U.S. Organ-on-a-Chip Market Size, Share, Trends, Industry Analysis Report

By Product & Services (Products, Services), By Application, By End Use – Market Forecast, 2025–2034

- Published Date:Aug-2025

- Pages: 125

- Format: PDF

- Report ID: PM6258

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

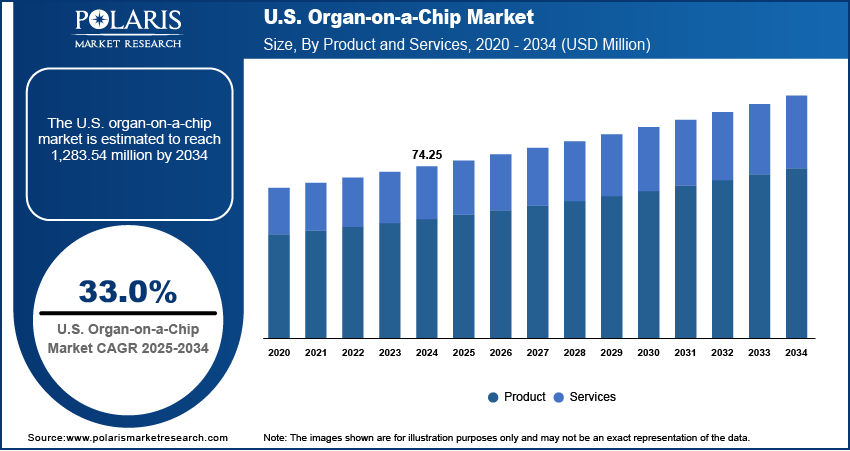

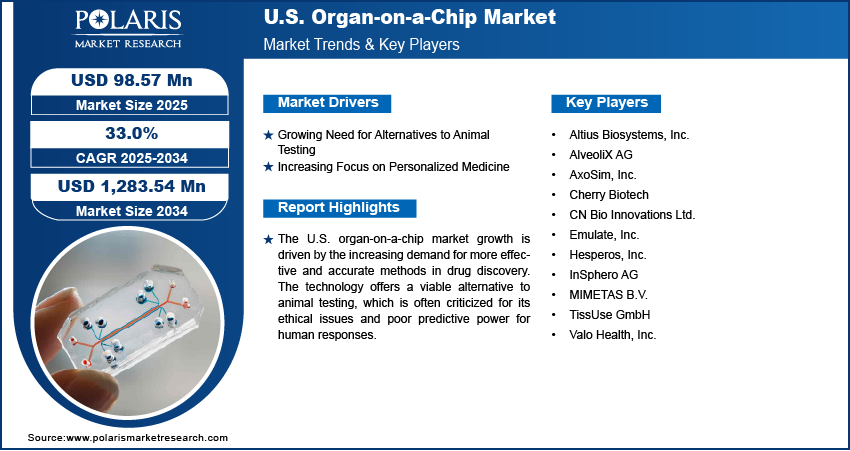

The U.S. organ-on-a-chip (OoC) market size was valued at USD 74.25 million in 2024 and is anticipated to register a CAGR of 33.0% from 2025 to 2034. Rising demand for alternatives to traditional animal testing fuels the market growth. There is also an increasing focus on creating personalized medicine, which drives the need for human-relevant testing models. Additionally, advancements in microfluidics and 3D cell culture technologies are making these devices more effective and widely used.

Key Insights

- By product & services, the services segment held the largest revenue share in 2024, driven by the need for specialized expertise and cost-effective solutions. This is because many companies choose to outsource complex research rather than investing in expensive equipment and training.

- Based on application, the drug discovery segment accounted for the largest share in 2024, due to the high costs and failure rates of traditional drug development, which the OoC technology helps reduce by providing more accurate preclinical testing.

- In terms of end use, the pharmaceutical and biotechnology companies segment held the largest share in 2024. These companies are major drivers of the market due to their substantial R&D investments and their strategic need for innovative platforms to streamline drug development processes.

Industry Dynamics

- Growing ethical concerns and legislative changes surrounding animal testing are a key driver. This technology provides a more accurate and human-relevant platform for assessing drug efficacy and toxicity, moving away from animal models that often fail to predict human responses and lead to high drug failure rates.

- The increasing focus on personalized medicine and tailored therapies is boosting demand. These devices can use patient-specific cells to create customized models, enabling more precise drug testing and disease modeling, ultimately leading to more effective and individualized treatment strategies for patients.

- Significant advancements in microfluidics and tissue engineering are driving growth. These innovations have enabled the creation of sophisticated, miniature systems that accurately mimic the complex structures and functions of human organs, making the technology more effective and easier for researchers to adopt.

Market Statistics

- 2024 Market Size: USD 74.25 million

- 2034 Projected Market Size: USD 1,283.54 million

- CAGR (2025–2034): 33.0%

AI Impact on Organ-on-a-Chip Market Statistics

- AI tools such as computer vision, machine learning (ML), and deep learning (DL) enhance preclinical testing as they can predict cellular behaviors and toxicity, which accelerates drug development and reduces failure rates.

- AI technology is used to optimize organ-on-a-chip design, such as microfluidic channel layouts and flow dynamics, saving on trial-and-error iterations.

- Insufficient training data, especially in complex fields such as oncology and neurology, negatively impacts the AI’s accuracy, which hinders the adoption of AI tools.

Organ-on-a-chip (OoC) technology uses micro-engineered systems to mimic the complex functions of human organs. These devices are about the size of a USB stick and contain living cells in tiny channels. They are designed to replicate organ-level functions and can be used for drug development, disease modeling, and studying human physiology in a controlled lab setting, providing a more relevant alternative to traditional methods.

Increased collaboration between academic institutions and companies is one key factor driving the growth of the industry. This synergy brings together advanced research from universities with the commercial expertise and resources of biotechnology firms. These partnerships help refine the technology, scale up production, and ensure that the devices meet the needs of the pharmaceutical and research sectors, accelerating the development of new applications and market penetration.

Another factor influencing the market is the rising government funding for research and development. Government agencies are increasingly recognizing the potential of these platforms to improve drug discovery and reduce the need for animal testing. This financial support helps push research forward and validates the technology as a reliable tool. As an instance, the National Institutes of Health (NIH) has awarded grants to support projects using these devices to study diseases and test drugs. For example, the NIH's National Center for Advancing Translational Sciences (NCATS) has a program dedicated to using these tissue chips to improve drug development processes.

Drivers and Trends

Growing Need for Alternatives to Animal Testing: The reliance on animal models for drug discovery and toxicology research has long been a standard practice. However, these models often fail to accurately replicate human physiological responses, leading to a high rate of drug failures in clinical trials. This inefficiency is a major concern for pharmaceutical companies, as it increases costs and lengthens the time it takes to bring new drugs to market. As a result, there is a strong push to adopt more predictive and ethically sound testing methods.

This focus on better testing methods is fueled by mounting scientific evidence highlighting the limitations of animal studies. According to an article titled "Limitations of Animal Studies for Predicting Toxicity in Clinical Trials: Is it Time to Rethink Our Current Approach?" published in PubMed Central, an analysis of animal experiments found that agreement with human studies occurred just 50% of the time. This 2019 publication concluded that results from animal tests are highly inconsistent predictors of toxic responses in humans. This growing awareness of the lack of predictive power in animal models is a primary reason why companies are seeking new solutions, thereby driving the demand for organ-on-a-chip technology across the U.S.

Increasing Focus on Personalized Medicine: Personalized medicine aims to tailor medical treatments to individual patients based on their genetic makeup, environment, and lifestyle. This approach requires precise testing methods that can accurately predict how a specific person's body will respond to a drug. Traditional drug testing methods, which use generalized cell lines or animal models, are not well-suited for this level of customization.

Organ-on-a-chip devices offer a unique solution by allowing researchers to use a patient's own cells to create a custom model of their organs on a chip. This creates a human-relevant system for assessing drug efficacy and safety on a case-by-case basis. According to a 2023 article titled "Organ-On-A-Chip: An Emerging Research Platform" from PubMed Central, the technology has the potential to provide more accurate and predictive models of human physiology and disease, which can lead to more effective treatments. The ability of this technology to create patient-specific models is a key advantage that supports the demand for personalized medical solutions. Therefore, the rising trend toward personalized medicine is a major factor contributing to the U.S. organ-on-a-chip market growth.

Segmental Insights

Product & Service Analysis

Based on product & services, the U.S. organ-on-a-chip market segmentation includes product and services. The services segment held the largest share in 2024, driven by the growing demand for specialized expertise, cost-effective solutions, and customized research support from pharmaceutical, biotechnology, and academic institutions. Many organizations, especially smaller ones, find it more efficient to outsource the development, validation, and testing of these complex systems rather than investing in expensive instrumentation, dedicated laboratory space, and highly trained personnel. Service providers offer a range of solutions, including contract research, custom chip development tailored to specific projects, and data analysis services. The increasing complexity of organ models and the need for rigorous, standardized validation protocols also contribute to the reliance on specialized service providers. This allows researchers to focus on their core scientific goals without the burden of managing the technology's technical aspects, thereby making the technology more accessible to a wider user base and solidifying the services segment's leading position.

The products segment, which includes the physical instruments and consumable devices, is anticipated to register the highest growth rate during the forecast period. This accelerated growth is fueled by continuous advancements in the technology itself, leading to more robust and user-friendly devices. Innovations in microfluidics, biomaterials, and 3D cell culture techniques are enabling the creation of more sophisticated and physiologically relevant organ models. As these products become more standardized and easier to use, a growing number of researchers and companies are expected to adopt the technology for their in-house research and development. The expansion of product portfolios to include a wider variety of organ models, such as lung, liver, heart, and multi-organ chips, is also a key growth factor. The combination of improved technology and a broader range of available products is driving greater adoption, making the products segment the fastest-expanding area of the market.

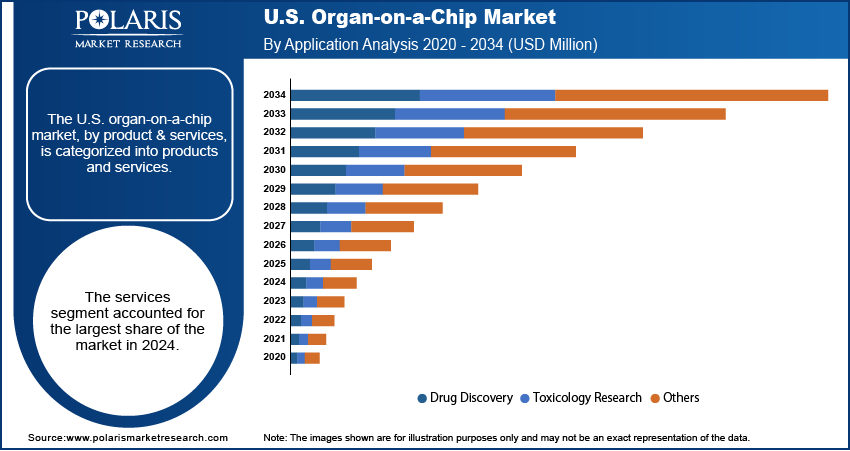

Application Analysis

Based on application, the U.S. organ-on-a-chip market segmentation includes drug discovery, toxicology research, and others. The drug discovery segment held the largest share in 2024. This is due to the immense and ongoing pressure on pharmaceutical and biotechnology companies to streamline their research and development processes. The high costs and long timelines of traditional drug discovery, along with the frequent failure of drug candidates in clinical trials, have created a strong incentive to adopt more efficient and predictive preclinical testing methods. These devices provide a platform that can more accurately mimic human physiology and disease states, helping researchers to screen drug compounds for efficacy and toxicity much earlier. This ability to filter out non-viable candidates early in the pipeline leads to significant cost savings and a higher success rate for promising new drugs, solidifying the application's leading position.

The toxicology research segment is anticipated to register the highest growth rate during the forecast period. The expansion is largely driven by a growing focus on alternatives to traditional animal testing methods. Regulatory bodies and the public are increasingly demanding more ethical and scientifically relevant approaches to testing a drug's safety. The technology offers a powerful solution by providing a platform to test for potential drug toxicity in a human-relevant context. These devices can replicate the unique metabolic and physiological responses of human organs, offering a more reliable assessment of a compound's potential adverse effects compared to animal models. This shift toward more precise and ethical testing methods is rapidly increasing the adoption of the technology for toxicology research, making it the fastest-growing application in the industry.

End Use Analysis

Based on end use, the segmentation includes academic & research institutes, pharmaceutical & biotechnology companies, and others. The pharmaceutical & biotechnology companies segment held the largest share in 2024. This dominance is attributed to the substantial research and development budgets these companies allocate toward improving drug discovery, leading to AI in drug discovery and development processes. Facing immense pressure to reduce the high cost and long timelines associated with bringing new drugs to market, these firms are rapidly adopting new technology. The technology provides a powerful platform for more accurate preclinical testing, allowing companies to screen drug candidates for efficacy and toxicity in a human-relevant environment. By incorporating these devices into their R&D pipelines, these companies can better predict how drugs will perform in humans, thereby reducing the rate of clinical trial failures and accelerating the development of new treatments. This strategic adoption by the industry's largest players solidifies its leading position in the end-use landscape.

The academic and research institutes segment is anticipated to register the highest growth rate during the forecast period. This rapid expansion is driven by increasing government and private funding for biomedical research, which is enabling these institutions to invest in and develop advanced technology. Researchers in academia are at the forefront of creating new organ models, refining existing ones, and exploring novel applications for the technology, from disease modeling to personalized medicine. The growing number of collaborations between academic institutions and biotechnology companies further fuels this growth, as it bridges the gap between fundamental research and commercial application. As government initiatives and grants continue to prioritize innovative research methods, these institutes are poised to lead the market's expansion by driving technological advancements and training the next generation of scientists.

Key Players and Competitive Insights

The U.S. organ-on-a-chip market is home to several key players, including Emulate, Inc.; MIMETAS B.V.; TissUse GmbH; and CN Bio Innovations Ltd. These companies, among others, are at the forefront of developing and commercializing sophisticated devices that replicate human organ functions. The competitive landscape is defined by a high degree of innovation, with firms focusing on a variety of strategies to gain an advantage. Many companies specialize in particular organ models, such as lung-on-a-chip or liver-on-a-chip, while others focus on providing multi-organ systems or specific services.

A few prominent companies in the U.S. organ-on-a-chip market include Emulate, Inc.; TissUse GmbH; MIMETAS B.V.; CN Bio Innovations Ltd.; InSphero AG; AxoSim, Inc.; Hesperos, Inc.; Nortis, Inc. (now part of Valo Health, Inc.); AlveoliX AG; Altis Biosystems, Inc.; and Cherry Biotech.

Key Players

- Altius Biosystems, Inc.

- AlveoliX AG

- AxoSim, Inc.

- Cherry Biotech

- CN Bio Innovations Ltd.

- Emulate, Inc.

- Hesperos, Inc.

- InSphero AG

- MIMETAS B.V.

- Nortis, Inc. (now part of Valo Health, Inc.)

- TissUse GmbH

U.S. Organ-on-a-Chip Industry Developments

September 2024: Emulate unveiled its Chip-R1 Rigid Chip. The new chip is designed with a minimally drug-absorbing profile, which helps provide more accurate data when studying a drug's absorption, distribution, metabolism, and excretion in the body.

U.S. Organ-on-a-Chip Market Segmentation

By Product & Services Outlook (Revenue – USD Million, 2020–2034)

- Products

- Services

By Application Outlook (Revenue – USD Million, 2020–2034)

- Drug Discovery

- Toxicology Research

- Others

By End Use Outlook (Revenue – USD Million, 2020–2034)

- Academic & Research Institutes

- Pharmaceutical & Biotechnology Companies

- Others

U.S. Organ-on-a-Chip Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 74.25 million |

|

Market Size in 2025 |

USD 98.57 million |

|

Revenue Forecast by 2034 |

USD 1,283.54 million |

|

CAGR |

33.0% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD million and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Insights |

|

Segments Covered |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The market size was valued at USD 74.25 million in 2024 and is projected to grow to USD 1,283.54 million by 2034.

The market is projected to register a CAGR of 33.0% during the forecast period.

A few key players in the market include Emulate, Inc.; TissUse GmbH; MIMETAS B.V.; CN Bio Innovations Ltd.; InSphero AG; AxoSim, Inc.; Hesperos, Inc.; Nortis, Inc. (now part of Valo Health, Inc.); AlveoliX AG; Altis Biosystems, Inc.; and Cherry Biotech.

The services segment accounted for the largest share of the market in 2024.

The toxicology research segment is expected to witness the fastest growth during the forecast period.