Board Governance Training Market Size, Share, & Industry Analysis Report

: By Type (Workshops & Seminars, Online/E-Learning Modules), By Application, By Industry, By Size, and By Region – Market Forecast, 2025–2034

- Published Date:Jun-2025

- Pages: 129

- Format: PDF

- Report ID: PM5860

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

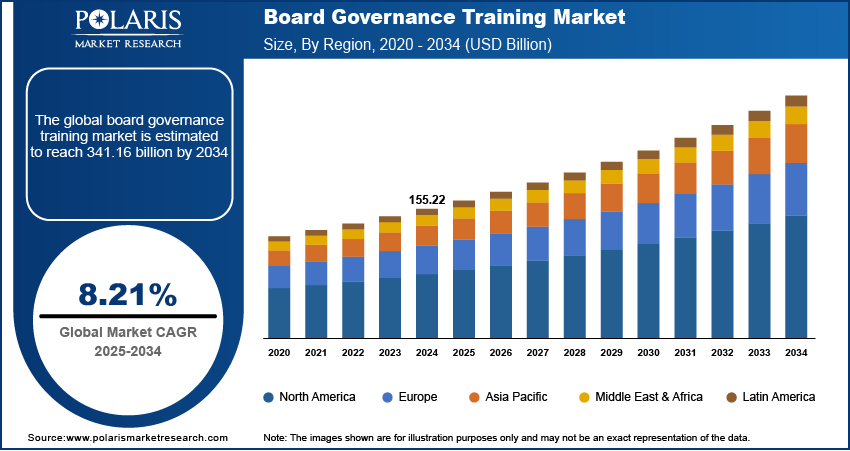

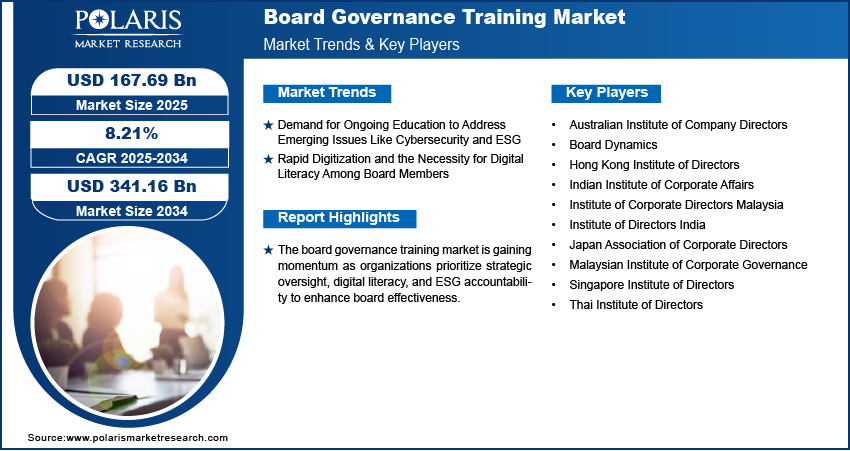

The global board governance training market size was valued at USD 155.22 billion in 2024, growing at a CAGR of 8.21% from 2025–2034. The growth is driven by the expanding stakeholder expectations for transparency and accountability, demand for ongoing education to address emerging issues, rapid digitization.

Board governance training refers to structured educational programs designed to enhance the skills, knowledge, and effectiveness of board members in fulfilling their oversight responsibilities. The demand for board governance training is on the rise as organizations operate in increasingly complex business environments and face evolving regulatory landscapes. Today’s directors navigate complex legal frameworks, digital transformation challenges, and rising financial risks, requiring a deeper understanding of compliance, risk management, and ethical decision-making. This complexity has driven boards to prioritize continuous learning to stay current with the rapidly changing governance ecosystem, making board training a strategic imperative rather than a regulatory formality.

To Understand More About this Research: Request a Free Sample Report

The expanding stakeholder expectations for transparency and accountability further drive the expansion opportunities. Investors, employees, customers, and regulators demand greater transparency in corporate operations and decision-making, and boards are expected to lead with integrity and transparency. Additionally, effective governance now relies on a board’s ability to engage in informed oversight, ask the right questions, and ensure ethical leadership. Training programs equip board members with the necessary competencies to fulfill these expectations, from ESG reporting to ethical conduct and stakeholder communication, thereby reinforcing their role in promoting long-term value and public trust.

Industry Dynamics

Demand for Ongoing Education to Address Emerging Issues Like Cybersecurity and ESG

The demand for ongoing education to address emerging issues, such as cybersecurity and ESG, is driving the sector's growth, as boards are increasingly required to oversee areas far beyond traditional financial metrics. Directors must possess the awareness and strategic understanding necessary to guide their organizations through these challenges as cyber threats become increasingly refined and ESG concerns gain importance in investor and regulatory agendas. For instance, in April 2025, Algeria-linked hackers targeted Morocco's National Social Security Fund, compromising the personal and financial data of ~2 million individuals from 500,000 companies. Moreover, governance training equips board members with current knowledge and practical insights into risk mitigation, sustainable practices, and compliance frameworks. This equips them to make informed decisions and uphold their responsibilities in a rapidly evolving business environment.

Rapid Digitization and the Necessity for Digital Literacy Among Board Members

Rapid digitization and the growing need for digital literacy among board members have significantly increased the demand for specialized governance training. Boards must understand the implications of these tools for strategy, security, and long-term growth as organizations integrate advanced technologies such as Artificial Intelligence, cloud computing, and data analytics into their operations. Digital literacy is no longer optional but essential for effective oversight and innovation governance. According to a GDI 2024 report, digitalization and intelligence will fuel 70% of global economic growth over the next five years, with the digital economy expanding at a 9.2% CAGR. Board training programs now focus on enhancing directors’ technological fluency, enabling them to engage in meaningful discussions, challenge assumptions, and contribute to shaping resilient, future-ready organizations.

Segmental Insights

Type Analysis

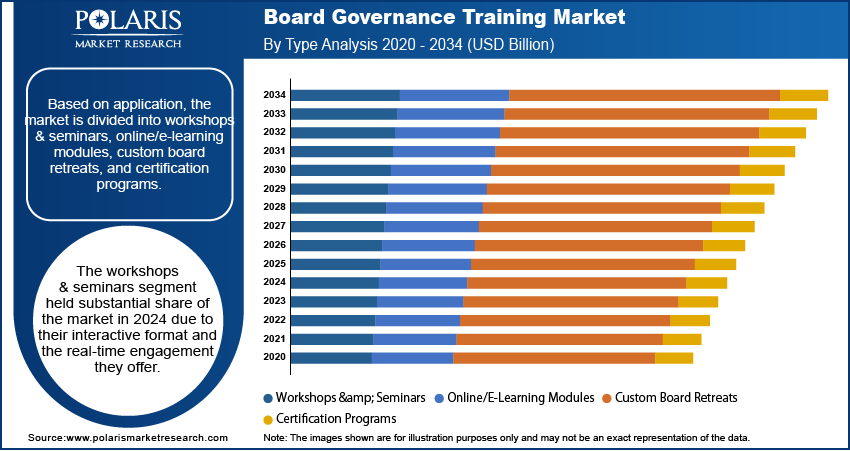

The global segmentation, based on type, includes workshops & seminars, online/e-learning modules, custom board retreats, and certification programs. The workshops & seminars segment held substantial share of the market in 2024 due to their interactive format and the real-time engagement they offer. These in-person or virtual gatherings enable direct dialogue among board members, facilitators, and subject-matter experts, creating a dynamic environment for knowledge exchange and scenario-based learning. Organizations often prefer this format to facilitate strategic discussions, simulate crisis responses, and build peer-level collaboration. Additionally, the tangible benefits of networking, hands-on learning, and tailored content delivery have contributed to their continued popularity among boards seeking wide and impactful training sessions.

Application Analysis

The global segmentation, based on application, includes foundational compliance training, advanced strategy & oversight, crisis management & risk oversight, and ESG integration for boards. The ESG integration for boards segment is expected to witness rapid growth during the forecast period as stakeholders increasingly demand responsible and transparent governance that aligns with environmental and social considerations. Boards are now expected to evaluate sustainability strategies, assess ESG risks, and ensure alignment with evolving regulatory expectations and investor scrutiny. Governance training focused on ESG equips directors with the frameworks, metrics, and strategic tools necessary to integrate sustainability into their corporate oversight. Therefore, as ESG continues to shape corporate reputations and access to capital, boards are boosting efforts to enhance their competency in this domain.

Industry Analysis

The global segmentation, based on industry, includes financial services, healthcare, technology, and public sector entities. The financial services segment is expected to grow with a significant CAGR during the forecast period due to the high regulatory burden, risk sensitivity, and emphasis on fiduciary responsibility. Financial institutions are facing increasing scrutiny of their governance practices, particularly in areas such as cybersecurity, compliance, and ESG reporting. Boards in the sector are investing heavily in training programs that strengthen oversight capabilities, improve accountability, and address emerging risks to navigate this complex landscape. This strategic investment in board education is considered essential for maintaining trust, ensuring regulatory alignment, and achieving long-term stability.

Size Analysis

The global segmentation, based on size, includes large enterprises, medium businesses, and small businesses. The large enterprises segment growth is driven by the complexity and scale of their operations, which necessitate governance practices. These organizations often operate across multiple jurisdictions, facing diverse regulatory, technological, and reputational challenges. As a result, their boards require advanced training to stay current with global compliance standards, manage multi-faceted risks, and guide enterprise-wide strategic decisions.

Additionally, large enterprises typically allocate greater resources to structured governance development, reinforcing their commitment to board effectiveness and accountability.

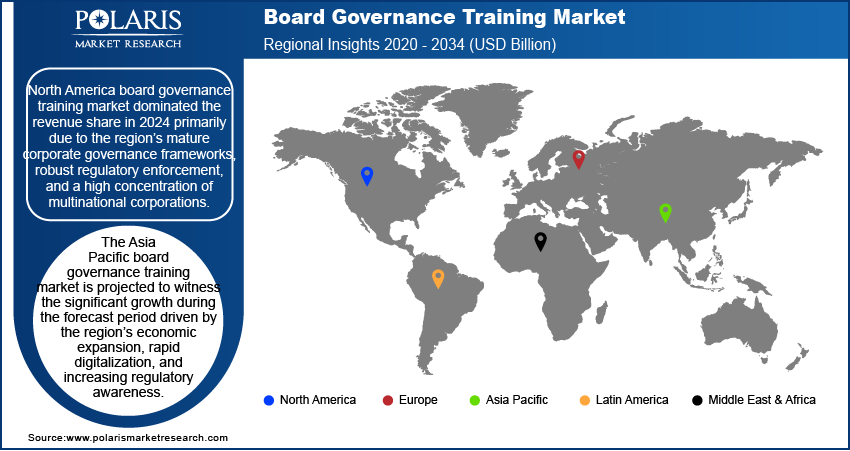

Regional Analysis

The report provides market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. North America board governance training market dominated the revenue share in 2024 primarily due to the region’s mature corporate governance frameworks, robust regulatory enforcement, and a high concentration of multinational corporations. According to a January 2025 report from the US Department of Commerce, global employment by US multinationals increased by 2.2% in 2022, reaching 44.3 million workers compared to 43.3 million in 2021. The heightened expectations for board performance, transparency, and ethical oversight have prompted organizations across sectors to institutionalize governance education. Moreover, the presence of well-established training providers and thought leadership hubs contributes to the region's leadership in structured board development initiatives.

The US board governance training market held the largest share, due to its well-established corporate governance ecosystem and a strong culture of regulatory compliance. US boards face high expectations regarding accountability, transparency, and performance, driving continuous investment in director education. The presence of leading training providers think tanks and governance institutes further strengthens the market, making board training an integral part of organizational leadership development.

The Asia Pacific board governance training market is projected to witness the significant growth during the forecast period driven by the region’s economic expansion, rapid digitalization, and increasing regulatory awareness. There is an increasing focus on strengthening governance structures to meet international standards as companies in the Asia Pacific mature and integrate into global value chains. This has driven demand for specialized training that equips board members with skills in risk management, strategic leadership, and ESG integration, positioning them for effective oversight in a globally competitive landscape.

China's board governance training sector is experiencing growth, fueled by ongoing corporate reforms, increased international investor participation, and a shifting regulatory landscape. There is a growing need for directors to align with international governance standards as Chinese companies expand their global operations. This has led to rising demand for structured training programs that focus on risk oversight, ESG, and digital transformation from a governance perspective.

The Europe board governance training market is projected to witness substantial growth during the forecast period driven by a strong regulatory focus on corporate accountability, ESG performance, and stakeholder engagement. European organizations are increasingly adopting governance training into their board culture to align with strict compliance mandates and shifting societal expectations. The focus on ethical leadership, transparency, and sustainable corporate practices is driving demand for continuous board education, ensuring directors are equipped to guide organizations responsibly and effectively in a complex policy environment.

The UK board governance training market has emerged as a major player, owing to its progressive approach to corporate governance and its emphasis on ethical leadership and sustainability. British organizations are increasingly prioritizing board education to meet evolving expectations around ESG integration, diversity, and strategic resilience. The UK's strong regulatory foundation and history of governance best practices support a robust training market for both private and public entities.

Key Players & Competitive Analysis

The board governance training sector is witnessing transformation, driven by economic and geopolitical shifts, as well as rising demand for sustainable value chains. Leading players, such as the Australian Institute of Company Directors and the Singapore Institute of Directors, dominate developed markets, leveraging industry-leading competitive intelligence to deliver programs aligned with future development strategies. Meanwhile, regional institutes such as the Indian Institute of Corporate Affairs and the Thai Institute of Directors are capitalizing on latent demand and opportunities in emerging markets, where governance standards are evolving rapidly. Disruptions and trends in digital learning platforms and ESG integration are reshaping vendor strategies, with providers like Board Dynamics focusing on business transformation through customized training. Competitive positioning increasingly hinges on technological advancements in virtual training and AI-driven analytics, while strategic investments in certification programs address growth opportunities among small and medium-sized businesses. Providers must align their offerings with trends, such as diversity mandates and climate governance, to maintain relevance as macroeconomic trends intensify scrutiny of corporate accountability. This dynamic landscape highlights the need for expert insights to navigate expansion opportunities and revenue growth in a crowded field.

A few key players are Australian Institute of Company Directors, Board Dynamics, Hong Kong Institute of Directors, Indian Institute of Corporate Affairs, Institute of Corporate Directors Malaysia, Institute of Directors India, Japan Association of Corporate Directors, Malaysian Institute of Corporate Governance, Singapore Institute of Directors, and Thai Institute of Directors.

Key Players

- Australian Institute of Company Directors

- Board Dynamics

- Hong Kong Institute of Directors

- Indian Institute of Corporate Affairs

- Institute of Corporate Directors Malaysia

- Institute of Directors India

- Japan Association of Corporate Directors

- Malaysian Institute of Corporate Governance

- Singapore Institute of Directors

- Thai Institute of Directors

Industry Developments

June 2025: The Corporate Governance Institute launched an Enterprise Learning Platform to address leadership accountability gaps. The platform delivers structured governance education for board directors and executives across healthcare, tech, finance, and public sectors.

July 2024: Duke Corporate Education and the Corporate Governance Institute partnered to enhance director training programs, addressing tightening global governance standards. The collaboration combines Duke CE’s executive education expertise with CGI’s certification leadership to develop next-generation board members.

Board Governance Training Market Segmentation

By Type Outlook (Revenue, USD Billion, 2020–2034)

- Workshops & Seminars

- Online/E-Learning Modules

- Custom Board Retreats

- Certification Programs

By Application Outlook (Revenue, USD Billion, 2020–2034)

- Foundational Compliance Training

- Advanced Strategy & Oversight

- Crisis Management & Risk Oversight

- ESG Integration for Boards

By Industry Outlook (Revenue, USD Billion, 2020–2034)

- Financial Services

- Healthcare

- Technology

- Public Sector Entities

By Size Outlook (Revenue, USD Billion, 2020–2034)

- Large Enterprises

- Medium Businesses

- Small Businesses

By Regional Outlook (Revenue, USD Billion, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Board Governance Training Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 155.22 billion |

|

Market Size in 2025 |

USD 167.69 billion |

|

Revenue Forecast by 2034 |

USD 341.16 billion |

|

CAGR |

8.21% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 155.22 billion in 2024 and is projected to grow to USD 341.16 billion by 2034.

The global market is projected to register a CAGR of 8.21% during the forecast period.

North America dominated the market share in 2024.

A few of the key players in the market are Australian Institute of Company Directors, Board Dynamics, Hong Kong Institute of Directors, Indian Institute of Corporate Affairs, Institute of Corporate Directors Malaysia, Institute of Directors India, Japan Association of Corporate Directors, Malaysian Institute of Corporate Governance, Singapore Institute of Directors, and Thai Institute of Directors.

The workshops & seminars segment held substantial share of the market in 2024.

The ESG integration for boards segment is expected to witness rapid growth during the forecast period.