Cardiovascular Device Market Size, Share, & Industry Analysis Report

By Device Type, By Application, By End Use (Hospitals, Ambulatory Surgical Centers, and Specialty Clinics), and By Region – Market Forecast, 2025–2034

- Published Date:Aug-2025

- Pages: 125

- Format: PDF

- Report ID: PM4534

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

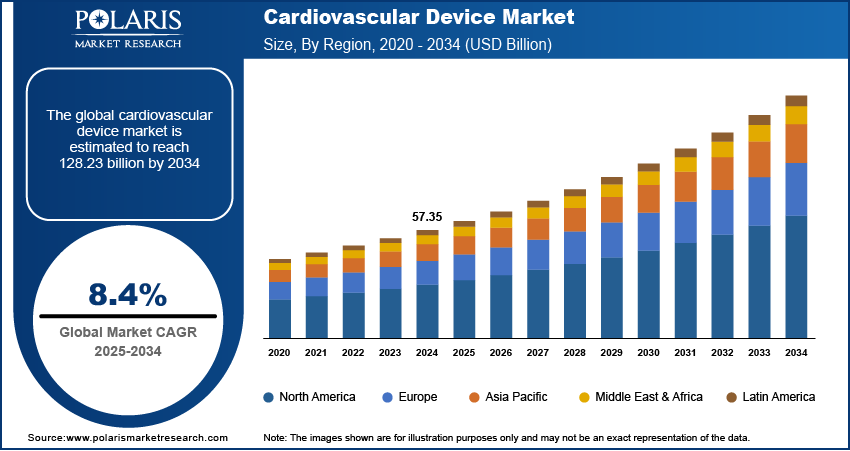

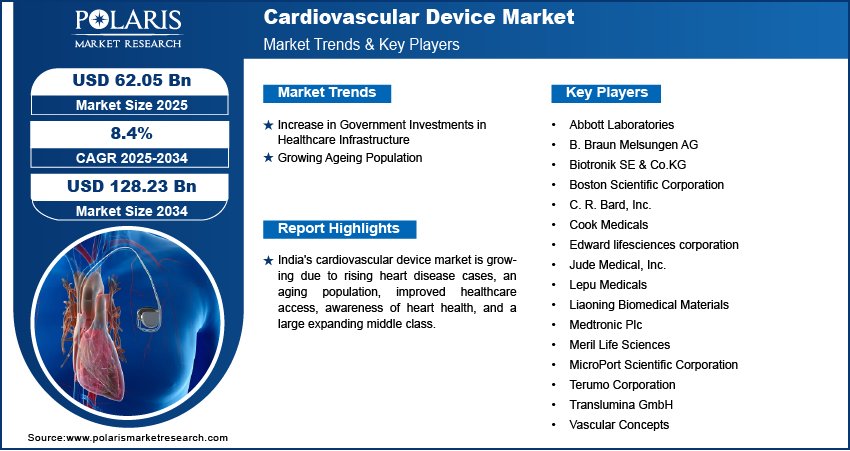

The global cardiovascular device market size was valued at USD 57.35 billion in 2024 and is anticipated to grow at a CAGR of 8.4% during 2025–2034. The growing prevalence of cardiovascular diseases (CVDs) worldwide is driving the demand. Aging populations, unhealthy lifestyles, poor diets, and increasing obesity rates are fueling the rising number of individual affected by heart-related conditions.

Key Insights

- The surgical devices segment holds the largest market share in 2024 due to the increasing complexity of cardiovascular interventions and demand for minimally invasive, precision tools.

- Hospitals dominate the end-user market in 2024 because they handle the highest volume of severe cardiovascular cases and complex interventions.

- North America leads the market due to a large network of technologically advanced hospitals and a high prevalence of heart disease.

- Asia Pacific shows significant growth driven by rising heart disease cases, expanding healthcare infrastructure, and increased access to advanced cardiovascular devices.

Industry Dynamics

- The rising global prevalence of cardiovascular diseases is increasing the demand for advanced diagnostic and treatment devices across healthcare systems.

- A growing aging population contributes to a higher incidence of heart conditions, driving long-term demand for implants and monitoring technologies.

- Advancements in AI and minimally invasive technologies are expanding treatment options, improving outcomes, and encouraging broader adoption of devices.

- Technological innovations such as AI-powered diagnostics and robotic-assisted surgeries are enhancing device efficiency, accuracy, and patient recovery outcomes.

- Stringent regulatory approval processes and device recalls can delay market entry and limit manufacturer competitiveness.

Market Statistics

2024 Market Size: USD 57.35 billion

2034 Projected Market Size: USD 128.23 billion

CAGR (2025–2034): 8.4%

North America: Largest market in 2024

AI Impact on Cardiovascular Device Market

- AI improves early detection of cardiovascular diseases by analyzing ECGs, imaging, and patient data with greater accuracy and speed.

- AI enhances remote monitoring through smart wearables, enabling continuous tracking of heart health and timely medical interventions.

- Integration of AI in diagnostic devices helps personalize treatment plans based on individual patient risk factors and clinical history.

- AI-powered surgical assistance systems increase precision during minimally invasive cardiovascular procedures, improving outcomes and reducing recovery time.

- AI streamlines clinical workflows and supports faster decision-making, helping healthcare providers manage cardiovascular cases more efficiently.

To Understand More About this Research: Request a Free Sample Report

A cardiovascular device is a medical instrument or implant used to diagnose, treat, or manage heart and blood vessel-related conditions. These devices include pacemakers, stents, heart valves, and defibrillators, all designed to improve heart function and prevent or manage cardiovascular diseases. These devices are essential for treating and managing conditions such as heart failure, arrhythmias, and coronary artery disease. The surge in CVD cases compels healthcare providers to explore innovative solutions to diagnose, treat, and manage these conditions more effectively, thereby driving the cardiovascular devices market development.

Technological innovations have improved the performance and accessibility of cardiovascular devices. Minimally invasive techniques, such as robotic-assisted surgery, reduce trauma during procedures and promote quicker recovery times for patients. Additionally, new product launches with the integration of AI in diagnostics and monitoring are improving treatment outcomes. In June 2024, AliveCor launched the Kardia 12L ECG System, featuring AI-powered technology, which detects 35 cardiac conditions using a reduced lead, revolutionizing cardiac care. These developments make devices more effective, safer, and user-friendly, boosting demand for advanced cardiovascular technologies and thereby driving the market growth.

Market Dynamics

Increase in Government Investments in Healthcare Infrastructure

Many countries are investing heavily in improving healthcare infrastructure and improving care for their populations. According to the US Centers for Medicare & Medicaid Services, in 2023, the US alone invested USD 4.9 trillion in healthcare infrastructure. These increased allocation of funds to medical advancements supports hospitals and clinics to purchase high-quality, state-of-the-art cardiovascular devices. Additionally, higher healthcare spending also facilitates the widespread adoption of these devices, including in developing regions. Thus, increasing investments from governments and private sectors in healthcare infrastructure contribute to the development.

Growing Ageing Population

A large portion of the global population is aged 65 years and above. Longer life expectancy increases susceptibility to heart-related conditions, resulting in a higher demand for cardiovascular interventions. Older individuals face a greater risk of developing diseases such as coronary artery disease, heart failure, and arrhythmias and require devices such as pacemakers, stents, and defibrillators. The growing elderly population is driving the demand for these devices, thereby driving the market growth.

Segment Analysis

Market Assessment by Device Type Outlook

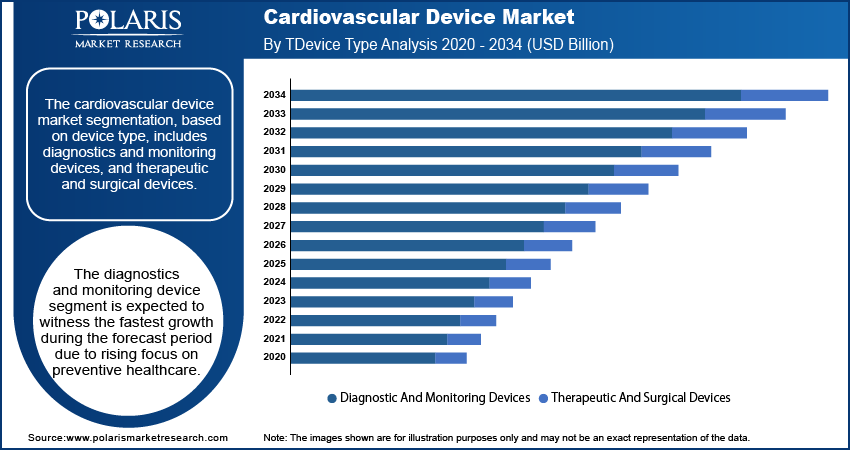

The cardiovascular device market segmentation, based on device type, includes diagnostics and monitoring devices, and therapeutic and surgical devices. The surgical devices segment is accounted for the largest market share in 2024 due to the increasing volume of complex cardiovascular interventions such as coronary artery bypass grafting (CABG), valve replacement, and device-based structural heart repairs. Rising prevalence of advanced-stage cardiac conditions has amplified the demand for precision-engineered tools that offer superior control, minimal invasiveness, and enhanced procedural outcomes. Advancements in catheter-based technologies, robotic-assisted platforms, and tissue-engineered implants are reinforcing the clinical efficacy and safety profile of surgical interventions. Surgeons and cardiologists are increasingly integrating these tools into hybrid operating environments, contributing to the overall expansion across tertiary care institutions and specialized cardiac centers.

The diagnostics and monitoring devices segment is expected to witness the fastest growth rate during the forecast period due to the increasing need for early detection and continuous monitoring of heart-related conditions. Devices such as ECG monitors, cardiac stress testing equipment, and wearable medical device to monitor heart are becoming advanced, allowing for better and more accurate diagnosis of cardiovascular diseases. Additionally, with a growing focus on preventative care and managing chronic heart conditions, healthcare providers are increasingly adopting diagnostic and monitoring devices, thereby driving the growth for the segment.

Market Evaluation by End User Outlook

The cardiovascular device market segmentation, based on end user, includes hospitals, ambulatory surgical centers, and specialty clinics. The hospitals segment dominated the market share in 2024 due to the high number of patients visiting hospitals for heart-related treatments. Hospitals are the primary healthcare settings where patients suffering from severe cardiovascular conditions receive critical care and interventions, such as surgeries, stent placements, and pacemaker installations. The large patient footfall in hospitals drives the demand for advanced cardiovascular devices, as hospitals are equipped with the necessary infrastructure and specialists to handle complex cardiovascular diseases.

The ambulatory surgical centers (ASCs) segment is expected to witness the fastest growth rate during the forecast period due to the ongoing shift toward cost-effective, outpatient-based cardiac care delivery. Advancements in minimally invasive cardiovascular procedures, combined with shorter recovery times and reduced hospitalization costs, are driving the preference for ASCs. Payers and healthcare systems are incentivizing procedural migration from hospitals to ambulatory settings to streamline expenditure while maintaining clinical outcomes. Investments in infrastructure, staff specialization, and high-acuity cardiac equipment are accelerating ASC capabilities, contributing to the growth by enabling broader access to interventional treatments in decentralized care environments.

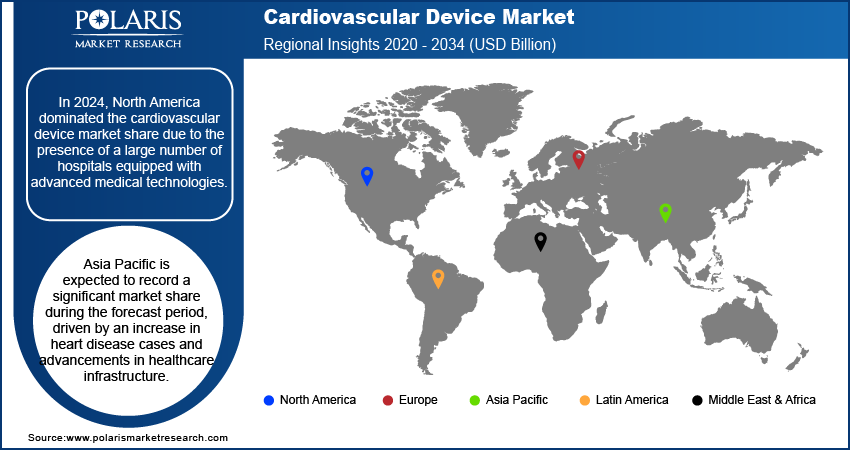

Regional Insights

By region, the study provides the cardiovascular device market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. In 2024, North America dominated the market revenue share due to the presence of a large number of hospitals equipped with advanced medical technologies. According to the American Hospital Association, the USA boasts a wide network of hospitals, accounting for 6,120 hospitals in total as of 2023. These hospitals often invest in the latest cardiovascular devices, ensuring they offer the best care to patients. Additionally, the high prevalence of heart disease in North America, along with the increasing adoption of innovative technologies, is contributing to its fast-paced expansion.

Asia Pacific cardiovascular device market is expected to record a significant market growth during the forecast period, driven by an increase in heart disease cases and advancements in healthcare infrastructure. Countries such as China, Japan, and South Korea are expanding their healthcare systems, making state-of-the-art cardiovascular technologies more accessible. Additionally, rising healthcare spending and improved medical access in urban and rural areas are boosting demand for these cardiovascular devices, thereby driving the Asia Pacific market expansion.

India's cardiovascular device market is experiencing substantial growth due to a higher incidence of heart diseases and an aging population. Improvements in healthcare infrastructure have made advanced cardiovascular treatments more widely available in hospitals across the country. Growing awareness of heart health and increased access to affordable healthcare services fuel the demand for devices such as stents, pacemakers, and heart valves. Additionally, the large population and expanding middle class are further contributing to the India market growth.

Key Players & Competitive Analysis Report

The competitive landscape of the global market is shaped by continual innovation, portfolio diversification, and strategic alignment through mergers and acquisitions aimed at enhancing procedural offerings across diagnostics, interventional cardiology, and structural heart therapy. Industry analysis reveals a concentrated focus on developing next-generation devices that integrate AI, real-time data analytics, and remote monitoring to support precision medicine and improve patient outcomes. Market expansion strategies are increasingly centered on penetrating underserved markets through localized manufacturing, regulatory harmonization, and tailored clinical support. Joint ventures and strategic alliances between device manufacturers and healthcare technology firms are fostering the co-development of integrated platforms that combine hardware innovation with software intelligence. Launches of miniaturized implantable devices, energy-efficient pacing systems, and drug-eluting technologies are redefining procedural efficiency and long-term efficacy. Post-merger integration is enabling synergies across supply chains and R&D pipelines, expediting product life cycles and market responsiveness. Technology advancements in biodegradable stents, wearable telemetry, and smart surgical tools are further contributing to market growth. Competitive differentiation is increasingly tied to value-based care models, enabling manufacturers to offer comprehensive procedural ecosystems that align with payer-driven quality metrics and evolving healthcare delivery frameworks.

New companies are impacting the cardiovascular device industry by introducing innovative products to meet the demand of specific market sectors. This competitive environment is amplified by continuous progress in product offerings. Major players in the market include Abbott Laboratories; B. Braun Melsungen AG; Biotronik SE & Co.KG; Boston Scientific Corporation; C. R. Bard, Inc.; Cook Medicals; Lepu Medicals; Liaoning Biomedical Materials; Medtronic Plc; Meril Life Sciences; MicroPort Scientific Corporation; Terumo Corporation; Translumina GmbH; Vascular Concepts; Jude Medical, Inc.; and Edward lifesciences corporation.

Medtronic plc is a global medical technology company established in 1949, with operational headquarters in Minneapolis, Minnesota, and legal headquarters in Dublin, Ireland. The company employs over 95,000 individuals and operates in more than 150 countries, focusing on the development of healthcare technologies and therapies for chronic diseases, particularly in cardiovascular health, diabetes management, and neurological disorders. The company is organized into four primary business segments cardiovascular, medical surgical equipment, neuroscience, and diabetes. The cardiovascular portfolio is a significant part of Medtronic's operations and includes a variety of products aimed at addressing heart conditions. This segment features cardiac rhythm management devices such as pacemakers and implantable cardioverter-defibrillators (ICDs), as well as structural heart therapies for valve disorders. Additionally, it provides solutions for coronary and peripheral vascular diseases through stents and angioplasty systems. Medtronic has a history of innovation in cardiac care, having developed the first implantable pacemaker. The medical-surgical portfolio focuses on technologies for various surgical specialties, including respiratory and gastrointestinal procedures. Medtronic operates across a diverse global market with a significant presence in North America, Europe, Asia Pacific, the Middle East, and Africa. Its products are used in hospitals and healthcare facilities worldwide, contributing to patient care and healthcare delivery systems.

Boston Scientific Corporation is a medical technology company founded in 1979 and headquartered in Marlborough, Massachusetts. The company operates in over 100 countries. Its focus is on developing medical devices that address various health conditions across multiple specialties, including cardiovascular, urology, endoscopy devices, and pain management. Boston Scientific is organized into several business segments, which include cardiovascular, rhythm management, MedSurg, and neuromodulation. The cardiovascular segment includes a range of products aimed at treating heart conditions. This encompasses drug-eluting stents, such as the TAXUS and SYNERGY Stent Systems, which are used in procedures for coronary artery disease. The segment also covers devices for electrophysiology, including implantable cardioverter-defibrillators (ICDs) and cardiac resynchronization therapy (CRT) devices. Additionally, Boston Scientific develops technologies for structural heart interventions, focusing on minimally invasive approaches to valve repair and replacement. The MedSurg segment provides products for various surgical applications, particularly in gastrointestinal and urological procedures. The rhythm management segment focuses on devices for managing cardiac arrhythmias, while the neuromodulation segment addresses chronic pain through various therapeutic solutions. Boston Scientific has a global presence with operations in North America, Europe, Asia Pacific, and Latin America. Its manufacturing facilities are located in the US, Ireland, Costa Rica, and Malaysia. The company utilizes an extensive distribution network to ensure its products reach healthcare providers worldwide.

List of Key Companies

- Abbott Laboratories

- B. Braun Melsungen AG

- Biotronik SE & Co.KG

- Boston Scientific Corporation

- C. R. Bard, Inc.

- Cook Medicals

- Edward lifesciences corporation

- Jude Medical, Inc.

- Lepu Medicals

- Liaoning Biomedical Materials

- Medtronic Plc

- Meril Life Sciences

- MicroPort Scientific Corporation

- Terumo Corporation

- Translumina GmbH

- Vascular Concepts

Cardiovascular Devices Industry Developments

October 2024: Philips showcased its latest cardiology solutions at the TCT annual meeting in Washington D.C. The company introduced new heart care technologies that use AI to help doctors perform better procedures, make more confident decisions, and improve patient outcomes during heart treatments.

In October 2024, The FARAWAVE NAV Ablation Catheter and FARAVIEW Software were launched by Boston Scientific, receiving FDA approval and enhancing the FARAPULSE PFA System with advanced navigation and visualization for AF treatments.

In January 2024, Cleerly launched Cleerly ISCHEMIA software, FDA-cleared for heart disease analysis. The AI-driven tool helps diagnose coronary artery disease by analyzing coronary CT angiography images for ischemia detection.

Cardiovascular Device Market Segmentation

By Device Type Outlook (Revenue USD Billion, 2020–2034)

- Diagnostic and Monitoring Devices

- Electrocardiogram

- Remote Cardiac Monitoring

- MRI

- Others

- Therapeutic and Surgical Devices

- Ventricular Assist Devices

- Cardiac Rhythm Management Devices

- Catheter

- Stents

- Others

By Application Outlook (Revenue USD Billion, 2020–2034)

- Heart Failure

- Cardiac Arrhythmia

- Coronary Artery Disease

- Others

By End Use Outlook (Revenue USD Billion, 2020–2034)

- Hospitals

- Ambulatory Surgical Centers

- Specialty Clinics

By Regional Outlook (Revenue USD Billion, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Cardiovascular Device Market Report Scope

|

Report Attributes |

Details |

|

Market Size value in 2024 |

USD 57.35 billion |

|

Market Size value in 2025 |

USD 62.05 billion |

|

Revenue Forecast by 2034 |

USD 128.23 billion |

|

CAGR |

8.4% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The cardiovascular device market size was valued at USD 57.35 billion in 2024 and is projected to grow to USD 128.23 billion by 2034.

The global market is projected to register a CAGR of 8.4% during the forecast period.

North America held the largest share of the global market in 2024.

A few key players in the market are Abbott Laboratories; B. Braun Melsungen AG; Biotronik SE & Co.KG; Boston Scientific Corporation; C. R. Bard, Inc.; Cook Medicals; Lepu Medicals; Liaoning Biomedical Materials; Medtronic Plc; Meril Life Sciences; MicroPort Scientific Corporation; Terumo Corporation; Translumina GmbH; Vascular Concepts; Jude Medical, Inc.; and Edward Lifesciences Corporation.

The hospital segment dominated the market in 2024 due to the large number of footfall of patients in hospital settingsdevice type, application, end-use, and region.

The diagnostics and monitoring device segment is expected to witness the fastest growth during the forecast period due to the rising focus on preventive healthcare.