U.S. Oncology Based Molecular Diagnostics Market Size, Share, Trends, Industry Analysis Report

By Product (Instruments, Reagents, Others), By Technology, By Type – Market Forecast, 2025–2034

- Published Date:Oct-2025

- Pages: 125

- Format: PDF

- Report ID: PM6453

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

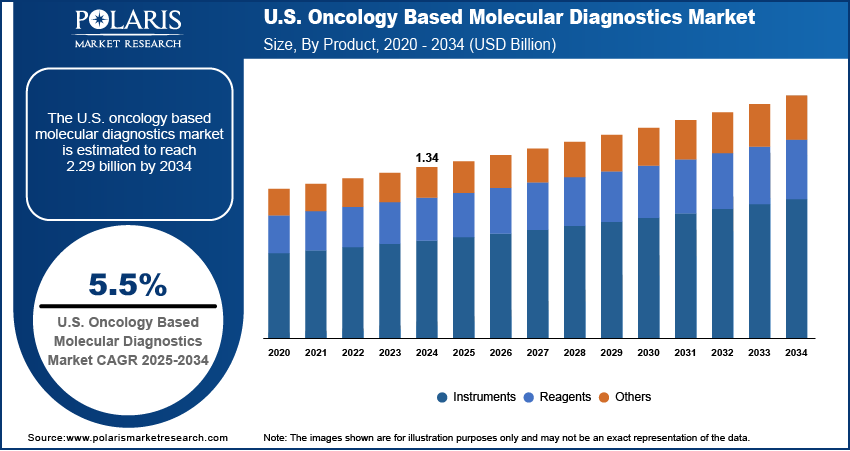

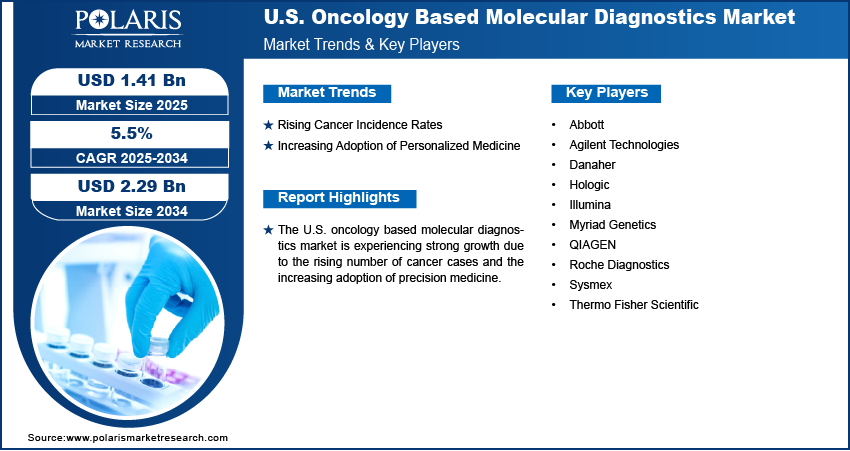

The U.S. oncology based molecular diagnostics market size was valued at USD 1.34 billion in 2024 and is anticipated to register a CAGR of 5.5% from 2025 to 2034. The industry growth is mainly driven by the growing number of cancer cases and the increasing focus on personalized medicine. Advancements in technology, such as next-generation sequencing and liquid biopsies, also help improve early cancer detection and treatment. Additionally, a greater emphasis on research and development for new diagnostic tools is boosting the growth.

Key Insights

- By product, the reagents segment held the largest share in 2024, due to its nature as a consumable product and use for performing every diagnostic test.

- By technology, the polymerase chain reaction (PCR) segment led in 2024, as it is a widely used, reliable, and cost-effective method.

- By type, the breast cancer segment dominated the share in 2024 due to the high number of breast cancer cases. Molecular diagnostics play a critical role in breast cancer treatment.

Industry Dynamics

- The increasing burden of cancer drives the industry expansion, as more people are being diagnosed with the disease. This rise creates a strong need for better and faster diagnostic tools that can find cancer early and guide proper treatment. According to the WHO, cancer is a leading cause of death worldwide.

- The rising demand for personalized medicine has a positive impact on the market under study. Molecular diagnostics help doctors find specific genetic markers in tumors. It enables them to choose the most effective and targeted therapies for each patient. This approach improves treatment success and patient outcomes.

- New and advanced technologies, such as next-generation sequencing (NGS) and liquid biopsies, are changing the field. These methods offer faster and more accurate ways to test for cancer using less invasive samples such as blood, which makes them easier for patients and doctors to use.

Market Statistics

- 2024 Market Size: USD 1.34 billion

- 2034 Projected Market Size: USD 2.29 billion

- CAGR (2025–2034): 5.5%

AI Impact on U.S. Oncology Based Molecular Diagnostics Market

- Artificial intelligence (AI) is rapidly becoming a groundbreaking component in the oncology segment as it offers sophisticated, innovative tools across the range of cancer care.

- AI algorithms help detect subtle patterns in molecular data. It enables the detection of early-stage cancer and reduces errors in diagnostics.

- Continued investments, regulatory support, and technological advancements are expected to increase the AI adoption across molecular diagnostics in oncology. AI integration is projected to rise across real-time tumor monitoring, liquid biopsy analysis, and AI-guided immunotherapy strategies.

- Integration of advanced AI systems requires high investments in infrastructure and training. Approvals from regulatory bodies such as the FDA and compliance with data privacy laws, including HIPAA, create challenges in AI adoption. These restraints hinder the AI adoption across oncology based diagnostics.

Oncology based molecular diagnostics involves the study of a patient's genetic and molecular makeup to detect, diagnose, and manage cancer. These advanced tests help doctors find specific genetic changes, gene expression patterns, and other biomarkers related to a tumor. This allows for a deeper understanding of the disease, which is vital for planning the best treatment.

The growing support from government and regulatory bodies boosts the U.S. oncology based molecular diagnostics market expansion. Agencies such as the FDA are playing a key role by giving faster approval to new diagnostic tests, especially those that are innovative and show great promise. These supportive programs help companies get their products to the sector more quickly, which, in turn, propels the adoption of new technologies in cancer care. For example, the FDA's Breakthrough Devices Program has helped advance new tests that provide a more accurate and faster diagnosis for patients.

Rising focus on better cancer screening and early disease detection drives the industry expansion. The emphasis on detecting cancer in its earliest stages has increased the demand for advanced diagnostic tools. Government health organizations and public health campaigns often promote regular screenings, which can lead to a higher number of people getting tested. A global breast cancer initiative by the World Health Organization (WHO) aims to reduce deaths by promoting better prevention and early diagnosis, including the use of advanced diagnostics.

Drivers and Trends

Rising Cancer Incidence Rates: In the U.S., more people are diagnosed with various cancer forms. According to the CDC's "Annual Report to the Nation on the Status of Cancer," published in April 2025, an estimated 2 million new cancer cases and 618,000 cancer deaths are projected to occur in the U.S. by 2025. This shows that the number of cancer cases is consistently high. To support patient care from the start of the process, there is a greater need for reliable molecular diagnostics that can accurately identify the disease and help healthcare experts plan an effective course of action. Oncology based molecular diagnostic tests are essential for confirming a diagnosis and understanding the specific genetic makeup of a tumor. Therefore, the rising incidence of cancer is creating a strong, continuous need for diagnostic technologies, which is directly driving the market growth.

Increasing Adoption of Personalized Medicine: Personalized medicine focuses on tailoring medical treatments to the individual characteristics of patients, especially their genetic profile. Molecular diagnostics are the key to this approach, since they provide the detailed information on a patient's tumor that is required to choose specific, targeted therapies. A report from the National Cancer Institute (NCI) in October 2024 described a new proof-of-concept clinical trial for precision medicine in leukemia. This trial tests new treatment combinations based on specific genetic changes found in cancer cells. This highlights the central role of molecular diagnostics in modern cancer treatment. The rising move toward more targeted treatments boosts the demand for molecular diagnostic tests that can guide these specific therapies.

Segmental Insights

Product Analysis

Based on product, the segmentation includes instruments, reagents, and others. The reagents segment held the largest share in 2024. Reagents are the chemical substances and kits that are used in a diagnostic test. The segment comprises items such as polymerase enzymes, DNA and RNA extraction solutions, and various other chemical buffers and components needed for each test. The upsurging number of cancer cases and diagnostic procedures propels the consumption of reagents. The essential nature of these consumables in all molecular diagnostic procedures, from standard PCR tests to advanced digital PCR and sequencing, ensures their dominance across the U.S. oncology based molecular diagnostics market.

The instruments segment is anticipated to register the highest growth rate during 2025–2034. The growth is largely attributed to ongoing technological advancements that are leading to the development of more advanced, automated, and user-friendly diagnostic instruments. These new instruments are designed to improve the speed and accuracy of tests, handle a wider range of samples, and often integrate multiple functions into a single platform. The shift toward compact, automated systems that can perform both DNA extraction and analysis on a single machine is a key factor. As these new instruments become more common in laboratories and hospitals, they are expected to drive strong growth, even though their initial purchase is a one-time cost compared to the recurring sales of reagents. This growth is also fueled by the increasing use of advanced technologies such as next-generation sequencing, which require specialized and high-tech instruments to run the tests.

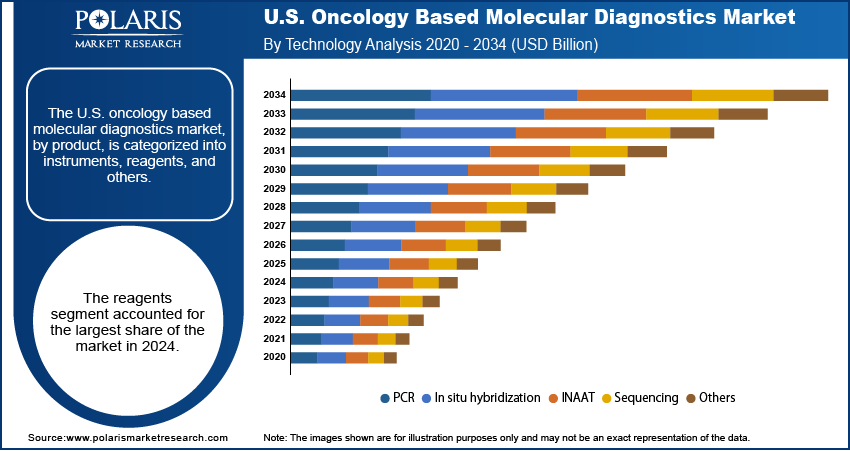

Technology Analysis

Based on technology, the U.S. oncology based molecular diagnostics market segmentation includes PCR, in situ hybridization, INAAT, sequencing, and others. The PCR segment held the largest share in 2024. PCR is a well-established and widely accepted technology in clinical labs due to its ability to quickly and accurately amplify DNA and RNA. It is a cost-effective and dependable method to detect specific genetic mutations related to various cancers. The use of PCR is common in a range of diagnostic applications, from initial screening to monitoring treatment response. Its reliability, ease of use, and quick turnaround time have made it a go-to technology for many routine diagnostic procedures in oncology. Owing to all these factors, the segment continues to hold the dominant position in the market despite the rise of newer technologies.

The sequencing segment is anticipated to register the highest growth rate during the forecast period. This is largely attributed to the increasing adoption of next-generation sequencing (NGS). NGS enables the simultaneous analysis of a patient's entire genetic makeup or a large panel of genes. This provides more comprehensive information on the patient's tumor, which is essential for the field of personalized medicine. The cost of sequencing has dropped significantly over the years. Thus, the technology has become more accessible to a wider range of clinical settings. The segment growth is also fueled by ongoing research and development in genomics. This boosts the discovery of new biomarkers and genetic mutations that can be identified and targeted using sequencing technologies. As doctors and researchers continue to learn more about the genetic basis of cancer, the demand for sophisticated sequencing tools is expected to rise in the coming years.

Type Analysis

Based on type, the market is segmented into breast cancer, prostate cancer, colorectal cancer, cervical cancer, liver cancer, lung cancer, blood cancer, kidney cancer, and others. The breast cancer segment held the largest share in 2024. The high prevalence of breast cancer and the widespread use of molecular diagnostics for personalized treatment contribute to the leading position of the segment. These diagnostic tests are essential for identifying key biomarkers, such as HER2 and BRCA1/2 mutations, which help doctors decide on the most effective targeted therapies. The well-established screening programs and greater awareness among the public drive the demand for diagnostic tests in this segment. This combination of a high patient population and the critical role of molecular diagnostics in treatment planning makes breast cancer the most significant segment in the market.

The liver cancer segment is anticipated to register the highest growth rate during the forecast period. This growth is attributed to a rising number of diagnoses for these specific cancers, as well as an increasing demand for precise, early detection methods. Molecular diagnostics are becoming essential in identifying tumor-specific mutations and circulating tumor cells or DNA in liver cancer detection, especially in high-risk populations. For the prostate cancer segment, molecular tests are being used more often to guide treatment decisions. The development of noninvasive tests, such as those that use urine samples, is boosting growth in the prostate cancer segment. The urgent need for better diagnostic tools for these cancers, along with new technologies and a growing patient base, is contributing to these segments to the forefront of market growth.

Key Players and Competitive Insights

The U.S. oncology based molecular diagnostics market is highly competitive. The industry comprises a few major players holding significant market share. The competitive landscape is fueled by innovation in technology, increasing focus on research and development (R&D), and strategic partnerships. Companies are constantly focusing on improving their product offerings, particularly in areas such as liquid biopsy, next-generation sequencing, and companion diagnostics. The market consists of a mix of large, established companies with a wide range of products, as well as smaller, specialized firms that focus on specific diagnostic technologies or cancer forms. The growing need for precise and fast results, along with the growing demand for personalized medicines, prompts companies to invest in automation and develop user-friendly instruments and assays.

A few prominent companies in the industry include Roche Diagnostics, Thermo Fisher Scientific, QIAGEN, Illumina, Abbott, Agilent Technologies, Danaher, Hologic, Myriad Genetics, and Sysmex.

Key Players

- Abbott

- Agilent Technologies

- Danaher

- Hologic

- Illumina

- Myriad Genetics

- QIAGEN

- Roche Diagnostics

- Sysmex

- Thermo Fisher Scientific

U.S. Oncology Based Molecular Diagnostics Industry Developments

February 2025: Myriad Genetics, Inc. entered into a strategic collaboration with Gabbi to enhance access to hereditary cancer risk assessment. The partnership combines Gabbi’s digital risk assessment platform and specialist referral network with Myriad’s MyRisk with RiskScore Hereditary Cancer Test.

September 2024: QIAGEN strengthened its clinical oncology diagnostics portfolio with the launch of the QIAcuityDx Digital PCR System. The 510(k) exempt and IVDR-certified platform is designed for accurate DNA and RNA quantification in applications such as cancer monitoring and liquid biopsies.

U.S. Oncology Based Molecular Diagnostics Market Segmentation

By Product Outlook (Revenue – USD Billion, 2020–2034)

- Instruments

- Reagents

- Others

By Technology Outlook (Revenue – USD Billion, 2020–2034)

- PCR

- In situ hybridization

- INAAT

- Sequencing

- Others

By Type Outlook (Revenue – USD Billion, 2020–2034)

- Breast Cancer

- Prostate Cancer

- Colorectal Cancer

- Cervical Cancer

- Liver Cancer

- Lung Cancer

- Blood Cancer

- Kidney Cancer

- Others

U.S. Oncology Based Molecular Diagnostics Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 1.34 billion |

|

Market Size in 2025 |

USD 1.41 billion |

|

Revenue Forecast by 2034 |

USD 2.29 billion |

|

CAGR |

5.5% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Insights |

|

Segments Covered |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The market size was valued at USD 1.34 billion in 2024 and is projected to grow to USD 2.29 billion by 2034.

The market is projected to register a CAGR of 5.5% during the forecast period.

A few key players in the market include Roche Diagnostics, Thermo Fisher Scientific, QIAGEN, Illumina, Abbott, Agilent Technologies, Danaher, Hologic, Myriad Genetics, and Sysmex.

The reagents segment accounted for the largest share of the market in 2024.

The sequencing segment is expected to witness the fastest growth during the forecast period.