Endoscopes Market Share, Size, Trends, Industry Analysis Report

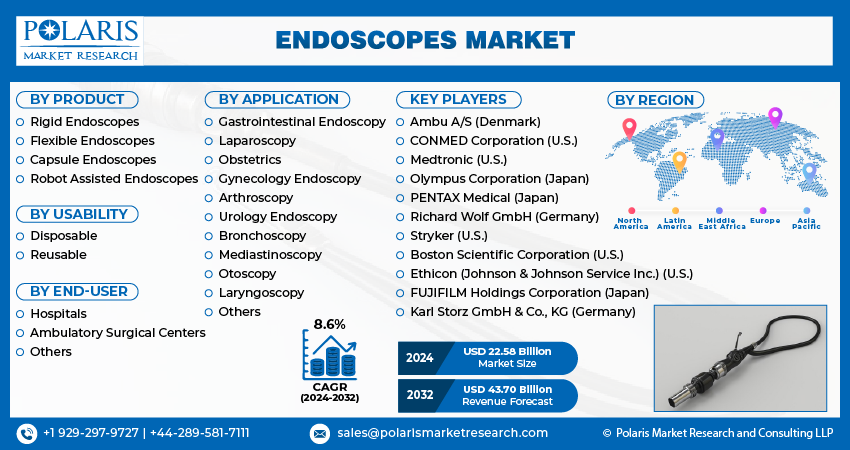

By Product (Rigid Endoscopes, Flexible Endoscopes, Capsule Endoscopes, and Robot Assisted Endoscopes); By Usability; By Application; By End-user; By Region; Segment Forecast, 2024- 2032

- Published Date:Feb-2024

- Pages: 114

- Format: PDF

- Report ID: PM2039

- Base Year: 2023

- Historical Data: 2019 – 2022

Report Outlook

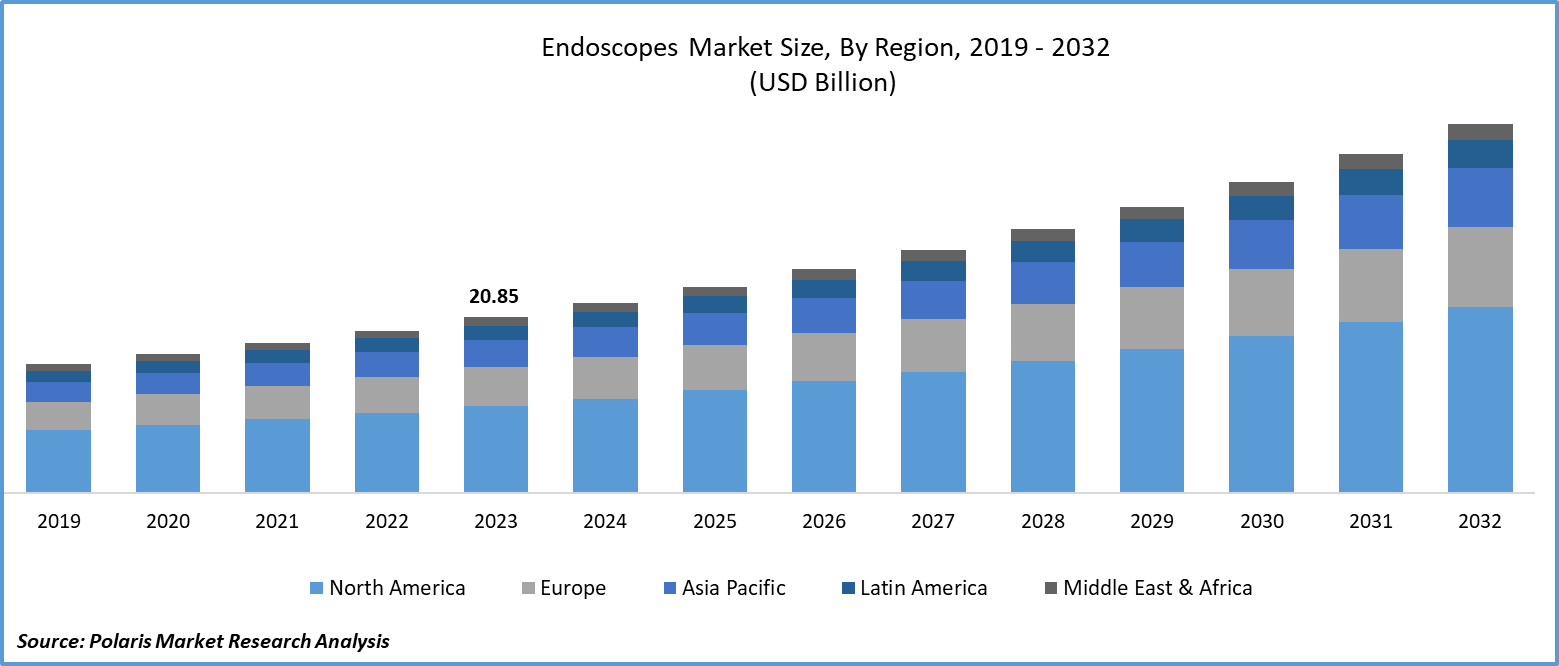

Global endoscopes market size was valued at USD 20.85 billion in 2023. The market is anticipated to grow from USD 22.58 billion in 2024 to USD 43.70 billion by 2032, exhibiting the CAGR of 8.6% during the forecast period.

Market Overview

An increase in the number of endoscopic procedures worldwide is one of the major factors driving the endoscopes market growth. Moreover, factors such as the growing prevalence of chronic disorders coupled with an increasing awareness related to the early detection & screening of diseases are contributing to the growth of the endoscopes market. Furthermore, the increasing popularity of robotic-assisted endoscopic procedures and the strong focus of the industry players on minimizing post-operative pain will increase the demand for endoscopes during the forecast timeframe.

The expansion of endoscopy units and the growing focus of hospitals towards the investment in purchasing technologically advanced endoscopy instruments are expected to fuel market growth. Moreover, favorable reimbursement policies and an increasing number of product approvals for endoscopic procedures will propel the endoscope market in the projected years. Furthermore, the growing geriatric population and an increasing number of patients suffering from cancer, inflammatory bowel disease (IBD), and other gastrointestinal disorders will increase the demand for endoscopes in the coming years.

To Understand More About this Research: Request a Free Sample Report

- For instance, according to the statistics by the American Cancer Society, Inc., in 2023, the estimated number of new cancer cases in males in the U.S. was approximately 1.01 million, compared to 0.98 million cases in 2022.

Endoscopy procedures are generally painless, although they can sometimes be uncomfortable for patients. The spread of viral infections during endoscopy procedures acts as a major restraint for market growth. Moreover, endoscopies can lead to complications such as perforation of an organ, infection, allergic reaction to the anesthesia, and excessive bleeding. Furthermore, a lack of skilled professionals and less penetration of endoscopes in several under-developed countries are expected to limit the market growth during the forecast timeframe.

Growth Factors

Rising incidence of gastrointestinal disorders and other chronic conditions is expected to boost the endoscopes market

Endoscopes are medical devices that are inserted into the body to help doctors in examining the body cavities or organs. The rapid growth in the incidence of gastrointestinal disorders coupled with an increase in the number of patients requiring endoscopic procedures are driving the endoscopes market growth. For instance, according to a study by the Crohn’s & Colitis Foundation in July 2023, it is estimated that 1 in 100 Americans has inflammatory bowel disease. Moreover, the strong focus of healthcare professionals and doctors to find out the cause of such diseases will significantly increase the number of endoscopic procedures, thereby fueling the overall market growth.

Technological advancements are expected to strengthen the endoscopes market growth in the coming years

The future of healthcare is being shaped by medical technology, which has led to notable technological advancements in endoscopic technology. The emergence of newer technologically advanced products to improve endoscopic procedures will drive the demand for endoscopes. For instance, in April 2020, Olympus Corporation announced the launch of EVIS X1, an innovative and most-advanced endoscopy system. This system includes Red Dichromatic Imaging (RDI), Extended Depth of Field (EDOF), and Texture and Color Enhancement Imaging (TXI).

Moreover, the company has also announced its plans to implement artificial intelligence (AI) in its endoscopy products. Furthermore, the novel imaging approach, optical coherence tomography, allows visuals of the micro-structures of the biological tissues at a cellular level. The advent of such innovative techniques and tools for endoscopic procedures will propel the endoscopes market revenue in the projected years.

Restraining Factors

Potential risks associated with endoscopic procedures will hamper the demand for endoscopes during the forecast period

An endoscopy is generally a safe procedure. However, several side effects associated with this procedure can impact the endoscopes market demand negatively. For instance, risks of endoscopy, such as mild cramping, over-sedation, a numb throat, internal bleeding, and perforation or tear of the lining of the stomach or esophagus are increasing the fear of patients towards this procedure. Moreover, the chest pain caused by endoscopy procedures is also one of the common complications that might hamper the demand for endoscopes.

Report Segmentation

The market is primarily segmented based on product, usability, application, end-user, and region.

|

By Product |

By Usability |

By Application |

By End-user |

By Region |

|

|

|

|

|

To Understand the Scope of this Report: Speak to Analyst

By Product Insights

The flexible endoscopes emerged as the largest market segment in 2023

Based on product, the flexible endoscopes segment dominated the global market. Screening programs are commonly done by flexible endoscopy since it is an effective method for the early detection and treatment of gastrointestinal cancer. The rapid growth in the diagnosis of stomach cancers, the rising aging population, and increasing demand for minimally invasive surgical procedures such as laparoscopy and cystoscopy are driving segmental growth.

For instance, according to the American Cancer Society, about 6 out of 10 people with age 65 or more are diagnosed with stomach cancer annually. Moreover, the resumption of elective surgeries after the COVID-19 pandemic has significantly increased the demand for flexible endoscopes, thereby fueling the segmental growth.

By Usability Insights

The disposable segment held the significant market share in 2023

The disposable segment generated significant revenue in the endoscopes market. Factors such as rapid advancements in single-use technology and increased safety concerns of patients and healthcare workers after the COVID-19 pandemic contributed to the segmental share. Moreover, the adoption of disposable endoscopes has increased over the past decade as it eliminates the need for wastewater reprocessing and personal protective equipment (PPE) required for sterilization.

Furthermore, the growing focus on reducing sanitation concerns and contamination rates, coupled with the recommendation by regulatory authorities to shift from reusable to disposable endoscopes, contributed to the segment’s growth. For instance, in April 2022, the U.S. FDA released guidelines directing healthcare facilities to strive towards replacing duodenoscopes with permanent endcaps with fully disposable or disposable components.

By Application Insights

Gastrointestinal (GI) endoscopy dominated the endoscopes market

The Gastrointestinal (GI) endoscopy segment accounted for the largest market share in 2023. The segmental share is mainly attributed to the increasing prevalence of gastrointestinal disorders and rising rates of screening for these diseases. For instance, according to the statistics by the American Cancer Society based on incidence from population-based cancer registries, in 2023, approximately 153,020 individuals were diagnosed with colorectal cancer. Such an increase in the diagnosis of patients suffering from various gastrointestinal disorders, coupled with the strong focus of manufacturers to launch endoscopes, particularly for GI applications, will propel segmental growth in the coming years.

By End-user Insights

The ambulatory surgical centers segment is expected to expand at the highest CAGR during the projected period

The ambulatory surgical centers segment is expected to witness significant growth during the forecast timeframe. Several advantages of ambulatory surgical centers, such as high patient satisfaction, more personalized care, and high efficiency, have supported a trend toward increasing the number of procedures in these settings. Moreover, the growing demand for therapeutic endoscopy to treat the problems associated with the mouth, esophagus, stomach, and small intestine is expected to contribute to segmental growth.

Regional Insights

North America dominated the global endoscopes market

North America accounted for a dominant share of the market in 2023 and is likely to hold its dominance over the endoscopes market forecast period. The dominance of this region is attributed to the presence of a large patient pool suffering from various chronic disorders and rising demand for minimally invasive procedures. For instance, according to the Cancer Facts & Figures Report 2023 by the American Cancer Society, in 2023, the estimated number of people suffering from small intestine cancer in the U.S. was 12,070, compared to 11,790 in 2022.

Moreover, the growing focus of physicians in the U.S. on the proper identification of the cause of a disease leads to an increase in the need for diagnostic endoscopic procedures. Furthermore, the advent of new technologically advanced products for endoscopic procedures is expected to boost the market growth during the forecast period.

Asia Pacific will grow rapidly. This growth is due to the increasing elderly population and the growing prevalence of chronic disorders requiring endoscopic procedures. Moreover, the strong focus of market players towards the launch of new endoscopic products in countries such as China, India, & Japan drives the market growth. For instance, in January 2024, FUJIFILM India expanded its endoscopy solutions portfolio with the introduction of FushKnife & ClutchCutter. Such new products for endoscopic procedures will increase the procedural volume, thereby spurring the market growth across the region.

Key Market Players & Competitive Insights

Companies with technologically advanced and sustainable products will strengthen their market share in the coming years

The endoscopes market development is consolidated, and major players account for a significant market share. Moreover, other small and medium-sized companies are focusing on strengthening their shares in the market by launching sustainable and technologically advanced endoscopes. For instance, in October 2023, Ambu A/S announced the launch of world’s first endoscope made with bioplastics, the Ambu aScopeTM Gastro Large.

Some of the major players operating in the global market include:

- Ambu A/S (Denmark)

- Boston Scientific Corporation (U.S.)

- CONMED Corporation (U.S.)

- Ethicon (Johnson & Johnson Service Inc.) (U.S.)

- FUJIFILM Holdings Corporation (Japan)

- Karl Storz GmbH & Co., KG (Germany)

- Medtronic (U.S.)

- Olympus Corporation (Japan)

- PENTAX Medical (Japan)

- Richard Wolf GmbH (Germany)

- Stryker (U.S.)

Recent Developments in the Industry

- In January 2024, Karl Storz acquired software manufacturer Innersight Labs. The acquisition will push artificial intelligence in laparoscopic and robotic imaging solutions in the healthcare sector.

Report Coverage

The endoscopes market report emphasizes on key regions across the globe to provide better understanding of the product to the users. Also, the report provides market insights into recent developments, trends and analyzes the technologies that are gaining traction around the globe. Furthermore, the report covers in-depth qualitative analysis pertaining to various paradigm shifts associated with the transformation of these solutions.

The report provides detailed analysis of the market while focusing on various key aspects such as competitive analysis, product, usability, application, and end-user, and their futuristic growth opportunities.

Endoscopes Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 22.58 billion |

|

Revenue forecast in 2032 |

USD 43.70 billion |

|

CAGR |

8.6% from 2024 – 2032 |

|

Base year |

2023 |

|

Historical data |

2019 – 2022 |

|

Forecast period |

2024 – 2032 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2024 to 2032 |

|

Segments covered |

|

|

Regional scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, region and segmentation. |

FAQ's

The global endoscopes market size is expected to reach USD 43.70 billion by 2032

Key players in the market are Olympus Corporation, Ethicon, Stryker, Boston Scientific

North America contribute notably towards the global Endoscopes Market

Global endoscopes market exhibiting the CAGR of 8.6% during the forecast period.

The Endoscopes Market report covering key segments are product, usability, application, end-user, and region.