Methanol Market Size, Share, Trends, Industry Analysis Report

: By Feedstock Type (Natural Gas, Coal, and Biomass & Renewables), Derivative, End User, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025–2034

- Published Date:Dec-2024

- Pages: 118

- Format: PDF

- Report ID: PM1543

- Base Year: 2024

- Historical Data: 2020-2023

Methanol Market Overview

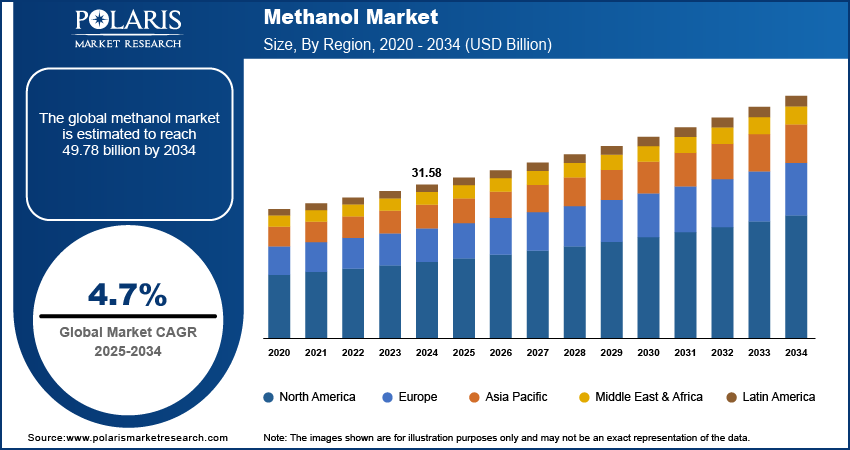

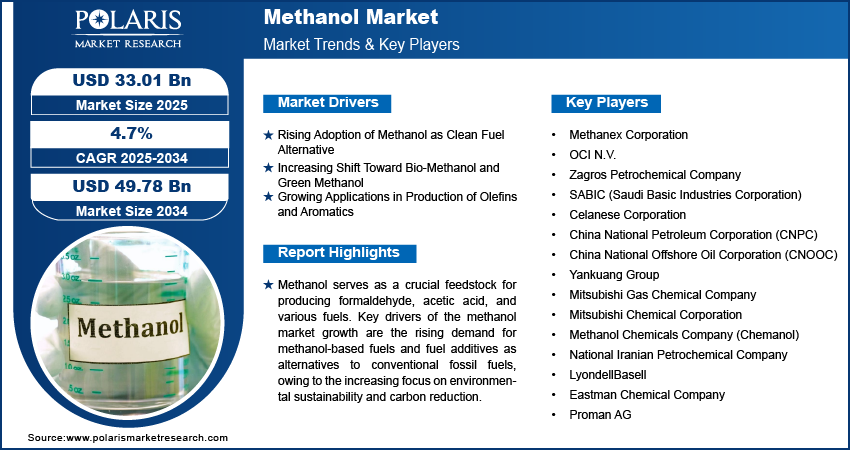

The global methanol market size was valued at USD 31.58 billion in 2024. The market is projected to grow from USD 33.01 billion in 2025 to USD 49.78 billion by 2034, exhibiting a CAGR of 4.7% during 2025–2034.

The global methanol market is a key sector within the chemical industry. The market is primarily driven by the rising demand from end-use industries such as automotive, construction, and electronics. Methanol serves as a crucial feedstock for producing formaldehyde, acetic acid, and various fuels. Key drivers of market growth include increasing demand for methanol-based fuels and fuel additives as alternatives to conventional fossil fuels, especially given the increasing focus on environmental sustainability and carbon reduction. The global methanol market trends highlight a shift toward bio-methanol and green methanol production, addressing regulatory pressures for reduced emissions. Furthermore, advancements in methanol-to-olefins (MTO) technology continue to expand methanol’s application in the production of olefins, enhancing its role in the global chemicals industry.

To Understand More About this Research: Request a Free Sample Report

Methanol Market Drivers and Trends

Rising Adoption of Methanol as Clean Fuel Alternative

The demand for methanol as a clean fuel alternative is growing, driven by increasing environmental regulations aimed at reducing greenhouse gas emissions. Methanol is increasingly used as a fuel in marine applications and as an alternative for gasoline blending, as it offers a cleaner-burning fuel option with lower sulfur oxide (SOx), nitrogen oxide (NOx), and particulate emissions. The International Maritime Organization (IMO) regulations on sulfur emissions, which mandate a reduction to 0.5% from 3.5% in sulfur content in marine fuels, have boosted methanol’s role as a marine fuel. According to the Methanol Institute, methanol-fueled ships can reduce SOx emissions by up to 99% and NOx emissions by around 60% compared to conventional marine fuels, highlighting methanol’s potential in the global push toward greener fuel solutions. Hence, this increasing use of methanal as a clean fuel alternative leads to the methanol market demand.

Increasing Shift Toward Bio-Methanol and Green Methanol

The shift toward bio-methanol and green methanol is gaining momentum as industries aim to meet carbon neutrality targets. Produced from renewable resources such as biomass, waste, and even captured carbon dioxide, bio-methanol significantly lowers the carbon footprint associated with conventional methanol production. According to the International Renewable Energy Agency (IRENA), bio-methanol production could reduce CO2 emissions by up to 95% compared to fossil fuel-based methanol, making it an attractive option for countries and companies with stringent sustainability goals. European countries, in particular, are adopting bio-methanol as part of their broader decarbonization strategies, spurred by policies such as the European Union’s Renewable Energy Directive (RED II), which encourages the use of renewable fuels in transport. Thus, the increasing preference for environment-friendly methanol drives the methanol market growth.

Growing Applications in Production of Olefins and Aromatics

Methanol’s application in the production of olefins, such as ethylene and propylene, through methanol-to-olefins (MTO) technology is expanding rapidly. Olefins are critical feedstocks for plastics, chemicals, and synthetic materials, and the MTO process provides an alternative route to traditional naphtha cracking. This trend is particularly pronounced in Asia, where China has established itself as a leader in MTO technology to meet rising domestic demand for petrochemical products. By 2022, China accounted for ∼60% of the global methanol-to-olefins capacity, driven by its focus on energy security and reducing dependency on imported oil. Additionally, the development of methanol-to-aromatics (MTA) processes is further diversifying methanol’s application in producing chemicals such as benzene, toluene, and xylene, amplifying its significance within the global chemicals industry. These applications propel the growth of the methanol market.

Methanol Market Segment Insights

Methanol Market Outlook – Feedstock Type-Based Insights

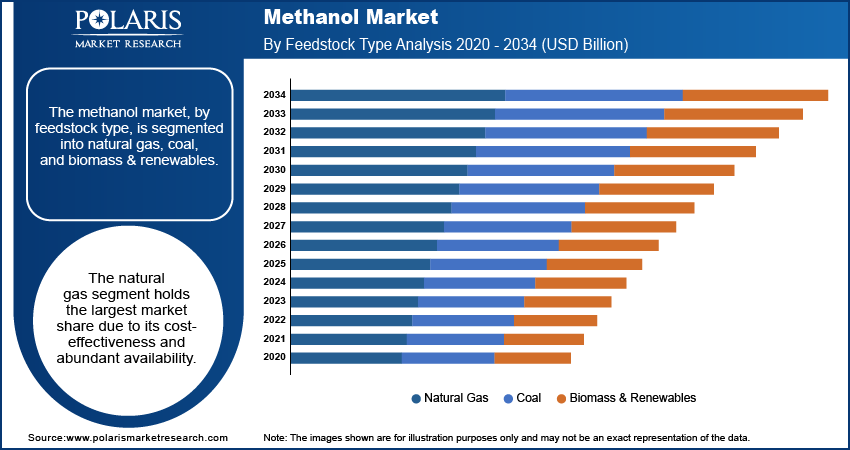

The methanol market, by feedstock type, is segmented into natural gas, coal, and biomass & renewables. The natural gas segment holds the largest market share due to its cost-effectiveness and abundant availability. Natural gas-based methanol production is widely preferred in regions such as North America and the Middle East, where natural gas is readily accessible and relatively inexpensive. This segment benefits from well-established infrastructure and a strong supply chain, making it the primary choice for methanol producers. Additionally, natural gas production methods have lower carbon emissions compared to coal, aligning with global efforts to reduce environmental impact. In 2022, natural gas accounted for over 65% of global methanol production, supported by countries with significant natural gas reserves, including the US and Saudi Arabia.

Biomass & renewables is the fastest-growing segment, driven by the global shift toward sustainable and low-carbon alternatives. The increasing adoption of bio-methanol, which is derived from organic waste or biomass, aligns with international carbon reduction targets and the pursuit of carbon-neutral production methods. Biomass & renewable methanol production receive support from government incentives and policies, particularly in Europe, which leads to the demand for renewable feedstock due to stringent environmental regulations. As environmental concerns drive more investments in sustainable production technologies, the biomass & renewables segment is expected to witness rapid growth during the forecast period.

Methanol Market Outlook – Derivative-Based Insights

The methanol market, by derivative, is segmented into formaldehyde, acetic acid, MTBE, DME, gasoline blending, biodiesel, MTO/MTP, solvent, and others. The formaldehyde segment holds the largest market share due to its extensive use in the production of resins, adhesives, and various construction materials. The construction and automotive sectors drive demand for formaldehyde-based products, as it is essential in manufacturing engineered wood, coatings, and automotive components. This segment benefits from stable demand in both mature and emerging economies, where the rising infrastructure and housing sectors continue to propel formaldehyde consumption. Additionally, formaldehyde’s application in the production of paints and coatings supports its dominance, with major consumption observed in regions such as Asia Pacific, where construction activities are robust.

Methanol-to-olefins (MTO)/methanol-to-propylene (MTP) production is experiencing the highest growth rate within the methanol derivatives market. This trend is particularly notable in China, which has heavily invested in MTO/MTP technologies to reduce dependency on imported petrochemical feedstocks. The MTO/MTP process enables the production of essential olefins used in plastics, textiles, and packaging, aligning with rising consumer demand for these materials. Expanding petrochemical industries and advancements in MTO/MTP processes are expected to propel the methanol market growth for the MTO/MTP segment, positioning it as a key area of investment within the market.

Methanol Market Outlook – End User-Based Insights

The methanol market, by end user, is segmented into construction, automotive, electronics, and others. The construction segment holds the largest market share due to methanol’s extensive application in producing formaldehyde-based resins and adhesives used in engineered wood products, laminates, and insulation materials. The growing construction activities across Asia Pacific and other developing regions drive the demand for methanol in this segment, as these materials are essential for infrastructure and residential projects. Additionally, the construction industry’s demand for coatings and paints, which often utilize methanol derivatives, contributes to the segment’s dominant position. This steady demand in the construction sector underlines methanol’s critical role in supporting global building and infrastructure development.

The automotive industry is the fastest-growing end-use segment of the methanol market, driven by its application as an alternative fuel and fuel additive. Methanol is increasingly recognized as a cleaner fuel option, offering reduced emissions when blended with gasoline or used in fuel cells. Additionally, methanol’s role in producing lightweight automotive components, such as those made from formaldehyde-based resins, aligns with industry trends favoring fuel efficiency and emission reduction. Rising automotive production, especially in Asia Pacific and Europe, along with the automotive industry’s push toward sustainable energy solutions, supports the rapid growth of this segment, making it a focal point for methanol producers aiming to meet evolving fuel and material demands.

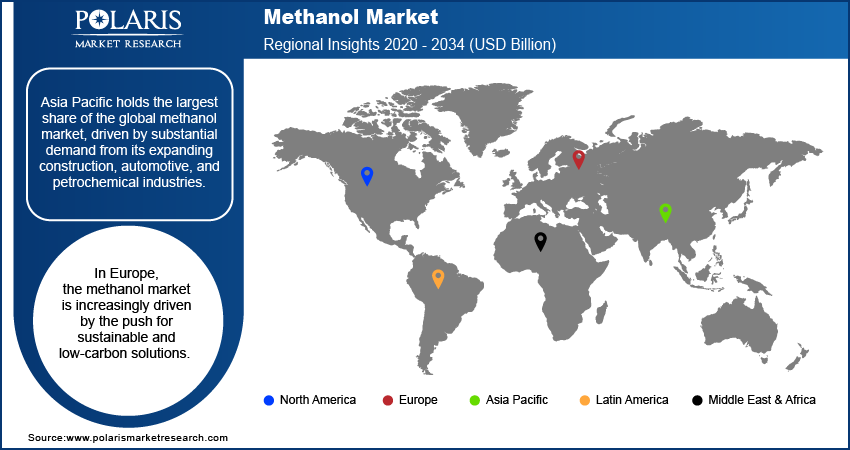

Methanol Market Regional Insights

By region, the study provides methanol market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. Asia Pacific holds the largest share of the global market, driven by substantial demand from its expanding construction, automotive, and petrochemical industries. China, in particular, is a dominant player due to its extensive methanol-to-olefins (MTO) capacity and its high consumption in formaldehyde and acetic acid production, both of which are vital for construction and manufacturing. The availability of coal as a cost-effective feedstock further boosts China’s methanol production, supporting its industrial growth. In addition to China, other Asia Pacific countries such as India and South Korea contribute to regional demand through increasing infrastructure projects and rising automotive production. This region's rapid industrialization, coupled with supportive government policies in favor of alternative fuels, positions Asia Pacific as the key growth hub in the global methanol market.

In Asia Pacific, China leads the methanol market with its vast methanol-to-olefins (MTO) production capacity, supported by its strong petrochemical and automotive sectors. Methanol's role as a feedstock in producing formaldehyde and acetic acid is crucial in China, where these derivatives meet significant demand from construction and industrial manufacturing. China’s reliance on coal as a cost-effective feedstock for methanol production further strengthens its market position, as it enables large-scale production at lower costs. Alongside China, countries such as India and South Korea are also contributing to regional market growth, with rising infrastructure projects and automotive production. Government policies favoring alternative fuels in the region further encourage methanol’s use as a cleaner energy source.

In Europe, the methanol market is increasingly driven by the push for sustainable and low-carbon solutions. With strict environmental regulations, the region is investing in renewable and bio-methanol production, aligning with the European Union’s Green Deal and Renewable Energy Directive (RED II) policies. Methanol is used in fuel blending to reduce emissions and in producing biodiesel, supporting the region’s decarbonization goals. Countries such as Germany and the Netherlands are particularly active in adopting bio-methanol, spurred by incentives for renewable fuels. This shift toward sustainable methanol sources is positioning Europe as a key player in the green methanol market, catering to the demand for environmentally friendly industrial and fuel applications.

Methanol Market – Key Market Players and Competitive Insights

The methanol market comprises several active companies with strong market presence, including Methanex Corporation, OCI N.V., Zagros Petrochemical Company, SABIC (Saudi Basic Industries Corporation), and Celanese Corporation. Key Asian players include China National Petroleum Corporation (CNPC), China National Offshore Oil Corporation (CNOOC), and Yankuang Group, each of which has significant production capacity and integrated supply chains. Additionally, Mitsubishi Gas Chemical Company in Japan and Mitsubishi Chemical Corporation contribute substantially to the region’s methanol output. In the Middle East, Methanol Chemicals Company (Chemanol) and National Iranian Petrochemical Company are among the prominent producers, supplying both regional and global markets. The US-based companies, such as LyondellBasell and Eastman Chemical Company, also play a substantial role, focusing on methanol derivatives for various applications.

These companies operate across diverse regions, balancing the demand for methanol in industrial applications, fuel blending, and chemical production. Methanex Corporation, for example, has strategically located production facilities worldwide, providing it with access to key markets across North America, South America, and Asia Pacific. SABIC and OCI N.V., with their established infrastructure and large-scale production capabilities, cater to industries needing high methanol volumes, particularly in petrochemicals. In China, Yankuang Group and CNPC leverage the country's vast coal resources for methanol production, supporting local industrial demand and reducing import dependence. Regional players such as Chemanol and Zagros Petrochemical Company address Middle Eastern demand while also catering to the growing Asian and European markets.

The competitive landscape in the methanol market reveals a focus on expanding production capacity and investing in sustainable methanol. Companies such as Methanex and SABIC are increasing their renewable methanol capabilities to align with sustainability goals. Many companies, especially in Europe and North America, are pursuing green methanol initiatives, reflecting a broader industry shift toward lower-carbon production methods. Additionally, as Asia Pacific continues to be a major consumer market, key players are exploring methanol-to-olefins (MTO) technologies to meet the demand for petrochemical derivatives. This competitive dynamic emphasizes a balance between capacity expansion and environmental compliance, with producers increasingly diversifying their product portfolios to capture both traditional and emerging applications for methanol.

Methanex Corporation, headquartered in Canada, is a methanol producer with production facilities across North America, South America, and Asia Pacific. The company focuses on providing methanol for various applications, including fuels and petrochemicals, by leveraging its global production network.

SABIC (Saudi Basic Industries Corporation), based in Saudi Arabia, is another key player with a strong presence in the methanol market, particularly in the Middle East. As part of its diversified chemical production, SABIC manufactures methanol mainly for use in formaldehyde, acetic acid, and fuel blending applications.

Key Companies in Methanol Market

- Methanex Corporation

- OCI N.V.

- Zagros Petrochemical Company

- SABIC (Saudi Basic Industries Corporation)

- Celanese Corporation

- China National Petroleum Corporation (CNPC)

- China National Offshore Oil Corporation (CNOOC)

- Yankuang Group

- Mitsubishi Gas Chemical Company

- Mitsubishi Chemical Corporation

- Methanol Chemicals Company (Chemanol)

- National Iranian Petrochemical Company

- LyondellBasell

- Eastman Chemical Company

- Proman AG

Methanol Industry Developments

- In October 2023, Methanex signed a supply agreement with a major European energy company to support methanol fuel adoption in marine applications, emphasizing the company’s role in cleaner fuel solutions amid growing environmental regulations.

- In August 2023, SABIC announced its plans to scale up renewable methanol production at its facilities, aiming to reduce the carbon footprint of its chemical processes. This aligns with the company’s broader sustainability goals, as it seeks to cater to both regional and international demand for low-carbon methanol products.

Methanol Market Segmentation

By Feedstock Type Outlook

- Natural Gas

- Coal

- Biomass & Renewables

By Derivative Outlook

- Formaldehyde

- Acetic Acid

- MTBE, DME

- Gasoline Blending

- Biodiesel

- MTO/MTP

- Solvent

- Others

By End User Outlook

- Construction

- Automotive

- Electronics

- Others

By Regional Outlook

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Methanol Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 31.58 billion |

|

Market Size Value in 2025 |

USD 33.01 billion |

|

Revenue Forecast by 2034 |

USD 49.78 billion |

|

CAGR |

4.7% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2024 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 31.58 billion in 2024 and is projected to grow to USD 49.78 billion by 2034.

The global market is projected to register a CAGR of 4.7% during 2025–2034.

Asia Pacific held the largest share of the global market in 2024

The methanol market comprises several active companies with strong market presence, including Methanex Corporation, OCI N.V., Zagros Petrochemical Company, SABIC (Saudi Basic Industries Corporation), and Celanese Corporation.

The natural gas segment accounted for the largest share of the global market in 2024.

The formaldehyde segment accounted for the largest share of the global market in 2024.

Methanol, also known as wood alcohol, is a colorless, flammable liquid with a slightly sweet odor. It is the simplest form of alcohol, consisting of a single carbon atom bonded to one hydroxyl group (-OH) and one methyl group (-CH3). Methanol is primarily produced through the synthesis of carbon monoxide and hydrogen, often derived from natural gas, coal, or biomass. It is used as a key feedstock in the production of chemicals such as formaldehyde, acetic acid, and acetic anhydride.

A few key trends in the market are described below: Growing Demand for Renewable Methanol: Increased focus on sustainable and low-carbon alternatives, with bio-methanol and green methanol gaining traction due to environmental regulations. Rising Adoption of Methanol as Fuel: Expansion of methanol’s use as a cleaner fuel, especially in marine and automotive sectors, as part of global efforts to reduce emissions. Methanol-to-Olefins (MTO) Technology Growth: Widespread adoption of MTO technologies, particularly in China, to meet rising demand for petrochemicals and plastics. Strategic Partnerships and Mergers: Companies are forming alliances and partnerships to strengthen production capabilities, expand geographically, and enhance market share.

A new company entering the market must focus on developing sustainable and renewable methanol production methods, such as bio-methanol or green methanol, to cater to the growing demand for low-carbon alternatives. Emphasizing innovation in methanol-to-olefins (MTO) technology could also provide a competitive edge, given the rising demand for petrochemical derivatives. Additionally, investing in partnerships with players in key industries such as automotive and marine for methanol-based fuels could open up new revenue streams for market players. Geographic expansion into emerging markets, especially in Asia Pacific, where industrial demand is surging, would also be critical for growth

Companies producing methanol and related products, and other consulting firms must buy the report