Japan E-Fuel Market Size, Share, Trend, Industry Analysis Report

By Product (E-Diesel, E-Gasoline, Ethanol, Hydrogen, Methanol, Others), By State, By Production Method, By End User, By Region – Market Forecast, 2025–2034

- Published Date:Aug-2025

- Pages: 125

- Format: PDF

- Report ID: PM6257

- Base Year: 2024

- Historical Data: 2020-2023

Overview

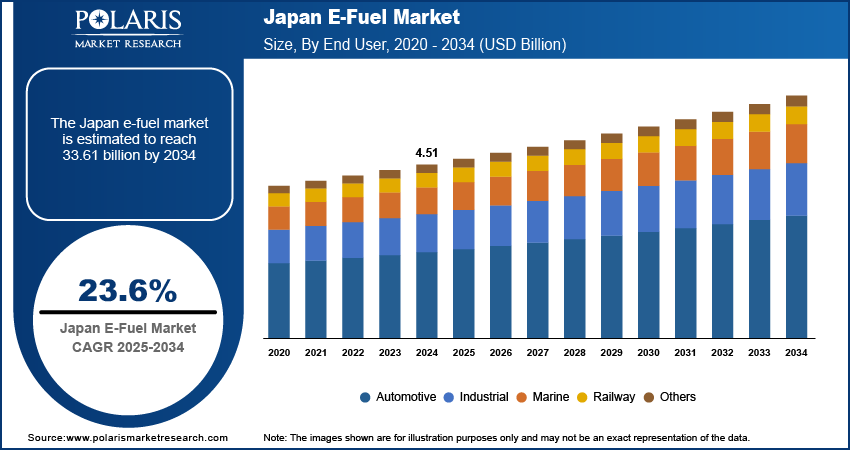

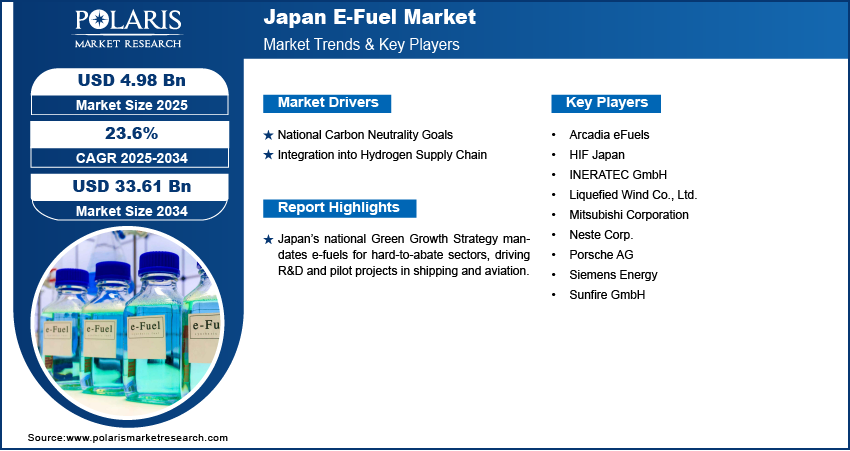

The Japan E-fuel market size was valued at USD 4.51 billion in 2024, growing at a CAGR of 23.6% from 2025 to 2034. Stricter emission standards from international aviation bodies are prompting airlines to seek sustainable alternatives. E-fuels present a viable drop-in replacement for jet fuel, enabling compliance without major aircraft modifications, making them a key enabler for cleaner aviation.

Key Insights

- The ethanol segment held ~32% of the market share in 2024, driven by compatibility with Japan’s existing fuel infrastructure and regulatory support for low-carbon fuels.

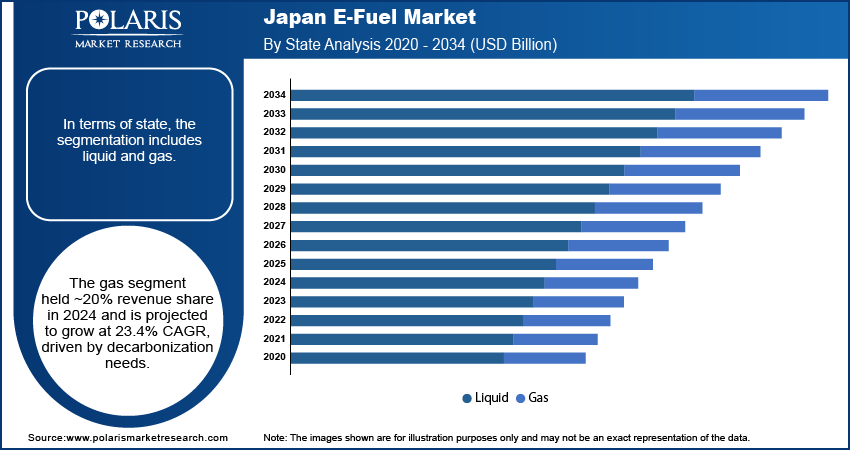

- The gas segment is projected to register a CAGR of 23.4% from 2025 to 2034, fueled by its use in decarbonizing hard-to-electrify sectors such as shipping and industrial heating.

Industry Dynamics

- Japan’s national Green Growth Strategy mandates e-fuels for hard-to-abate sectors, driving R&D and pilot projects in shipping and aviation.

- Limited domestic fossil fuel resources and energy security concerns are accelerating investments in imported e-fuels and green hydrogen.

- Collaborations with Australia and Southeast Asia enable early supply chain development for e-ammonia and e-methanol in power and transport.

- Lack of domestic renewable energy capacity and high import dependency increase production and logistics costs for e-fuel adoption.

Market Statistics

- 2024 Market Size: USD 4.51 billion

- 2034 Projected Market Size: USD 33.61 billion

- CAGR (2025–2034): 23.6%

AI Impact on Japan E-Fuel Market Statistics

- The adoption of AI in the Japan e-fuel market is still in the pilot and planning stages.

- The technology is expected to play a key role in optimizing production processes (for instance, hydrogen + CO₂ synthesis).

- AI tools would enhance monitoring, efficiency, and predictive control in capital-intensive plants.

The Japan e-fuel market refers to the industry focused on the production, distribution, and application of synthetic fuels created using renewable electricity and captured carbon dioxide or hydrogen. These fuels serve as low-emission alternatives to conventional fossil fuels in sectors such as aviation, shipping, and heavy transport, where full electrification remains technologically or economically challenging. E-Fuels include options like e-diesel, e-kerosene, and e-methanol, produced via Power-to-Liquid (PtL) or Power-to-Gas (PtG) processes. Advancements in high-efficiency electrolysis systems are improving hydrogen yield and reducing energy consumption. These innovations are enhancing the viability of power-to-liquid processes critical for e-fuel production, supporting cost reductions and increasing project scalability across Japan’s energy ecosystem.

Japan’s government is providing targeted subsidies and low-interest loans for synthetic fuel projects. Such fiscal incentives are de-risking early-stage investments, enabling pilot-to-commercial scale transitions and attracting domestic and foreign players to develop localized e-fuel production facilities. Moreover, Japan is forming research partnerships and international alliances to co-develop e-fuel technologies. collaborative frameworks are accelerating innovation, standardization, and deployment while reducing technological and regulatory fragmentation.

Drivers & Opportunities

National Carbon Neutrality Goals: Japan’s commitment to achieving carbon neutrality by 2050 is driving focused efforts to decarbonize energy-intensive sectors. According to Japan’s Ministry of Economy, Trade and Industry, in May 2024, the government approved a revised Green Transformation Strategy, allocating USD 140 billion to accelerate decarbonization in industry, power, and transport sectors toward its 2050 carbon neutrality goal. E-fuels are gaining attention for their potential to replace fossil fuels in industries where electrification is not feasible, such as aviation, maritime, and heavy transportation. These synthetic fuels, created using renewable electricity and captured carbon dioxide, provide a drop-in alternative to conventional fuels while significantly reducing lifecycle emissions. Strong alignment with national climate targets is encouraging public and private investment in e-fuel projects. This policy-backed momentum is also helping build long-term investor confidence and pushing forward the development of clean energy infrastructure.

Integration into Hydrogen Supply Chain: E-fuels are becoming a vital component of Japan’s broader hydrogen economy strategy. Acting as carriers of hydrogen in a liquid form, they enable safe and efficient transport and storage, addressing logistical challenges tied to hydrogen distribution. This integration enhances the flexibility of Japan’s energy system by connecting renewable hydrogen production with downstream demand across transport, power generation, and industrial applications. E-fuels also offer a solution for exporting hydrogen-derived energy, supporting Japan’s ambitions to lead in the global hydrogen supply chain. Their compatibility with existing fuel infrastructure further accelerates adoption while enabling cross-sectoral decarbonization in a more cost-effective and scalable manner.

Segmental Insights

Product Analysis

Based on product, the segmentation includes e-diesel, e-gasoline, ethanol, hydrogen, methanol, and others. The ethanol segment dominated the market with ~32% of the revenue share in 2024, driven by its compatibility with Japan’s existing fuel infrastructure and regulatory support for low-carbon alternatives. Demand from the transport sector, particularly in blended fuels for passenger vehicles, has supported its strong market position. Ethanol production using renewable electricity and biomass aligns with national carbon reduction goals, offering a sustainable route to reduce emissions without major overhauls in engine design or fuel distribution systems. Rising investments in bio-refineries and synthetic ethanol technologies improve supply security and position ethanol as a commercially viable e-fuel in the near term.

State Analysis

In terms of state, the segmentation includes liquid and gas. The gas segment is expected to register a CAGR of 23.4% from 2025 to 2034 fueled by its role in decarbonizing hard-to-electrify sectors such as shipping and industrial heating. Gaseous e-fuels such as e-methane and synthetic hydrogen are gaining momentum due to their compatibility with Japan’s expanding gas grid and hydrogen pipeline infrastructure. Industrial demand for cleaner combustion options is creating opportunities for scalable deployment of gaseous fuels. Companies are also leveraging existing LNG terminals and gas utilities to handle e-gas, minimizing infrastructure costs. Technological progress in high-efficiency electrolysis and carbon capture further supports the economic feasibility of gas-phase e-fuels across a wide range of applications.

Key Players & Competitive Analysis

The competitive landscape of the Japan e-fuel market is evolving through robust industry analysis and a focus on long-term decarbonization strategies. Market participants are actively pursuing joint ventures and strategic alliances to secure access to renewable feedstocks, electrolysis technologies, and carbon capture systems. Market expansion strategies increasingly target integration with Japan’s hydrogen roadmap and low-carbon fuel initiatives.

Mergers and acquisitions are reshaping the value chain, enabling vertical integration and accelerating commercialization timelines. Post-merger integration efforts are emphasizing operational synergies and cross-border technology transfer. Companies are investing heavily in R&D to advance catalyst efficiency, power-to-liquid processes, and scalable production models. Technological advancements in synthetic fuel synthesis and electrochemical conversion are enhancing output yields while reducing costs. Industry players are also engaging in pilot projects and regulatory partnerships to align fuel certification and infrastructure compatibility. Competitive positioning in this market hinges on innovation, supply chain localization, and alignment with national energy and climate frameworks.

Key Players

- Arcadia eFuels

- HIF Japan

- INERATEC GmbH

- Liquefied Wind Co., Ltd.

- Mitsubishi Corporation

- Neste Corp.

- Porsche AG

- Siemens Energy

- Sunfire GmbH

Japan E-Fuel Industry Developments

August 2024: HIF Global secured a strategic equity investment of USD 36 million from the Japan Organization for Metals and Energy Security (JOGMEC), a governmental body in Japan. This investment will be facilitated through Idemitsu Efuels America Corp. and is aimed at scaling up HIF’s e-Fuels initiatives, enhancing their capacity to produce synthetic fuels derived from renewable energy sources.

Japan E-Fuel Market Segmentation

By Product Outlook (Revenue, USD Billion, 2020–2034)

- E-Diesel

- E-Gasoline

- Ethanol

- Hydrogen

- Methanol

- Others

By State Outlook (Revenue, USD Billion, 2020–2034)

- Liquid

- Gas

By Production Method Outlook (Revenue, USD Billion, 2020–2034)

- Power-to-Liquid

- Power-to-Gas

- Gas-to-Liquid

By End User Outlook (Revenue, USD Billion, 2020–2034)

- Automotive

- Industrial

- Marine

- Railway

- Others

Japan E-Fuel Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 4.51 billion |

|

Market Size in 2025 |

USD 4.98 billion |

|

Revenue Forecast by 2034 |

USD 33.61 billion |

|

CAGR |

23.6% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The Japan market size was valued at USD 4.51 billion in 2024 and is projected to grow to USD 33.61 billion by 2034.

The Japan market is projected to register a CAGR of 23.6% during the forecast period.

A few of the key players in the market are Arcadia eFuels; HIF Japan; INERATEC GmbH; Liquefied Wind Co., Ltd.; Mitsubishi Corporation; Neste Corp.; Porsche AG; Siemens Energy; and Sunfire GmbH.

The ethanol segment dominated the market with ~32% of the revenue share in 2024, driven by its compatibility with Japan’s existing fuel infrastructure and regulatory support for low-carbon alternatives.

The gas segment is expected to register a CAGR of 23.4% from 2025 to 2034 fueled by its role in decarbonizing hard-to-electrify sectors such as shipping and industrial heating.