3D Printing Filaments Market Size, Share, Trends, Industry Analysis Report

By Type (Plastics, Metals, Ceramics, Others), By Plastic Type, By Application, By Region – Market Forecast, 2025–2034

- Published Date:Oct-2025

- Pages: 129

- Format: PDF

- Report ID: PM6455

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

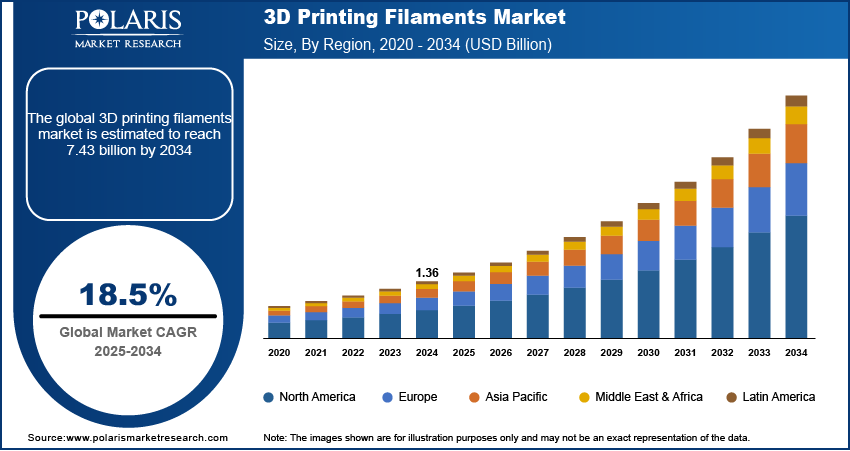

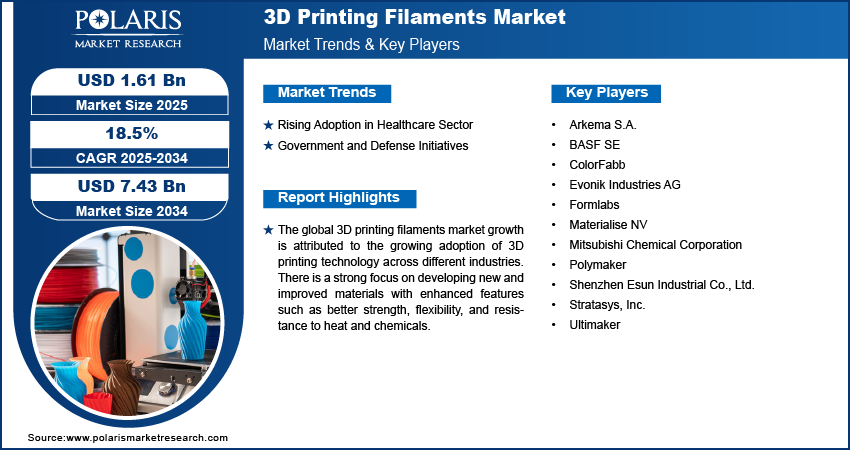

The global 3D printing filaments market size was valued at USD 1.36 billion in 2024 and is anticipated to register a CAGR of 18.5% from 2025 to 2034. The increasing use of 3D printing across different industries such as automotive, aerospace, and healthcare is a major driver. The growing need for custom-made products and rapid prototyping also boosts the demand for 3D printing filaments. Advancements in material science and technology are leading to the development of new and improved filaments with better properties.

Key Insights

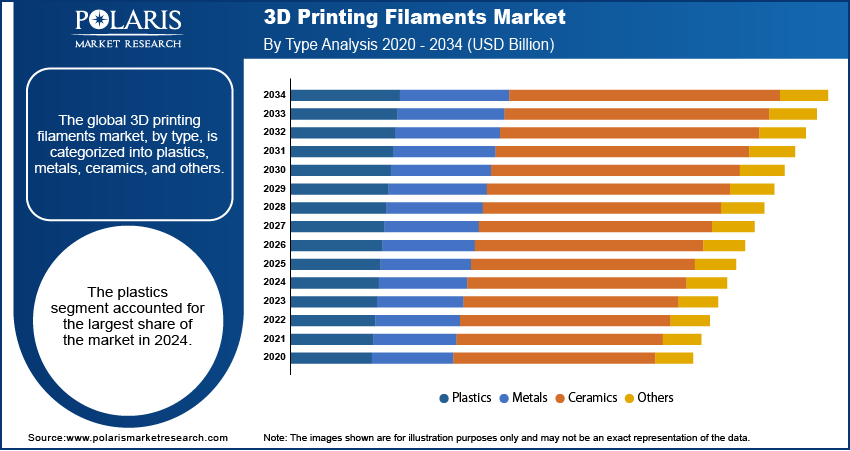

- By type, the plastics segment held the largest share in 2024, due to its wide range of applications, ease of use, and low cost.

- By plastic type, the polylactic acid (PLA) segment dominated in 2024 because of its eco-friendly properties, user-friendliness, and wide use.

- By application, the industrial sector is the leading application segment due to the fact that it has an extensive use for prototyping and tooling.

- By region, North America is the leading region because of its strong industrial base, high rate of technology adoption, and significant investment.

Industry Dynamics

- The growing use of 3D printing metal and other technologies for creating custom-made products and for rapid prototyping drives the industry growth. This is especially used in industries such as healthcare, where there is a high demand for personalized medical devices and implants. The ability to quickly design and produce complex parts without traditional manufacturing methods is boosting demand.

- Technological progress is also a major growth factor. The continuous development of new and improved filament materials with enhanced properties such as better strength, flexibility, and heat resistance is expanding the possible uses for these products. This has led to more widespread use in sectors that require high-performance parts.

- There is a rising need for sustainable, 3D printing construction, and eco-friendly manufacturing methods. This trend boosts the demand for biodegradable filaments such as PLA, which are made from renewable resources. The growing focus on environmental responsibility among consumers and businesses is positively influencing this demand trend.

Market Statistics

- 2024 Market Size: USD 1.36 billion

- 2034 Projected Market Size: USD 7.43 billion

- CAGR (2025–2034): 18.5%

- North America: Largest market in 2024

AI Impact on 3D Printing Filaments Market

- AI tools are used to analyze the vast datasets of chemical properties and performance metrics of filaments. Its integration boosts the discovery of new filament compositions.

- An AI-based system, using IoT sensors and predictive analytics, monitors printer health and filament feed systems, which helps minimize downtime and filament waste.

- The technology provides demand forecasts based on historical usage, real-time production data, and industry trends. It helps market players avoid overstocking or shortages, which improves responsiveness to market shifts and reduces storage costs.

The 3D printing filaments market focuses on the sale of various materials in a long, thin form that are used as a base material for FDM or FFF-type 3D printers. These materials, which are melted and layered to create a 3D object, are available in a range of types, from basic plastics to more advanced composites.

The educational sector is one of the important end users of the 3D printing industry. Many schools and universities use 3D printers in their courses, especially in fields such as science, technology, engineering, arts, and mathematics (STEAM). This approach enables students to have hands-on experience and turn digital designs into real objects, which helps them better understand complex ideas and develop practical skills. Rising adoption of this technology among more institutions propels the demand for affordable and simple-to-use filaments such as PLA and ABS.

Rising government support and initiatives boost the growth of the 3D printing filaments industry. Governments across the world promote the use of additive manufacturing to boost their local industries and improve supply chain stability. Some government-led programs offer grants and funding to businesses to support them to use 3D printing technology. Such initiatives reduce their reliance on foreign components. These initiatives also focus on training to increase a skilled workforce and encouraging research and development in this area. Hence, the rising government support for 3D printing adoption drives the need for filament materials.

Drivers and Trends

Rising Adoption in Healthcare Sector: 3D printing technology is increasingly used to create customized implants, medical devices, and prosthetics for better fit, comfort, and outcomes for patients. The technology creates complex and precise anatomical models from patient data. It helps surgeons plan and practice complicated procedures before even entering the operating room. This is especially helpful for rare cases or complex surgeries. The use of 3D printing saves time and improves success rates.

As per a 2024 report from the Centers for Disease Control and Prevention (CDC) titled “Approaches to Safe 3D Printing,” the National Institute for Occupational Safety and Health (NIOSH) focuses on reducing potential health and safety risks from using 3D printers in numerous settings, including medical facilities. The report also states that, owing to the increasing use of 3D printers in the healthcare sector to create patient-specific solutions, hospitals are establishing in-house 3D printing facilities to improve surgical outcomes and minimize recovery times. Therefore, the growing adoption of 3D printing in healthcare boosts the demand for specialized filaments such as biocompatible materials.

Government and Defense Initiatives: Governments worldwide invest significantly in additive manufacturing to enhance supply chains, increase manufacturing efficiency, and develop new technologies. The Department of Defense (DOD) revealed its strategy to use 3D printing to quickly produce replacement parts and tools. It helps maintain readiness and reduces the risk of dealing with outdated or hard-to-find hardware. This push for on-demand manufacturing helps reduce storage costs and logistics delays, which are common with traditional supply chains.

The U.S. Department of Defense is heavily investing in 3D printing technology. In 2021, the U.S. Department of Defense released its first detailed strategy for additive manufacturing with an aim to integrate AM into the DoD and its industrial base. Its goals include increasing material readiness and enabling soldiers to use innovative solutions on the battlefield. The commitment and financial support from the government for additive manufacturing boost the demand for a variety of 3D printing materials, including filaments.

Segmental Insights

Type Analysis

Based on type, the segmentation includes plastics, metals, ceramics, and others. The plastics segment held the largest share in 2024 due to its low cost, wide range of applications, and overall ease of use. Plastic filaments, including PLA and ABS, are common and are used by hobbyists and professionals alike. Their use spans many industries, from making simple prototypes and consumer goods to producing tools and functional parts in the automotive and education sectors. The availability of a vast array of plastic materials, each with unique properties such as flexibility or strength, makes this type a preferred choice for most 3D printing tasks. These materials are compatible with the most common types of 3D printers, which boosts their widespread use and dominance.

The metals segment is anticipated to register the highest growth rate during the forecast period. Metal filaments are becoming popular, especially in demanding industries. Their rising adoption is fueled by the need for strong, durable, and lightweight parts in high-performance sectors such as aerospace, automotive, and healthcare. These filaments enable the creation of complex metal components without the high cost and waste of traditional manufacturing. The ongoing development of new metal alloys and blends is also propelling the segment expansion. As more industries witness the benefits of using 3D printed metal parts for their properties and design freedom, the demand for these specialized filaments will increase in the future.

Plastic Type Analysis

In terms of plastic type, the industry is segmented into polylactic acid (PLA), acrylonitrile butadiene styrene (ABS), polyethene terephthalate glycol (PETG), acrylonitrile styrene acrylate (ASA), and others. The polylactic acid (PLA) segment dominated revenue share in 2024 due to its eco-friendly nature. PLA is derived from renewable resources, including sugarcane and corn starch. Due to its ease of use and low printing temperature, demand for PLA is rising from beginners, hobbyists, and educational settings. Unlike some other filaments, PLA does not require a heated build plate and produces very little odor during printing. These benefits make it suitable for indoor use. PLA can be used to produce high-quality prototypes and models with fine details, which boosts its widespread adoption across various applications. The combination of its benefits, such as affordability, user-friendly properties, and biodegradability, makes it the preferred material in the consumer and educational sectors.

The polyethylene terephthalate glycol (PETG) segment is anticipated to record the highest growth rate during 2025–2034. The material is gaining demand as it combines the features of both PLA and ABS. PETG is known for its various properties such as excellent strength, durability, and resistance to impact. This plastic type is more flexible than PLA and less prone to warping and shrinkage than ABS. Thus, PETG becomes an ideal choice to create strong and tough parts, such as functional prototypes, mechanical parts, and consumer products. The material’s properties, including resistance to chemicals and clarity, boost its use in areas such as medical devices and food packaging. As more consumers and businesses seek a material that offers a balance between ease of printing and high performance, PETG is becoming a popular choice.

Application Analysis

By application, the industry is segmented into industrial, aerospace & defense, automotive, healthcare, and others. The industrial segment held the dominant revenue share in 2024. The dominance is primarily fueled by the wide range of uses of 3D printing in industrial settings, including the production of prototypes, jigs, tools, and fixtures. Many manufacturing companies use additive manufacturing to quickly test and improve product designs before moving on to full-scale production. This strategy helps reduce costs and shortens the time it takes to get new products. 3D printing can create complex and custom parts on demand, which is a major benefit for these businesses. In industrial applications, 3D printing use extends in making end-use parts, especially for low-volume production where traditional manufacturing methods are expensive. The versatility of 3D printing filaments in the industrial segment, from standard plastics to high-performance composites, allows for various industrial applications, contributing to its dominance.

The healthcare segment is anticipated to register the highest growth rate during the forecast period. This growth is propelled by the increasing demand for customized medical solutions and devices that are made for a specific patient. The use of 3D printing in healthcare has expanded to include everything from personalized prosthetics and dental 3D printing aligners to surgical guides and anatomical models for pre-operative planning. The technology enables medical professionals to create devices that fit perfectly and improve patient outcomes. The ongoing innovation in biocompatible filaments and other specialized materials drives the segment growth. As medical regulations and standards for 3D printed devices become defined and technology becomes accessible, adoption of 3D printing filaments in hospitals and clinics is expected to rise rapidly during the forecast period.

Regional Analysis

The North America 3D printing filaments market accounted for the largest share in 2024. The dominance is driven by the presence of a strong industrial base and a high rate of technology adoption across various sectors. The region has a focus on innovation and research and development (R&D), which encourages the use of advanced manufacturing methods. Key industries such as aerospace, automotive, and healthcare are among the largest users of 3D printing for applications such as prototyping and creating specialized parts. The industry also benefits from a high consumer awareness and interest in personal and desktop 3D printing.

U.S. 3D Printing Filaments Market Insights

The U.S. is a significant contributor to the North American industry and is playing a major role in its overall growth. The country has a well-established industrial and technology sector, which has been a leader in using 3D printing for various applications. Further, strong support from the government and private sector for additive manufacturing leads to more investments and a rapid adoption of new technologies. This support propels a strong demand for filaments, ranging from standard plastics for consumer use to 3D printing high-performance plastics and other materials for professional and industrial purposes. The large number of companies and research institutions in the country drives continuous innovation in printers and the materials they use.

Europe 3D Printing Filaments Market Trends

Europe is a major market for 3D printing filaments owing to its long history of industrial manufacturing and a strong focus on engineering and design. The region has been quick to adopt 3D printing technology to improve production processes and create custom parts. The automotive and aerospace sectors increasingly use additive manufacturing to develop lightweight and complex components, driving the demand for 3d printing filaments. Government initiatives and strong partnerships between industry and research institutions propel the industry demand. An emerging trend toward sustainable manufacturing boosts the demand for eco-friendly and recycled filaments.

The Germany 3D printing filaments market plays a key role across Europe. It is home to a robust automotive and manufacturing industry, which heavily uses 3D printing for prototyping, tooling, and producing final parts. The country's strong focus on engineering and its significant investments in technology create a favorable environment for the rising adoption of additive manufacturing. German companies are known for their high standards and demand for quality, which drives the development of high-performance and specialized filaments. This strong industrial base makes Germany a major industry across Europe

Asia Pacific 3D Printing Filaments Market Analysis

The Asia Pacific industry is expected to show a high growth rate. This is mainly due to the rapid growth of industrialization and manufacturing in the area. Countries in this region are quickly adopting 3D printing to increase production efficiency and gain a competitive edge global. The sector here is also growing because of a rising number of small and medium-sized businesses that are starting to use 3D printing for their needs. Government support and investments in new technologies, as well as a large and growing consumer base, are also helping to fuel this expansion.

China 3D Printing Filaments Market Overview

China is a major contributor to the Asia Pacific industry. The country comprises a massive manufacturing sector and has a strong focus on technological advancements. The government of the country makes significant investments in additive manufacturing to modernize its industries. This has led to a quick and widespread adoption of 3D printing across many different sectors, including consumer goods, automotive, and electronics. The presence of numerous domestic manufacturers and a focus on research and development (R&D) in new materials drive demand for a wide variety of filaments across China.

Key Players and Competitive Insights

The competitive landscape of the 3D printing filaments market is made up of a mix of smaller, specialized filament manufacturers, established 3D printing firms, and large chemical companies. These players focus on making new materials with better properties such as flexibility, strength, and heat resistance. The major players are employing various strategies, including product innovation, partnerships, and expansion into new geographic areas, to increase their industry share. There is also a rising push toward introducing eco-friendly and sustainable filaments. Also, industry players focus on materials that can be used for specific high-end applications such as aerospace parts and medical implants.

A few prominent companies in the 3D printing filaments market include Stratasys, Inc.; BASF SE; Evonik Industries AG; Arkema S.A.; Mitsubishi Chemical Corporation; Shenzhen Esun Industrial Co., Ltd.; Polymaker; ColorFabb; Materialise NV; Formlabs; and Ultimaker.

Key Players

- Arkema S.A.

- BASF SE

- ColorFabb

- Evonik Industries AG

- Formlabs

- Materialise NV

- Mitsubishi Chemical Corporation

- Polymaker

- Shenzhen Esun Industrial Co., Ltd.

- Stratasys, Inc.

- Ultimaker

3D Printing Filaments Industry Developments

February 2024: Evonik introduced a new 3D printing resin designed for manufacturing tough, flame-retardant parts. This product launch, called INFINAM FR 4100 L, is aimed at meeting the increasing demand for high-performance materials in industries that require strict safety standards.

3D Printing Filaments Market Segmentation

By Type Outlook (Revenue – USD Billion, 2020–2034)

- Plastics

- Metals

- Ceramics

- Others

By Plastic Type Outlook (Revenue – USD Billion, 2020–2034)

- Polylactic Acid (PLA)

- Acrylonitrile Butadiene Styrene (ABS)

- Polyethylene Terephthalate Glycol (PETG)

- Acrylonitrile Styrene Acrylate (ASA)

- Others

By Application Outlook (Revenue – USD Billion, 2020–2034)

- Industrial

- Aerospace & Defense

- Automotive

- Healthcare

- Others

By Regional Outlook (Revenue – USD Billion, 2020–2034)

- North America

- U.S.

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- Suth Korea

- Indnesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- Suth Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

3D Printing Filaments Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 1.36 billion |

|

Market Size in 2025 |

USD 1.61 billion |

|

Revenue Forecast by 2034 |

USD 7.43 billion |

|

CAGR |

18.5% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Insights |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 1.36 billion in 2024 and is projected to grow to USD 7.43 billion by 2034.

The global market is projected to register a CAGR of 18.5% during the forecast period.

North America dominated the market share in 2024.

A few key players in the market include Stratasys, Inc.; BASF SE; Evonik Industries AG; Arkema S.A.; Mitsubishi Chemical Corporation; Shenzhen Esun Industrial Co., Ltd.; Polymaker; ColorFabb; Materialise NV; Formlabs; and Ultimaker.

The plastics segment accounted for the largest share of the market in 2024.

The polyethylene terephthalate glycol (PETG) segment is expected to witness the fastest growth during the forecast period.