Microfluidics Market Share, Size, Trends, Industry Analysis Report

By Material (Silicon, Glass, Polymer, PDMS); Technology (Medical, Non-medical); By Application; By Region; Segment Forecast, 2024 - 2032

- Published Date:Jan-2024

- Pages: 118

- Format: PDF

- Report ID: PM1944

- Base Year: 2023

- Historical Data: 2019-2022

Report Outlook

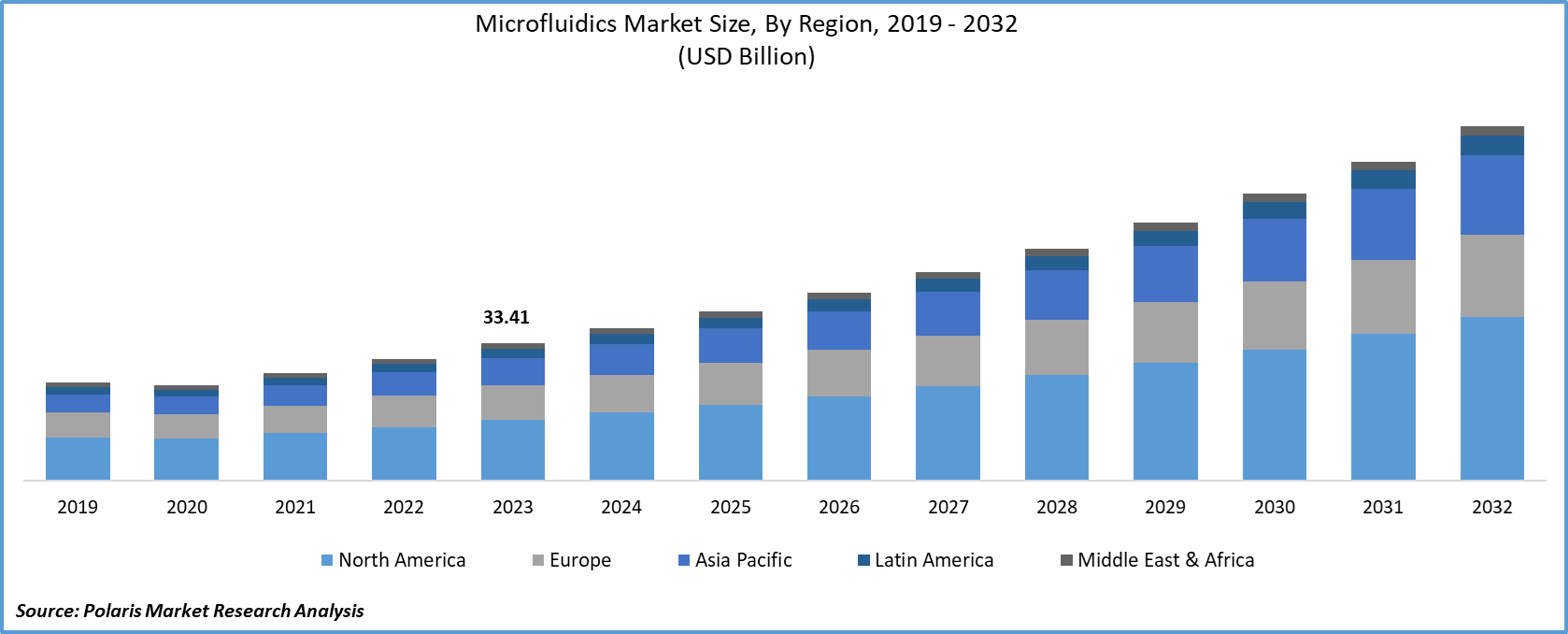

The global microfluidics market size was valued at USD 33.41 billion in 2023. The market is anticipated to grow from USD 37.10 billion in 2024 to USD 86.23 billion by 2032, exhibiting the CAGR of 11.1% during the forecast period.

Growing demands for point-of-care testing, an increasing incidence rate of lifestyle diseases, advancement in technology, greater emphasis on data sensitivity and efficiency, fast returns on investment, quicker testing, and better portability with microfluidic chip miniaturization are some of the factors that will supplement the growth of the global market during the forecast period.

Know more about this report: request for sample pages

Know more about this report: request for sample pages

Moreover, due to its cost-effective production, high systems engineering, and accessibility, microfluidics has a lot of potential in next-generation sequencing point-of-care diagnostic devices, which will drive up demand for the market over the forecast period. The introduction of microfluidics-based 3D cell culture systems, like organ-on-a-chip and the emerging application of drug delivery technologies, provides potential growth opportunities for industry players. Furthermore, high-throughput screening techniques, low-volume laboratory testing, and rising market demand for in vitro diagnostics (IVD) are anticipated to provide multiple growth potential for the market players in the near future.

Microfluidics is an emerging technology in the field of in-vitro diagnostics. The global market is driven by factors such as increased adaptation of point of care diagnostics in various medical fields and the emergence of 3D cell culture systems based on microfluidics such as organ-on-a-chip. Point of care devices is portable and handheld instruments used in the diagnostics of various diseases. Microfluidics-based biosensors in PoC devices can efficiently reduce the size, cost, and assay time of diagnostic testing.

Industry Dynamics

Growth Drivers

The new emerging applications of microfluidics are the emergence of 3D microfluidic cell culture systems such as organ-on-a-chip systems. Traditional animal studies and in-vitro culture systems have been useful in understanding the pathogenesis of viral infections and facilitating vaccine production. However, models that closely resemble human responses to specific disease conditions are still missing.

Organ-on-a-chip is a new technology that can accurately replicate in-vivo conditions. They can recapitulate fluid flows, tissue-tissue interfaces, organ-level physiology, and mechanical cues that can mimic humans' pathophysiology. Lungs, liver, and kidneys have been built by using Organ-on-a-chip technology.

Many companies are launching new microfluidic devices along with investing heavily to develop new innovative devices. The US FDA approved GeneXpert rapid molecular diagnostic machines designed by Cepheid in March 2020 to detect Coronavirus. In the US, 5000 automated modules are installed in health facilities, and these machines employ a disposable cartridge with test chambers based on microfluidics.

In June 2018, Emulate raised USD 36 million in series C financing to expand its microfluidics platform in developing disease models for drug testing. The company is trying to develop models that can mimic the physiology of the intestines, lungs, liver, and brain and modulation of the immune system. In February 2020, USD 25.85 million was raised in Series C funding by Lunaphore to expand its portfolio of ultra-rapid automated staining instruments based on microfluidic technology.

Microfluidics Market Report Scope

The market is primarily segmented on the basis of technology, material, application, and region.

|

By Technology |

By Material |

By Application |

By Region |

|

|

|

|

Know more about this report: request for sample pages

Insight by Technology

The medical segment dominated the market and held the highest revenue in 2020. Microfluidics is receiving a lot of interest in Point-of-Care (PoC) diagnostics as it has a lot of benefits that make it easier to create new POC diagnostics. These advantages are increasingly being applied to the development of point-of-care devices to identify a wide range of diseases. PCR and RT-PCR is the major contributor to the medical technology segment’s revenue.

Insight by Material

Polydimethylsiloxane (PDMS) segment dominated the microfluidics market and generated the highest revenue in 2020. Among other polymers, PDMS has received popularity, especially in microfluidic devices that require rapid prototyping.

This is due to the strong adoption of these polymers among academic professionals, primarily due to the material's ease of fabrication and affordability. To overcome the problems associated with PDMS's hydrophobicity, novel PDMS surface modifications are being introduced into the market.

The glass segment occupied the second position in market share and is expected to grow at a strong growth rate during the forecast period. Glass-based microfluidics instruments are commonly used in high-temperature and organic solvent analysis applications.

Geographic Overview

North America will be the largest region for the global market during the forecast period. Many companies involved in microfluidics market technology, such as Illumina, Thermo Fisher, and others, are based in this region. In the last few years, many new microfluidic systems were approved by US FDA.

In addition, the rising market demand for point-of-care testing, the upsurge in the incidence of chronic diseases, rising government and academic investments in proteomics and genomics study, and stakeholders' increased emphasis on studies involving genes, proteins, and related biomolecules are some of the factors expected to propel the growth in the region.

The Asia Pacific is expected to be the fastest-growing market for the global market during the forecast period. The introduction of new technology and increased healthcare infrastructure in countries like China and India has resulted in the increased adoption of PoC devices in diagnostic testing.

Competitive Landscape

The major players in the global market are launching new diagnostic devices based on microfluidics owing to the need for fast, cost-effective, and portable devices in healthcare. Companies are raising considerable funds to develop automated chip-based devices for drug screening and diagnosis.

Some of the major players operating in the market include Roche Ltd, PerkinElmer, Agilent Technologies, Inc., Danaher Corporation, Abbott Laboratories, Life Technologies Corporation, Thermo Fisher Scientific, Biomerieu, Illumina, Inc., Qiagen, Bio-Rad Laboratories, Elveflow, Micronit Micro Technologies B.V., Cellix Ltd., and Fluidigm Corporation.

Breast Implants Industry Developments

- July 2024: Illumina, Inc., a worldwide leader in DNA sequencing and array-based technologies, announced the acquisition of Fluent BioSciences, a developer of innovative single-cell technology. The company stated that the acquisition will support its multiomics growth strategy.

- May 2024: Takara Bio USA, Inc., a subsidiary of Takara Bio Inc., introduced the Lenti-X Transduction Sponge, a unique microfluidic enhancer for lentivirus-mediated gene delivery. According to Takara Bio, the new microfluidic enhancer is the first of its kind on the market.

Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 37.10 billion |

|

Revenue forecast in 2032 |

USD 86.23 billion |

|

CAGR |

11.1% from 2024 - 2032 |

|

Base year |

2023 |

|

Historical data |

2019 - 2022 |

|

Forecast period |

2024 - 2032 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2024 - 2032 |

|

Segments covered |

By Technology, By Material, By Application, By Region |

|

Regional scope |

North America Europe Asia Pacific Latin America, Middle East & Africa |

|

Key Companies |

Roche Ltd, PerkinElmer, Agilent Technologies, Inc., Danaher Corporation, Abbott Laboratories, Life Technologies Corporation, Thermo Fisher Scientific, Biomerieu, Illumina, Inc., Qiagen, Bio-Rad Laboratories, Elveflow, Micronit Micro Technologies B.V., Cellix Ltd., and Fluidigm Corporation |