Plasmid Purification Market Size, Share, Trends, Industry Analysis Report

By Product & Service (Products, Services), By Grade, By Application, By End Use, By Region – Market Forecast, 2025–2034

- Published Date:Aug-2025

- Pages: 125

- Format: PDF

- Report ID: PM6249

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

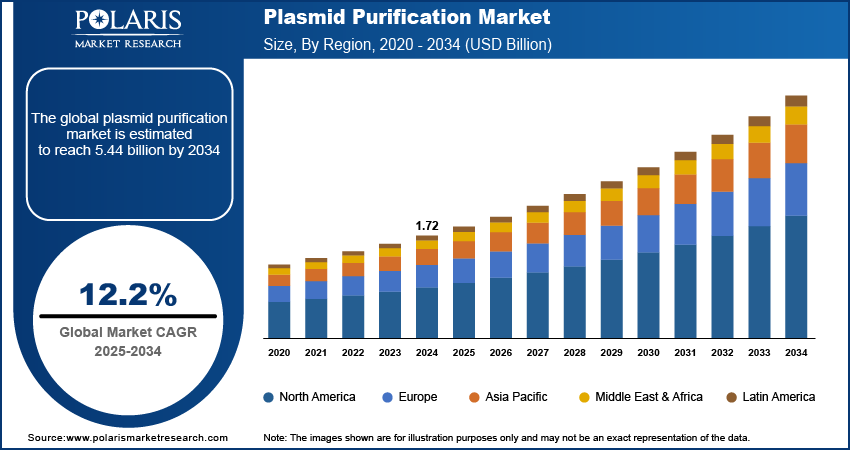

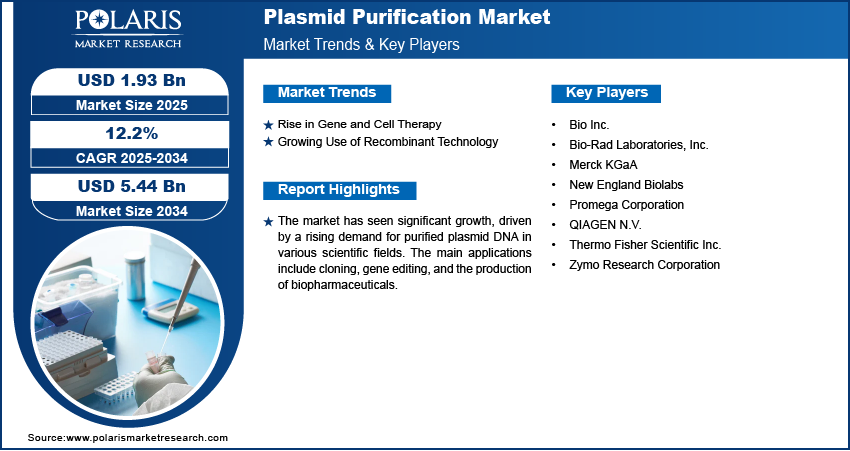

The global plasmid purification market size was valued at USD 1.72 billion in 2024 and is anticipated to register a CAGR of 12.2% from 2025 to 2034. The rising use of cell and gene therapy and the growing demand for recombinant technology products drive the market growth. Additionally, technological advancements in purification techniques, such as automation, are leading to the industry growth.

Key Insights

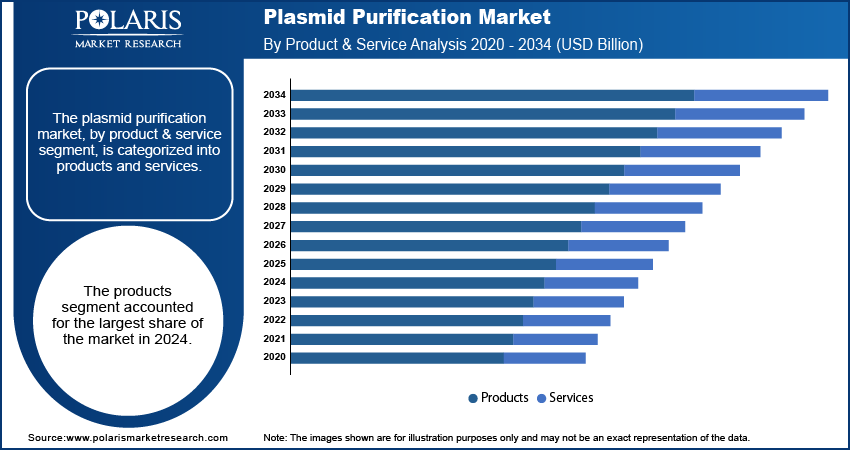

- By product & service, the products segment held the largest share in 2024 owing to the widespread use of kits and reagents. These products are a standardized and efficient solution for purifying plasmids in both academic research and commercial manufacturing.

- Based on grade, the molecular grade segment held the largest share in 2024 due to its extensive use in basic and routine lab applications such as cloning and sequencing. The lower cost and ease of production of these plasmids make them the primary choice for a broad range of research activities.

- In terms of application, the cloning and protein expression segment held the largest share in 2024, as it is a fundamental process for producing vaccines, therapeutic proteins, and enzymes. This application's widespread use in drug discovery and industrial biotechnology solidifies its position.

- By end use, the academic and research institutes segment held the largest share in 2024 due to their consistent and high demand for plasmids in various fundamental research projects. Government funding and a focus on scientific innovation in these institutions drive the growth.

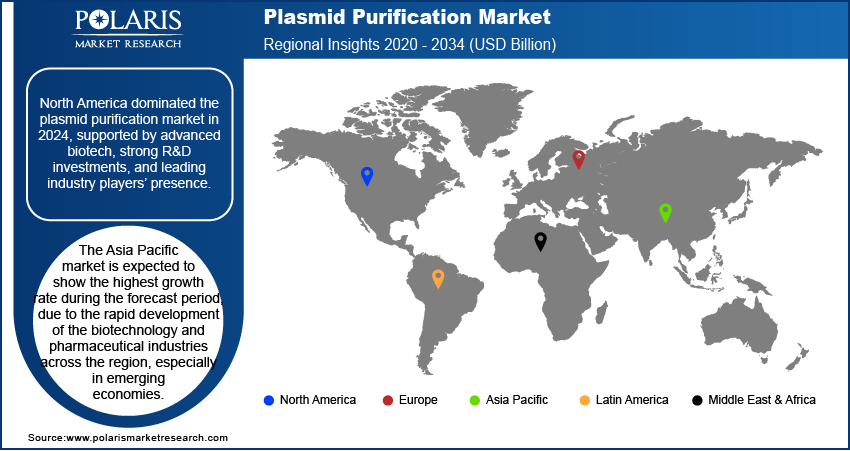

- North America holds the largest share of the market, primarily due to its advanced biotechnology and pharmaceutical industries. The region also benefits from significant research and development investments and a strong presence of key players.

Industry Dynamics

- The growing use of gene and cell therapy is a key factor driving the demand for plasmid purification. These therapies rely on high-purity plasmid DNA to deliver genetic material into a patient's cells. As more of these advanced treatments receive approval, the need for scalable and compliant purification technologies is increasing.

- Increased research and development spending by pharmaceutical companies is boosting demand. These companies are focused on creating new biologics and biosimilars, which require plasmid DNA. This is also driven by ongoing clinical trials for plasmid DNA-based therapies.

- The prevalence of genetic disorders and chronic diseases creates a need for personalized medicine and other advanced treatments, which often use plasmid DNA as a key component for therapy.

Market Statistics

- 2024 Market Size: USD 1.72 billion

- 2034 Projected Market Size: USD 5.44 billion

- CAGR (2025–2034): 12.2%

- North America: Largest market in 2024

AI Impact on Plasmid Purification Market

- AI tools simplify patient data analysis, and the results can be used to plan individualized and accurate gene therapies, which are expected to improve treatment outcomes.

- AI algorithms help analyze experimental data to optimize plasmid extraction protocols, which improves yield and purity as well as reduce processing time.

- AI is integrated with sensors to track various parameters such as temperature, pH, and buffer composition, thereby preventing degradation.

Plasmid purification is a process in molecular biology used to isolate and purify plasmid DNA from bacterial cells or nucleic acid isolation and purification. This process involves several steps to remove unwanted components such as proteins and genomic DNA, leaving behind a clean sample of the plasmid. The purified plasmid DNA is then used in various downstream applications, such as DNA sequencing and genetic engineering.

One of the growth drivers is the increasing use of synthetic biology. Synthetic biology involves creating new biological systems or redesigning existing ones for specific purposes, such as producing pharmaceuticals or biofuels. The development of these systems relies heavily on constructing custom genetic circuits, which often use plasmids as a crucial tool. As this field expands, so does the demand for pure plasmids.

Another factor contributing to the industry growth is the rise of personalized medicine. This approach to healthcare tailors medical treatments to individual patients based on their genetic makeup. Plasmid DNA is an important component in developing these customized therapies. As the focus on personalized care grows, the need for high-quality plasmids to be used in gene editing and targeted therapies also increases. For instance, the NIH is actively funding research into gene-based treatments for genetic disorders and chronic illnesses, which highlights the importance of tools such as plasmid purification.

Drivers and Trends

Rise in Gene and Cell Therapy: The increasing development and use of gene and cell therapies boosts the demand for plasmid purification. These advanced therapies, which aim to correct genetic defects or use living cells to treat disease, are heavily dependent on high-quality plasmid DNA. Plasmids are used as vectors to carry the necessary genetic material into a patient's cells. As more of these innovative treatments move through clinical trials and gain regulatory approval, the demand for highly pure plasmid DNA for research and commercial production continues to grow.

The U.S. Food and Drug Administration (FDA) has been approving a number of cellular and gene therapies, which shows the growth in this area. According to the FDA's "Approved Cellular and Gene Therapy Products" list updated as of May, 2025, there are numerous approved products for various conditions. The approval of these therapies, such as those for sickle cell disease and different types of cancer, proves a strong need for reliable plasmid purification in the manufacturing process. This increase in approvals and a robust pipeline of new therapies drives the need for more efficient and scalable plasmid purification methods.

Growing Use of Recombinant Technology: The expanding applications of recombinant DNA technology in the biotechnology and pharmaceutical sectors fuel the market expansion. Recombinant technology involves combining genetic material from different sources to create new DNA sequences. Plasmids are essential in this process as they act as the primary cloning vectors to carry the desired genes into host cells for protein expression. This technology is widely used to produce therapeutic proteins, vaccines, and enzymes, all of which require a reliable source of purified plasmids.

The use of recombinant technology in medicine has a long and successful history. According to a publication titled "Recombinant DNA Therapeutic Products" by the Technology Information, Forecasting and Assessment Council (TIFAC), recombinant therapeutics have been approved globally for commercial use, with many more in clinical trials. The article also notes that in India, several products such as insulin and the hepatitis B vaccine are produced using this technology. This widespread and increasing use of recombinant technology in healthcare shows the critical role of purified plasmids in creating these life-saving products.

Segmental Insights

Product & Service Analysis

Based on product & service, the segmentation includes products and services. The products segment held the largest share in 2024. This dominance is driven by the widespread use of kits and reagents, which are essential for purifying plasmids in various research and manufacturing settings. These kits offer a standardized and user-friendly approach, making the purification process more efficient and reproducible. The increasing adoption of automated systems, which streamline workflows and reduce the chance of human error, also contributes to the products segment's leadership. The demand for high-quality, reliable, and consistent plasmid DNA across different scales, from small-scale lab experiments to large-scale biopharmaceutical production, has cemented the products segment's position. This consistent demand is a direct result of ongoing advancements in genetic engineering, cell and gene therapy development, and the production of biologics, where plasmids are a fundamental component.

The services segment is anticipated to register the highest growth rate during the forecast period. This is due to a rising trend among companies to outsource complex and large-scale plasmid purification tasks to specialized providers. Many pharmaceutical and biotechnology companies, as well as academic research institutions, are focusing their resources on core research and development activities, preferring to rely on external experts for manufacturing and purification needs. These service providers offer significant advantages, including access to advanced technologies, economies of scale, and the ability to ensure regulatory compliance for clinical-grade plasmids. The growing complexity of purification processes for specific applications, combined with the need for high-purity, GMP-compliant plasmid DNA for gene therapies and vaccines, makes outsourcing an attractive option.

Grade Analysis

Based on grade, the segmentation includes molecular grade and transfection grade. The molecular grade segment held the largest share in 2024. This grade of plasmid DNA is sufficient for many applications, such as cloning, DNA sequencing, and PCR, where the presence of bacterial endotoxins is not a major concern. As these applications are fundamental to a wide range of academic research and early-stage drug discovery, the demand for molecular grade plasmids is consistently high. The relative ease and lower cost of producing this grade also make it the preferred choice for many researchers, contributing to its dominant position.

The transfection grade segment is anticipated to register the highest growth rate during the forecast period, driven by the increasing number of clinical trials and commercial approvals for gene and cell therapies. Transfection grade plasmids are purified to a much higher standard, with very low levels of endotoxins, which is critical for successful gene transfer into living cells without causing an inflammatory response. The stringent quality requirements for in vivo and in vitro research, especially for developing vaccines and advanced therapeutics, are fueling the need for this higher-purity grade. The shift toward personalized medicine and the growing pipeline of gene-based treatments are key factors pushing the demand for transfection grade plasmids, making it the fastest-growing segment.

Application Analysis

Based on application, the segmentation includes cloning & protein expression, transfection & gene editing, and others. The cloning & protein expression segment held the largest share in 2024. This dominance is attributed to the wide range of applications for this technology in academic research, drug discovery, and industrial biotechnology. Plasmids are fundamental tools for expressing proteins on a large scale, which is essential for producing vaccines, therapeutic proteins, and enzymes. The constant need for these products, along with ongoing research into new biological molecules and drug targets, drives the strong and steady demand for plasmid purification in this application. The simplicity and efficiency of cloning and protein expression workflows in standard laboratory settings also contribute to the segment's leading position.

The transfection and gene editing segment is anticipated to register the highest growth rate during the forecast period. This growth is directly linked to the rapid advancements in gene therapies and the increasing adoption of gene-editing technologies such as CRISPR. These applications require extremely pure plasmid DNA to ensure accurate and safe delivery of genetic material into cells. As more gene therapies enter clinical trials and become commercially available, the need for high-quality plasmids for both research and manufacturing is growing. The potential of gene editing to treat a wide variety of diseases, from genetic disorders to cancer, is also boosting this segment. The continuous development of new gene-editing tools and the expansion of personalized medicine are key drivers behind the high growth potential of this application.

End Use Analysis

Based on end use, the segmentation includes pharmaceutical & biotechnology companies, academic & research institutes, and contract research organizations. The academic & research institutes segment held the largest share in 2024 as these institutions are at the forefront of fundamental research in molecular biology, genetics, and biotechnology. They constantly require high-quality plasmid DNA for a wide variety of experiments, including cloning, gene expression, and DNA sequencing. The significant number of research projects, coupled with consistent government funding for life sciences and health-related research, ensures a steady demand from this end-user segment. These institutes also play a vital role in training the next generation of scientists, further fueling the use of plasmid purification products and services. The continuous and broad-based research activities make this segment the largest consumer of plasmid purification solutions.

The contract research organizations segment is anticipated to register the highest growth rate during the forecast period. This is due to a growing trend among pharmaceutical and biotechnology companies to outsource specialized tasks like plasmid purification to external partners. As the development of advanced therapies, such as cell and gene therapies, becomes more complex, many companies find it more efficient to rely on the expertise and advanced equipment of these organizations. Outsourcing allows companies to focus on their core competencies while benefiting from the specialized services and large-scale manufacturing capabilities offered by contract research organizations. These organizations are well-equipped to handle the strict quality control and regulatory requirements for producing clinical-grade plasmids, which is a key driver for their rapid expansion.

Regional Analysis

The North America plasmid purification market accounted for the largest share in 2024, due to a well-established and robust biotechnology and pharmaceutical industry, along with high levels of research and development spending. The region is a key hub for gene and cell therapy development, which drives the demand for high-quality plasmid DNA. Additionally, the presence of major industry players and a strong ecosystem of academic and research institutions further contributes to the region's leadership. Favorable government policies and private investments in life sciences also play a crucial role in maintaining its strong position.

U.S. Plasmid Purification Market Insights

The U.S. is the main market in North America. The country has an advanced biotechnology and pharmaceutical sector, which leads to significant investments in research and development. The U.S. is home to a large number of companies and research centers that are pioneers in gene editing and advanced therapeutics, creating a strong and steady demand for plasmid purification. Government support through funding and favorable regulatory frameworks for drug development also helps accelerate growth.

Europe Plasmid Purification Market Trends

Europe is a significant player in the market, with a strong presence in the life sciences and biotechnology fields. The region benefits from a solid academic and research base, with numerous universities and institutes conducting advanced genetic analysis and molecular biology research. Government initiatives and funding programs aimed at supporting scientific innovation and developing novel therapies also contribute to the growth of the market. This supportive environment has led to the emergence of many biotech startups and a robust pipeline of new therapies.

The Germany plasmid purification market is a major contributor to the European market. The country has a well-developed pharmaceutical and biotechnology sector, known for its innovation and strong emphasis on research. German companies are actively involved in the development of biologics and gene therapies, which require a reliable supply of purified plasmid DNA. The country's strong economic foundation and focus on scientific excellence make it a key area for plasmid purification products and services.

Asia Pacific Plasmid Purification Market Assessment

The Asia Pacific market is expected to show the highest growth rate during the forecast period, due to the rapid development of the biotechnology and pharmaceutical industries across the region, especially in emerging economies. Increasing research and development investments, government support for the life sciences sector, and a growing number of contract manufacturing organizations are fueling this growth. The region's large population and rising demand for advanced healthcare solutions are also creating new opportunities.

Japan Plasmid Purification Market Overview

Japan is a key country in the Asia Pacific industry. With a well-established pharmaceutical industry and a strong focus on innovation, Japan is a leader in biotechnology research. The country has a supportive environment for developing and commercializing advanced therapies. This, combined with growing investments in gene-based research and a high demand for advanced medical treatments, makes Japan an important area for plasmid purification.

Key Players and Competitive Insights

The competitive landscape is dynamic and includes several key players such as Thermo Fisher Scientific, QIAGEN, Merck KGaA, Promega Corporation, and Takara Bio. These companies are focused on a mix of strategic activities to maintain and grow their positions. A major trend is the constant innovation in product offerings, with companies developing more efficient kits, reagents, and automated systems that provide faster and more reliable results. They are also investing heavily in research and development to create high-purity, clinical-grade solutions that meet the strict regulatory requirements for advanced therapies like gene and cell therapies. The competitive environment is also shaped by strategic partnerships and collaborations aimed at expanding product portfolios and reaching new markets. Companies are also working to meet the growing demand for services, with some players offering contract manufacturing for research and GMP-grade plasmids, which is becoming increasingly important for both small and large biotechnology firms.

A few prominent companies in the industry include Thermo Fisher Scientific Inc., QIAGEN N.V., Merck KGaA, Promega Corporation, Takara Bio Inc., New England Biolabs, Zymo Research Corporation, and Bio-Rad Laboratories, Inc.

Key Players

- Bio Inc.

- Bio-Rad Laboratories, Inc.

- Merck KGaA

- New England Biolabs

- Promega Corporation

- QIAGEN N.V.

- Thermo Fisher Scientific Inc.

- Zymo Research Corporation

Plasmid Purification Industry Developments

May 2025: Thermo Fisher Scientific launched the Applied Biosystems MagMAX Pro HT NoSpin Plasmid MiniPrep Kit in the U.S., designed to provide rapid, automated plasmid DNA isolation for small-scale experiments.

Plasmid Purification Market Segmentation

By Product & Service Outlook (Revenue – USD Billion, 2020–2034)

- Products

- Instruments

- Kits & Reagents

- Services

By Grade Outlook (Revenue – USD Billion, 2020–2034)

- Molecular Grade

- Transfection Grade

By Application Outlook (Revenue – USD Billion, 2020–2034)

- Cloning & Protein Expression

- Transfection & Gene Editing

- Others

By End Use Outlook (Revenue – USD Billion, 2020–2034)

- Pharmaceutical & Biotechnology Companies

- Academic & Research Institutes

- Contract Research Organizations

By Regional Outlook (Revenue – USD Billion, 2020–2034)

- North America

- U.S.

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- Suth Korea

- Indnesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- Suth Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Plasmid Purification Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 1.72 billion |

|

Market Size in 2025 |

USD 1.93 billion |

|

Revenue Forecast by 2034 |

USD 5.44 billion |

|

CAGR |

12.2% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Insights |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 1.72 billion in 2024 and is projected to grow to USD 5.44 billion by 2034.

The global market is projected to register a CAGR of 12.2% during the forecast period.

North America dominated the share in 2024.

A few key players include Thermo Fisher Scientific Inc., QIAGEN N.V., Merck KGaA, Promega Corporation, Takara Bio Inc., New England Biolabs, Zymo Research Corporation, and Bio-Rad Laboratories, Inc.

The products segment accounted for the largest share of the market in 2024.

The transfection grade segment is expected to witness the fastest growth during the forecast period.