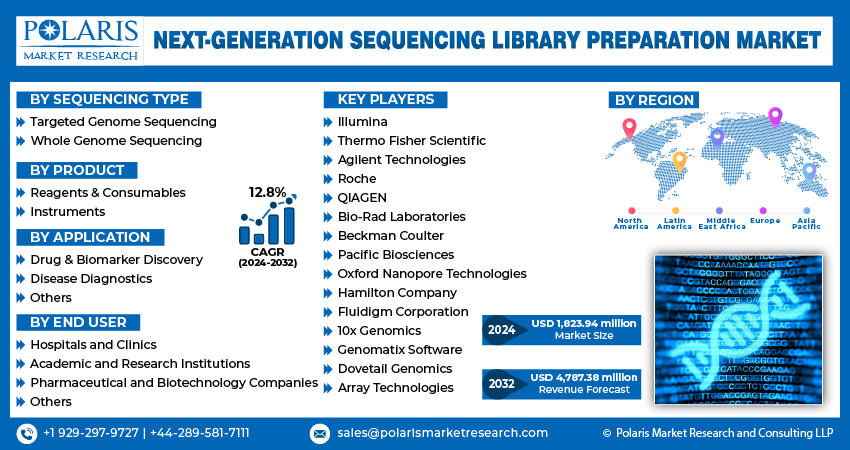

The global next-generation sequencing library preparation market size was valued at USD 1.71 billion in 2024, growing at a CAGR of 13.21% from 2025 to 2034. Key factors driving demand for next-generation sequencing library preparation include advancements in genomic research, increased adoption of automation and high-throughput solutions, expansion of applications in personalized medicine and drug discovery, and technological innovations that enhance library preparation processes.

The field of next-generation sequencing library preparation market focuses on technologies and solutions for preparing biological samples, such as DNA or RNA, for next-generation sequencing. This crucial step involves converting samples into a suitable format for sequencing, enabling accurate and high-throughput genetic analysis. The market includes tools, reagents, and services essential for genomics research, diagnostics, and personalized medicine.

The industry is rapidly expanding due to advancements in genomic research and the increasing adoption of NGS technologies across various applications, including personalized medicine, cancer research, and drug discovery. Emerging trends in the industry are the development of automation and high-throughput solutions, integration with bioinformatics tools, and the growing emphasis on personalized and precision medicine. Additionally, the increasing focus on genomics-based diagnostics and therapeutics fuels the demand for sophisticated library preparation techniques.

To Understand More About this Research: Request a Free Sample Report

Industry Dynamics

Increased Adoption of Automation and High-Throughput Solutions

Automation streamlines the library preparation process, reducing manual labor and minimizing errors, which is crucial for high-volume sequencing projects. High-throughput solutions such as advanced robotic systems and automated liquid handling enable labs to process multiple samples simultaneously, significantly increasing efficiency and throughput. The adoption of these technologies is expected to rise in the coming years as laboratories and research institutions seek to enhance their operational capabilities and deliver faster and reliable results. Owing to all these factors, integration of automation and high-throughput solutions is expected to revolutionize the next-generation sequencing (NGS) library preparation market during the forecast period.

Expansion of Applications in Personalized Medicine and Drug Discovery

The application of NGS library preparation in personalized medicine and drug discovery is expanding, driven by the increasing emphasis on tailoring treatments to individual genetic profiles and the need for novel drug targets. Personalized medicine leverages genomic data to customize patient care, improve treatment efficacy, and reduce adverse effects. NGS library preparation plays a critical role in generating the comprehensive genomic data required for such applications. In drug discovery, NGS library preparation facilitates the identification of genetic variations associated with diseases and potential therapeutic targets, accelerating the development of new drugs.

Technological Innovations Enhancing Library Preparation Processes

Technological innovations are making NGS library preparation processes more efficient and cost-effective. Advances in sequencing chemistries, library preparation kits, and reagents are enabling more accurate and faster generation of sequencing libraries. Innovations such as improved adapters, barcoding techniques, and high-fidelity enzymes are addressing challenges related to library complexity and quality. Additionally, the development of new methods for library enrichment and amplification is advancing the capabilities of NGS. The emergence of these technological innovations is expected to drive the growth of the NGS library preparation market in the coming years.

Segment Insights

Sequencing Type Insights

Based on sequencing type, the segmentation includes targeted genome sequencing and whole genome sequencing. The targeted genome sequencing segment dominated revenue share in 2024 due to its cost-efficiency, high throughput, and focused approach in identifying genetic variants within specific genomic regions. Researchers and clinicians preferred this method as it reduces sequencing costs while delivering actionable insights, particularly in applications such as oncology, inherited disorders, and pharmacogenomics. Targeted sequencing enables deeper coverage of select genes, improving the accuracy of variant detection and minimizing data analysis complexities. The increasing demand for companion diagnostics and precision medicine across both clinical and research settings further supported the dominance of the segment.

The whole genome sequencing segment is projected to grow at a robust pace in the coming years, owing to the continuous decline in sequencing costs, coupled with rising investments in large-scale population genomics and personalized healthcare initiatives. Governments and research institutions globally are launching extensive genome mapping projects to understand disease mechanisms at a deeper level, which is projected to drive demand for whole genome sequencing. Furthermore, advancements in high-throughput platforms and bioinformatics tools are making whole-genome approaches more accessible and scalable.

Product Insights

In terms of product, the segmentation includes reagents & consumables, and instruments. The reagents & consumables segment dominated the revenue share share in 2024, due to their critical role in the sequencing workflow. Reagents and consumables include a wide range of essential components such as enzymes, buffers, and adapters, which are necessary for preparing sequencing libraries. This segment also benefited from the rising need for reagents & consumables in ongoing research and clinical applications.

Application Insights

Based on application, the segmentation includes drug & biomarker discovery, disease diagnostics, and others. The drug & biomarker discovery segment held the largest revenue share in 2024, driven by the increased focus on personalized medicine and the need for identifying novel drug targets and biomarkers. The segment benefited from the ability of next generation sequencing to provide comprehensive genomic data, which is essential for understanding disease mechanisms and developing targeted therapies.

The disease diagnostics segment is projected to grow at a robust pace in the coming years, owing to the growing adoption of genomic diagnostics and advancements in sequencing technologies that enable accurate and faster disease detection. The increasing prevalence of genetic disorders, advances in NGS technology that enhance sensitivity and accuracy, and the shift toward personalized healthcare are also driving the demand for next-generation sequencing library preparation within this segment.

End User Insights

In terms of end user, the segmentation includes hospitals and clinics, academic and research institutions, pharmaceutical and biotechnology companies, and others. The academic and research institutions segment dominated revenue share in 2024 due to their extensive involvement in genomics studies, disease research, and prostate cancer biomarker discovery. These institutions led numerous population-scale initiatives and fundamental research projects aimed at decoding the genetic basis of complex diseases such as cancer, neurological disorders, and rare inherited conditions, where next-generation sequencing library preparation is required. Moreover, the growing focus on translational research and precision medicine encouraged universities and research centers to invest heavily in sequencing technologies and library preparation protocols to generate high-quality, reproducible data.

Regional Insights

The North America next-generation sequencing library preparation market accounted for a 43.12% global share in 2024. This dominance is attributed to high investments in genomics research, an established biotechnology sector, and increasing applications in precision medicine. The region benefited from strong government funding, high adoption of NGS in clinical diagnostics, and a growing focus on cancer genomics and rare disease research. Additionally, the presence of major sequencing companies and academic institutions in the region fueled innovation in the market.

U.S. Next Generation Sequencing Library Preparation Market Insight

The U.S. accounted for a major revenue share in North America in 2024 due to advancements in personalized medicine, large-scale genomic initiatives, and widespread use in oncology. The FDA’s increasing approval of NGS-based diagnostics and the rise of consumer genetic testing also contributed to its dominance. Furthermore, collaborations between biotech firms, academic labs, and pharmaceutical companies in the U.S. drove the need for high-throughput, automated library preparation solutions to support large genomic datasets.

Europe Next Generation Sequencing Library Preparation Market Trends

The market in Europe is projected to grow at a rapid pace in the coming years, owing to the strong government-backed genomics initiatives such as the UK Biobank, the EU’s 1+ Million Genomes Project, and increasing integration of NGS into healthcare systems. The region’s emphasis on translational research, infectious disease surveillance, and agricultural genomics is further boosting adoption. Strict regulatory frameworks and partnerships between academia and industry are promoting innovation in sequencing technologies, leading to industry expansion.

Germany Next Generation Sequencing Library Preparation Market Overview

The next-generation sequencing library preparation industry in Germany is witnessing high demand due to its strong academic research infrastructure, precision medicine initiatives, and growing molecular diagnostics sector. Government funding through programs such as the German Human Genome-Phenome Archive is supporting large-scale sequencing projects. Additionally, the rise of liquid biopsy in oncology and increasing partnerships between diagnostic companies and hospitals are driving the need for efficient, scalable library preparation workflows.

Asia Pacific Next Generation Sequencing Library Preparation Market Assessment

Asia Pacific is projected to hold a substantial share during 2025–2034, owing to expanding genomics research, increasing healthcare investments, and rising prevalence of chronic diseases. Countries such as China, Japan, and South Korea are leading in the region with national genomics projects and growing biopharma research and development (R&D). Lower sequencing costs, improving healthcare infrastructure, and a surge in agricultural and microbial genomics applications are further contributing to market expansion. Additionally, government support and increasing private-sector investments are fueling the demand for NGS and its library preparation across clinical and research settings in Asia Pacific.

Key Players and Competitive Insights

Illumina, Thermo Fisher Scientific, and Agilent Technologies are a few of the key players in the global next-generation sequencing (NGS) library preparation market. These players are recognized for their comprehensive NGS solutions and advanced library preparation kits. Other notable companies, including Roche, QIAGEN, and Bio-Rad Laboratories, offer a range of products and services that cater to diverse genomic research needs. Additional significant players include Beckman Coulter, Pacific Biosciences, and Oxford Nanopore Technologies, known for their innovative technologies and specialized solutions. Also, a few companies contributing to the market are Hamilton Company, Fluidigm Corporation, and 10x Genomics, which provide automation and high-throughput capabilities. Companies such as Genomatix Software, Dovetail Genomics, and Array Technologies contribute unique technologies and advancements to the NGS library preparation.

In terms of competitive analysis, Illumina and Thermo Fisher Scientific dominate the market due to their extensive product portfolios, strong R&D capabilities, and global reach. Illumina’s leadership is supported by its broad range of NGS platforms and library preparation kits that cater to various research and clinical applications. Thermo Fisher Scientific’s competitive edge lies in its comprehensive offerings and integration of NGS technologies with other laboratory services. Agilent Technologies and Roche are also key players, leveraging their extensive experience in molecular biology and genomic research to drive innovation and market presence.

Key Players

- 10x Genomics

- Agilent Technologies

- Array Technologies

- Beckman Coulter

- Bio-Rad Laboratories

- Dovetail Genomics

- Fluidigm Corporation

- Genomatix Software

- Hamilton Company

- Illumina

- Oxford Nanopore Technologies

- Pacific Biosciences

- QIAGEN

- Roche

- Thermo Fisher Scientific

Industry Developments

January 2025: Thermo Fisher Scientific introduced Olink Reveal, a NGS-based proteomics solution designed to integrate seamlessly with existing NGS platforms.

October 2024: BD announced the launch of a new robotics-compatible reagent kit designed to automate and standardize single-cell research workflows.

Next-Generation Sequencing Library Preparation Market Segmentation

By Sequencing Type Outlook (Revenue, USD Billion, 2020–2034)

- Targeted Genome Sequencing

- Whole Genome Sequencing

By Product Outlook (Revenue, USD Billion, 2020–2034)

- Reagents & Consumables

- Instruments

By Application Outlook (Revenue, USD Billion, 2020–2034)

- Drug & Biomarker Discovery

- Disease Diagnostics

- Others

By End User Outlook (Revenue, USD Billion, 2020–2034)

- Hospitals and Clinics

- Academic and Research Institutions

- Pharmaceutical and Biotechnology Companies

- Others

By Regional Outlook (Revenue, USD Billion, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Next-Generation Sequencing Library Preparation Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 1.71 billion |

|

Market Size in 2025 |

USD 1.93 billion |

|

Revenue Forecast in 2034 |

USD 5.89 billion |

|

CAGR |

13.21% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

Next-Generation Sequencing Library Preparation Industry Share Analysis (2024) Company Profiles/Industry participants profiling includes company overview, financial information, product/service benchmarking, and recent developments |

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, region, and segmentation. |

How the report is valuable for an organization?

Workflow/Innovation Strategy

The next-generation sequencing library preparation market has been segmented on the basis of sequencing types, products, applications, and end users. Moreover, the study provides the reader with a detailed understanding of the different segments at global and regional levels.

Growth/Marketing Strategy

To drive growth in the global next-generation sequencing (NGS) library preparation market, companies are focusing on several key strategies. These include expanding their product portfolios with innovative and high-throughput solutions to meet diverse research needs and enhancing automation capabilities to increase efficiency. Strategic partnerships and acquisitions are being leveraged to access new technologies and markets, while investments in R&D ensure the development of advanced products. Additionally, companies are targeting emerging markets with tailored solutions and engaging in aggressive marketing campaigns to raise awareness and adoption of their NGS technologies. Building strong relationships with key research institutions and healthcare providers also plays a crucial role in their business growth.

FAQ's

The global next-generation sequencing library preparation market size was valued at USD 1.71 billion in 2024 and is projected to grow to USD 5.89 billion by 2034.

The global market is projected to register a CAGR of 13.21% during 2025–2034.

North America dominated the market share in 2024.

A few of the key players in the market include 10x Genomics, Agilent Technologies, Beckman Coulter, Bio-Rad Laboratories, Dovetail Genomics, Fluidigm Corporation, Genomatix Software, Illumina, Pacific Biosciences, QIAGEN, Roche, and Thermo Fisher Scientific.

The targeted genome sequencing segment dominated the market in 2023.

The disease diagnostics segment accounted for a larger market share.

The global next-generation sequencing (NGS) library preparation market focuses on the development, production, and sale of products and services used to prepare DNA or RNA samples for sequencing on NGS platforms. Library preparation is a critical step in the NGS workflow, involving the fragmentation, amplification, and addition of adapters to nucleic acid samples to create libraries that are compatible with sequencing machines. This market encompasses a range of reagents, kits, and automation solutions designed to enhance the efficiency, accuracy, and throughput of NGS processes. It is driven by the increasing adoption of NGS technologies in various fields such as clinical diagnostics, genomics research, personalized medicine, and drug discovery, as well as continuous advancements in sequencing technologies and decreasing costs of sequencing.

A few key trends in the global next-generation sequencing (NGS) library preparation market are described below: Increased Adoption of Automation: Growing integration of automated and high-throughput solutions to enhance efficiency and reduce errors in library preparation processes. Expansion of Personalized Medicine: Rising use of NGS in personalized medicine and precision medicine, driving demand for sophisticated library preparation techniques. Technological Innovations: Continuous advancements in sequencing chemistries, library preparation kits, and reagents, improving accuracy and efficiency. Cost Reduction: Decreasing the costs of sequencing makes NGS technologies more accessible and drives market growth. Increased Adoption of Automation: Growing integration of automated and high-throughput solutions to enhance efficiency and reduce errors in library preparation processes. Expansion of Personalized Medicine: Rising use of NGS in personalized medicine and precision medicine, driving demand for sophisticated library preparation techniques. Technological Innovations: Continuous advancements in sequencing chemistries, library preparation kits, and reagents, improving accuracy and efficiency. Cost Reduction: Decreasing costs of sequencing make NGS technologies more accessible and drive market growth.

A new company entering the global next-generation sequencing (NGS) library preparation market must focus on developing innovative, high-throughput, and automated solutions to enhance efficiency and accuracy in sample preparation. Investing in R&D to create innovative, cost-effective products tailored to emerging applications such as personalized medicine and cancer genomics can provide a competitive edge. Building strategic partnerships with leading research institutions and healthcare providers can facilitate market entry and growth. Additionally, integrating advanced bioinformatics tools for seamless data analysis and offering robust customer support and training services can help differentiate the company and attract a loyal customer base.

Companies manufacturing and distributing next-generation sequencing library preparation products, kits, and other consumables, and other consulting firms must buy the report.