Oncology Based Molecular Diagnostics Market Size, Share, Trends, Industry Analysis Report

By Product (Instruments, Reagents, Others), By Type, By Technology, By Region – Market Forecast, 2025–2034

- Published Date:Aug-2025

- Pages: 129

- Format: PDF

- Report ID: PM6200

- Base Year: 2024

- Historical Data: 2020-2023

Overview

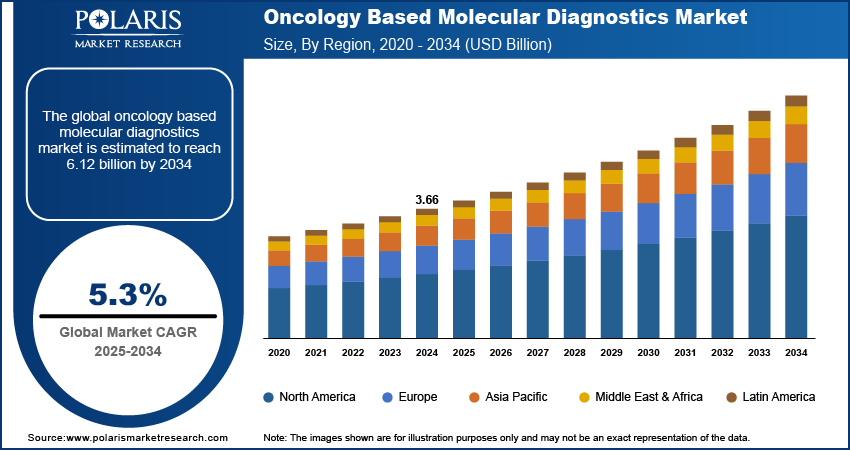

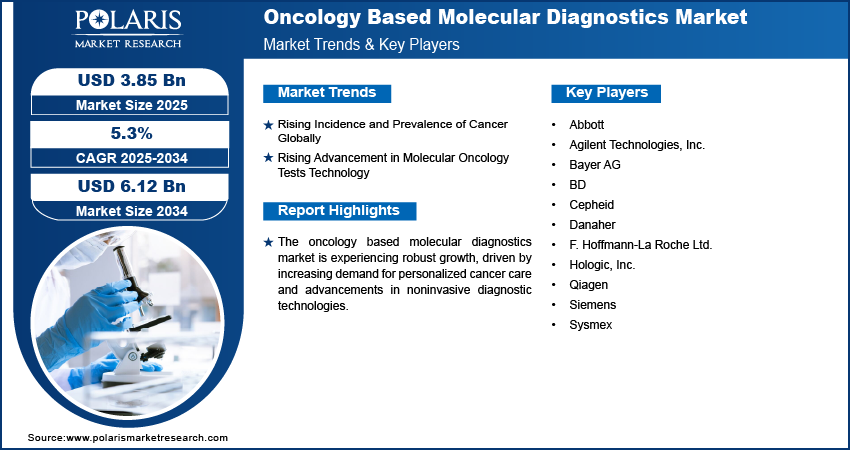

The global oncology based molecular diagnostics market size was valued at USD 3.66 billion in 2024, growing at a CAGR of 5.3% from 2025 to 2034. Key factors driving demand for oncology based molecular diagnostics include increasing investments in research, development, and adoption of molecular diagnostics technologies, rising prevalence of cancer, and rapid advancements in molecular oncology testing technologies.

Key Insights

- The breast cancer segment held an 18.69% revenue share in 2024, driven by high disease prevalence and widespread screening programs promoting early detection.

- The reagents segment led the market with 58.61% revenue share, as they are essential for various molecular diagnostic tests such as PCR, sequencing, and hybridization.

- The sequencing segment is projected to grow the fastest during the forecast period due to its ability to deliver detailed, high-resolution cancer genomic insights.

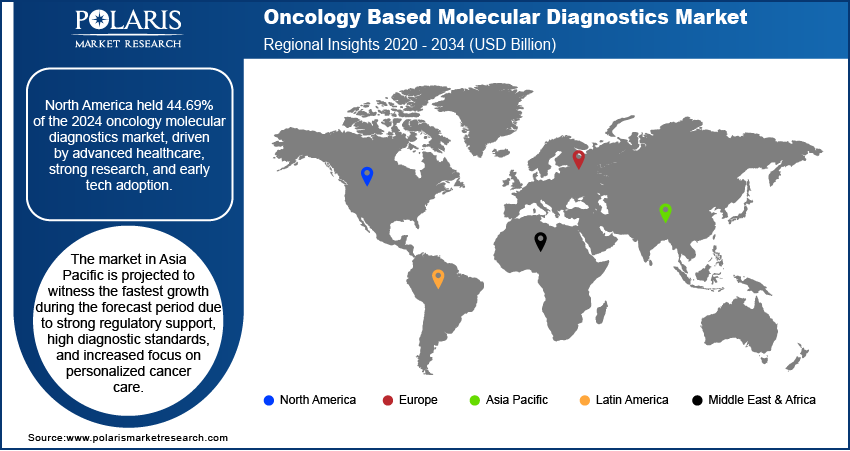

- North America dominated the global oncology based molecular diagnostics market with a 44.69% share in 2024, supported by advanced healthcare infrastructure, a robust research ecosystem, and early adoption of innovative diagnostic technologies.

- The U.S. led the region due to its strong R&D capabilities and well-structured reimbursement system.

- Meanwhile, the Asia Pacific market is set to grow the fastest, fueled by supportive regulations, high diagnostic standards, and rising demand for personalized cancer care.

- India is emerging as a key growth market, driven by increasing emphasis on early detection, growing patient awareness, and improved healthcare accessibility in urban and semi-urban areas.

Industry Dynamics

- The growing global cancer burden is driving demand for oncology based molecular diagnostics, as early and precise detection becomes crucial in treating the disease.

- Technological advancements, including NGS, liquid biopsy, and multiplex PCR, are revolutionizing cancer diagnostics, enhancing speed, accuracy, and clinical applications for detection and monitoring.

- High costs of advanced molecular tests limit accessibility, especially in developing regions, slowing widespread adoption despite their clinical benefits.

- Rising demand for personalized cancer care creates growth potential for affordable, rapid diagnostic solutions in emerging markets.

Market Statistics

- 2024 Market Size: USD 3.66 billion

- 2034 Projected Market Size: USD 6.12 billion

- CAGR (2025-2034): 5.3%

- North America: Largest market in 2024

To Understand More About this Research: Request a Free Sample Report

AI Impact on Oncology Based Molecular Diagnostics Market

- AI integration supports precision oncology as it matches cancer patients with therapies based on molecular profiles. It enables real-time decision-making for targeted cancer treatments.

- Genomic and imaging data can be analyzed using AI algorithms to detect cancer at earlier stages.

- AI models provide forecasts on recurrence risk, disease progression, and survival rates, which help clinicians plan treatment strategies.

- AI tools reduce manual errors and accelerate report generation. They reduce diagnostic costs and enhance sample processing capacity in clinical laboratories.

Oncology-based molecular diagnostics refer to advanced laboratory tests that analyze genetic, epigenetic, and molecular markers to detect and monitor cancer with high precision. The increasing investments in research, development, and adoption of molecular diagnostics technologies drive the growth of this market. Governments, research institutions, and private enterprises are committing substantial funds to enhance diagnostic accuracy and accelerate the availability of advanced cancer tests. In February 2024, Freenome raised USD 254 million to advance its multiomics-based blood tests for early cancer detection, including single and multi-cancer screening solutions. These investments are boosting innovation in assay development and next-generation sequencing platforms and are also facilitating broader clinical integration and regulatory approvals. As a result, the oncology diagnostics landscape is evolving rapidly, enabling earlier detection, improved prognostic assessment, and better-informed treatment decisions.

The expanding application of precision and personalized medicine in oncology care contributes to the expansion opportunities. There is a rising demand for diagnostic tools that enable tailored therapeutic strategies with the growing understanding that cancer is not a single disease but a complex set of conditions driven by unique genetic mutations. Molecular diagnostics play a central role in identifying patient-specific biomarkers and guiding the selection of targeted therapies, thereby improving clinical outcomes and minimizing unnecessary treatments. This shift toward individualized treatment pathways is reinforcing the relevance of molecular diagnostics in routine oncology practice, establishing them as essential tools for oncologists worldwide.

Drivers & Opportunities

Rising Incidence and Prevalence of Cancer Globally: The rising incidence and prevalence of cancer globally are boosting the oncology-based molecular diagnostics sector. There is a pressing demand for early and accurate diagnostic tools that detect malignancies at their molecular roots as cancer continues to emerge as one of the leading causes of morbidity and mortality worldwide. A February 2024 World Health Organization report projected global cancer cases to rise to 35 million by 2050, marking a 77% surge from the 20 million cases recorded in 2022. Molecular diagnostics enable the identification of genetic alterations and tumor-specific biomarkers that are critical for confirming diagnoses, determining disease stage, and guiding treatment decisions. Healthcare systems and clinicians are turning to these advanced diagnostics to improve patient outcomes, reduce late-stage detection, and support timely intervention, with the global cancer burden steadily increasing, thereby accelerating the market's growth.

Rising Advancements in Molecular Oncology Test Technology: Rapid advancements in molecular oncology testing technologies are enhancing the capabilities and clinical utility of these diagnostic platforms. Innovations in techniques such as next-generation sequencing (NGS), liquid biopsy, and multiplex PCR have expanded the range, speed, and accuracy of cancer detection and monitoring. In February 2025, Roche launched its Sequencing by Expansion (SBX) technology, a novel NGS approach combining innovative chemistry and sensors for rapid, scalable sequencing. This advancement supports research in complex diseases such as cancer by enabling deeper genomic analysis. These technological developments are driving improvements in test sensitivity, throughput, and cost-effectiveness, making molecular diagnostics more accessible and informative across diverse healthcare settings. As these technologies evolve, they are enabling deeper insights into tumor biology and supporting the development of more targeted and personalized oncology solutions, thereby reinforcing their adoption and driving sustained expansion opportunities.

Segmental Insights

Type Analysis

Based on type, the segmentation includes breast cancer, prostate cancer, colorectal cancer, cervical cancer, liver cancer, lung cancer, blood cancer, kidney cancer, and others. The breast cancer segment accounted for 18.69% revenue share in 2024 due to the high prevalence of breast cancer and the widespread implementation of screening programs that emphasize early detection. The availability of well-established molecular diagnostic tests specifically tailored to identify hormonal and genetic markers, such as HER2 and BRCA mutations, has increased diagnostic accuracy and guided personalized treatment strategies. Additionally, growing awareness about the importance of routine breast cancer screening among women, coupled with the integration of molecular diagnostics in standard oncology protocols, has strengthened the market position of this segment.

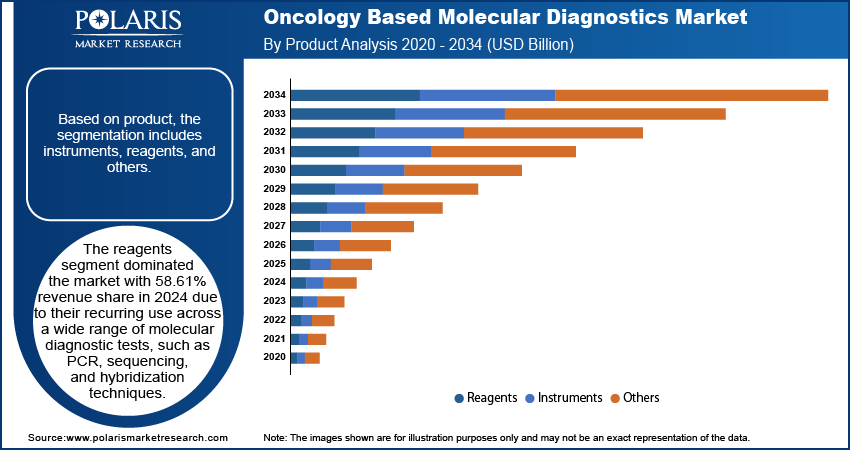

Product Analysis

In terms of product, the segmentation includes instruments, reagents, and others. The reagents segment dominated the market with 58.61% revenue share in 2024 due to their recurring use across a wide range of molecular diagnostic tests, such as PCR, sequencing, and hybridization techniques. Unlike instruments, which are typically one-time capital investments, reagents are required for every test performed, driving consistent and high-volume consumption. Moreover, ongoing advancements in reagent formulations that enhance assay sensitivity, specificity, and throughput have expanded their applicability and reliability in clinical diagnostics, contributing to their dominant market share.

Technology Analysis

The segmentation, based on technology, includes PCR, In situ hybridization, INAAT, chips and microarrays, mass spectrometry, sequencing, TMA, and others. The sequencing segment is expected to witness the fastest growth during the forecast period owing to its ability to provide comprehensive and high-resolution insights into cancer genomics. Next-generation sequencing (NGS) technologies enable the simultaneous analysis of multiple genes and mutations associated with tumor development and progression, supporting the implementation of precision oncology. Sequencing is becoming integral for identifying actionable targets and resistance mechanisms as the demand for personalized treatment regimens grows, making it an increasingly preferred choice in both research and clinical applications.

Regional Analysis

The North America oncology based molecular diagnostics market accounted for 44.69 % of global market share in 2024, due to its advanced healthcare infrastructure, strong research ecosystem, and early adoption of advanced diagnostic technologies. The presence of leading biotechnology companies and academic institutions actively engaged in molecular oncology innovations has contributed to the region’s dominance. Furthermore, robust reimbursement frameworks and high awareness among healthcare providers and patients regarding molecular testing have supported widespread clinical integration of these diagnostics.

U.S. Oncology Based Molecular Diagnostics Market Insights

The U.S. held the largest market share in North America oncology based molecular diagnostics landscape in 2024 due to its extensive R&D infrastructure and a well-established reimbursement framework. The country's proactive approach toward early cancer detection, coupled with widespread availability of advanced diagnostic platforms, supports the integration of molecular testing in routine oncology care. Additionally, a high level of awareness among healthcare providers and patients continues to drive demand for personalized diagnostic solutions.

Asia Pacific Oncology Based Molecular Diagnostics Market Trends

The market in Asia Pacific is projected to witness the fastest growth during the forecast period due to strong regulatory support, high diagnostic standards, and increased focus on personalized cancer care. Widespread implementation of national screening programs and integration of molecular testing into clinical pathways are enhancing early cancer detection and treatment planning. Additionally, the region’s focus on clinical research, cross-border collaborations, and public health initiatives is accelerating the adoption of advanced molecular diagnostic solutions across European healthcare systems.

India Oncology Based Molecular Diagnostics Market Overview

The market in India is expanding due to a growing focus on early cancer diagnosis, increasing patient awareness, and improving healthcare access across urban and semi-urban regions. There is an increasing shift toward molecular diagnostics for accurate and timely detection as the burden of cancer rises. A February 2025 report by the Ministry of Health and Family Welfare revealed that 20 million new cancer cases and 9.7 million cancer-related deaths occurred globally in 2022. Moreover, supportive government initiatives, rising investments in healthcare infrastructure, and the emergence of local diagnostic service providers are also playing a major role in enhancing the market landscape.

Europe Oncology Based Molecular Diagnostics Market Analysis

The oncology based molecular diagnostics landscape in Europe is projected to hold a substantial share in 2034 due to strong regulatory support, high diagnostic standards, and increased emphasis on personalized cancer care. Widespread implementation of national screening programs and integration of molecular testing into clinical pathways are enhancing early cancer detection and treatment planning. Additionally, the region’s focus on clinical research, cross-border collaborations, and public health initiatives are accelerating the adoption of advanced molecular diagnostic solutions across European healthcare systems.

UK Oncology Based Molecular Diagnostics Market Assessment

The growth of the oncology-based molecular diagnostics market in the UK is driven by its strong focus on integrating genomic medicine into cancer care and the presence of national screening and early detection programs. Continued investments in life sciences and public-private research collaborations accelerated innovation and accessibility of advanced diagnostic tools. The structured regulatory environment and commitment to evidence-based healthcare further support the adoption of molecular diagnostics in clinical oncology.

Key Players & Competitive Analysis

The oncology-based molecular diagnostics sector is witnessing transformative growth, driven by technological advancements in next-generation sequencing and liquid biopsy platforms. Competitive intelligence and strategy reveal dominant players such as Roche, Abbott, and Qiagen leveraging strategic investments to enhance precision oncology solutions, while small and medium-sized businesses innovate with niche assays. Developed markets lead adoption due to robust healthcare infrastructure, but emerging markets present untapped revenue opportunities fueled by rising cancer prevalence and improving diagnostic access. Industry trends highlight a shift toward AI-powered data interpretation and multi-omics integration, addressing latent demand and opportunities in personalized therapy selection. Economic and geopolitical shifts, including local manufacturing incentives in Asia Pacific, are reshaping sustainable value chains. Growth projections indicate expansion in high-growth markets such as India and Brazil, where macroeconomic trends support healthcare investments.

A few major companies operating in the oncology based molecular diagnostics industry include Artivion, Inc.; Aroa Oncology Based Molecular Diagnostics; B. Braun SE; Baxter; BD; INTEGRA LIFESCIENCES; Johnson & Johnson Services, Inc.; Medtronic; Pfizer Inc.; Sanofi; and Stryker.

Key Players

- Abbott

- Agilent Technologies, Inc.

- Bayer AG

- BD

- Cepheid

- Danaher

- F. Hoffmann-La Roche Ltd.

- Hologic, Inc.

- Qiagen

- Siemens

- Sysmex

Oncology Based Molecular Diagnostics Industry Developments

- May 2025: Illumina expanded its clinical oncology portfolio with new tumor profiling and IVD solutions to enhance precision oncology care. The offerings aim to broaden patient access and will be showcased at ASCO's annual meeting.

- August 2024: Hitachi High-Tech and Gencurix partnered to develop cancer molecular diagnostics, combining Hitachi’s IVD expertise with Gencurix’s biomarker discovery. They announced their plan to commercialize testing services in Japan after completing a feasibility study.

Oncology Based Molecular Diagnostics Market Segmentation

By Type Outlook (Revenue, USD Billion, 2020–2034)

- Breast Cancer

- Prostate Cancer

- Colorectal Cancer

- Cervical Cancer

- Liver Cancer

- Lung Cancer

- Blood Cancer

- Kidney Cancer

- Others

By Product Outlook (Revenue, USD Billion, 2020–2034)

- Instruments

- Reagents

- Others

By Technology Outlook (Revenue, USD Billion, 2020–2034)

- PCR

- In situ hybridization

- INAAT

- Chips and microarrays

- Mass spectrometry

- Sequencing

- TMA

- Others

By Regional Outlook (Revenue, USD Billion, 2020–2034)

- North America

- U.S.

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Oncology Based Molecular Diagnostics Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 3.66 Billion |

|

Market Size in 2025 |

USD 3.85 Billion |

|

Revenue Forecast by 2034 |

USD 6.12 Billion |

|

CAGR |

5.3% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 3.66 billion in 2024 and is projected to grow to USD 6.12 billion by 2034.

The global market is projected to register a CAGR of 5.3% during the forecast period.

North America dominated the market in 2024, holding 44.69% global share.

A few of the key players in the market are Artivion, Inc; Aroa Oncology Based Molecular Diagnostics; B. Braun SE; Baxter; BD; INTEGRA LIFESCIENCES; Johnson & Johnson Services, Inc; Medtronic; Pfizer Inc; Sanofi; and Stryker.

The reagents segment dominated the market with 58.61% revenue share in 2024

The sequencing segment is expected to witness fastest growth during the forecast period.