Endoscopy Devices Market Size, Share, Trends, Industry Analysis Report

: By Devices Type (Endoscopes, Endoscopy Visualization Systems, Accessories, and Others), By Application, By End Use, and By Region – Market Forecast, 2025–2034

- Published Date:Aug-2025

- Pages: 129

- Format: PDF

- Report ID: PM1131

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

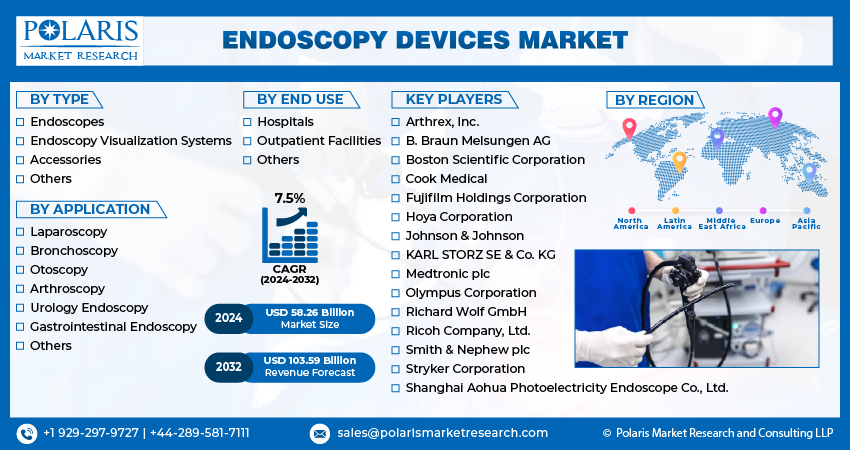

The global endoscopy devices market size was valued at USD 60.94 billion in 2024. It is expected to grow from USD 63.13 billion in 2025 to USD 87.41 billion by 2034, at a CAGR of 3.68% during 2025–2034. The market is growing due to the increasing preference for minimally invasive surgeries, the rising prevalence of chronic diseases, advancements in endoscopy technology, and the expanding geriatric population requiring diagnostic and therapeutic solutions.

Key Insights

- The endoscopes segment accounted for the largest market share in 2024.

- The hospitals segment is anticipated to witness sizeable growth during the forecast period due to the comprehensive framework and progressive healthcare facilities they provide.

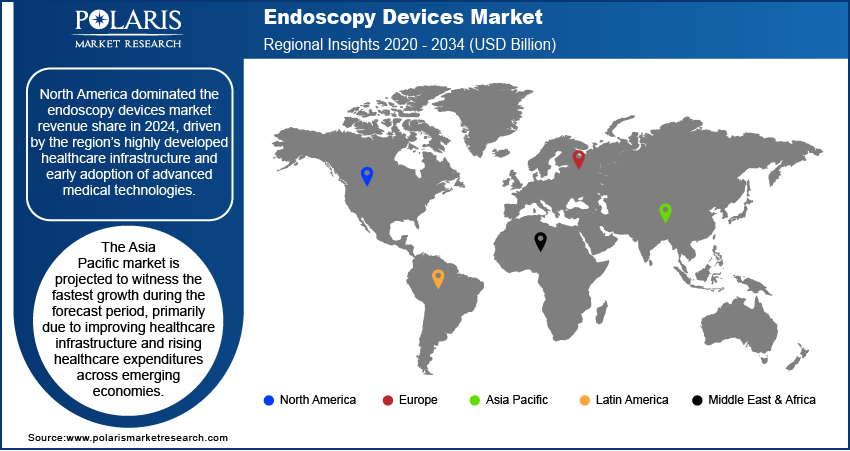

- North America dominated the market revenue share in 2024 because of the region’s advanced healthcare framework and early adoption of advanced medical technologies.

- The Asia Pacific market is estimated to witness the fastest growth because of an enhanced healthcare framework and growing healthcare disbursement in emerging economies.

Industry Dynamics

- The growing existence of detrimental illnesses is a prominent driver driving the market as conditions such as cancer, gastrointestinal illnesses, and cardiovascular illnesses growingly need early and precise diagnosis.

- Advances in endoscopy devices play an important part in the accuracy, security, and usability of the devices, which also enable precise diagnosis and minimally invasive procedures.

- The growing geriatric population globally is providing an opportunity to aging persons inclined to acute conditions such as colorectal cancer, gastrointestinal disorders, and orthopedic problems, which need diagnostic and therapeutic endoscopy.

Market Statistics

2024 Market Size: USD 60.94 billion

2034 Projected Market Size: USD 87.41 billion

CAGR (2025-2034): 3.68%

North America: Largest market in 2024

To Understand More About this Research: Request a Free Sample Report

Endoscopy devices are medical instruments used to view and operate on the internal organs and vessels of the body through minimally invasive techniques. These devices have become integral to modern healthcare practices as they offer a less intrusive alternative to traditional open surgeries. The endoscopy devices market is growing due to the increasing preference for minimally invasive surgeries. Patients and healthcare providers increasingly favor these procedures due to benefits such as reduced postoperative pain, shorter hospital stays, quicker recovery times, and lower overall healthcare costs. A 2024 NCBI report stated that the US performs over 20 million GI endoscopies yearly, including 6.1 million upper endoscopies and 15 million colonoscopies, reflecting widespread use in diagnostic and preventive care. The adoption of endoscopic procedures across various specialties, such as gastroenterology, urology, and gynecology, continues to strengthen as awareness of these advantages rises.

The increasing geriatric population worldwide is contributing to the endoscopy devices market demand as aging individuals are more prone to chronic conditions such as colorectal cancer, gastrointestinal disorders, and orthopedic issues, many of which require diagnostic or therapeutic endoscopy. There is a consistent surge in the number of elderly patients seeking minimally invasive solutions for diagnosis and treatment, with life expectancy rising globally. An October 2024 WHO report projected that the global population aged 60 and above will rise from 1 billion in 2020 to 1.4 billion by 2030. It is expected to double to 2.1 billion by 2050. Those aged 80 and above will triple to 426 million in the same period. This demographic shift places higher demand on healthcare systems, thereby driving the need for advanced, efficient, and patient-friendly endoscopic devices to support the specialized care requirements of older populations.

Market Dynamics

Rising Prevalence of Chronic Diseases

The rising prevalence of chronic diseases is a major driver of the endoscopy devices market, as conditions such as cancer, gastrointestinal disorders, and cardiovascular diseases increasingly require early and accurate diagnosis. A December 2024 WHO report stated that noncommunicable diseases caused 43 million deaths in 2021 (75% of non-pandemic deaths). Cardiovascular diseases led to 19 million, followed by cancers, 10 million; chronic respiratory diseases, 4 million; and diabetes, over 2 million, further contributing to the market development. Endoscopy offers a minimally invasive approach to detect and manage these conditions, leading to greater reliance on these devices across healthcare settings. Healthcare providers are adopting endoscopic procedures more frequently to improve patient outcomes and reduce the need for more invasive surgical interventions as the global burden of chronic diseases grows. This trend continues to fuel consistent demand for advanced and specialized endoscopy solutions.

Advancements in Endoscopy Devices

Advancements in endoscopy devices play an essential role in enhancing the precision, safety, and usability of the devices. Innovations such as high-definition imaging, flexible endoscopes, and robotic-assisted procedures have expanded the range of clinical applications for endoscopy, enabling more accurate diagnostics and minimally invasive treatments. In October 2023, Olympus launched its EVIS X1 endoscopy system in the US, along with GIF-1100 and CF-HQ1100DL/I scopes for upper/lower digestive tracts. The lighter ErgoGrip design improves handling and comfort, particularly for users with smaller hands. These technological improvements improve procedural outcomes and also increase the acceptance of endoscopic techniques among both physicians and patients. As a result, continuous innovation in device capabilities supports broader adoption and contributes greatly to the industry growth opportunities.

Segment Insights

Market Assessment by Device Type

The global endoscopy devices market segmentation, based on device type, includes endoscopes, endoscopy visualization systems, accessories, and others. The endoscopes segment dominated the market share in 2024 due to the fundamental role endoscopes play in a wide range of diagnostic and therapeutic procedures. Endoscopes are critical tools in minimally invasive surgeries, offering direct visualization of internal organs with minimal patient trauma. Their widespread adoption across specialties such as gastroenterology, pulmonology, and orthopedics highlights their indispensable value in clinical settings. Furthermore, the continuous advancements in flexible and rigid endoscope technologies have enhanced procedural efficiency and expanded their use in both routine screenings and complex interventions, solidifying their leading position within the market.

Market Evaluation by End Use

The global endoscopy devices market segmentation, based on end use, includes hospitals, outpatient facilities, and others. The hospitals segment is expected to witness substantial growth during the forecast period during the forecast period owing to the comprehensive infrastructure and advanced healthcare facilities they offer. Hospitals are well-equipped to handle a broad spectrum of endoscopic procedures, ranging from diagnostics to complex surgeries, under a single roof. They also benefit from the availability of skilled healthcare professionals and the ability to invest in technologically advanced endoscopy systems. Additionally, the rising number of inpatient and outpatient endoscopic interventions performed in hospitals supports the growing demand for endoscopy devices in this segment.

Regional Analysis

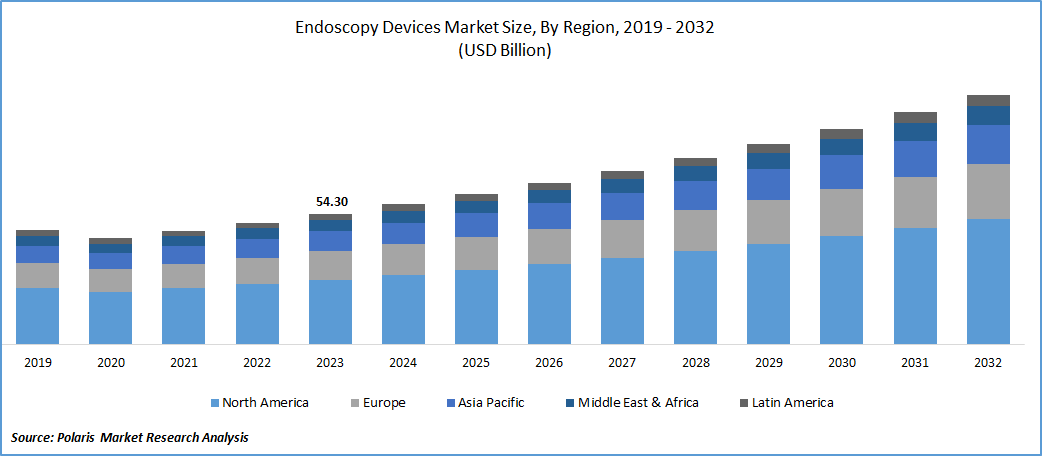

By region, the report provides the endoscopy devices market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. North America dominated the market revenue share in 2024 driven by the region’s highly developed healthcare infrastructure and early adoption of advanced medical technologies. Strong healthcare reimbursement policies, increasing preference for minimally invasive procedures, and the high prevalence of chronic diseases contribute immensely to the region's market leadership. A February 2024 CDC report stated that 129 million Americans have at least one major chronic disease, with 42% managing two or more conditions and 12% suffering from five or more. Furthermore, robust investments in healthcare innovation, coupled with a strong presence of major industry players, facilitate the widespread availability and adoption of next-generation laparoscopy and endoscopy devices across hospitals and specialized centers.

The Asia Pacific market is projected to witness the fastest growth during the forecast period, primarily due to improving healthcare infrastructure and rising healthcare expenditures across emerging economies. An October 2024 report by the Ministry of Health and Family Welfare revealed that Government Health Expenditure (GHE) rose to 1.84% of GDP and 6.12% of General Government Expenditure in 2021–22. Growing awareness about the benefits of early disease detection, coupled with the increasing burden of chronic illnesses, is driving the demand for endoscopic procedures in the region. Additionally, a large and aging population, along with government initiatives to expand access to advanced medical technologies, is expected to accelerate market growth further. This dynamic environment positions Asia Pacific as a key region for the expansion of the laparoscopy and endoscopy devices market.

Key Players and Competitive Landscape

The endoscopy devices market demonstrates robust technological advancement, with players such as Olympus, Boston Scientific, and Karl Storz dominating the market. Emerging competitors such as Fujifilm and Pentax are gaining traction through strategic alliances focused on improved visualization capabilities and miniaturization trends. Customer demand increasingly centers on less invasive procedures with shorter recovery times, driving innovation in disposable laparoscopy and endoscopy devices and AI-assisted diagnostic tools. The competitive positioning landscape is evolving as companies vie to establish superior value propositions through differentiated features rather than price competition alone. Latent demand exists, particularly in emerging economies where healthcare infrastructure development is accelerating. Economic and geopolitical shifts have prompted manufacturers to diversify production facilities and secure alternative component sourcing arrangements, fundamentally altering established industry dynamics. A few key major players are AspireIQ, Inc.; AWISEE; Creator; Grin Technologies Inc.; Heepsy; Insense; IZEA Worldwide, Inc.; Later (Formerly Mavrck); Modash OÜ; NeoReach; SocialEdge, Inc. (CreatorIQ); Takumi International Ltd; TRIBE; and Upfluence.

B. Braun Melsungen AG, headquartered in Germany, is a provider of medical and surgical technologies, including a comprehensive range of endoscopy devices. The company’s endoscopy portfolio is anchored by high-quality rigid endoscopes designed for various minimally invasive procedures such as laparoscopy, arthroscopy, neuroendoscopy, ENT, gynecology, and urology. These endoscopes utilize a glass rod lens system to transmit images from the body cavity to a chip camera, ensuring precise visualization and reliable illumination during surgery. B. Braun’s endoscopes are available in multiple diameters, working lengths, and viewing angles. They can be connected to standard medical chip cameras and light cables from various suppliers, offering flexibility and compatibility in the operating room. The medical devices are engineered for durability, with options for autoclave or chemical sterilization, and are supported by specially designed trays to protect fragile optical components. The company also offers advanced solutions such as the MINOP TREND transnasal endoscopic system for pituitary and skull base surgeries, featuring integrated suction, cleaning, and irrigation functions, as well as Full HD optics for enhanced image quality.

Fujifilm Holdings Corporation, headquartered in Tokyo, Japan, specializes in healthcare technology, with a presence in the endoscopy devices sector. Fujifilm designs, manufactures, and markets advanced medical systems, building on its legacy in imaging and optical innovation. It includes a comprehensive range of endoscopic equipment used for diagnostic and therapeutic procedures across gastroenterology, pulmonology, and surgery. The company’s endoscopy portfolio is renowned for integrating high-definition imaging, proprietary optical technologies, and user-centric ergonomics to enhance visualization and procedural accuracy. Fujifilm’s solutions, such as flexible endoscopes, endoscopic ultrasound systems, and innovative imaging platforms, support early disease detection and minimally invasive interventions. The company’s global reach spans the Americas, Europe, Asia Pacific, and other regions, serving hospitals, clinics, and healthcare providers with both equipment and related medical consumables. Fujifilm’s commitment to research and development ensures continuous product innovation, addressing evolving clinical needs and improving patient outcomes. Its healthcare business, which encompasses endoscopy, is a core pillar alongside material solutions and imaging systems, reflecting the company’s strategic focus on advancing diagnostics services and life sciences.

List of Key Companies in Endoscopy Devices Industry

- Arthrex, Inc.

- B. Braun Melsungen AG

- Boston Scientific Corporation

- Cook Medical

- Fujifilm Holdings Corporation

- Hoya Corporation

- Johnson & Johnson

- KARL STORZ SE & Co. KG

- Medtronic plc

- Olympus Corporation

- PENTAX Medical

- Richard Wolf GmbH

- Shanghai Aohua Photoelectricity Endoscope Co., Ltd.

- STERIS

- Stryker Corporation

Endoscopy Devices Industry Developments

May 2025: Olympus Corporation (Japan) revealed that it received FDA 501(k) clearance for its EZ1500 series endoscopes. These endoscopes come with the EDOF technology that enables physicians to get sharp images.

December 2024: HOYA Corporation secured FDA 510(k) clearance for new models in the PENTAX Medical i20c Video Endoscope Series. The company noted that the series is designed to assist healthcare professionals in detection, diagnosis, and therapy.

October 2024: Olympus Europa received CE-MDR approval for Odin Vision’s AI endoscopy tools (CADDIE, CADU, SMARTIBD) in Europe. These cloud-based systems assist in detecting colorectal polyps, Barrett’s Esophagus dysplasia, and ulcerative colitis, enhancing real-time decision-making in endoscopy procedures.

August 2024: KARL STORZ and FUJIFILM collaborated to combine advanced OR integration solutions with high-performance GI endoscopes. The collaboration aims to enhance efficiency in surgical suites, hospitals, and ASCs by integrating endoscopic data for improved procedural outcomes.

March 2024: Scivita Medical expanded its collaboration with Boston Scientific to co-develop future endoscopic devices and distribute Scivita's single-use endoscopes globally, aiming to increase product accessibility in China and other markets.

January 2023: FUJIFILM India launched the ClutchCutter and FushKnife, adding to its endoscopy solutions. These proprietary devices are designed for ESD and EMR procedures and are compatible with specific endoscopes, aiding clinicians in endoscopic submucosal dissection (ESD) within the digestive tract.

Endoscopy Devices Market Segmentation

By Devices Type Outlook (Revenue, USD Billion, 2020–2034)

- Endoscopes

- Endoscopy Visualization Systems

- Accessories

- Others

By Application Outlook (Revenue, USD Billion, 2020–2034)

- Laparoscopy

- Bronchoscopy

- Otoscopy

- Arthroscopy

- Urology Endoscopy

- Gastrointestinal Endoscopy

- Others

By End Use Outlook (Revenue, USD Billion, 2020–2034)

- Hospitals

- Outpatient Facilities

- Others

By Regional Outlook (Revenue, USD Billion, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Endoscopy Devices Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 60.94 billion |

|

Market Size Value in 2025 |

USD 63.13 billion |

|

Revenue Forecast in 2034 |

USD 87.41 billion |

|

CAGR |

3.68% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 60.94 billion in 2024 and is projected to grow to USD 87.41 billion by 2034.

The global market is projected to register a CAGR of 3.68% during the forecast period.

North America dominated the market share in 2024.

A few of the key players are AspireIQ, Inc.; AWISEE; Creator; Grin Technologies Inc.; Heepsy; Insense; IZEA Worldwide, Inc.; Later (Formerly Mavrck); Modash OÜ; NeoReach; SocialEdge, Inc. (CreatorIQ); Takumi International Ltd; TRIBE; and Upfluence.

The endoscopes segment dominated the market share in 2024.

The hospitals segment is expected to witness substantial growth during the forecast period during the forecast period.