Cardiology EHR Market Size, Share, Trends & Industry Analysis Report

: By Product (Web/ cloud-based EHR and On-premise EHR), By Business Model, By End Use, and By Region – Market Forecast, 2025–2034

- Published Date:Jun-2025

- Pages: 130

- Format: PDF

- Report ID: PM5855

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

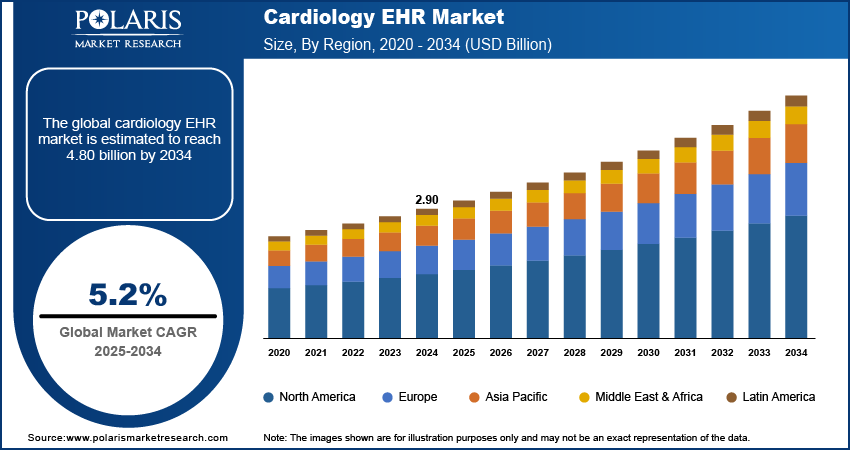

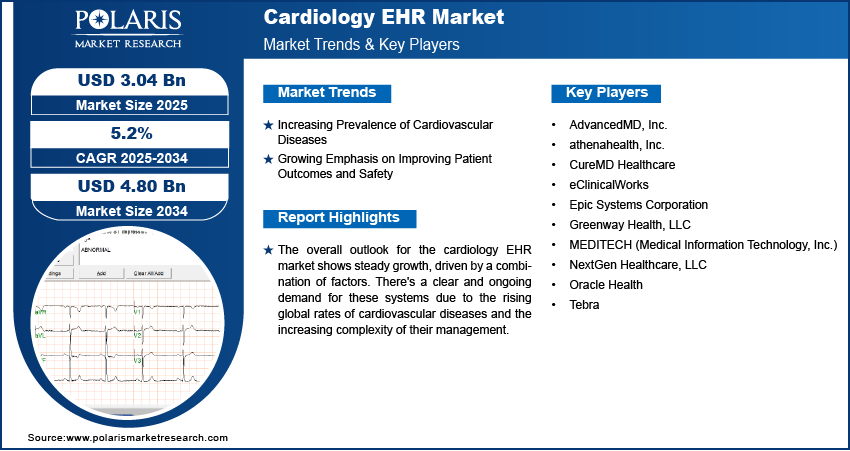

The global cardiology EHR market size was valued at USD 2.90 billion in 2024, and is anticipated to grow at a CAGR of 5.2% from 2025 to 2034. The market is mainly driven by the increasing number of cardiovascular diseases and the growing need for better patient care. Also, advancements in technology, like cloud-based systems and artificial intelligence, are making these systems more effective and easier to use.

The cardiology electronic health records (EHR) market involves specialized digital systems designed to manage patient health information specifically for cardiovascular care. These systems help cardiologists and other healthcare providers store, access, and share patient data, including medical history, test results, and treatment plans.

The increasing use of telehealth services and remote patient monitoring (RPM) is a significant driver for the market. The COVID-19 pandemic greatly accelerated the shift towards virtual care, highlighting the need for robust digital infrastructure. Telehealth enables cardiologists to conduct virtual consultations, while RPM allows for continuous tracking of vital signs and cardiac data from a patient's home.

Government initiatives and financial incentives aimed at promoting the adoption of digital health technologies are a powerful force driving the market. Many governments worldwide recognize the benefits of electronic health records in improving healthcare efficiency, reducing costs, and enhancing patient outcomes. These initiatives often include funding, regulatory frameworks, and standardization efforts to encourage healthcare providers to transition from paper-based systems to integrated digital platforms, including specialized cardiology EHRs.

To Understand More About this Research: Request a Free Sample Report

Industry Dynamics

Increasing Prevalence of Cardiovascular Diseases

The rising number of individuals affected by cardiovascular diseases (CVDs) globally is a significant driver for the market. As these conditions become more widespread, there is a heightened demand for efficient and comprehensive tools to manage patient data, track disease progression, and coordinate care across various healthcare settings. Cardiology-specific EHRs enable healthcare providers to maintain detailed, long-term records of patients' cardiac health, including diagnostic images, lab results, and medication histories, which are crucial for effective disease management and prevention.

According to the World Health Organization (WHO), in their 2023 "Cardiovascular Diseases" fact sheet, CVDs are the leading cause of death worldwide, responsible for an estimated 17.9 million deaths each year. Furthermore, the World Heart Federation's "World Heart Report 2023" highlighted that more than half a billion people globally continue to be affected by CVDs. This growing disease burden necessitates advanced digital health solutions to manage the increasing patient load and complexity of care. This consistently high and growing incidence of CVDs directly fuels the demand for specialized cardiology EHR solutions, driving market growth.

Growing Emphasis on Improving Patient Outcomes and Safety

The healthcare industry's continuous push for better patient outcomes and enhanced safety plays a vital role in the adoption of cardiology EHR systems. These systems are designed to minimize human error, improve clinical decision-making, and ensure that patients receive the most appropriate and timely care. By centralizing patient information, EHRs provide healthcare professionals with immediate access to critical data, reducing the likelihood of medication errors, duplicate tests, and other adverse events that can impact patient safety and health. For instance, "The Impact of Patient Access to Electronic Health Records on Health Care Engagement: Systematic Review," study discussed how EHRs, by streamlining data access, can improve the efficiency and quality of healthcare delivery. The ability of cardiology EHRs to provide a comprehensive, real-time view of a patient's medical history empowers cardiologists to make more informed decisions, thereby contributing to better patient outcomes and driving the growth of the market.

Segmental Insights

By Product

The web/cloud-based EHR segment held the largest share in 2024. This dominance is primarily due to the flexibility and accessibility these solutions offer to healthcare providers. Cardiologists can securely access patient records from any location with an internet connection, which is especially beneficial for managing patients across multiple clinics or during telehealth consultations. Cloud-based systems also reduce the need for significant upfront investments in hardware and IT infrastructure, making them an attractive option for practices of varying sizes. This ease of access and reduced burden on internal IT teams are key reasons for its widespread adoption.

The web/cloud-based EHR segment is also anticipated to grow at the highest growth rate during the forecast period. This growth is driven by increasing digitalization within healthcare and a rising demand for solutions that promote seamless data exchange and interoperability. As healthcare systems continue to embrace remote patient monitoring and telemedicine, the ability of cloud-based EHRs to support these services becomes even more critical. Their scalability allows practices to easily expand their patient base without complex IT upgrades, further accelerating their adoption and solidifying their position as a leading growth area in the cardiology EHR market.

By Bussiness Model

The professional services segment held the largest share in 2024. This dominance stems from the crucial need for specialized support throughout the entire lifecycle of an EHR system, from initial setup to ongoing maintenance. Healthcare organizations, especially larger hospital systems with complex needs, often require expert assistance for system implementation, data migration, customization, staff training, and continuous technical support. These services ensure that the hospital EHR system is properly integrated into existing workflows, optimized for cardiology-specific requirements, and that staff can use it effectively to improve patient care.

The professional services segment is also anticipated to grow at the highest growth rate during the forecast period. As EHR systems become more sophisticated with features like artificial intelligence and advanced analytics, the demand for specialized expertise to fully leverage these capabilities will increase. Furthermore, the continuous evolution of healthcare regulations and security requirements means that ongoing professional support is vital for practices to remain compliant and to protect sensitive patient data. This growing complexity and the need for tailored solutions are driving healthcare providers to rely heavily on professional services, thereby fueling this segment's rapid expansion within the cardiology EHR market.

By End Use

The hospital segment held the largest share in 2024. This is mainly due to the complex and large-scale nature of cardiac care delivered within hospital settings. Hospitals manage a high volume of cardiovascular patients who often require advanced diagnostic tests, surgical procedures, cardiovascular devices and ongoing chronic care management. EHR systems in hospitals are essential for consolidating vast amounts of patient data, coordinating care among multiple specialists, and ensuring seamless transitions between different departments, which is critical for positive patient outcomes in complex cardiac cases.

Ambulatory surgical centers (ASCs) is anticipated to grow at the highest growth rate during the forecast period. This growth is driven by a global trend towards performing more minimally invasive cardiology procedures in outpatient settings, rather than traditional inpatient hospitals. As medical technology advances, many procedures like pacemaker insertions and certain catheterizations are increasingly done in ASCs, which are often more cost-effective and convenient for patients. The need for efficient data management, streamlined workflows, and strong interoperability with referring physicians and hospitals is driving the rapid adoption of specialized EHRs in these growing outpatient cardiology settings.

.webp)

Regional Analysis

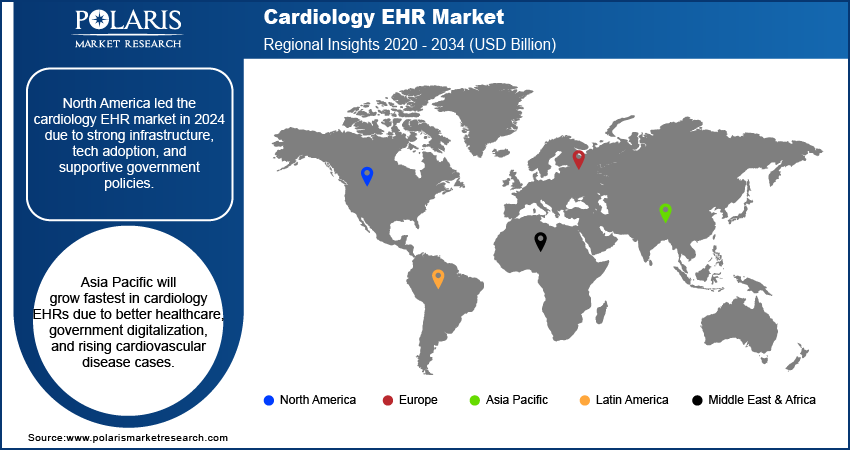

North America Cardiology EHR market held the largest share, primarily driven by a robust healthcare infrastructure, high adoption rates of advanced medical technologies, and supportive government initiatives. The region benefits from a strong focus on digital health transformation, with many healthcare providers already having implemented EHR systems. The ongoing push for interoperability and data exchange among different healthcare facilities further fuels the demand for sophisticated cardiology EHR solutions that can integrate seamlessly with existing systems and improve coordinated patient care.

US Cardiology EHR Market Insight

Within North America, the US is a major contributor to the cardiology EHR market. The widespread adoption of EHRs across US hospitals and clinics, spurred by government incentives like the HITECH Act, has created a fertile ground for specialized cardiology solutions. The country's high prevalence of cardiovascular diseases including heart failure and a strong emphasis on value-based care models also drive the need for comprehensive EHRs that support detailed documentation, clinical decision support, and performance tracking. Continuous technological advancements and a competitive vendor landscape further contribute to the dynamic growth of the cardiology EHR segment in the US.

Europe Cardiology EHR Market

The Europe cardiology EHR market is experiencing steady growth, influenced by government efforts to digitize healthcare systems and a growing demand for paperless technology. Many European countries are investing in national e-health strategies, which include the widespread adoption of electronic health records to improve efficiency, patient safety, and data accessibility. The increasing focus on integrated care models and cross-border health information exchange also drives the need for interoperable cardiology EHR solutions across the continent. Germany cardiology EHR market is a key country contributing to the European market. Germany has one of the most advanced digital health systems in Europe, with significant government investments in digital health technologies. The German government's eHealth Act and initiatives like the Hospital Future Act aim to promote the adoption of electronic medical records across medical facilities, ensuring better patient care and streamlined processes. This strong governmental push, coupled with an emphasis on data security and patient privacy under regulations like GDPR, is a major factor driving the uptake of cardiology EHR systems in the country.

Asia Pacific Cardiology EHR Market Overview

The Asia Pacific region is a rapidly expanding market for cardiology EHRs, propelled by improving healthcare infrastructure, increasing digitalization efforts by governments, and a rising burden of chronic diseases, including cardiovascular conditions. Countries in this region are actively investing in modernizing their healthcare systems, recognizing the efficiency and quality benefits that digital records offer. The growing adoption of telehealth and mobile health solutions, especially in geographically diverse areas, further underscores the need for accessible and integrated cardiology EHR platforms. China cardiology EHR market holds a prominent share of Asia Pacific market. The Chinese government has been actively promoting digital health solutions as part of its broader healthcare reform initiatives, such as the Healthy China 2030 program. These efforts aim to leverage technology to enhance healthcare accessibility and efficiency, leading to a significant increase in EHR adoption across hospitals. The large patient population and the growing prevalence of chronic diseases in China create a pressing need for effective patient management systems, boosting the demand for specialized cardiology EHR solutions.

Key Players and Competitive Insights

The cardiology EHR market is highly competitive, with a mix of established healthcare technology giants and specialized vendors. Companies are constantly innovating to offer more integrated, user-friendly, and data-driven solutions, leading to a dynamic landscape where interoperability and advanced features like AI-powered insights are key differentiators. The competition often revolves around providing comprehensive suites that cover clinical, administrative, and financial aspects of cardiology practices, while also ensuring compliance with evolving healthcare regulations.

Prominent companies in the industry include Epic Systems Corporation, Oracle Health, MEDITECH (Medical Information Technology, Inc.), eClinicalWorks, NextGen Healthcare, LLC, athenahealth, Inc., AdvancedMD, Inc., CureMD Healthcare, Greenway Health, LLC, and Tebra.

Key Players

- AdvancedMD, Inc.

- athenahealth, Inc.

- CureMD Healthcare

- eClinicalWorks

- Epic Systems Corporation

- Greenway Health, LLC

- MEDITECH (Medical Information Technology, Inc.)

- NextGen Healthcare, LLC

- Oracle Health

- Tebra

Industry Developments

September 2024: Oracle announced big improvements to its EHR system. The main goal of these updates was to make things more efficient for doctors and better for patients. Some key changes included easier chart reviews, better tools for writing notes, improved mobile access, and safer ways to manage medications.

October 2022: Emory Healthcare switched to the Epic electronic medical records system. This change brought together several patient portals into one easy-to-use platform called MyChart. This helped patients get to their medical records more easily, made it simpler to coordinate care across different locations, and generally made the healthcare experience better.

Cardiology EHR Market Segmentation

By Product Outlook (Revenue – USD Billion, 2020–2034)

- Web/ cloud-based EHR

- On-premise EHR

By Business Model Outlook (Revenue – USD Billion, 2020–2034)

- Licensed Software

- Technology Resale

- Subscriptions

- Professional Services

- Others

By End Use Outlook (Revenue – USD Billion, 2020–2034)

- Hospital

- Ambulatory Surgical Centers

- Other end use

By Regional Outlook (Revenue-USD Billion, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Cardiology EHR Market Report Scope:

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 2.90 billion |

|

Market Size in 2025 |

USD 3.04 billion |

|

Revenue Forecast by 2034 |

USD 4.80 billion |

|

CAGR |

5.2% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Insights |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 2.90 billion in 2024 and is projected to grow to USD 4.80 billion by 2034.

The global market is projected to register a CAGR of 5.2% during the forecast period.

North America dominated the market share in 2024.

Key players in the market include Epic Systems Corporation, Oracle Health (formerly Cerner Corporation), MEDITECH (Medical Information Technology, Inc.), eClinicalWorks, NextGen Healthcare, LLC, athenahealth, Inc., AdvancedMD, Inc., CureMD Healthcare, Greenway Health, LLC, and Tebra.

The web/cloud-based EHR segment accounted for the largest share of the market in 2024.

The professional services segment is expected to witness the fastest growth during the forecast period.