ESG Advisory Market Size, Share, & Industry Analysis Report

: By Type (Environmental Advisory, Social Responsibility Advisory), By Application, By Industry, By Size, and By Region – Market Forecast, 2025–2034

- Published Date:Jun-2025

- Pages: 125

- Format: PDF

- Report ID: PM5861

- Base Year: 2023

- Historical Data: 2020-2023

Market Overview

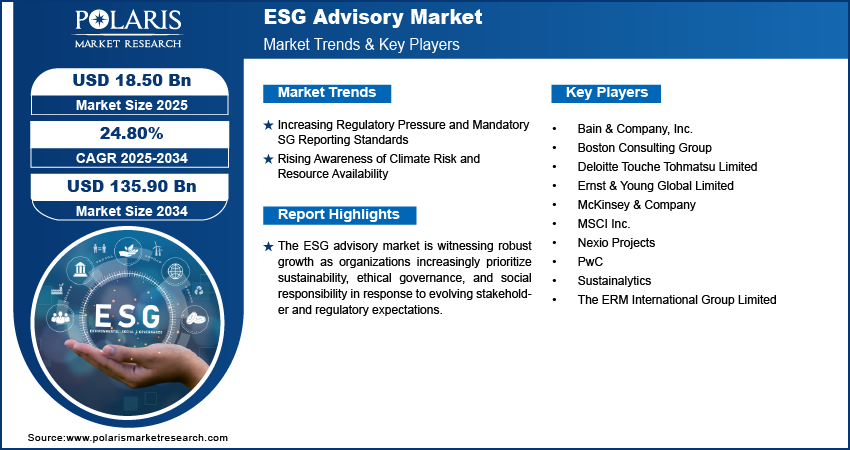

The global ESG advisory market size was valued at USD 14.89 billion in 2024, growing at a CAGR of 24.80% from 2025–2034. The growth is driven by influence of sustainable and responsible investing, focus on diversity, equity, and inclusion (DEI), increasing regulatory pressure and mandatory ESG reporting standards, and others.

ESG advisory refers to specialized consulting services that help organizations integrate environmental, social, and governance (ESG) principles into their core strategies, operations, and reporting frameworks. The growing influence of sustainable and responsible investing is driving growth opportunities. The demand for credible ESG advisory services has surged as investors increasingly evaluate companies based on their ESG performance rather than just financial metrics. Organizations are turning to ESG consultants to align their sustainability initiatives with investor expectations, improve transparency, and gain competitive advantage. For instance, in March 2023, EY and IBM partnered to help businesses navigate ESG challenges by aligning sustainability with financial performance, combining strategic advisory services with technology solutions to manage ESG data complexity. This shift has encouraged firms to incorporate long-term ESG considerations into decision-making processes, further boosting the relevance of advisory services in guiding businesses through the evolving investment landscape.

To Understand More About this Research: Request a Free Sample Report

The increasing focus on diversity, equity, and inclusion (DEI) within ESG frameworks further contributes to the expansion of opportunities. DEI has emerged as an essential component of the ‘Social’ pillar, with stakeholders demanding greater accountability in enabling inclusive workplace cultures. ESG advisors play a crucial role in helping organizations develop DEI strategies, establish measurable goals, and monitor progress in alignment with global best practices. Companies are seeking expert guidance to integrate DEI values into their corporate governance and operational policies as regulatory scrutiny and stakeholder awareness of social impact issues increase. This increasing focus on social responsibility is driving advisory firms to refine their offerings and deliver targeted, data-driven insights to ensure meaningful DEI integration.

Industry Dynamics

Increasing Regulatory Pressure and Mandatory ESG Reporting Standards

The increasing regulatory pressure and the introduction of mandatory ESG reporting standards across various jurisdictions are fueling the growth opportunities. Companies are driven to improve transparency in their environmental, social, and governance practices as governments and regulatory bodies tighten disclosure requirements. For instance, in June 2025, SEBI established standards for issuing ESG debt securities in India, addressing social, environmental, and sustainability-linked bonds for disclosures, third-party verification, and alignment with global standards to enhance transparency and investor confidence in sustainable finance. This growing compliance burden has led organizations to aim for expertise from advisory firms to navigate complex regulations, align with evolving standards, and lower compliance-related risks. The advisors assist in developing robust reporting frameworks, conducting materiality assessments, and assuring data accuracy.

Rising Awareness of Climate Risk and Resource Availability

The rising awareness of climate risk and resource availability is reshaping corporate priorities and investor expectations. Companies are under increasing pressure to assess, manage, and disclose their environmental impact as climate-related risks such as extreme weather events and resource scarcity become more pronounced. For instance, in April 2025, EFM and Sojitz Corporation launched a USD 200 million forestry fund targeting climate-smart forest management and carbon credit generation in the US, aiming for EFM’s forestry expertise with Sojitz’s capital networks to deliver biodiversity and community co-benefits. ESG advisory services help businesses identify vulnerabilities, implement climate-resilient strategies, and align their operations with sustainable resource use. This growing recognition of environmental risk is driving firms to actively incorporate climate considerations into long-term planning, further strengthening the role of these advisors in shaping sustainable corporate strategies and risk mitigation frameworks.

Segmental Insights

Type Analysis

The segmentation, based on type, includes environmental advisory, social responsibility advisory, governance & ethics advisory, ESG reporting & disclosure. The ESG reporting & disclosure segment is expected to witness fastest growth during the forecast period due to the rapid acceleration in global regulatory frameworks and increasing investor expectations for transparency. Companies are increasingly required to disclose their ESG performance in a standardized, auditable manner, creating demand for specialized advisory services. These advisors help organizations navigate evolving disclosure standards, integrate ESG metrics into financial reporting, and align with global frameworks such as the TCFD, GRI, or SASB. Additionally, the need for reliable ESG reporting solutions continues to rise, driving the growth of this segment as scrutiny over data accuracy and completeness boosts.

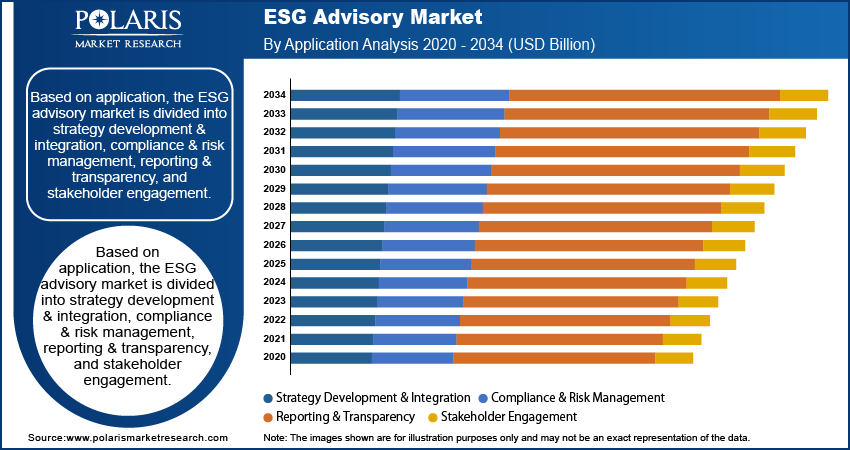

Application Analysis

The global segmentation, based on application, includes strategy development & integration, compliance & risk management, reporting & transparency, and stakeholder engagement. The strategy development & integration services segment held the largest share of the market in 2024 as organizations increasingly prioritized ESG principles in their core business strategies. Rather than treating ESG as a compliance function, businesses are adopting a proactive, strategic approach to sustainability. ESG advisors play a crucial role in guiding clients through materiality assessments, setting goals, and integrating ESG into operational models and governance structures. This strategic alignment not only enhances long-term value creation but also helps company’s future-proof their operations against environmental monitoring and social disruptions, making this segment a central focus of ESG advisory demand.

Industry Analysis

The global segmentation, based on industry, includes energy & utilities, manufacturing, financial services, technology, healthcare. The energy & utilities segment is expected to grow at a significant CAGR during the forecast period driven by the sector’s urgent need to transition towards low-carbon, sustainable practices. Firms within this sector are increasingly turning to ESG advisory services for support in emissions management, climate risk mitigation, and reporting as they face mounting pressure to decarbonize and adopt cleaner technologies. ESG consultants help these companies align their operations with global sustainability goals, manage resource dependencies, and address investor scrutiny. Thus, as the sector witness’s structural transformation, advisory services become crucial for navigating regulatory expectations and stakeholder demands.

Size Analysis

The global segmentation, based on size, includes large enterprises, medium businesses, small businesses. The large enterprises segment growth is driven by their complex operational structures, higher regulatory exposure, and increased visibility among stakeholders. These organizations are often early adopters of ESG initiatives, aiming to maintain brand reputation, access sustainable financing, and meet shareholder demands. Large enterprises typically allocate dedicated budgets for ESG programs and are more likely to invest in specialized advisory services to develop integrated strategies, ensure compliance, and deliver robust ESG reporting. Moreover, their scale and global presence make it essential to manage ESG risks comprehensively, fueling continued reliance on ESG consulting support.

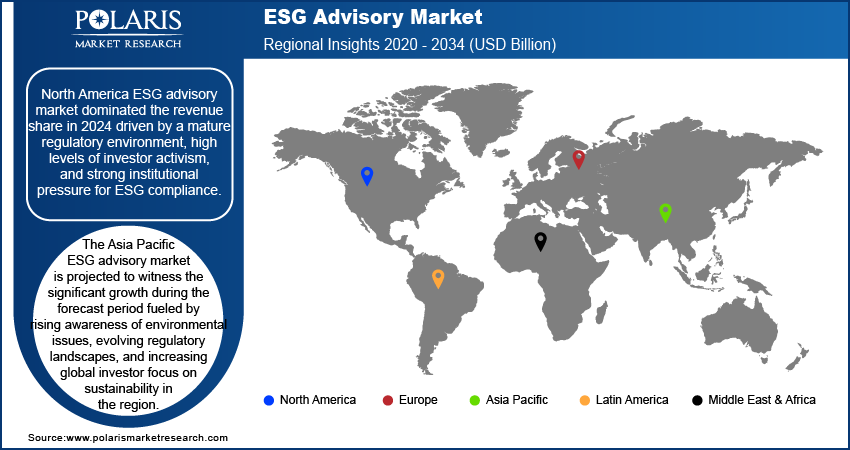

Regional Analysis

The report provides market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. North America ESG advisory market dominated the revenue share in 2024 driven by a mature regulatory environment, high levels of investor activism, and strong institutional pressure for ESG compliance. Organizations across sectors have increasingly adopted ESG frameworks to meet the growing expectations of shareholders, regulators, and customers. For instance, in February 2025, Ramboll partnered with IBM to enhance client’s sustainability efforts by combining expertise in ESG data management, reporting software, and digital solutions. The presence of a well-established financial sector, robust corporate governance practices, and early adoption of sustainability frameworks further strengthened the region’s leadership. ESG in North America plays a crucial role in helping companies improve their sustainability reporting, stakeholder engagement, and long-term value creation strategies.

The US ESG advisory market held the largest share, primarily due to the presence of a mature financial ecosystem, strong regulatory momentum, and heightened investor demand for ESG-aligned disclosures. US-based corporations are increasingly prioritizing ESG integration to meet the expectations of institutional investors and mitigate reputational risks. Additionally, the market benefits from a high level of corporate awareness, active shareholder engagement, and widespread adoption of ESG rating frameworks, which has driven the need for strategic advisory services.

The Asia Pacific ESG advisory market is projected to witness the significant growth during the forecast period fueled by rising awareness of environmental issues, evolving regulatory landscapes, and increasing global investor focus on sustainability in the region. Rapid industrialization and urbanization have brought ESG concerns to the forefront, driving businesses to aim for expert guidance in integrating ESG practices. Additionally, demand for advisory services related to emissions tracking, climate risk assessments, and ESG integration is accelerating as regional economies commit to decarbonization and climate-related goals. This structural shift positions Asia Pacific as a major growth hub for these advisory services.

China's ESG advisory sector is experiencing growth, fueled by the government’s intensified focus on green technology & sustainability, carbon neutrality targets, and sustainable finance. Chinese enterprises are becoming increasingly aware of the strategic importance of ESG, particularly in aligning with global supply chain expectations and enhancing access to international capital. This evolving landscape is encouraging businesses to engage ESG consultants to help build credible frameworks, measure performance and align with international best practices.

The Europe ESG advisory market is projected to witness substantial growth during the forecast period driven by driven by its strict regulatory environment, advanced sustainability policies, and heightened stakeholder expectations. The region has long been a leader in ESG innovation, with strong alignment between the public and private sectors on climate and social governance goals. Businesses are increasingly compelled to align with the European Union’s ESG disclosure regulations and climate objectives, creating a strong demand for advisory support. ESG consultants in Europe are helping firms navigate compliance, conduct impact assessments, and develop long-term, measurable sustainability strategies that align with evolving regulatory and market dynamics.

The UK ESG advisory market has emerged as a major player, supported by a well-established regulatory foundation, investor activism, and a strong culture of corporate transparency. UK firms are increasingly aiming for expert advisory to comply with evolving disclosure mandates and embed ESG into their long-term business strategies. The country’s focus on responsible governance, coupled with growing pressure from stakeholders and institutional investors, is reinforcing the demand for specialized ESG consulting services.

Key Players & Competitive Analysis

The ESG advisory sector is witnessing dynamic shifts as firms navigate economic and geopolitical shifts, sustainable value chains, and emerging market segments. Companies dominate developed markets, leveraging strategic investments and expert insights to guide clients on compliance and risk management, stakeholder engagement, and ESG reporting. Meanwhile, niche players such as Sustainalytics and ERM focus on competitive intelligence, helping small and medium-sized businesses adapt to the trends and regulatory disruptions. The rise of technological advancements in data analytics is reshaping revenue opportunities, enabling advisors to deliver future development strategies tailored to sectors such as financial services and energy & utilities.

Additionally, major differentiators include vendor share in high-growth markets, pricing insights, and regional footprint, with firms increasingly prioritizing joint ventures and mergers and acquisitions to expand their partner ecosystems.

A few key players are Bain & Company, Inc.; Boston Consulting Group; Deloitte Touche Tohmatsu Limited; Ernst & Young Global Limited; McKinsey & Company; MSCI Inc.; Nexio Projects; PwC; Sustainalytics; The ERM International Group Limited.

Key Players

- Bain & Company, Inc.

- Boston Consulting Group

- Deloitte Touche Tohmatsu Limited

- Ernst & Young Global Limited

- McKinsey & Company

- MSCI Inc.

- Nexio Projects

- PwC

- Sustainalytics

- The ERM International Group Limited

Industry Developments

April 2025: ESG Book ‘LEO’, launched in collaboration with BCG and Google Cloud, it streamlines sustainability reporting for corporates and financial institutions. It addresses data gaps, aligns with regulations, and reduces reporting burdens via smart pre-fill and cross-framework mapping.

July 2024: Kennedys IQ and Vested Impact partnered to integrate ESG data into insurance underwriting, claims, and compliance processes, with plans to expand to supply chain management. The collaboration leverages transparent algorithms and cognitive decision science to enhance client decision-making.

ESG Advisory Market Segmentation

By Type Outlook (Revenue, USD Billion, 2020–2034)

- Environmental Advisory

- Social Responsibility Advisory

- Governance & Ethics Advisory

- ESG Reporting & Disclosure

By Application Outlook (Revenue, USD Billion, 2020–2034)

- Strategy Development & Integration

- Compliance & Risk Management

- Reporting & Transparency

- Stakeholder Engagement

By Industry Outlook (Revenue, USD Billion, 2020–2034)

- Energy & Utilities

- Manufacturing

- Financial Services

- Technology

- Healthcare

By Size Outlook (Revenue, USD Billion, 2020–2034)

- Large Enterprises

- Medium Businesses

- Small Businesses

By Regional Outlook (Revenue, USD Billion, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

ESG Advisory Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 14.89 billion |

|

Market Size in 2025 |

USD 18.50 billion |

|

Revenue Forecast by 2034 |

USD 135.90 billion |

|

CAGR |

24.80% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 14.89 billion in 2024 and is projected to grow to USD 135.90 billion by 2034.

The global market is projected to register a CAGR of 24.80% during the forecast period.

North America dominated the market share in 2024.

A few of the key players in the market are Bain & Company, Inc.; Boston Consulting Group; Deloitte Touche Tohmatsu Limited; Ernst & Young Global Limited; McKinsey & Company; MSCI Inc.; Nexio Projects; PwC; Sustainalytics; The ERM International Group Limited.

The strategy development & integration services segment held the largest share of the market in 2024.

The ESG reporting & disclosure segment is expected to witness fastest growth during the forecast period.