E-learning Market Share, Size, Trends, Industry Analysis Report

By Provider (Content Provider, Service Provider), By Deployment Model, By Course, By End User; By Region; Segment Forecast, 2025 - 2034

- Published Date:Sep-2025

- Pages: 114

- Format: PDF

- Report ID: PM2295

- Base Year: 2024

- Historical Data: 2020 - 2023

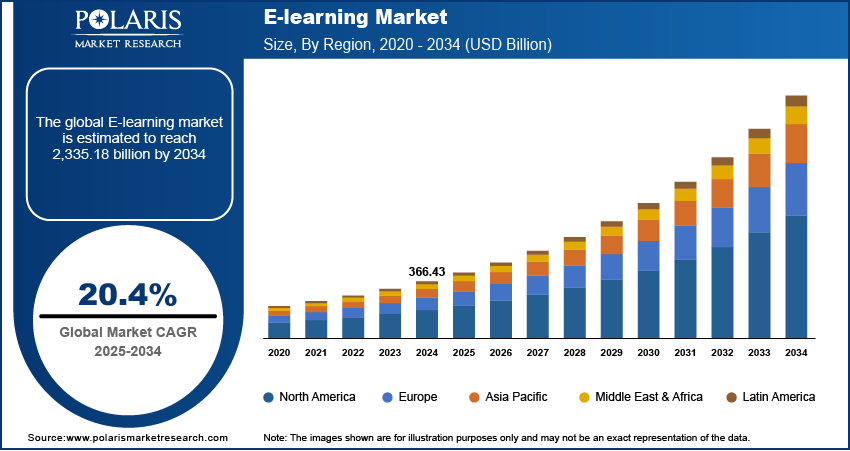

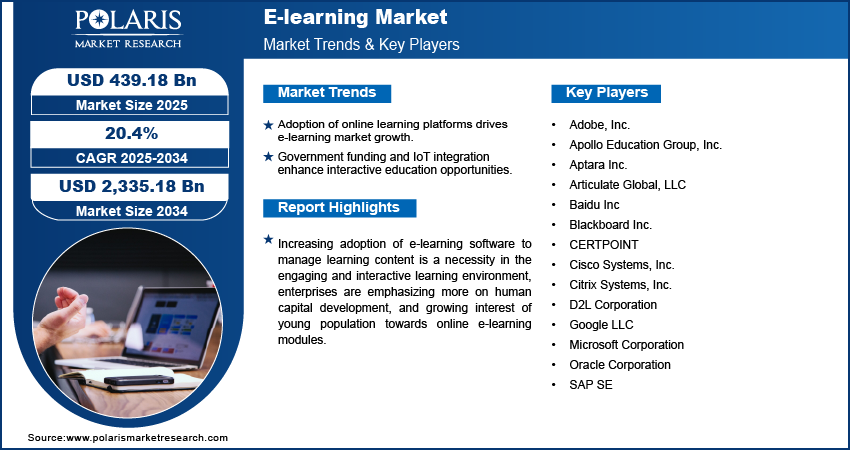

The global E-learning market was valued at USD 366.43 billion in 2024 and is expected to grow at a CAGR of 20.4% during the forecast period. Key factors driving the market demand includes emergence of AI in e-learning service, smart digitized content, rising government initiatives on smart education and learning, and increasing adoption of online learning solutions and platforms.

Key Insights

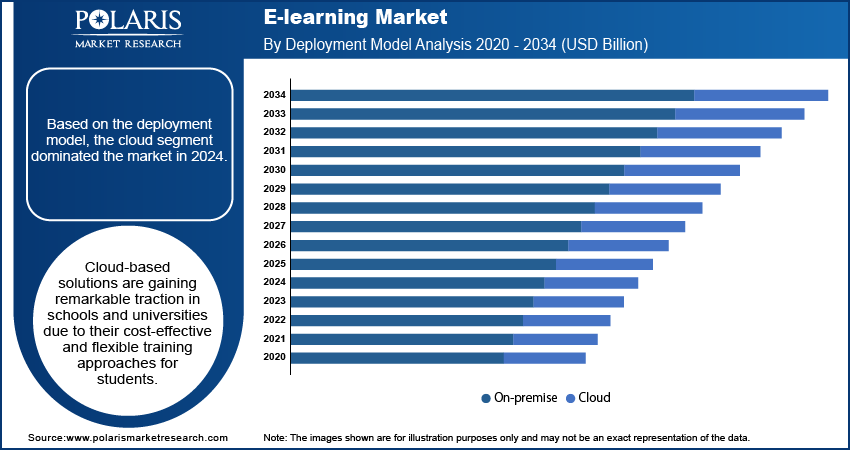

- In 2024, the cloud segment accounted for the largest market share. This is due to the traction in schools and universities, which is driven by their cost-effective and flexible training approaches for students.

- The higher education segment is projected to witness significant growth during the forecast period due to the rise in adoption of advanced learning methodologies, which offer low-cost, specialized course learning.

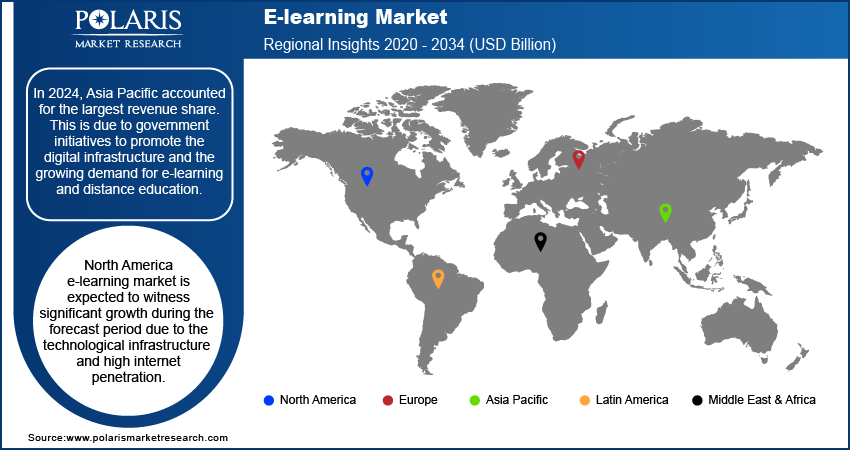

- North America e-learning market is expected to witness significant growth during the forecast period due to the technological infrastructure and high internet penetration.

- In 2024, Asia Pacific accounted for the largest revenue share. This is due to government initiatives to promote the digital infrastructure and the growing demand for e-learning and distance education.

Industry Dynamics

- The rise in adoption of online learning platforms by educational centers for advanced teaching methods are driving the e-learning market.

- Rise in government funding for smart education and integration of IoT makes learning interactive contributing to the growth opportunities for the industry.

- Digital fatigue and lack of personal intreaction leads to high drop rates as e-learning sector faces challenges to ensure learning engagement and completion rates.

- Integration of generative AI and technologies such as AR and VR creates opportunity for the creation of adaptive, personalized, and engaging learning experience for premium pricing.

Market Statistics

- 2024 Market Size: USD 366.43 billion

- 2034 Projected Market Size: USD 2,335.18 billion

- CAGR (2025-2034): 20.4%

- Asia Pacific: Largest market in 2024

To Understand More About this Research: Request a Free Sample Report

AI Impact on E-Learing Market

- AI assesses each student's performance and learning styles to automate the creation of personalized lessons and recommend personalized content.

- It automates the grading process, provides instant feedback on homework and assignments, and deploys chatbots to answer students questions.

- Many AI tools are expected to create personalized, interactive learning materials and cultivate simulations of real-world scenarios for practice, increasing the pool of educational resources.

- AI is expected to provide early alerts and assessments for educators to identify students at risk of disengagement and falling behind.

Increasing adoption of e-learning software to manage learning content is a necessity in the engaging and interactive learning environment, enterprises are emphasizing more on human capital development, and growing interest of young population towards online e-learning modules. AI and machine learning have grown tremendously in e-learning services since it enables customized content depending on each student's requirement. Furthermore, the introduction of technologies like VR and AR produced realistic and active-training environments, improving skill acquisitions. The innovation in technology, with the shift toward flexible and remote work environments, is also a contributing factor in the e-learning platforms in corporate and academic educational environments.

Industry Dynamics

Growth Drivers

The adoption of online learning solutions and platforms is being deployed throughout the educational institution region to assess the effectiveness of advanced learning methodologies, thereby contributing significantly to the growth of the e-learning market. Furthermore, the surging focus on childhood education and the growing public-private funding for K-12 education are further driving industry growth during the forecast period.

Additionally, increasing government initiatives in smart education and learning will further create high growth prospects for the industry globally. IoT devices have been utilized to facilitate e-learning and education, making the exchange of information simple, exciting, and interactive, thereby gaining wide acceptance in the industry, which in turn is expected to accelerate the growth of the e-learning market worldwide.

Report Segmentation

The market is primarily segmented on the basis of provider, deployment model, course, end-user, and region.

|

By Provider |

By Deployment Model |

By Course |

By End User |

By Region |

|

|

|

|

|

Know more about this report: request for sample pages

Segmental Insights

Deployment Model Analysis

Based on the deployment model, the cloud segment dominated the market in 2024. Cloud-based solutions are gaining remarkable traction in schools and universities due to their cost-effective and flexible training approaches for students. The amalgamation of cloud technology in digital learning allows students to access information at any time and place. The cloud computing-based e-learning technology further enables educational institutions to build a virtual environment for learners and educators. Thus, cloud technology is majorly implemented in the education sector, which is expected to contribute towards high segmental growth.

Course Analysis

The primary and secondary education segment dominated the global industry due to the increased utilization of digital learning methods in primary schools, especially in the wake of the COVID scenario, along with the significant presence of online K-12 education providers across the world. Further, digital tools, such as smartphones, have become an exciting learning tool used to improve education quality and e-learning in distance education. Also, the use of digital mediums ensures greater flexibility in course delivery, making it feasible for learners to access online learning platforms and retrieve course resources. Thus, the emergence of a digital learning solution for primary and secondary education to engage online training courses, which in turn expands the industry growth during the forecast timeframe.

The higher education segment is projected to witness a significant growth stake in the overall industry due to the rise in adoption of advanced learning methodologies that can be effective to the education sector, on account of its various benefits, such as offering low cost of education specialized course learning. According to IBM statistics, e-learning can raise productivity by about 50% by utilizing online learning software. Therefore, these factors are anticipated to promote market growth across the globe.

Regional Analysis

North America E-Learning Market Assessment

North America e-learning market is expected to witness significant growth during the forecast period due to the technological infrastructure and high internet penetration, which provide advancements in digital platforms. The region's high number of leading edtech companies and universities has boosted innovation with immersive and AI technologies. Moreover, investment in employee training to adopt online learning solutions boosts the demand.

Asia Pacific E-Learning Market Insights

Asia-Pacific is accounted for the largest revenue share in the global E-learning market in 2024. This is due to government initiatives to promote the digital infrastructure and the growing demand for e-learning and distance education. The policy indicates that online education is developing to a noticeable extent. Furthermore, the rapid rise in the number of smart device users and the large presence of online K-12 education providers are directly impacting the higher market growth in emerging Asian countries, such as China, India, Malaysia, and others. Asia-Pacific market accounts for a significant stake in the global market over the foreseen period, owing to the growing number of public-private funding on K-12 education.

Europe E-Learning Market Assessment

Europe also witnessed remarkable growth in the global market due to the high presence of the education system in Europe that paved the way for the e-learning market. Further, the European government funds and private companies on educational and vocational programs can insist citizens benefit from opportunities that emerged in online education. Thus, the market will grow at an unprecedented rate throughout the forecast period.

Competitive Insight

Some of the major players operating in the global market include Adobe, Inc., Apollo Education Group, Inc., Aptara Inc., Articulate Global, LLC, Baidu Inc, Blackboard Inc., CERTPOINT, Cisco Systems, Inc., Citrix Systems, Inc., D2L Corporation, Google LLC, Microsoft Corporation, Oracle Corporation, and SAP SE.

E-learning Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 366.43 Billion |

|

Market Size in 2025 |

USD 439.18 Billion |

|

Revenue Forecast by 2034 |

USD 2,335.18 Billion |

|

CAGR |

20.4% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

• The global market size was valued at USD 366.43 billion in 2024 and is projected to grow to USD 2,335.18 billion by 2034.

• The global market is projected to register a CAGR of 20.4% during the forecast period.

• Asia Pacific dominated the global market share in 2024.

• A few market players are Adobe, Inc., Apollo Education Group, Inc., Aptara Inc., Articulate Global, LLC, Baidu Inc, Blackboard Inc., CERTPOINT, Cisco Systems, Inc., Citrix Systems, Inc., D2L Corporation, Google LLC, Microsoft Corporation, Oracle Corporation, and SAP SE.

• In 2024, the cloud segment accounted for the largest market share.

• The higher education segment is projected to witness significant growth during the forecast period.