Electronic Health Records Market Share, Size, Trends, Industry Analysis Report

By Product (Client Server-Based EHR, Web-Based EHR), By Type, By End-Use; By Regions; Segment Forecast, 2025 - 2034

- Published Date:Sep-2025

- Pages: 119

- Format: PDF

- Report ID: PM1794

- Base Year: 2024

- Historical Data: 2020-2023

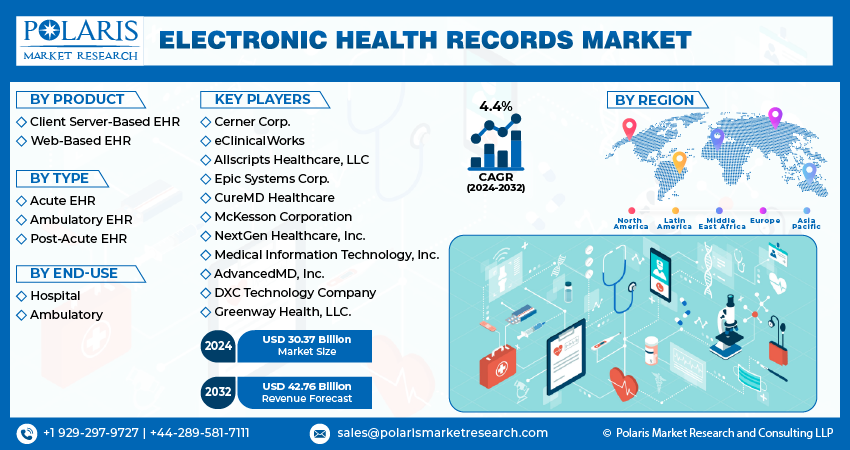

The global electronic health records market size was valued at USD 32.35 billion in 2024, exhibiting the CAGR of 5.0% during the forecast period. Favorable government initiatives to increase the adoption of IT in healthcare services and delivery for better patient outcomes is driving the market forward.

Key Insights

- By product, the web-based EHR subsegment held the largest share in 2024, due to its lower upfront costs, ease of installation without on-premises servers, and its flexibility and scalability.

- By type, the acute subsegment held the largest share in 2024, due to government-funded programs encouraging the adoption and meaningful use of EHR systems.

- By end use, the hospital use held the largest share in 2024, due to robust systems on the increasing digitized management of clinical data, clinical efficiencies, and decreasing medical errors.

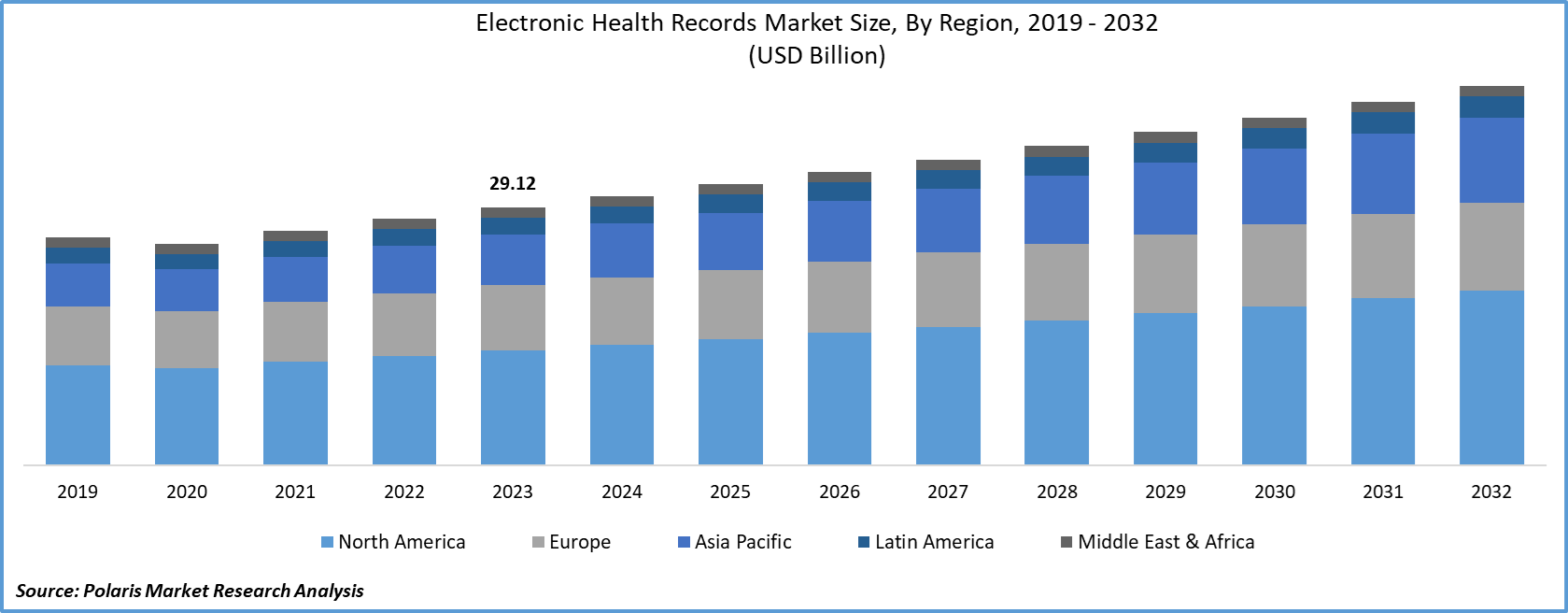

- By region, North America held the largest share in 2024 due to its HITECH Act and adoption, and the EHR infrastructure and government support of the region.

Industry Dynamics

- The increasing demand for management of healthcare data is driving the growth. With the increasing complexity of healthcare, the patients’ data that is captured is difficult to handle in paper format.

- Global governance and strategic policies and regulations are also primary factors. Governments are advocating the conversion of paper health records to electronic formats for increased integration to improve the overall safety and quality of the healthcare provided to the patients.

- The proliferation and growing use of integrated digital health solutions, such as telemedicine, is also an important factor.

Market Statistics

- 2024 Market Size: USD 32.35 billion

- 2034 Projected Market Size: USD 52.57 billion

- CAGR (2025-2034): 5.0%

- North America: Largest market in 2024

To Understand More About this Research: Request a Free Sample Report

AI Impact on the Market

- AI assists advances in technology by streamlining essential administrative tasks such as organizing patient information and other forms of automated documentation.

- AI has also improved clinical predictive analytics by devising new forms of clinical decision support.

- AI has also increased the interoperability of various information systems, whereby patient information documented in different healthcare facilities can easily be retrieved through AI and big data technology.

For instance, My Health Record, the South Korean government nationwide digital health platform to ensure medical records on the go. According to the claims of the agency, by 2022, medical providers in the country would be able to use medical data through this platform. Moreover, the emergence of innovative IT companies is providing varied specific services, contributing largely to the market growth.

Industry Dynamics

Growth Drivers

Growing demand for centralization and streamlining of medical operations is projected to boost the adoption of electronic health records in the market. Centralization of the medical management is mostly driven by the value-based model, which largely focuses on streamlining hospital management processes, outsourcing of ancillary services, and improvement in quality care with better patient outcomes. Moreover, rising mergers & acquisitions activities expected to fuel market activity.

For instance, the U.S.-based Allscripts Healthcare LLC acquired medical analytics firm Pulse8, Inc. With this acquisition, Allscripts widened its portfolio of offerings by adopting Pulse8’s intelligence software services. Electronic health records communities were able to install electronic health records systems without any value-added cost. The community was able to reciprocate its impact during pandemic. Moreover, significant rise in product demand in the market, with worldwide digitization initiatives, particularly in middle income countries, fueling the market prospects.

Report Segmentation

The market is primarily segmented on the basis of product, type, end-use, and region.

|

By Product |

By Type |

By End-Use |

By Region |

|

|

|

|

Know more about this report:request for sample pages

Insight by Product

Based upon the product, the global electronic health records market is categorized into client server-based electronic health records and web-based electronic health records. Of all, the web-based segment held the largest share in the global electronic health records industry in 2024. Factors attributed to such market growth include the growing popularity of the web-based electronic health records system among medical providers and its easy installation, without any need for in-house servers with customized solutions, ensuring scalability.

The client-based electronic health records segment is projected to register the highest market growth rate over the study period. These solutions provide safe data storage, preventing any kind of data theft, could be customized according to customer’s need, and is regarded as a favorable option among multi-physician medical facilities.

Insight by Type

On the basis of type, the acute electronic health records segment held a significant market share in 2024 and is projected to have a remarkable market growth rate over the study period. Such massive growth is attributed to favorable government initiatives to adopt small facilities. For instance, acute care facilities based in the U.S., which comes under the purview of the In-patient Prospective Payment System, are eligible in gaining benefits from medicare incentive programs.

Post-acute electronic health records are anticipated to register the highest market growth over the forecast period, owing to a rise in the spending capacity of acute care facilities. Such electronic health records are mostly used for rehabilitation services, where patients require longer hospital stays. Acute care hospitals comprise home wellbeing, rehabilitation centers, and long-term care hospitals.

Insight by End-Use

On the basis of end-use, hospital segment held a significant market share in 2024 and is projected to have a remarkable growth rate over the study period. Factors responsible for such high share include high hospital admissions, rapid flow of medical data, and low cost of installation in hospitals as compared to ambulatory centers. On contrary, the adoption of electronic health records in ambulatory centers is projected to register lucrative market growth. Rising establishments of ambulatory care centers projected to drive segment’s growth.

Geographic Overview

Geographically, North America accounts for the largest revenue holder in the global electronic health records market, owing to favorable government policies, in support of the digitization of medical infrastructure. In line with this, the federal government has introduced Federal wellbeing IT strategic plan mandating the use of electronic health records by medical services providers.

A strategic plan is outcomes-driven, with a clear focus on meeting the needs of caregivers, payers and providers, developers, medical professionals, and innovators. Policies promote the usage of standard APIs, including regulations established to implement the current Cures Act. This will encourage medical apps development to provide access to electronic health records data used to support patient-centered approach and empowerment. Additional federal activities include price disclose by payers and medical organizations, timely access to medical records at reasonable cost, and antitrust and consumer protection laws to promote, safeguard competition, and data privacy.

What is the impact of the regulations on the electronic health records market in the U.S.?

Government and other regulators are imposing stringent regulations on EHR. The regulations focus on safeguarding patient data through access controls, encryption, and breach notification protocols. A few standards and international frameworks emphasize facilitating the seamless exchange of healthcare data across various systems and platforms. Industry players are required to adhere to these norms. Also, government and private healthcare organizations focus on standardizing data management and ensuring patient privacy. Hence, regulatory compliance is a significant factor that drives the growth of the electronic health records industry in the U.S.

|

Regulation/Initiative |

Key Requirements / Focus |

Impact on EHR Market |

|

HIPAA (Health Insurance Portability and Accountability Act) |

Focuses on patient data privacy and security through access control, encryption, and breach notification |

Ensures secure handling of patient data Mandates compliance for providers and vendors |

|

HITECH Act (Health Information Technology for Economic and Clinical Health Act) |

Offers incentives for EHR adoption Focuses on "Meaningful use" of EHRs, reporting metrics |

Boosts EHR adoption Encourages standardization and interoperability of the health data |

|

Proposed HIPAA Security Rule Updates (2025) |

Mandates multi-factor authentication (MFA) Stronger encryption for electronically protected health information (EPHI) |

Mandates stringent cybersecurity requirements for EHR systems |

|

Antitrust Oversight (e.g., Epic Systems case) |

Prevent monopolistic practices Ensures interoperability |

Encourages access flexibility and vendor competition |

Competitive Insight

Some of the major market players operating the global electronic health records industry include Cerner Corp., eClinicalWorks, Allscripts Healthcare, LLC, Epic Systems Corp., CureMD Healthcare, McKesson Corporation, NextGen Healthcare, Inc., Medical Information Technology, Inc., AdvancedMD, Inc., DXC Technology Company, and Greenway Health, LLC.

Industry Dynamics

November 2024: CarolinaEast implemented the Epic Electronic Health Record (EHR) System to strengthen care delivery across the U.S.

October 2024: Athenahealth introduced athenaOne, an integrated solution combining EHR, revenue cycle, practice management, and patient engagement tools tailored for orthopedic practices.

Report Scope:

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 32.35 billion |

|

Market Size in 2025 |

USD 33.89 billion |

|

Revenue Forecast by 2034 |

USD 52.57 billion |

|

CAGR |

5.0% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Insights |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

? The global market size was valued at USD 32.35 billion in 2024 and is projected to grow to USD 52.57 billion by 2034.

? The global market is projected to register a CAGR of 5.0% during the forecast period.

? North America dominated the share in 2024.

? A few key players include Cerner Corp., eClinicalWorks, Allscripts Healthcare, LLC, Epic Systems Corp., CureMD Healthcare, McKesson Corporation, NextGen Healthcare, Inc., Medical Information Technology, Inc., AdvancedMD, Inc., DXC Technology Company, and Greenway Health, LLC.

? The acute segment accounted for the largest share of the market in 2024.

? The hospital use segment dominated the market in 2024.