3D Printing High Performance Plastic Market Share, Size, Trends, Industry Analysis Report

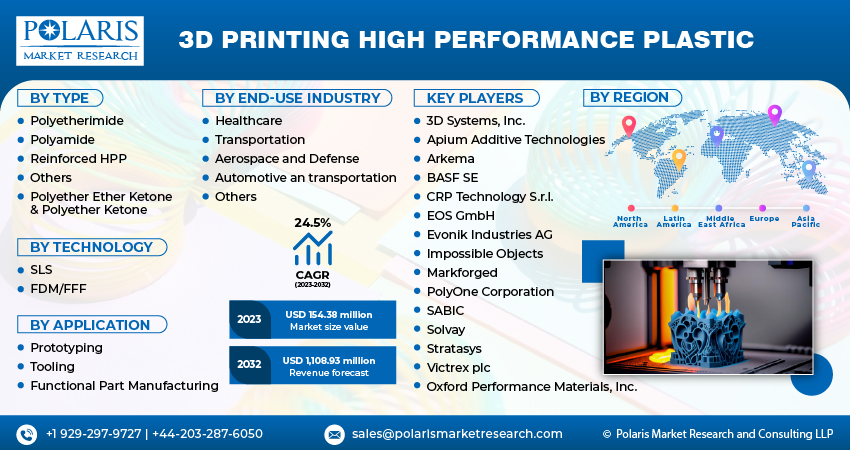

By Type (Polyetherimide, Polyamide, Polyether Ether Ketone & Polyether Ketone, Reinforced HPP, and Others); By Technology; By Application; By End-Use Industry; By Region; Segment Forecast, 2023- 2032

- Published Date:Nov-2023

- Pages: 116

- Format: PDF

- Report ID: PM3889

- Base Year: 2022

- Historical Data: 2019-2021

Report Outlook

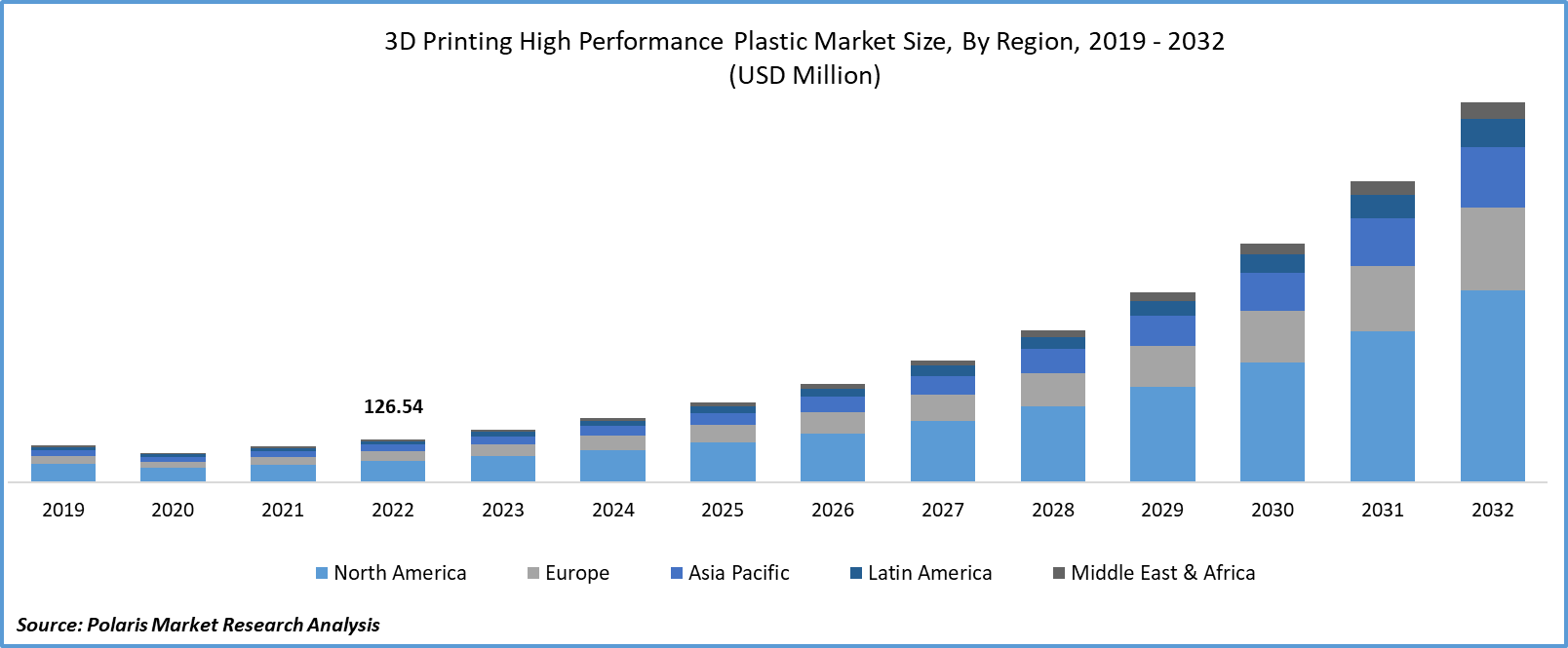

The global 3D printing high performance plastic market was valued at USD 126.54 million in 2022 and is expected to grow at a CAGR of 24.5% during the forecast period.

The increasing versatility and accessibility of 3D printing technology, along with the advancements in high-performance plastic materials, are fueling the growth of applications across industries. High-performance plastics play a role in manufacturing as they are utilized to create customized jigs, fixtures, and tooling. These materials can withstand the demands of production while remaining cost-effective. The durability, chemical resistance, and exceptional performance properties of high-performance plastics make them indispensable in sectors that prioritize reliability. Sectors such as aerospace and automotive are progressively adopting high-performance plastics to achieve weight reduction, boost fuel efficiency, and enhance performance.

To Understand More About this Research: Request a Free Sample Report

In addition, companies operating in the 3D printing high performance plastic market are introducing new products with enhanced capabilities to cater to the growing consumer demand. For instance, in November 2022, Arkema and EOS announced the launch of a new Kepstan PEKK powder for the EOS P 810 system. It is developed to offer higher ductility and superior electrical insulation for applications in oil & gas and electrical & electronic markets.

Furthermore, certain high-performance plastics are undergoing development using sustainable and recyclable materials, aligning with the global shift towards eco-friendly products and packaging solutions. Meanwhile, continuous research and development endeavors are diversifying the spectrum of high-performance plastics, tailoring their attributes to align with the specific demands of various applications, thus driving their adoption in emerging industries.

The COVID-19 pandemic posed threats such as supply chain disruption, limited availability of resources, and closure of facilities while highlighting the importance of resilient supply chains. 3D printing high-performance plastics allows for the production of critical components on-demand, reducing supply chain vulnerabilities.

For Specific Research Requirements, Request for a Customized Research Report

Growth Drivers

Increased demand for customization across various industries is projected to spur the market demand

Customization serves as a major catalyst in industries such as healthcare, aerospace, and automotive. The utilization of 3D printing facilitates the creation of highly customized, patient-specific products, an imperative aspect in domains like medical implants and prosthetics.

3D printing high-performance plastics are used in the production of medical equipment and devices. They possess biocompatibility, resistance to chemicals, and sterilizability rendering them exceptionally well-suited for applications encompassing surgical instruments, implants, and diagnostic apparatus.

As industries persist in prioritizing attributes like lightweight design, durability, and superior performance, the demand for high-performance plastics is anticipated to experience further growth. Additionally, the continuous progress in materials and manufacturing technologies is poised to extend the scope of potential applications and foster innovation in this domain.

Report Segmentation

The market is primarily segmented based on type, technology, application, end use industry, and region.

|

By Type |

By Technology |

By Application |

By End-Use Industry |

By Region |

|

|

|

|

|

To Understand the Scope of this Report: Speak to Analyst

By Type Analysis

Polyamide emerged as the largest segment in 2022

The polyamide emerged as the largest segment in 2022. Polyamide emerged as the dominant segment in 2022. It is a versatile, high-performance plastic widely utilized in 3D printing. Its unique blend of flexibility and durability makes it an ideal choice for applications involving parts that require both bending capabilities and resilience to repetitive stress.

Polyamide is popular for its proficiency in 3D printing complex geometries with intricate details. In industries where weight reduction is critical, such as automotive and aerospace, polyamide is favored for its lightweight attributes, while maintaining the structural integrity demanded by these sectors.

By Technology Analysis

FDM/FFF emerged as the largest segment in 2022

The FDM/FFF segment accounted for the largest market share in 2022. The utilization of high-performance plastics, in combination with 3D printing techniques like Fused Deposition Modeling (FDM) or Fused Filament Fabrication (FFF) has become widely adopted across industries. The reason behind its popularity lies in its versatility and cost-effectiveness. FDM/FFF methods are commonly employed to produce prototypes using high-performance plastics quickly.

These prototypes serve as models that facilitate the testing and improvement of concepts. Furthermore, FDM/FFF technology enables the production of customized components finding applications in sectors such as aerospace and healthcare. 3D printing high-performance plastics is increasingly being used in manufacturing personalized medical implants, orthopedic devices, and aerospace components. This customization ensures that the final products meet the requirements and strict standards of both patients and industry regulations.

By Application Analysis

Prototyping emerged as the largest segment in 2022

The prototyping segment accounted for the largest market share in 2022 and is likely to retain its market position throughout the forecast period. Using 3D printing with high-performance plastics for prototyping offers a cost-efficient method to evaluate designs and refine concepts before moving to full-scale production. It speeds up the product development cycle while reducing development expenses.

In the automotive sector, 3D printing with high-performance plastics is relied upon for creating prototypes of vehicle parts and accessories. This enables the development and testing of designs, resulting in enhanced efficiency and reduced time to market. With 3D printing, iterative design processes are made possible, allowing for modifications and reprints of prototypes to address design flaws or incorporate improvements.

By End-Use Industry Analysis

Healthcare segment held the significant market revenue share in 2022

The healthcare segment held a significant market share in revenue share in 2022. 3D printing with high-performance plastics has introduced a versatile and innovative approach to enhance patient care, reduce costs, and propel advancements in medical research and development. This technology empowers the creation of personalized implants and prosthetic devices precisely tailored to an individual's unique anatomy. Surgeons benefit from the precision-enhancing capabilities of 3D-printed surgical guides and instruments, ensuring accuracy in complex procedures. Moreover, high-performance plastics employed in this context provide the requisite durability and sterilization properties necessary for the operating room.

In addition, the dental industry has experienced a profound transformation through the adoption of 3D printing with high-performance plastics. This technology is harnessed for crafting dental crowns, bridges, and removable dentures, resulting in dental solutions that are remarkably precise, customizable, and often markedly more comfortable for patients.

Regional Insights

North America region dominated the global market in 2022

The North American region has asserted its dominance in the global market and is expected to continue leading throughout the forecast period. The 3D printing high-performance plastics industry in North America is experiencing substantial growth across diverse industries. Renowned for their outstanding mechanical, thermal, and chemical attributes, high-performance plastics find wide-ranging utility. North American medical device firms have readily adopted 3D printing for crafting custom implants, surgical tools, and orthopedic equipment. Biocompatible materials like PEEK are preferred to ensure adherence to rigorous safety and regulatory norms.

The Asia Pacific region is anticipated to experience significant growth during the projected period. Numerous manufacturing industries in Asia Pacific have embraced 3D printing using high-performance plastics to manufacture tailored parts for machinery and equipment. Sectors like automotive, aerospace, and electronics utilize 3D printing high-performance plastics for developing prototypes, tooling, and functional components. Asian consumer goods companies leverage 3D printing to craft personalized products. High-performance plastics enable the production of visually appealing items. The demand for customization and swift prototyping plays a role in driving this industry.

Key Market Players & Competitive Insights

The 3D printing high performance plastic market is fragmented and is anticipated to witness competition due to several players' presence. Major market players are constantly introducing new products to strengthen their position in the market. These players focus on partnership, product upgrades, and collaboration to gain a competitive edge over their peers and capture a significant market share.

Some of the major players operating in the global market include:

- 3D Systems, Inc.

- Apium Additive Technologies

- Arkema

- BASF SE

- CRP Technology S.r.l.

- EOS GmbH

- Evonik Industries AG

- Impossible Objects

- Markforged

- Oxford Performance Materials, Inc.

- PolyOne Corporation

- SABIC

- Solvay

- Stratasys

- Victrex plc

Recent Developments

- In March 2021, Evonik expanded its product portfolio through the introduction of its new PEEK filament, INFINAM PEEK 9359 F. The new product is developed for industrial 3D applications, and can be processed through fused deposition modelling (FDM) and fused filament fabrication (FFF).

3D Printing High Performance Plastic Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2023 |

USD 154.38 million |

|

Revenue forecast in 2032 |

USD 1,108.93 million |

|

CAGR |

24.5% from 2023 – 2032 |

|

Base year |

2022 |

|

Historical data |

2019 – 2021 |

|

Forecast period |

2023 – 2032 |

|

Quantitative units |

Revenue in USD million and CAGR from 2023 to 2032 |

|

Segments covered |

By Type, By Technology, By Application, By End-Use Industry, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Customization |

Report customization as per your requirements with respect to countries, region and segmentation. |