Compressed Air Filter and Dryer Market Size, Share, Trends, Industry Analysis Report

By Product (Compressed Air Dryers, Compressed Air Filters), By Industry Vertical, By Region – Market Forecast, 2025–2034

- Published Date:Aug-2025

- Pages: 116

- Format: PDF

- Report ID: PM2454

- Base Year: 2024

- Historical Data: 2020-2023

Overview

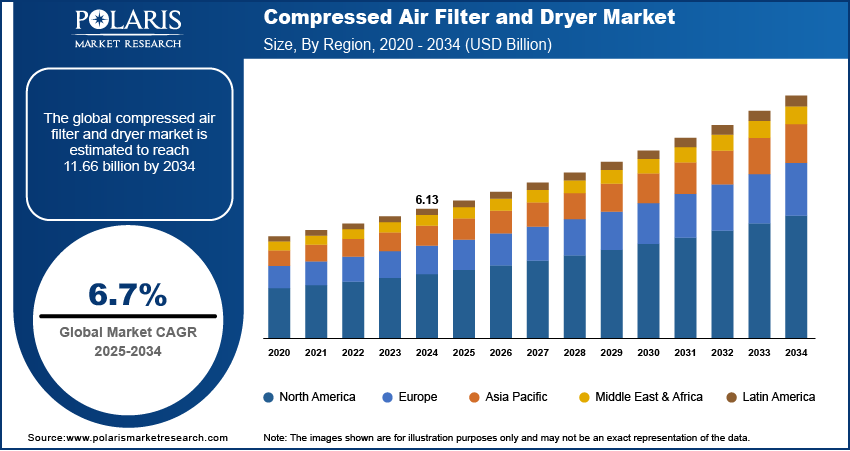

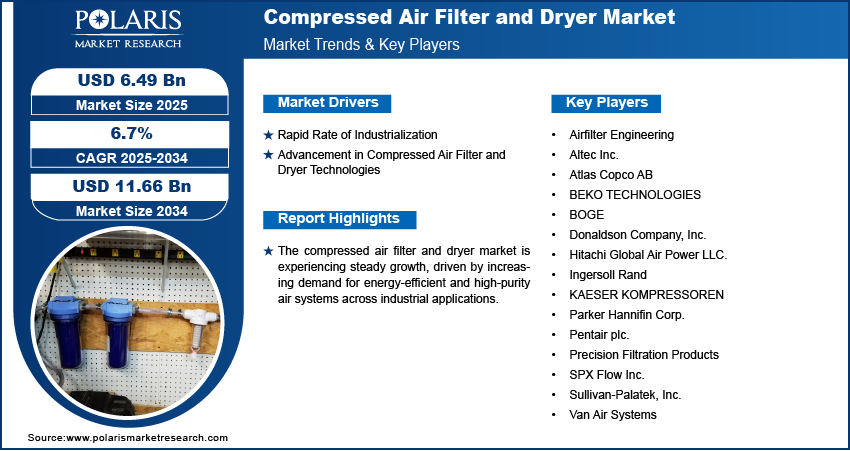

The global compressed air filter and dryer market size was valued at USD 6.13 billion in 2024, growing at a CAGR of 6.7% from 2025 to 2034. Key factors driving demand compressed air filters and dryers include the expanding use of compressed air in critical end-use applications, rapid industrialization, and rising technological advancements in compressed air filters and dryers.

Key Insights

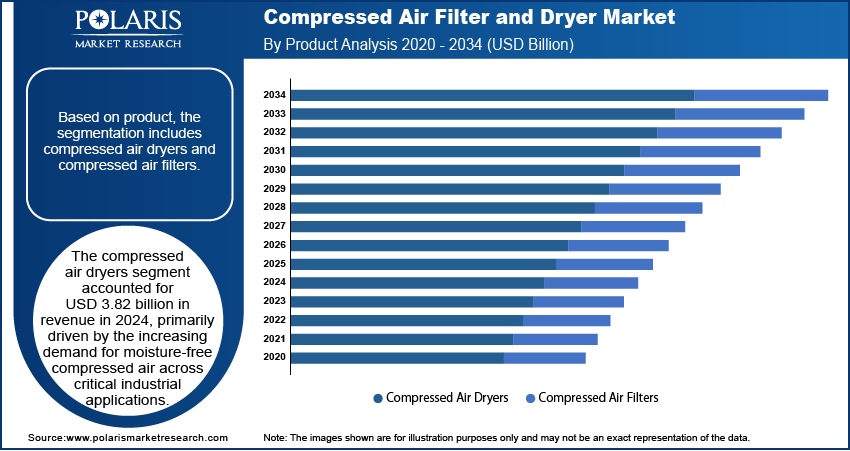

- The compressed air dryers segment generated USD 3.82 billion in revenue in 2024, driven by rising demand for moisture-free air in critical industrial applications.

- The food & beverage sector is expected to register a CAGR of 7.2% during the forecast period, fueled by strict hygiene standards requiring ultra-clean compressed air.

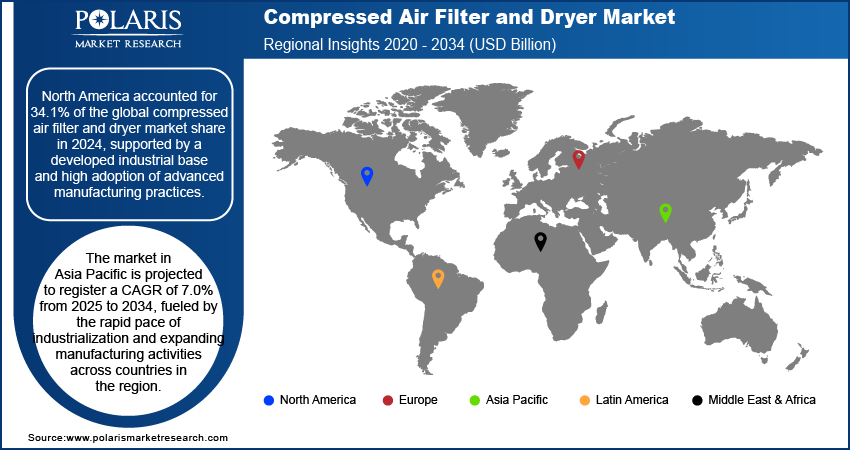

- North America held a 34.1% global market share in 2024, supported by its advanced industrial base and high adoption of modern manufacturing technologies.

- The U.S. accounted for 73.0% of North America’s market share in 2024, due to its strong industrial infrastructure and early adoption of advanced air treatment solutions.

- The Asia Pacific market is projected to register a CAGR of 7.0% during 2025–2034, driven by rapid industrialization and expanding manufacturing sectors.

- India captured 18.0% of the Asia Pacific’s market share in 2024, supported by industrial expansion and the modernization of manufacturing facilities.

Industry Dynamics

- Compressed air dryers consume energy, increasing operational costs. Stricter efficiency regulations and rising energy prices pressurize manufacturers to develop cost-effective, low-power solutions.

- Growing demand for IoT-connected filters and dryers allows real-time monitoring, predictive maintenance, and energy optimization, creating new revenue streams for tech-driven suppliers.

- Rapid industrialization boosts demand for compressed air filters and dryers, as sectors such as manufacturing and automotive require clean, dry air for equipment efficiency and process reliability.

- Innovations such as smart sensors, modular designs, and energy-efficient filters enhance performance, reduce maintenance, and meet stricter industry regulations, supporting market expansion.

Market Statistics

- 2024 Market Size: USD 6.13 billion

- 2034 Projected Market Size: USD 11.66 billion

- CAGR (2025–2034): 6.7%

- North America: Largest market in 2024

AI Impact on Compressed Air Filter and Dryer Market

- The integration of IoT sensors and AI-powered monitoring systems helps in real-time tracking of filter status, dew point, pressure drops, and performance metrics, which fuels predictive maintenance and operational optimization.

- AI algorithms enable adjustment of filtration settings to target specific pollutants. It allows dryers and filters to deliver healthier and cleaner air, especially in variable operational environments.

- As markets prioritize sustainability and focus on complying with regulations, AI-enabled filter and dryer systems offer high-value solutions for industries where air purity is mission-critical.

Compressed air filters and dryers are essential components used to remove contaminants and moisture from compressed air systems, ensuring clean and dry air for industrial processes. The demand for energy-efficient and sustainable air treatment solutions is gaining traction as industries increasingly prioritize operational efficiency. Manufacturers are focusing on optimizing filter and dryer designs to reduce energy consumption, carbon emissions, and maintenance costs. According to the IEA March 2024 report, global electricity demand rose by 1,100 TWh, 4.3% in 2024, nearly twice the average annual growth rate, reflecting accelerating electrification trends worldwide. This trend aligns with broader environmental goals, as clean, dry compressed air helps prevent equipment wear and supports sustainable manufacturing. In addition, the integration of smart monitoring technologies further enhances energy optimization, making these systems integral to eco-conscious industrial infrastructure.

The market is witnessing growth due to the expanding use of compressed air in various critical end-use applications such as pharmaceuticals, automotive, food and beverage, electronics, and healthcare. These sectors require high-quality, contaminant-free air to meet strict regulatory and quality standards. Compressed air filters and dryers ensure reliability and process integrity by maintaining air purity and reducing the risk of equipment failure or product contamination. Therefore, as automation and precision manufacturing become more prevalent across industries, the reliance on clean, dry compressed air continues to rise, reinforcing the essential role of advanced filtration and drying technologies in critical operations.

Drivers & Opportunities

Rapid Rate of Industrialization: The rapid rate of industrialization is driving the growth opportunities, as expanding industrial activities require efficient and reliable compressed air systems to support diverse operational processes. According to a July 2024 Ministry of Finance report, the industrial sector in India grew by 9.5%, with 47.5% of total output value serving as inputs for production activities. The demand for clean, moisture-free compressed air becomes critical to ensure equipment longevity and maintain process integrity as industries such as manufacturing, automotive, chemicals, and textiles scale up their production capacities. This has led to increased adoption of filtration and drying systems that help reduce operational downtime and enhance productivity. Moreover, the growing number of industrial facilities, particularly in emerging economies, is further supporting the need for advanced compressed air treatment solutions.

Advancement in Compressed Air Filter and Dryer Technologies: Advancements in compressed air filter and dryer technologies are contributing to the market's growth by addressing the evolving efficiency, performance, and regulatory needs of modern industries. Innovations such as modular system designs, smart sensors for real-time monitoring, and low-pressure drop filters are improving energy efficiency and reducing maintenance requirements. For instance, in April 2025, ELGi Compressors launched its energy-efficient compressed air solutions, such as EQ Series (direct-drive, 122°F tolerance) and EG PMSM Series (low-power motor, Neuron 4 Controller), to reduce ownership costs, targeting reliability in demanding industrial environments. These technological improvements allow for greater customization and adaptability across different industrial environments, thereby increasing their appeal to end users. Moreover, the integration of advanced features in compressed air treatment systems is becoming a critical factor in procurement decisions as industries aim for more reliable and sustainable operations.

Segmental Insights

Product Analysis

Based on product, the segmentation includes compressed air dryers and compressed air filters. The compressed air dryers segment accounted for USD 3.82 billion in revenue in 2024, primarily driven by the increasing demand for moisture-free compressed air across critical industrial applications. Many industries such as pharmaceuticals, electronics, and food & beverages require high air quality standards, where the presence of moisture compromises product integrity and system efficiency. Compressed air dryers play a crucial role in enhancing system reliability, minimizing corrosion, and reducing maintenance costs. The continued focus on productivity and equipment longevity in manufacturing environments has led to the widespread adoption of efficient drying solutions, solidifying the segment’s position in the market.

The compressed air filters segment is projected to register a CAGR of 6.6% during the forecast period due to the rising awareness of air purity standards and the need to protect sensitive downstream equipment. Compressed air often contains particulates, oil aerosol, and other contaminants that can affect product quality and operational performance. The importance of maintaining clean air has become essential as more industries adopt automated and high-precision systems. The increasing implementation of strict regulatory requirements and the need for high-performance filtration systems are further driving demand for advanced air filter technologies across diverse industrial sectors.

Industry Vertical Analysis

In terms of industry vertical, the segmentation includes automotive, oil & gas, chemicals, power generation, food & beverages, metals & machinery, pharmaceuticals, electronics, and others. The automotive segment dominated the market with USD 1.27 billion in revenue in 2024, attributed to the widespread use of compressed air systems in assembly lines, spray painting, and pneumatic tooling. These applications demand high reliability and consistent air quality to ensure precision and maintain production flow. The automotive sector’s focus on lean manufacturing and automation has further increased the reliance on efficient air treatment solutions. Therefore, as manufacturers aim to reduce operational downtime and enhance equipment life, the use of advanced filters and dryers has become crucial to maintaining optimal production environments.

The food & beverage segment is projected to witness a CAGR of 7.2% during the forecast period due to its strict hygiene and safety standards, which necessitate high-purity compressed air. In this sector, compressed air often comes into direct or indirect contact with food products, making the removal of moisture, oil, and particulates essential to avoid contamination. The increasing demand for processed and packaged food, associated with growing regulatory oversight, is encouraging food manufacturers to invest in high-performance air treatment solutions. This demand is accelerating the adoption of advanced compressed air dryers and filters to ensure compliance, product quality, and operational efficiency.

Regional Analysis

The North America compressed air filter and dryer market accounted for 34.1% of the global market share in 2024, supported by a developed industrial base and high adoption of advanced manufacturing practices. The region’s strong focus on energy efficiency, sustainability, and compliance with strict air quality regulations is driving demand for high-performance air treatment systems. In February 2024, the U.S. Environmental Protection Agency strengthened annual PM2.5 limits to 9.0 µg/m³, enhancing protection against health risks like cardiovascular disease. Furthermore, the presence of major industrial sectors, such as automotive, pharmaceuticals, and food processing, has created a consistent need for reliable and efficient compressed air infrastructure. Continuous investments in technological innovation and system upgrades are reinforcing the region’s dominant position in the global market.

U.S. Compressed Air Filter and Dryer Market Insights

The U.S. held 73.0% market share of the North America compressed air filter and dryer landscape in 2024, primarily due to its well-developed industrial infrastructure and early adoption of advanced air treatment technologies. High demand from sectors such as automotive, food and beverage, and pharmaceuticals has driven the consistent growth of high-efficiency filters and dryers. Additionally, strong regulatory frameworks supporting energy efficiency and air quality compliance have boosted the need for reliable and sustainable compressed air solutions across industries.

Asia Pacific Compressed Air Filter and Dryer Market Trends

The market in Asia Pacific is projected to register a CAGR of 7.0% from 2025 to 2034, fueled by the rapid pace of industrialization and expanding manufacturing activities across countries in the region. The demand for clean and dry compressed air is increasing as industries continue to modernize production facilities and adopt automation. The growing focus on energy conservation and cost-effective operations is also encouraging the adoption of advanced filtration and drying technologies. According to an April 2025 report, the Indian Ministry of Power announced cross-sector plans for Industry, Buildings, Transport, and other sectors to cut energy use by 89 Mtoe by 2030 via efficiency initiatives. In addition, rising regulatory standards and quality awareness among manufacturers are contributing to the increased penetration of compressed air filters and dryers across various end-use industries in the region.

India Compressed Air Filter and Dryer Market Overview

India captured 18.0% share of the Asia Pacific landscape in 2024, supported by the country’s rapid industrial expansion and modernization of manufacturing facilities. The growing focus on improving operational efficiency and maintaining product quality in sectors such as chemicals, textiles, and electronics has increased the deployment of compressed air treatment systems. Furthermore, rising awareness of air purity standards and energy conservation has encouraged industries to invest in advanced filtration and drying technologies.

Europe Compressed Air Filter and Dryer Market Outlook

The compressed air filter and dryer landscape in Europe is accounted for USD 1.87 billion in 2024, driven by the region’s well-established industrial infrastructure and focus on sustainable production practices. European industries are increasingly investing in energy-efficient air treatment systems to align with environmental goals and reduce operating costs. The adoption of smart technologies and compliance with strict emission and air purity regulations are further shaping purchasing decisions in the region. European manufacturers continue to prioritize the integration of high-quality compressed air systems into their operations with a strong focus on reliability, efficiency, and environmental responsibility.

UK Compressed Air Filter and Dryer Market Assessment

The UK market is expected to witness steady growth by 2034, driven by increased focus on sustainable manufacturing and compliance with strict environmental and quality standards. Industries in the UK are progressively adopting modern, energy-efficient compressed air systems to enhance process reliability and reduce operational costs. The growing integration of smart technologies and a focus on reducing carbon emissions further support the country’s evolving demand for advanced compressed air filters and dryers.

Key Players & Competitive Analysis

The compressed air filter and dryer industry is witnessing significant revenue growth driven by technological advancements and emerging market segments. Major companies are leveraging competitive intelligence and strategy to capitalize on expansion opportunities, particularly in developed markets where sustainable value chains are gaining traction. Disruptions and trends in energy efficiency and IoT technology integration are reshaping industry trends, creating increasing demand and opportunities for innovation. Small and medium-sized businesses are adopting advanced filtration solutions to enhance operational efficiency, while strategic investments in R&D are fueling future development strategies. Economic and geopolitical shifts are influencing vendor strategies, with a focus on regional footprint expansion. Expert's insight on the sector highlights growth projections, highlighting supply chain disruptions and pricing insights as critical factors. Companies are also exploring joint ventures, and mergers and acquisitions to strengthen competitive positioning and tap into high-growth markets and emerging technologies. This dynamic landscape presents revenue opportunities for businesses that align with industry-leading competitive intelligence and adapt to evolving macroeconomic trends.

A few major companies operating in the compressed air filter and dryer industry include Airfilter Engineering; Altec Inc.; Atlas Copco AB; BEKO TECHNOLOGIES; BOGE; Donaldson Company, Inc.; Hitachi Global Air Power LLC.; Ingersoll Rand; KAESER KOMPRESSOREN; Parker Hannifin Corp.; Pentair plc.; Precision Filtration Products; SPX Flow Inc.; Sullivan-Palatek, Inc.; and Van Air Systems.

Key Players

- Airfilter Engineering

- Altec Inc.

- Atlas Copco AB

- BEKO TECHNOLOGIES

- BOGE

- Donaldson Company, Inc.

- Hitachi Global Air Power LLC.

- Ingersoll Rand

- KAESER KOMPRESSOREN

- Parker Hannifin Corp.

- Pentair plc.

- Precision Filtration Products

- SPX Flow Inc.

- Sullivan-Palatek, Inc.

- Van Air Systems

Compressed Air Filter and Dryer Industry Developments

- July 2025: Tsunami introduced a pneumatic air dryer for C1D1 hazardous locations (oil refineries, chemical plants). The electricity-free design mitigates explosion risks, addressing critical safety needs in volatile environments.

- September 2024: Donaldson launched sterile air/liquid testing and ISO 8573-compliant services in France, Germany, and Austria, targeting food/beverage sectors. The move enhances local support for filter maintenance and process validation.

Compressed Air Filter and Dryer Market Segmentation

By Product Outlook (Revenue, USD Billion, 2020–2034)

- Compressed Air Dryers

- Refrigeration

- Desiccant/Adsorption

- Deliquescent

- Membrane

- Compressed Air Filters

- Particulate Filters

- Coalescing Filters

- Compressed Intake Filters

- Activated Carbon Filters

By Industry Vertical Outlook (Revenue, USD Billion, 2020–2034)

- Automotive

- Oil & Gas

- Chemicals

- Power Generation

- Food & Beverages

- Metals & Machinery

- Pharmaceuticals

- Electronics

- Others

By Regional Outlook (Revenue, USD Billion, 2020–2034)

- North America

- U.S.

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Compressed Air Filter and Dryer Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 6.13 Billion |

|

Market Size in 2025 |

USD 6.49 Billion |

|

Revenue Forecast by 2034 |

USD 11.66 Billion |

|

CAGR |

6.7% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 6.13 billion in 2024 and is projected to grow to USD 11.66 billion by 2034.

The global market is projected to register a CAGR of 6.7% during the forecast period

North America accounted for 34.1% of global market share in 2024.

A few of the key players in the market are Airfilter Engineering; Altec Inc.; Atlas Copco AB; BEKO TECHNOLOGIES; BOGE; Donaldson Company, Inc.; Hitachi Global Air Power LLC.; Ingersoll Rand; KAESER KOMPRESSOREN; Parker Hannifin Corp.; Pentair plc.; Precision Filtration Products; SPX Flow Inc.; Sullivan-Palatek, Inc.; and Van Air Systems.

The compressed air dryers segment accounted for USD 3.82 billion in revenue in 2024.

The food & beverage segment is projected to witness the highest CAGR of 7.2% during the forecast period.