Japan Compressed Air Filter and Dryer Market Size, Share, Trends, Industry Analysis Report

By Product (Compressed Air Dryers, Compressed Air Filters), By Industry Vertical – Market Forecast, 2025–2034

- Published Date:Aug-2025

- Pages: 123

- Format: PDF

- Report ID: PM6255

- Base Year: 2024

- Historical Data: 2020-2023

Overview

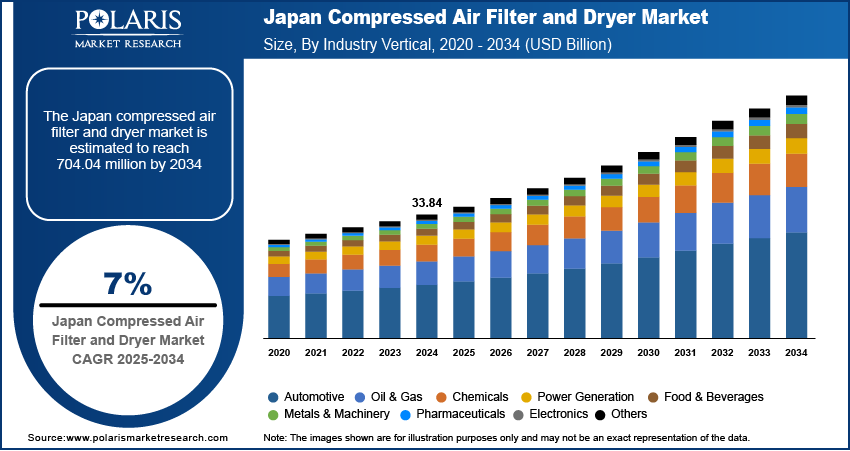

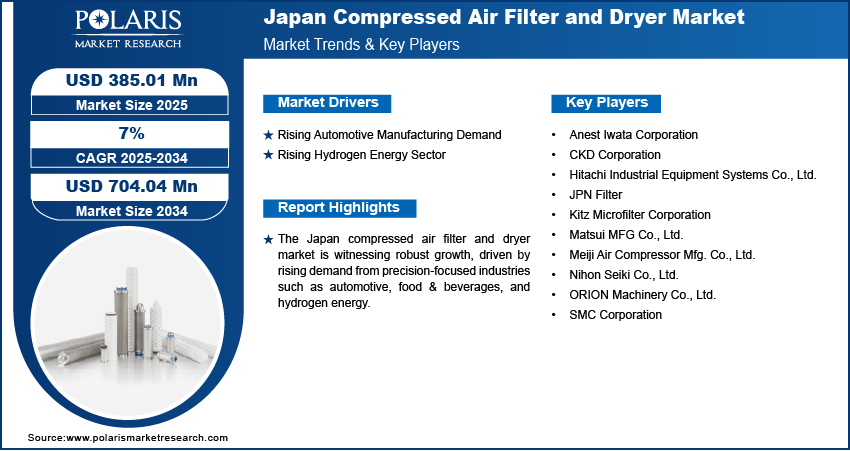

The Japan compressed air filter and dryer market size was valued at USD 362.58 million in 2024, growing at a CAGR of 7% from 2025 to 2034. Key factors driving demand include the implementation of strict standards from government, rising automotive manufacturing demand, and expansion of Japan’s hydrogen energy sector.

Key Insights

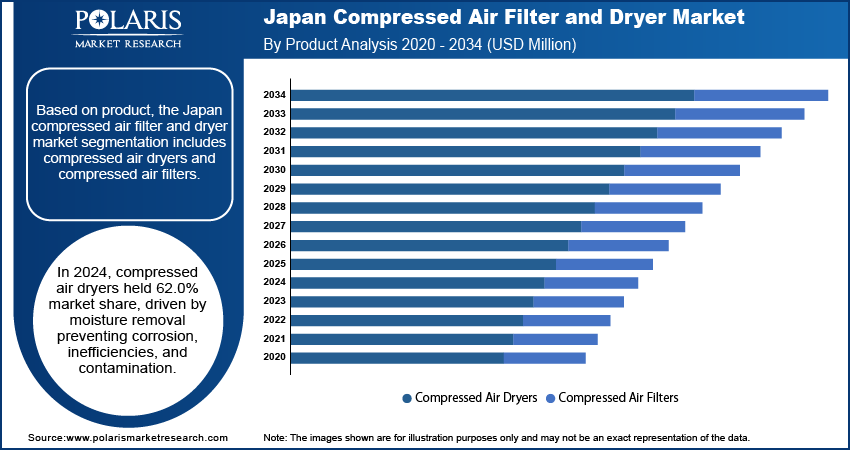

- The compressed air dryers segment dominated the market in 2024 with a 62.0% share, as moisture removal remains essential to prevent system corrosion and maintain operational efficiency across industries.

- The food & beverage sector is expected to register a highest CAGR of 7.5% during the forecast period, driven by stringent hygiene regulations and compressed air quality requirements in food processing and packaging operations.

Industry Dynamics

- Japan's growing auto manufacturing requires precision air systems for painting and automation, driving demand for advanced filters and dryers to prevent defects and maintain quality standards.

- The Japan's hydrogen sector needs ultra-clean air for fuel cells, boosting high-performance air treatment systems to ensure safety and efficiency in production.

- Japan's compressed air filter and dryer market faces pricing pressures from low-cost Asian imports, squeezing margins for domestic manufacturers while maintaining high quality standards demanded by local industries.

- Growing hydrogen energy investments create new demand for ultra-clean air solutions, offering Japanese manufacturers a premium market segment to leverage their expertise in precision filtration technology.

Market Statistics

- 2024 Market Size: USD 362.58 million

- 2034 Projected Market Size: USD 704.04 million

- CAGR (2025–2034): 7%

AI Impact on Japan Compressed Air Filter and Dryer Market

- Although AI integration in compressed air filters and dryers is still nascent across Japan, the rising push from METI and manufacturers toward smart manufacturing practices boosts the deployment of AI-based monitoring and IoT sensors.

- The imposition of stringent standards across various sectors such as semiconductors and pharmaceuticals creates a requirement for ultra-clean, precision air systems, which propels the demand for AI-enabled compressed air filtering and drying systems.

Compressed air filters and dryers are critical systems used to remove contaminants such as water, oil, and particulates from compressed air, ensuring a reliable and clean air supply for industrial processes. In Japan, the market for compressed air filters and dryers is strongly shaped by the implementation of strict standards such as those set by the Japanese Industrial Standards (JIS) and the Pharmaceuticals and Medical Devices Agency (PMDA). These regulations enforce high air purity levels across sectors, such as manufacturing, healthcare, and pharmaceuticals. The adoption of advanced filtration and drying systems has grown, particularly in applications where even minor impurities compromise product quality or regulatory compliance, as industries aim to comply with these demanding specifications. These regulatory frameworks mandate continuous quality assurance, thereby driving end-users to invest in systems that guarantee consistent air purity and system longevity.

Drivers & Opportunities

Rising Automotive Manufacturing Demand: The rising automotive manufacturing demand in Japan is boosting the sector, primarily due to the high reliance on precision and cleanliness in production processes. A January 2024 report by the U.S. International Trade Administration (ITA) highlights that Japan’s automotive sector comprises 2.9% of total GDP and 13.9% of manufacturing GDP. In 2022, 3,448,272 new passenger vehicles were sold domestically. Compressed air is extensively used in tasks such as pneumatic control systems, painting, and assembly line automation, where the presence of contaminants leads to quality defects or equipment inefficiencies. The need for advanced filtration and drying solutions has increased as automotive manufacturers aim to meet increasingly strict quality standards and optimize operational performance. This growing dependence on clean and dry compressed air systems to ensure consistent output and minimize downtime boosts the adoption of these technologies within the automotive sector.

Rising Hydrogen Energy Sector: The expansion of Japan’s hydrogen energy sector accelerates demand for compressed air filters and dryers, driven by the sector’s requirement for ultra-clean air in the production and compression of hydrogen. Hydrogen systems, especially in applications like fuel cells and electrolysis, are highly sensitive to moisture and particulate contamination, which compromise efficiency and safety. The infrastructure supporting hydrogen production and distribution increasingly integrates high-performance compressed air treatment systems as Japan boosts efforts to transition toward cleaner energy alternatives. According to an April 2024 World Economic Forum report, the Tokyo Metropolitan Government raised its FY2024 hydrogen initiative budget to USD 134 million, an 80% increase from 2023, reflecting increased focus on clean energy development. This alignment of clean energy goals with strict air quality requirements highlights the major role of compressed air filters and dryers in supporting the country’s evolving energy landscape.

Segmental Insights

Product Analysis

Based on product, the segmentation includes compressed air dryers and compressed air filters. The compressed air dryers segment accounted for 62.0% share of the market in 2024, primarily driven by their critical role in removing moisture from compressed air systems to prevent corrosion, operational inefficiencies, and product contamination. Industries such as automotive, electronics, and pharmaceuticals demand a consistently dry air supply to maintain process integrity and ensure equipment longevity. Japan's precision-oriented industrial landscape has further increased the adoption of advanced dryer technologies, such as desiccant and refrigerated dryers, which offer reliable performance under rigid environmental and quality standards. The focus on minimizing maintenance downtime and ensuring long-term operational stability has positioned compressed air dryers as an essential component across manufacturing facilities.

The compressed air filters segment is projected to register a CAGR of 6.9% during the forecast period, supported by the increasing need to eliminate oil aerosols, particulates, and other contaminants from compressed air, particularly in sensitive industries. The requirement for high-purity compressed air has grown as Japan’s industrial sectors adopt more automation and cleanroom-based manufacturing environments. This is especially evident in the food & beverage, electronics, and pharmaceutical industries, where product safety, hygiene, and compliance with strict national standards are non-negotiable. Moreover, the push for enhanced energy efficiency and environmental compliance is also encouraging the use of efficient filtration systems, supporting the segment's future growth.

Industry Vertical Analysis

In terms of industry vertical, the segmentation includes automotive, oil & gas, chemicals, power generation, food & beverages, metals & machinery, pharmaceuticals, electronics, and others. The automotive segment captured 21.1% share of the market in 2024, attributed to the industry's strong reliance on compressed air for tasks such as pneumatic operations, spray painting, and robotics. Clean and dry air is essential in ensuring the accuracy and consistency of these operations, reducing defects, and enhancing production efficiency. The demand for reliable air treatment systems remains high, with Japanese automakers maintaining global reputations for quality and precision. Moreover, the integration of advanced automation and quality assurance protocols within automotive manufacturing has reinforced the segment’s dependence on compressed air filtration and drying technologies.

The food & beverage segment is projected to witness the highest CAGR of 7.5% during the forecast period, owing to strict hygiene standards and regulatory requirements governing air quality in food processing and packaging environments. Compressed air comes into direct or indirect contact with food products, making filtration and moisture removal essential to prevent contamination and spoilage. Japan’s focus on food safety, associated with the modernization of food production facilities, is driving investments in high-efficiency air dryers and filters. This trend is further supported by the growing demand for packaged and processed food, which requires highly controlled environments to maintain product integrity and shelf life.

Key Players & Competitive Analysis

The Japan compressed air filter and dryer market is highly competitive, with companies leveraging strategic investments and technological advancements to strengthen their position. Competitive intelligence and strategy reveal that small and medium-sized businesses are adopting future development strategies to capitalize on emerging market segments, driven by industry trends such as energy efficiency and automation. Revenue growth analysis indicates strong latent demand and opportunities in industrial applications, while supply chain disruptions and economic and geopolitical shifts pose challenges. Leading vendors focus on sustainable value chains and expansion opportunities through mergers and acquisitions, enhancing their regional footprint. Expert’s insight suggests that growth projections will be shaped by disruptions and trends in smart manufacturing, with revenue opportunity tied to innovation. Competitive positioning relies on product offerings, pricing insights, and partner & customer ecosystems, ensuring long-term dominance in this evolving sector.

A few major companies operating in the Japan compressed air filter and dryer market include Anest Iwata Corporation; CKD Corporation; Hitachi Industrial Equipment Systems Co., Ltd.; JPN Filter; Kitz Microfilter Corporation; Matsui MFG Co., Ltd.; Meiji Air Compressor Mfg. Co., Ltd.; Nihon Seiki Co., Ltd.; ORION Machinery Co., Ltd.; and SMC Corporation.

Key Players

- Anest Iwata Corporation

- CKD Corporation

- Hitachi Industrial Equipment Systems Co., Ltd.

- JPN Filter

- Kitz Microfilter Corporation

- Matsui MFG Co., Ltd.

- Meiji Air Compressor Mfg. Co., Ltd.

- Nihon Seiki Co., Ltd.

- ORION Machinery Co., Ltd.

- SMC Corporation

Japan Compressed Air Filter and Dryer Industry Developments

- September 2024: Donaldson launched sterile air/liquid testing and ISO 8573-compliant services in France, Germany, and Austria, targeting the food & beverage sectors. The move enhances local support for filter maintenance and process validation.

Japan Compressed Air Filter and Dryer Market Segmentation

By Product Outlook (Revenue, USD Million, 2020–2034)

- Compressed Air Dryers

- Refrigeration

- Desiccant/Adsorption

- Deliquescent

- Membrane

- Compressed Air Filters

- Particulate Filters

- Coalescing Filters

- Compressed Intake Filters

- Activated Carbon Filters

By Industry Vertical Outlook (Revenue, USD Million, 2020–2034)

- Automotive

- Oil & Gas

- Chemicals

- Power Generation

- Food & Beverages

- Metals & Machinery

- Pharmaceuticals

- Electronics

- Others

Japan Compressed Air Filter and Dryer Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 362.58 Million |

|

Market Size in 2025 |

USD 385.01 Million |

|

Revenue Forecast by 2034 |

USD 704.04 Million |

|

CAGR |

7% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Million and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The market size was valued at USD 362.58 million in 2024 and is projected to grow to USD 704.04 million by 2034.

The market is projected to register a CAGR of 7% during the forecast period.

A few of the key players in the market are Anest Iwata Corporation; CKD Corporation; Hitachi Industrial Equipment Systems Co., Ltd.; JPN Filter; Kitz Microfilter Corporation; Matsui MFG Co., Ltd.; Meiji Air Compressor Mfg. Co., Ltd.; Nihon Seiki Co., Ltd.; ORION Machinery Co., Ltd.; and SMC Corporation.

The compressed air dryers segment accounted for a 62.0% share of the market in 2024.

The food & beverage segment is projected to witness the highest CAGR of 7.5% during the forecast period.