Liquid Biopsy Market Size, Share, Trends, Industry Analysis Report

By Sample Type (Blood Sample, Others), By Biomarker, By Technology, By Application, By End Use, By Region – Market Forecast, 2025–2034

- Published Date:Aug-2025

- Pages: 117

- Format: PDF

- Report ID: PM1521

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

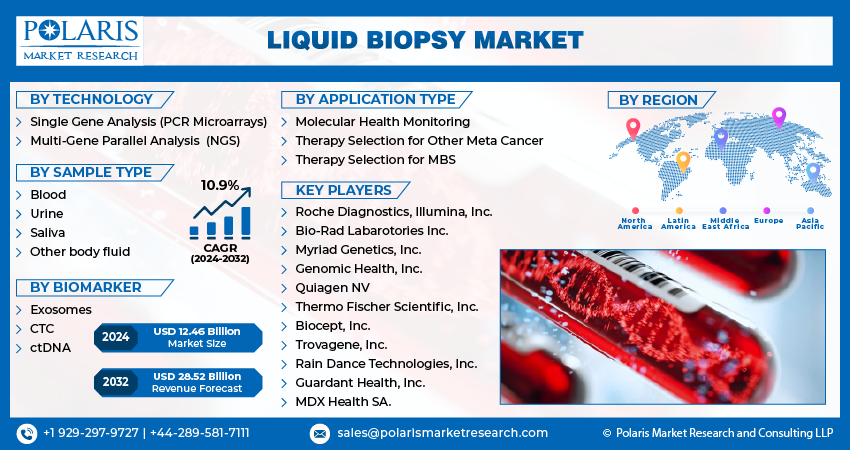

The global liquid biopsy market size was valued at USD 11.91 billion in 2024 and is anticipated to register a CAGR of 11.9% from 2025 to 2034. The increasing number of cancer cases globally and the growing focus on early detection drive the market growth. The rise of personalized medicine is driving the development of more targeted and precise treatment options, which liquid biopsies can help provide. Another factor is the demand for minimally invasive testing methods, as traditional biopsies can be painful and carry risks.

Key Insights

- By sample type, the blood sample segment held the largest share in 2024 because of its convenience and the wide range of biomarkers it provides. Blood is the most common sample type used in liquid biopsy, and its collection is a simple, noninvasive process.

- Based on biomarker, the circulating tumor DNA (ctDNA) segment held the largest share in 2024. The high sensitivity and specificity of ctDNA-based tests, which can provide a detailed genetic profile of a tumor, have made it the most widely adopted biomarker for various clinical applications.

- In terms of technology, the multi-gene parallel analysis using next-generation sequencing (NGS) segment held the largest share in 2024. This technology's ability to analyze multiple genes at once and provide a comprehensive view of a tumor's genetics makes it the preferred method for advanced cancer diagnostics and personalized treatment planning.

- By application, the cancer segment held the largest share in 2024, as the technology was developed primarily to address the needs of oncology. Liquid biopsies are used throughout the cancer care process, from early detection to monitoring treatment response, which drives its widespread adoption.

- By end use, the hospitals and laboratories segment held the largest share in 2024. These facilities are at the forefront of cancer diagnosis and treatment. They have the necessary infrastructure and skilled personnel to conduct liquid biopsy tests and integrate them into patient care.

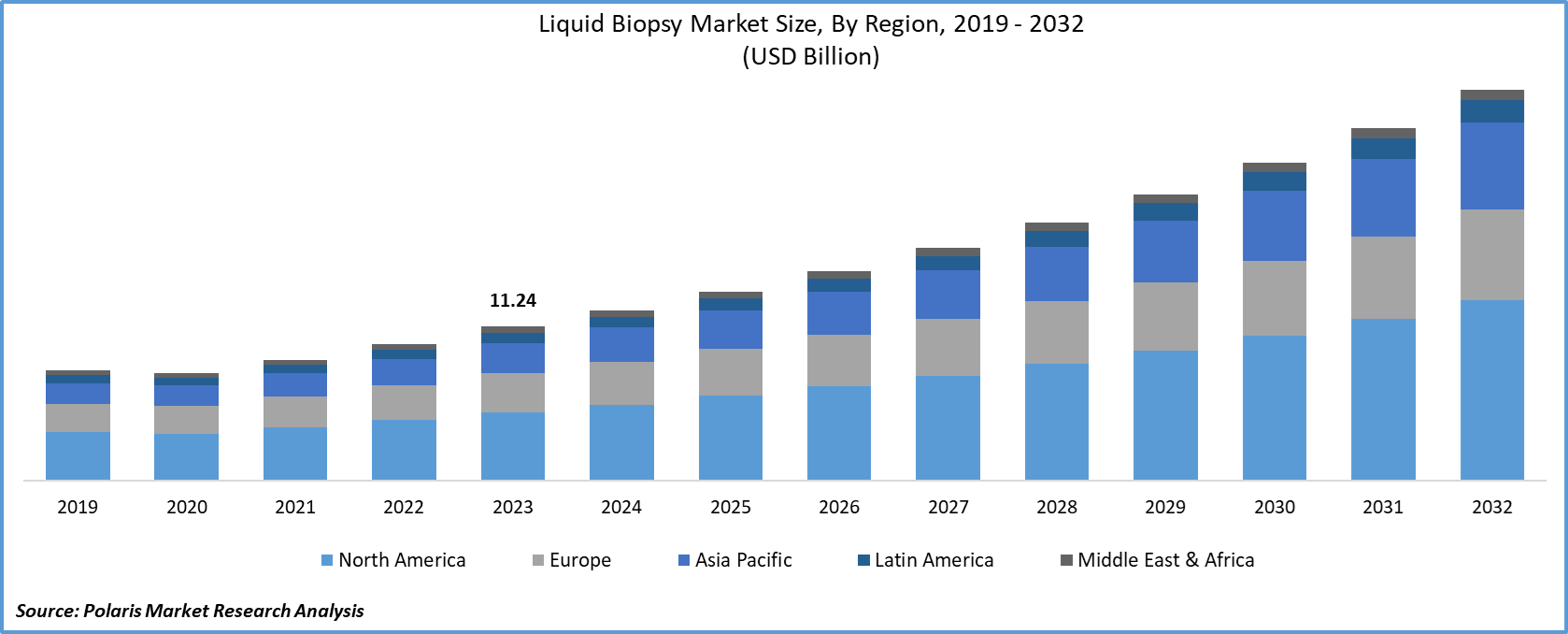

- By region, North America holds a dominant position, driven by a well-established healthcare system and a strong focus on advanced diagnostics. The region benefits from a high level of awareness among both healthcare professionals and patients about the benefits of non-invasive testing.

Industry Dynamics

- The growing global prevalence of cancer drives the demand for liquid biopsy. It increases the need for diagnostic tools that can help with early detection, accurate disease monitoring, and effective treatment planning. This is crucial for improving patient outcomes.

- The increasing focus on personalized medicine is a strong growth factor as these tests can analyze a tumor’s genetic makeup from a blood sample. This allows doctors to choose the most effective and targeted therapies for each patient.

- Technological advancements in areas such as next-generation sequencing and digital PCR are significant drivers. These innovations have improved the sensitivity and accuracy of testing, making it possible to find very small amounts of tumor DNA in the blood.

Market Statistics

- 2024 Market Size: USD 11.91 billion

- 2034 Projected Market Size: USD 36.59 billion

- CAGR (2025–2034): 11.9%

- North America: Largest market in 2024

AI Impact on Liquid Biopsy Market

- Artificial intelligence (AI) is broadening liquid biopsy applications from oncology to neurological and cardiovascular diseases, opening new revenue streams

- AI enables ultra-sensitive detection of biomarkers such as ctDNA and extracellular vesicles, helping companies offer more accurate and earlier cancer diagnostics

- Companies are integrating AI to automate data analysis and reporting, which reduces manual errors and speeds up turnaround times. This factor boosts operational efficiency and scalability for high-throughput labs.

A liquid biopsy is a noninvasive diagnostic test that detects cancer markers from a sample of body fluid, such as blood or urine. The test looks for circulating tumor cells or small bits of DNA and RNA that tumors shed. This provides valuable information about a tumor’s genetics, which can help doctors in their care for a patient.

One driver for growth is the push for more government funding and public health initiatives. Governments and public health organizations worldwide are starting programs to lower the burden of cancer. These efforts focus on prevention, early detection, and improving access to care. To support these initiatives, governments are investing in advanced diagnostic tools. For example, the National Cancer Institute (NCI), part of the National Institutes of Health (NIH), has provided funding for research into liquid biopsy technologies. This funding aims to develop more accurate and accessible tests, making them a bigger part of public health screening programs in the future.

Drivers and Trends

Rising Global Cancer Incidence: The growing number of cancer cases around the world propels the demand for liquid biopsies. As the global population ages and lifestyles change, cancer has become a leading cause of death. There is a greater need for diagnostic tools that can help with early disease detection, accurate disease monitoring, and effective treatment. Liquid biopsies, such as breast cancer liquid biopsy, offer a less invasive and faster way to get this information, which is important for patients who may not be able to undergo traditional surgical biopsies.

According to a February 2024 news release from the World Health Organization (WHO) titled "Global cancer burden growing, amidst mounting need for services," there were almost 20 million new cancer cases in 2022. The report also predicts that the annual number of new cases will jump to 35 million by 2050. This huge increase in the number of people affected by the disease is creating a strong demand for more advanced and accessible diagnostic methods, which is directly driving the liquid biopsy industry growth.

Advancements in Personalized Medicine: The shift toward personalized medicine in cancer treatment is a major driver. This modern approach focuses on tailoring a patient’s treatment based on their unique genetic makeup and the specific molecular features of their tumor. Liquid biopsies are a perfect fit for this trend as they can provide real-time information about a tumor without the need for invasive surgery. They allow doctors to track how a cancer is changing and to select the most effective drug therapies.

In a recent study published in the Journal Cureus in December 2023, titled "Liquid Biopsy: An Evolving Paradigm for Non-invasive Disease Diagnosis and Monitoring in Medicine," the authors noted that liquid biopsy is an innovative tool in precision medicine. They highlighted how it helps in the extraction of circulating tumor DNA from blood samples. This ability to get detailed molecular information in a noninvasive way is crucial for advancing personalized treatment, thereby boosting the demand for liquid biopsy.

Segmental Insights

Sample Type Analysis

Based on sample type, the segmentation includes blood sample and others. The blood sample segment held the largest share in 2024. Blood is easily accessible. It is collected using a minimally invasive process, which makes it far more convenient and safer for patients compared to traditional tissue biopsies. The large volume of research and development that has focused on blood-based assays over the years has led to significant technological advancements. These advancements have greatly improved the sensitivity and accuracy of detecting biomarkers such as circulating tumor DNA (ctDNA) and circulating tumor cells (CTCs) in blood. This reliability has earned regulatory approvals for a number of blood-based liquid biopsy tests, cementing their use in clinical practice for various applications, including cancer biopsy for screening and monitoring. The proven track record of these tests, combined with their ease of use, has led to their widespread adoption in hospitals and laboratories, making the blood sample category the dominant force.

The others segment is anticipated to register the highest growth rate during the forecast period. This segment includes samples such as urine, saliva, and cerebrospinal fluid. It is gaining traction due to its specific benefits in certain clinical situations. For example, urine-based liquid biopsies are particularly useful for detecting urological cancers such as bladder and prostate cancer, as the tumor-specific biomarkers are more concentrated in the urine. Similarly, cerebrospinal fluid is a valuable source for analyzing brain tumors and other central nervous system cancers. These non-blood samples can offer unique insights that are not always available from a blood draw, especially for tumors that shed biomarkers into other body fluids. The increasing research into these alternative sample types and the potential for a new range of diagnostic applications are driving this fast growth.

Biomarker Analysis

Based on biomarker, the segmentation includes circulating tumor cells (CTCs), circulating tumor DNA (ctDNA), extracellular vehicles (EVs), and others. The circulating tumor DNA (ctDNA) segment held the largest share in 2024. This dominance is driven by its exceptional utility and reliability in a variety of clinical scenarios. Unlike other biomarkers, ctDNA provides a direct and detailed snapshot of the tumor's genetic makeup, allowing for the identification of specific mutations that can guide treatment decisions. The high sensitivity and specificity of ctDNA-based tests, especially with the use of advanced technologies, enable them to detect even minute amounts of cancer-related DNA circulating in the bloodstream. This makes them ideal for early cancer detection, monitoring treatment response in real-time, and identifying the emergence of drug resistance. The extensive research and clinical validation of ctDNA assays have led to a strong presence in the clinical setting, with a growing number of approved tests available for use in different cancer types.

The extracellular vehicles (EVs) segment, which includes exosomes, is anticipated to register the highest growth rate during the forecast period. While this segment is still newer compared to ctDNA, it is rapidly gaining attention for its unique advantages. Extracellular vehicles are small particles released by cells that carry a wide variety of biological molecules, including proteins, DNA, and RNA, which provide a rich source of information about their parent tumor cells. A key benefit of EVs is their stability, as they are protected by a lipid membrane, which prevents their cargo from breaking down in the bloodstream. This makes them highly durable and easier to analyze than other biomarkers. The multifaceted information contained within EVs allows for a more comprehensive view of the tumor and its environment, opening up new possibilities for multi-biomarker analysis. As technology for isolating and analyzing EVs becomes more refined and cost-effective, this segment is expected to witness a sharp increase in adoption and clinical application.

Technology Analysis

Based on technology, the segmentation includes multi-gene parallel analysis (NGS) and single gene analysis (PCR microarrays). The multi-gene parallel analysis (NGS) segment held the largest share in 2024. This technology allows for the simultaneous analysis of hundreds of genes, providing a full molecular profile of a tumor. This is crucial for modern oncology, where multiple genetic alterations and biomarkers can influence treatment decisions. NGS offers high sensitivity and accuracy, which is essential for detecting rare mutations and subtle changes in a tumor’s genetic makeup from a blood sample. Its ability to generate a vast amount of data in a single test also makes it a powerful tool for research and the development of new therapies. The widespread adoption of NGS has been driven by its ability to offer a holistic view of a tumor's genetics, enabling more effective and personalized treatment strategies.

The single gene analysis technologies, such as PCR microarrays, are anticipated to register the highest growth rate during the forecast period. This growth is largely attributed to their specific applications and cost-effectiveness in targeted scenarios. PCR microarrays are designed to detect known, specific genetic mutations that are already linked to particular cancers. For instance, they are widely used to identify mutations in genes such as EGFR or KRAS, which are well-established biomarkers for certain types of cancer and can determine if a patient is a candidate for a specific targeted drug. These tests are faster and more affordable than full-scale NGS, making them ideal for routine monitoring and for use in smaller laboratories or clinics with limited resources. As the use of liquid biopsies becomes more common, the demand for these focused, cost-effective tests for specific clinical questions is increasing, driving the growth of this segment.

Application Analysis

Based on application, the segmentation includes cancer, reproductive health, and others. The cancer segment held the largest share in 2024. Liquid biopsies are highly valuable in oncology for a wide range of uses, including initial diagnosis, selecting the most effective personalized therapies, and monitoring a patient's response to treatment. The rising global prevalence of various cancer types, such as lung, breast, and colorectal cancer, has created a massive and ongoing demand for more effective and less invasive diagnostic methods. Liquid biopsies offer a compelling solution by providing a simple blood test that can reveal critical information about a tumor’s genetic profile, changes over time, and whether a cancer has returned. This widespread and essential use across the entire cancer care continuum is the main reason for its dominant position.

The reproductive health segment is anticipated to register the highest growth rate during the forecast period. Liquid biopsy tests in this area are being used for noninvasive prenatal testing (NIPT), which can screen for chromosomal abnormalities and certain genetic conditions in a fetus without posing any risk to the pregnancy. The high demand for safer, more accurate prenatal screening methods is driving this rapid expansion. Liquid biopsies can analyze cell-free fetal DNA from a pregnant person's blood, offering a convenient and less risky alternative to more invasive procedures such as amniocentesis. The growing awareness among expectant parents about these noninvasive options, along with advancements in technology that make these tests more accurate and accessible, is propelling this segment's growth. As research continues to expand the potential uses of liquid biopsies in reproductive health, it is expected to become an even more significant application in the coming years.

Regional Analysis

The North America liquid biopsy market accounted for the largest share in 2024, driven by a well-established healthcare system and a strong focus on advanced diagnostics. The region benefits from a high level of awareness among both healthcare professionals and patients about the benefits of noninvasive testing. There is a strong presence of major biotechnology and diagnostic companies that are investing heavily in research and development to bring new tests to the sector. Favorable reimbursement policies for advanced diagnostic tests and a high incidence of cancer also play a significant role in the widespread adoption of liquid biopsy technologies. This combination of technological innovation, maturity, and supportive infrastructure solidifies the region's leading role in the industry.

U.S. Liquid Biopsy Market Insights

The U.S. dominated the market in North America in 2024, propelled by a robust framework for new product approvals and a high volume of cancer cases. The U.S. also has a large number of research institutions and academic centers that are actively involved in clinical trials and studies for liquid biopsies, which help in validating new tests and driving their adoption. A strong focus on personalized medicine and targeted therapies has also made liquid biopsies an essential tool for oncologists. The extensive network of diagnostic laboratories and hospitals, along with patient advocacy groups, further supports the use and growth of this technology.

Europe Liquid Biopsy Market Trends

The European industry growth is driven by increasing government support for cancer research and a move toward precision medicine. Many European countries have well-developed healthcare systems that are increasingly incorporating innovative diagnostic methods into standard clinical practice. There is a growing awareness of liquid biopsies among both doctors and patients, leading to a higher demand for these noninvasive tests. The market is also benefiting from a number of partnerships between research institutions and industry players, which helps accelerate the development and commercialization of new technologies. The regulatory landscape in Europe, while complex, is also evolving to support these advancements.

In Europe, the Germany liquid biopsy market stands out as a major one with a strong emphasis on research and development. The country has a robust life sciences sector and is home to a number of leading diagnostic companies and academic centers. The healthcare system's strong funding for cancer research and its focus on using advanced technologies to improve patient care have created a favorable environment for liquid biopsies. German medical professionals are early adopters of new technologies, and there is a high demand for innovative tools that can provide more detailed information for diagnosis and treatment planning.

Asia Pacific Liquid Biopsy Market Overview

Asia Pacific is one of the fastest-growing markets for liquid biopsy. Its growth is fueled by a large and aging population, which has resulted in a high number of cancer cases. Increasing healthcare spending and a growing focus on improving medical infrastructure are also key drivers. Countries in this region are investing in advanced diagnostic technologies to improve early disease detection and management. There is a rising awareness among the public and healthcare providers about the benefits of liquid biopsies. However, the segment is still developing, and challenges such as regulatory hurdles and the need for standardized testing procedures remain.

China Liquid Biopsy Market Assessment

China is a major driver of the Asia Pacific market growth. The country has a massive population and a high burden of cancer, which creates a huge demand for advanced diagnostic solutions. The Chinese government has been actively supporting the healthcare industry through various initiatives and investments aimed at promoting innovative medical technologies. There is a strong push to develop domestic technologies and reduce reliance on foreign products. The large number of clinical trials and research projects focused on liquid biopsies further contributes to the rapid adoption of new diagnostic tools.

Key Players and Competitive Insights

The competitive landscape is dynamic, with a mix of established life sciences companies and emerging biotechnology firms vying for share. Key players such as F. Hoffmann-La Roche Ltd, Illumina, Guardant Health, Thermo Fisher Scientific, and Bio-Rad Laboratories are at the forefront. The competition is primarily based on technological innovation, with companies constantly working to improve the sensitivity and accuracy of their tests. Strategic partnerships and collaborations are also a common competitive strategy, allowing companies to combine their expertise in genomics, diagnostics, and data analysis to offer more comprehensive solutions. The ability to secure regulatory approvals and favorable reimbursement policies is also a critical factor that can provide a significant competitive advantage.

A few prominent companies in the industry include F. Hoffmann-La Roche Ltd; Illumina, Inc.; Guardant Health, Inc.; Bio-Rad Laboratories, Inc.; Thermo Fisher Scientific, Inc.; Natera, Inc.; Exact Sciences Corporation; Adaptive Biotechnologies Corporation; Myriad Genetics, Inc.; and NeoGenomics Laboratories, Inc.

Key Players

- Adaptive Biotechnologies Corporation

- Bio-Rad Laboratories, Inc.

- Exact Sciences Corporation

- F. Hoffmann-La Roche Ltd

- Guardant Health, Inc.

- Illumina, Inc.

- Myriad Genetics, Inc.

- Natera, Inc.

- NeoGenomics Laboratories, Inc.

- Thermo Fisher Scientific, Inc.

Liquid Biopsy Industry Developments

April 2025: Guardant Health entered a collaboration with Pfizer. The partnership is focused on using Guardant’s Infinity Smart Liquid Biopsy platform to support the development and commercialization of new cancer therapies.

July 2024: Guardant Health, Inc., a precision oncology company, announced that the U.S. Food and Drug Administration (FDA) has approved its Shield blood test for colorectal cancer (CRC) screening in adults aged 45 and above, who are at average risk for the disease.

Liquid Biopsy Market Segmentation

By Sample Type Outlook (Revenue – USD Billion, 2020–2034)

- Blood Sample

- Others

By Biomarker Outlook (Revenue – USD Billion, 2020–2034)

- Circulating Tumor Cells (CTCs)

- Circulating Tumor DNA (ctDNA)

- Extracellular Vehicles (EVs)

- Others

By Technology Outlook (Revenue – USD Billion, 2020–2034)

- Multi-Gene Parallel Analysis (NGS)

- Single Gene Analysis (PCR Microarrays)

By Application Outlook (Revenue – USD Billion, 2020–2034)

- Cancer

- Reproductive Health

- Others

By End Use Outlook (Revenue – USD Billion, 2020–2034)

- Hospitals and Laboratories

- Specialty Clinics

- Academic and Research Centers

- Others

By Regional Outlook (Revenue – USD Billion, 2020–2034)

- North America

- U.S.

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- Suth Korea

- Indnesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- Suth Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Liquid Biopsy Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 11.91 billion |

|

Market Size in 2025 |

USD 13.30 billion |

|

Revenue Forecast by 2034 |

USD 36.59 billion |

|

CAGR |

11.9% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Insights |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 11.91 billion in 2024 and is projected to grow to USD 36.59 billion by 2034.

The global market is projected to register a CAGR of 11.9% during the forecast period.

North America dominated the market share in 2024.

A few key players in the market include F. Hoffmann-La Roche Ltd; Illumina, Inc.; Guardant Health, Inc.; Bio-Rad Laboratories, Inc.; Thermo Fisher Scientific, Inc.; Natera, Inc.; Exact Sciences Corporation; Adaptive Biotechnologies Corporation; Myriad Genetics, Inc.; and NeoGenomics Laboratories, Inc.

The blood sample segment accounted for the largest share of the market in 2024.

The extracellular vehicles (EVs) segment is expected to witness the fastest growth during the forecast period.