Europe Medical Waste Container Market Size, Share, Trends, Industry Analysis Report

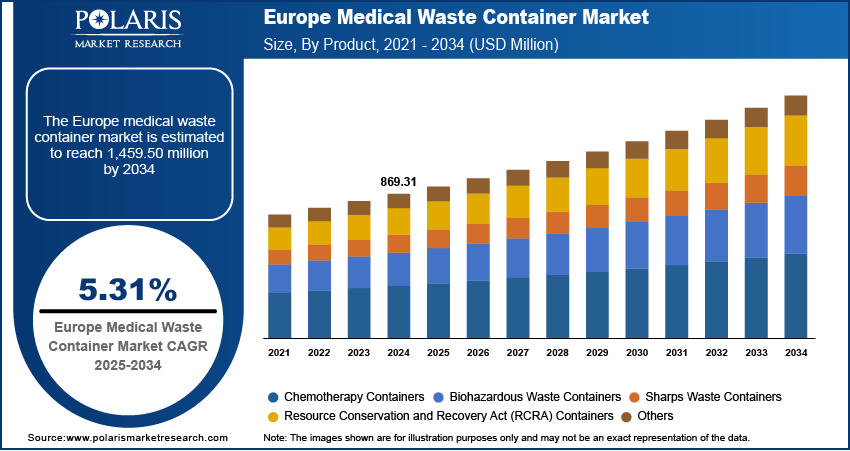

By Product (Chemotherapy Containers, Biohazardous Waste Containers, Sharps Waste Containers), By Waste Type, By End Use, By Country – Market Forecast, 2025–2034

- Published Date:Aug-2025

- Pages: 129

- Format: PDF

- Report ID: PM6253

- Base Year: 2024

- Historical Data: 2020-2023

Overview

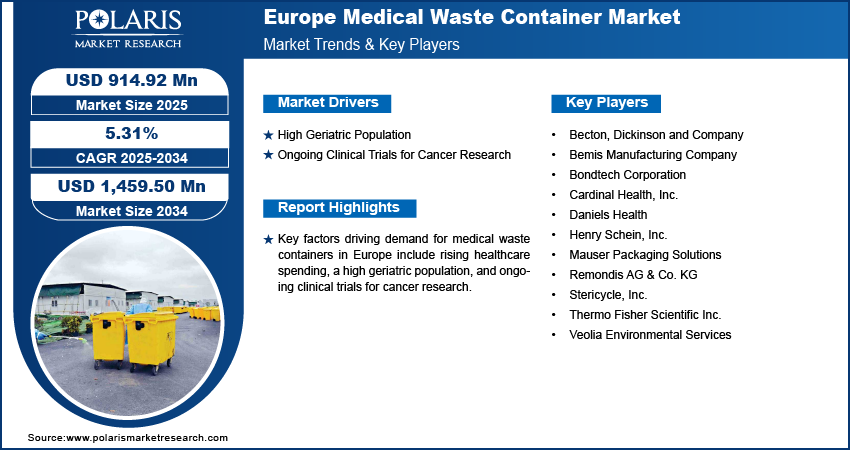

The Europe medical waste container market size was valued at USD 869.31 million in 2024, growing at a CAGR of 5.31% from 2025 to 2034. Key factors driving demand for medical waste containers in Europe include rising healthcare spending, a high geriatric population, and ongoing clinical trials for cancer research.

Key Insights

- The chemotherapy containers segment accounted for 36.50% of the Europe medical waste container market share in 2024 due to strict EU regulations.

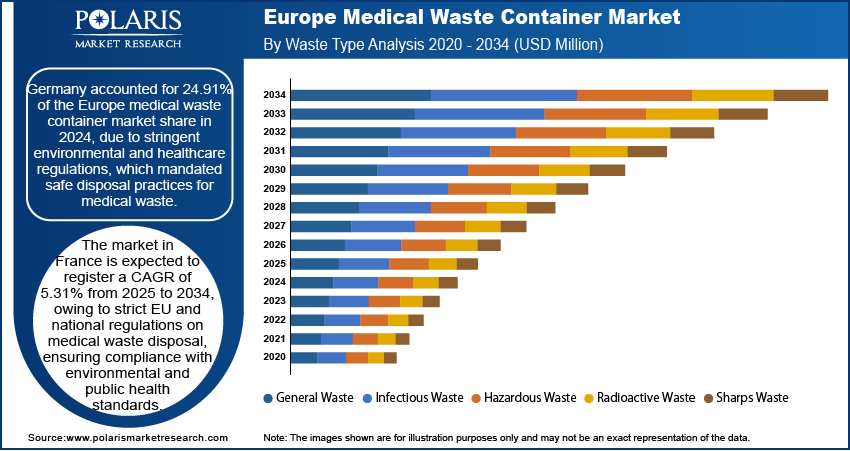

- The general waste segment held 36.92% of revenue share in 2024, owing to high volumes of non-hazardous medical waste in hospitals and diagnostic labs.

- Germany accounted for a 24.91% share of the Europe medical waste container market in 2024, owing to stringent environmental and healthcare regulations.

- The market in France is expected to register a CAGR of 5.31% from 2025 to 2034, owing to expanding healthcare spending.

Industry Dynamics

- The high geriatric population in Europe is fueling the demand for medical waste containers as older adults require more frequent medical treatments, hospital stays, and long-term care, generating larger volumes of medical waste.

- The ongoing clinical trials for cancer research in Europe are driving the adoption of medical waste containers, as these clinical trials generate a high amount of medical waste, including used syringes and contaminated gloves.

- The rising prevalence of chronic diseases and stricter regulations on medical waste are creating a lucrative market opportunity.

- The high competition between the key players may hamper the growth of the Europe medical waste container market.

Market Statistics

- 2024 Market Size: USD 869.31 Million

- 2034 Projected Market Size: USD 1,459.50 Million

- CAGR (2025–2034): 5.31%

AI Impact on Europe Medical Waste Container Market

- AI adoption in medical waste containers is still in an emerging stage in Europe. Adjacent technologies such as intelligent routing, IoT sensors, and robotic vision sorting systems are expected to lay the foundation for broader AI integration in the market during the forecast period.

- Countries such as Germany (with its regulatory flexibility) and the Nordics/UK (with strong adoption of tech infrastructure) are early adopters of these AI-enabled solutions.

A medical waste container is a specially designed vessel used for the safe collection, storage, and disposal of medical waste generated. These containers are crucial in healthcare facilities for segregating hazardous materials such as sharps, infectious waste, and biohazardous substances. The primary purpose of these containers is to prevent the spread of infections, ensure safe handling by healthcare workers, and comply with regulatory waste management protocols. These containers are made of puncture-resistant and leak-proof materials such as polyethylene.

The Europe medical waste container market is witnessing rapid growth due to stringent waste management regulations, and rising awareness about infection control. Countries such as Germany, France, and the UK are leading contributors, driven by high hospital density and advanced medical infrastructure. The demand for sharps and biohazardous waste containers is particularly strong, supported by the region’s commitment to sustainability and safe disposal practices. Additionally, the aging population and rising number of outpatient procedures continue to fuel medical waste generation, prompting hospitals and clinics to invest in high-quality, compliant waste containment solutions across the region.

The Europe medical waste container market demand is driven by the rising healthcare spending. According to the UK Census Data 2021, total healthcare expenditure increased by 5.6% in nominal terms in 2023. This drove healthcare facilities to expand their services and handle higher patient volumes, requiring more medical waste containers to safely dispose of used filter needles, contaminated materials, and other hazardous waste. Additionally, increased investments in healthcare infrastructure, including new facilities and upgraded equipment, created additional needs for medical waste management solutions, boosting the market for these containers.

Drivers & Opportunities

High Geriatric Population: Older adults require more frequent medical treatments, hospital stays, and long-term care, generating larger volumes of medical waste, thereby creating the need for medical waste containers. On January 1st, 2024, the EU population was estimated at 449.3 million people, and more than one-fifth (21.6%) of it was aged 65 years and above. Chronic conditions such as diabetes and cardiovascular diseases are also common among the elderly, leading to more diagnostic tests, medications, and disposable medical supplies, all of which contribute to medical waste, encouraging the adoption of medical waste containers. Nursing homes and home healthcare services catering to seniors also rely heavily on medical waste containers to safely dispose of used syringes, wound dressings, and other hazardous materials. Stricter infection control measures in elderly care facilities further drive the need for specialized waste disposal solutions, boosting demand for medical waste containers.

Ongoing Clinical Trials for Cancer Research: Ongoing clinical trials for cancer research are generating a high amount of medical waste, including used syringes, contaminated gloves, chemotherapy vials, and biohazardous materials, directly increasing the need for secure disposal solutions. Research facilities and hospitals conducting these trials must adhere to strict safety regulations, requiring specialized medical waste containers to handle hazardous and infectious waste properly. The expansion of cancer trials, driven by advancements in immunotherapy and personalized medicine, also leads to higher volumes of experimental treatments and diagnostic procedures, further boosting demand for compliant waste management systems. Additionally, the rise in cancer research funding ensures continuous growth in clinical trials, sustaining the need for durable and high-capacity medical waste containers.

Segmental Insights

Product Analysis

Based on product, the segmentation includes chemotherapy containers, biohazardous waste containers, sharps waste containers, resource conservation and recovery act (RCRA) containers, and others. The chemotherapy containers segment accounted for 36.50% of the Europe medical waste container market share in 2024 due to the growing incidence of cancer, coupled with strict EU regulations such as the Directive 2008/98/EC on waste management. Chemotherapy containers offer leak-proof designs, tamper resistance, and color-coded labeling, making them the preferred choice for managing hazardous pharmaceutical waste. The rising focus on patient and worker safety in oncology treatment environments further boosted demand. Hospitals and oncology centers across major European countries, including Germany, France, and the UK, increased their demand for safe and compliant disposal solutions for cytotoxic and cytostatic drugs, contributing to segment’s dominance.

The resource conservation and recovery act (RCRA) containers segment is projected to register a CAGR of 6.62% from 2025 to 2034, owing to increasing awareness and enforcement of hazardous waste classification under EU and national regulatory frameworks. These containers provide secure, durable, and compliant options for handling flammable and corrosive substances, aligning with Europe's push for sustainable and legally accountable hazardous waste management practices.

Waste type Analysis

In terms of waste type, the segmentation includes general waste, infectious waste, hazardous waste, radioactive waste, and sharps waste. The general waste segment held 36.92% of the revenue share in 2024. Healthcare facilities, including public hospitals, outpatient centers, and private clinics, generated high volumes of non-hazardous medical waste such as packaging materials, food scraps, paper products, and disposable items. These materials, while not posing biological or chemical risks, still required secure containment to comply with hygiene protocols and municipal waste regulations. The widespread use of disposable medical supplies and the growing emphasis on cost-effective waste segregation practices contributed to the dominance of the segment. Additionally, the region's well-established waste classification and disposal infrastructure allowed healthcare providers to efficiently manage general medical waste using standard containers.

The sharps waste segment is expected to register a CAGR of 6.80% from 2025 to 2034, owing to the rising use of needles, syringes, scalpels, and other sharp instruments in vaccination programs, chronic disease management, and home healthcare services. Governments and health authorities are strengthening their regulations around sharps handling to prevent needlestick injuries, cross-contamination, and the spread of bloodborne pathogens. Furthermore, increasing awareness among patients and caregivers regarding at-home sharps disposal is leading to higher adoption of puncture-resistant and tamper-proof containers.

End Use Analysis

In terms of end use, the segmentation includes hospitals & private clinics, diagnostic laboratories, pharmaceutical and biotechnology companies & CROs, academic research institutes, and others. The hospitals & private clinics segment accounted for 38.63% of the Europe medical waste container market share in 2024 due to high patient inflow, surgical procedures, and continuous diagnostic and therapeutic activities. Strict regulatory requirements under EU waste management directives and national healthcare standards compelled hospitals to adopt reliable and compliant waste containment systems. Additionally, the growing burden of chronic diseases and the expansion of specialized treatment centers across Western and Central Europe increased the consumption of disposable medical supplies, further driving demand for secure waste containers in these settings.

The pharmaceutical and biotechnology companies & CROs segment is estimated to register a CAGR of 6.90% from 2025 to 2034, owing to the expansion of drug discovery and clinical trials across the region. These organizations face pressure to comply with stringent environmental and safety regulations, such as those outlined in the EU’s Waste Framework Directive and Good Manufacturing Practice (GMP) guidelines, which encourage these companies to increasingly invest in specialized waste containment solutions that ensure safe handling, storage, and disposal of high-risk materials.

Country Analysis

The Germany medical waste container market accounted for a 24.91% share in 2024. This is attributed to stringent environmental and healthcare regulations, which mandated safe disposal practices for medical waste. The country’s developed healthcare infrastructure, including numerous hospitals, clinics, and research facilities, generated significant volumes of medical waste, necessitating proper containment solutions. Additionally, Germany’s focus on sustainability and circular economy principles encouraged the adoption of high-quality, reusable, and recyclable waste containers. The growing elderly population and increasing surgical procedures further contributed to medical waste generation, boosting demand. Statistisches Bundesamt stated that the number of people aged 67 years or over in Germany will rise by roughly 4 million by the middle of the 2030s.

The market in France is expected to register a CAGR of 5.31% from 2025 to 2034, owing to strict EU and national regulations on medical waste disposal, ensuring compliance with environmental and public health standards. The country’s extensive network of hospitals, diagnostic centers, and pharmaceutical companies generates substantial medical waste, requiring efficient containment systems. France’s emphasis on eco-friendly waste management solutions, including sterilization and recycling, is driving innovation in medical waste container design. The increasing prevalence of chronic diseases and surgical interventions further escalates waste production, leading to market growth.

Key Players and Competitive Analysis

The Europe medical waste container market is highly competitive, with key players such as Becton, Dickinson and Company, Cardinal Health, Inc., and Thermo Fisher Scientific Inc. dominating due to their extensive product portfolios and strong distribution networks. These companies focus on innovation, offering advanced solutions such as smart containers and RFID-enabled waste tracking to enhance compliance and safety. Regional players such as Remondis AG & Co. KG and Veolia Environmental Services leverage their expertise in waste management to provide integrated disposal solutions, catering to hospitals and clinics. Meanwhile, Stericycle, Inc. and Daniels Health emphasize sustainability, promoting reusable and eco-friendly containers to meet stringent EU waste regulations. The market also witness competition from specialized manufacturers such as Bondtech Corporation and Mauser Packaging Solutions, which provide durable, high-capacity containers for hazardous waste. Mergers, acquisitions, and partnerships are common strategies to expand market share, particularly in Germany, France, and the UK, where healthcare waste volumes are rising.

A few major companies operating in the Europe medical waste container industry include Becton, Dickinson and Company; Bemis Manufacturing Company; Bondtech Corporation; Cardinal Health, Inc.; Daniels Health; Henry Schein, Inc.; Mauser Packaging Solutions; Remondis AG & Co. KG; Stericycle, Inc.; Thermo Fisher Scientific Inc.; and Veolia Environmental Services.

Key Players

- Becton, Dickinson and Company

- Bemis Manufacturing Company

- Bondtech Corporation

- Cardinal Health, Inc.

- Daniels Health

- Henry Schein, Inc.

- Mauser Packaging Solutions

- Remondis AG & Co. KG

- Stericycle, Inc.

- Thermo Fisher Scientific Inc.

- Veolia Environmental Services

Europe Medical Waste Container Industry Developments

In May 2023, BD announced to evaluate the feasibility of recycling used blood collection tubes to reduce medical waste as part of the participants' sustainability goals and Denmark's Climate Action Strategy in collaboration with Odense University Hospital, the Health Innovation Centre of Southern Denmark, Danish Technological Institute, and GMAF Circular Medico/EcoFitt.

In August 2023, Stericycle, announced the launch of its re-engineered one-gallon SafeDrop Sharps Mail Back and one-gallon CsRx Controlled Substance Wastage containers.

Europe Medical Waste Container Market Segmentation

By Product Outlook (Revenue, USD Million, 2021–2034)

- Chemotherapy Containers

- Biohazardous Waste Containers

- Sharps Waste Containers

- Resource Conservation and Recovery Act (RCRA) Containers

- Others

By Waste Type Outlook (Revenue, USD Million, 2021–2034)

- General Waste

- Infectious Waste

- Hazardous Waste

- Radioactive Waste

- Sharps Waste

By End Use Outlook (Revenue, USD Million, 2021–2034)

- Hospitals & Private Clinics

- Diagnostic Laboratories

- Pharmaceutical and Biotechnology Companies & CROs

- Academic Research Institutes

- Others

By Country Outlook (Revenue, USD Million, 2021–2034)

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

Europe Medical Waste Container Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 869.31 Million |

|

Market Size in 2025 |

USD 914.92 Million |

|

Revenue Forecast by 2034 |

USD 1,459.50 Million |

|

CAGR |

5.31% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2021–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Million and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Country Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The market size was valued at USD 869.31 million in 2024 and is projected to grow to USD 1,459.50 million by 2034.

The market is projected to register a CAGR of 5.31% during the forecast period.

Germany dominated the market in 2024.

A few of the key players in the market are Becton, Dickinson and Company; Bemis Manufacturing Company; Bondtech Corporation; Cardinal Health, Inc.; Daniels Health; Henry Schein, Inc.; Mauser Packaging Solutions; Remondis AG & Co. KG; Stericycle, Inc.; Thermo Fisher Scientific Inc.; and Veolia Environmental Services.

The chemotherapy containers segment dominated the market revenue share in 2024.

The pharmaceutical and biotechnology companies & CROs segment is projected to witness the fastest growth during the forecast period.