Sustainable Finance Market Size, Share, Trends & Industry Analysis Report

: By Investment Type (Equity, Fixed Income, Mixed Allocation, and Others), By Transaction Type, By Industry Verticals, and By Region– Market Forecast, 2025–2034

- Published Date:Jun-2025

- Pages: 130

- Format: PDF

- Report ID: PM3658

- Base Year: 2024

- Historical Data: 2020-2023

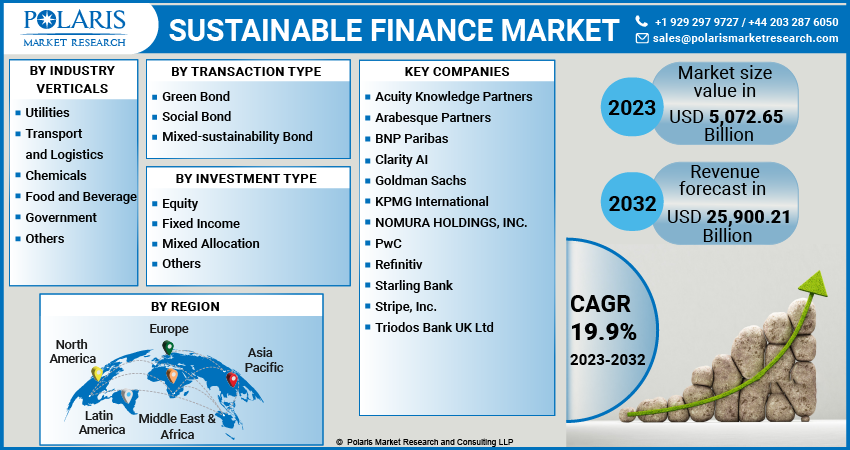

The sustainable finance market size was valued at USD 756.31 billion in 2024, exhibiting a CAGR of 22.5% during 2025–2034. The sustainable finance market is driven by growing environmental awareness, regulatory support, investor demand for ESG-compliant assets, climate change risks, corporate sustainability goals, and increasing integration of social and governance factors in investment decisions.

Market Overview:

Sustainable finance seeks to balance economic growth, environmental conservation, and social equity by integrating environmental, social, and governance (ESG) factors into financial activities. This approach contrasts sharply with conventional finance, which typically prioritizes monetary gains with little regard for environmental impacts. Sustainable finance emphasizes responsible decision-making and represents a new business paradigm where sustainable investment drives the economy, aligning the financial ecosystem with established sustainable development goals.

The key components of sustainable finance include ESG integration, impact investing, green financing, and Socially Responsible Investing (SRI). The demand for sustainable finance, particularly from small and medium-sized enterprises (SMEs), is influenced by dynamics within the value chain, examined through competitive perspectives, further underscoring their transition to net-zero emissions.

The shift toward sustainable finance yields positive environmental, social, and economic effects. It plays a significant role in addressing climate change, resource depletion, and other environmental challenges by providing capital support for “green” initiatives. A low-carbon economy heavily relies on this reallocation of financial resources. Moreover, the emerging green industry is stimulating further financing, innovation, and job creation. Incorporating ESG considerations offers investors and businesses enhanced opportunities to mitigate risks associated with environmental and social factors, leading to more resilient investments.

To Understand More About this Research: Request a Free Sample Report

Industry Dynamics:

Growing Investor Demand and ESG Integration

Investors are increasingly prioritizing Environmental, Social, and Governance (ESG) factors in their investment decisions, driving significant growth in the sustainable finance market. A report by the United Nations Environment Programme Finance Initiative states that sustainable financial services blend innovative finance with fiduciary responsibilities, balancing profit motives with responsible practices. This shift goes beyond merely avoiding risks; it also focuses on identifying new opportunities. AI algorithms plays a key role in analyzing ESG data and recognizing trends, enabling investors to make informed decisions and discover promising investment opportunities. This heightened emphasis on ESG integration and sustainable investing is directing more capital toward sustainable projects and companies, fueling further growth in the sector.

Regulatory Support and Policy Initiatives

Governments around the world are implementing policies and regulations to promote sustainable finance. A key example is the European Union (EU) Taxonomy, which is a comprehensive initiative designed to define environmentally sustainable economic activities (ICMA, 2021). Such regulatory frameworks provide clarity and guidance, which helps to boost investor confidence and encourages the adoption of sustainable finance practices.

In India, the government has set ambitious targets to achieve net-zero emissions by 2070, requiring a substantial investment of US$10 trillion. This commitment calls for the development and expansion of the sustainable finance sector. Government initiatives—including policy interventions, fiscal instruments, and various mechanisms—are essential for mobilizing green investments and driving growth.

Technological Advancements

Technological advancements, particularly in data analytics and reporting, are making it easier for financial institutions to assess and manage green investments. Innovations in AI and machine learning are revolutionizing the sustainable finance sector including embedded finance. These technologies enable more accurate ESG reporting and enhance investor confidence in sustainable finance. The ability to better measure and report on the impact of sustainable investments is attracting more capital. As technology continues to evolve, it will further facilitate the growth and efficiency of the sustainable finance market.

Segmental Insights:

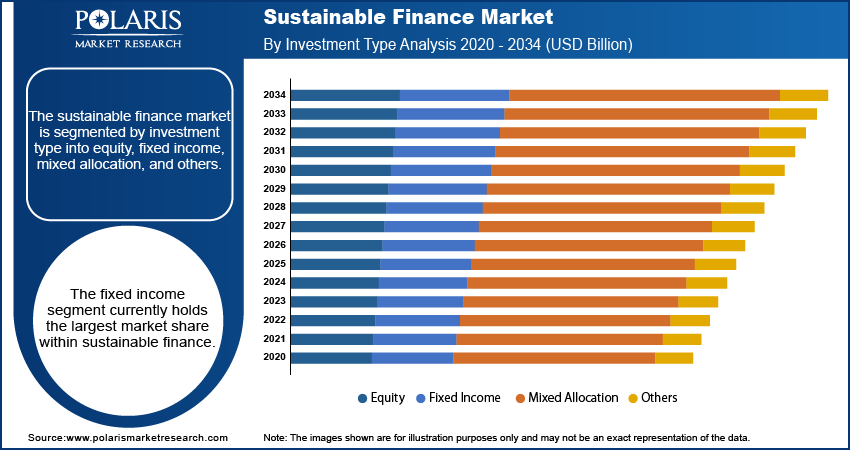

Market Assessment By Investment Type

The fixed income segment accounts for the largest share of sustainable finance during the forecast period. This is primarily due to the growing issuance and investor interest in green and social bonds, which fall under this category. These financial instruments have a low operating risk because they provide a straightforward method for directing capital toward projects that are environmentally and socially beneficial. For example, green bonds are debt securities in the form of corporate bonds used to fund initiatives such as renewable energy projects and sustainable infrastructure development. These efforts are crucial for achieving global environmental goals.

The mixed allocation segment is expected to grow at the fastest rate in the coming years. This trend reflects an increasing willingness among investors to create diversified portfolios that balance optimal risk and return while maintaining a strong focus on sustainability. Mixed allocation strategies allow for the combination of fixed income securities with equities and other alternative investments that have been rigorously assessed for Environmental, Social, and Governance (ESG) criteria, all within a managed risk framework.

Market Evaluation By Transaction Type

The green bond subsegment holds the largest share among sustainable finance transaction types. This is due to the widespread acceptance of green bonds by governments, financial institutions, and corporations, as well as the established frameworks that support them. Green bonds are designed to finance projects that provide significant environmental benefits, including renewable energy, energy efficiency, and sustainable waste management. Additionally, they play a crucial role in combating climate change, as the proceeds from green bonds are intended for climate-related initiatives.

Within the bond submarket, there is a growing focus on a specific type of financing known as dual-purpose bonds, which combine green and social objectives. This sector is expanding rapidly in the broader context of sustainable finance. Dual-purpose bonds address a wider array of social and environmental issues than traditional bonds, as they fund both green and social projects. They meet the needs of issuers and investors who favor comprehensive approaches to achieving multiple sustainable development goals simultaneously.

Market Evaluation By Industry Vertical

The utilities sector currently holds the largest share of sustainable finance across various industries. This segment benefits significantly from the emphasis on sustainability in capital expenditures related to energy transition, infrastructure renewal, and smart grids. Utilities are increasingly turning to decarbonization and energy efficiency by utilizing green bonds and sustainable loans to finance large-scale projects, which often enhance operational efficiency.

The food and beverage sector is anticipated to grow at fastest CAGR during forecast period. This growth has led to an increase in the worldwide issuance of dual-purpose bonds, which are recognized as the fastest-growing category in sustainability. The urgent demand for environmentally friendly practices, heightened awareness of social issues and supply chains, and a growing interest in responsibly marketed products all contribute to this swift growth rate.

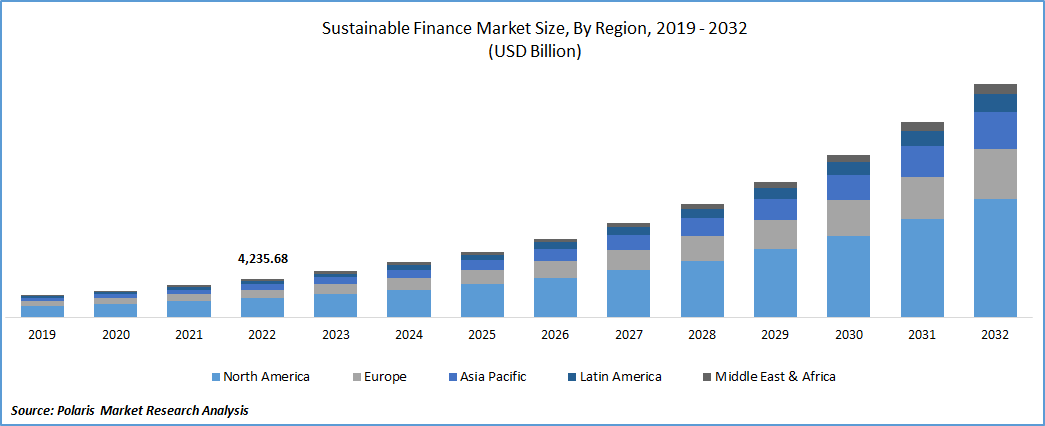

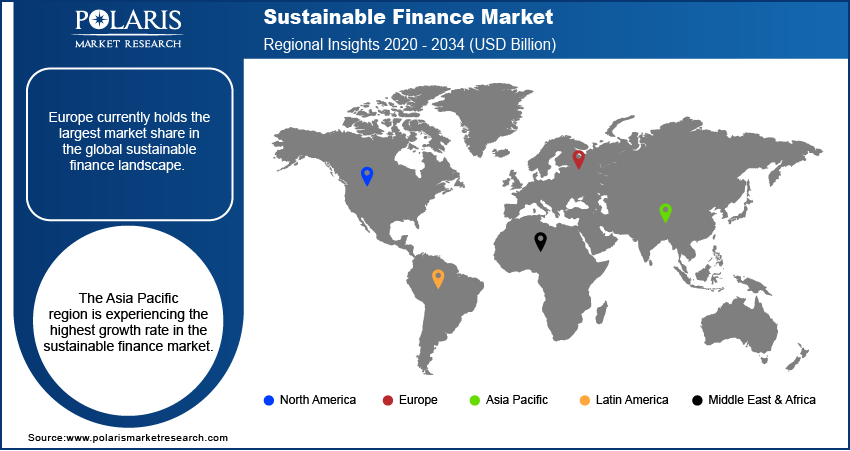

Regional Analysis

Europe's sustainable finance market currently holds the largest share in the forecast period. The region's EU Taxonomy, along with the Sustainable Finance Disclosure Regulation (SFDR), serves as a key driver of this position. The comprehensive framework provided by these policies for sustainable investing has led to a significant increase in available capital for green and social initiatives. Additionally, the heightened social and environmental awareness among European investors and financial institutions has contributed to remarkable growth in the supply of sustainable financial instruments, further reinforcing Europe's leading position.

Meanwhile, the Asia-Pacific sustainable finance market is experiencing the highest growth rate. This growth is driven by a greater understanding of climate change, a significant need for infrastructure development, and increasing government support for green policies in countries like Japan, India, and China. Although the region started with a smaller base compared to Europe, the considerable investment potential in Europe’s unsustainable projects, along with the growing integration of ESG (Environmental, Social, and Governance) policies into business and financial practices, is notably accelerating growth across the entire region. This rapid development highlights the Asia-Pacific region's crucial role in the future of sustainable finance worldwide.

Key Players and Competitive Insights

The landscape for competition under sustainable finance is with ever-renewed competition for innovation. Socially responsible investment funds are being offered alongside new green and social bonds. Furthermore, social bonds alongside sustainability-linked loans have also been developed. The race towards more advanced technology is made clearer with the use of analytics and AI to improve ESG screening, reporting, and measuring impacts. Additionally, these experts are further narrowing gaps in their global reach, and raising the holes left behind by global leaders in developing regions to bring new opportunities in the context of climate and sustainability shared goals, which aids market expansion.

List of Key Companies:

- Allianz SE

- Amundi (part of Crédit Agricole S.A.)

- Bank of America Corporation

- BlackRock

- BNP Paribas

- Deutsche Bank AG

- Goldman Sachs Group

- HSBC Holdings plc

- ING Groep N.V.

- J.P. Morgan Chase & Co.

- Morgan Stanley

- UBS Group AG

Industry Developments

- May 2025: HSBC Holdings plc has been recognized for its notable expansion in the sustainable finance market, particularly within the Middle East. As reported in May 2025, the bank significantly grew its sustainable finance business in the region by 15% in 2024, achieving a leading position in the ESG loan league table.

- February 2025: BNP Paribas announced that it had surpassed 75% of its energy financing directed towards low-carbon energies in 2024. This achievement marks significant progress towards the bank's sustainable finance goals, demonstrating a strategic acceleration of its commitment to the energy transition.

Sustainable Finance Market Segmentation

By Investment Type Outlook (Revenue – USD Billion, 2020–2034)

- Equity

- Fixed Income

- Mixed Allocation

- Others

By Transaction Type Outlook (Revenue – USD Billion, 2020–2034)

- Green Bond

- Social Bond

- Mixed-sustainability Bond

By Industry Verticals Outlook (Revenue – USD Billion, 2020–2034)

- Utilities

- Transport & Logistics

- Chemicals

- Food & Beverage

- Government

- Others

By Regional Outlook (Revenue-USD Billion, 2020–2034)

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

Sustainable Finance Market Report Scope:

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 756.31 billion |

|

Market Size Value in 2025 |

USD 924.58 billion |

|

Revenue Forecast by 2034 |

USD 5,743.39 billion |

|

CAGR |

22.5% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Industry Insights |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 756.31 billion in 2024 and is projected to grow to USD 5,743.39 billion by 2034.

The market is projected to register a CAGR of 22.5% during the forecast period, 2024-2034.

Europe had the largest share of the market.

Some major players include BlackRock, BNP Paribas, UBS Group AG, HSBC Holdings plc, Bank of America Corporation, J.P. Morgan Chase & Co., Goldman Sachs Group, Morgan Stanley, Amundi (part of Crédit Agricole S.A.), Deutsche Bank AG, ING Groep N.V., and Allianz SE.

The fixed income segment accounted for the largest share of the market in 2024.

Following are some of the market trends: ? Shifting International and National Policies: New and more aggressive ESG policies are being created at a faster pace across the world, like the European Union Green Bond Standard (EU GBS) and the EU Taxonomy which focuses on increasing transparency and responsibility. ? Emerging AI (Artificial Intelligence) and Data Science Tools: Sophisticated technologies are used to enhance the analysis and reporting of ESG related information, and risk evaluation which helps decision-making for the financial institutions and investors.

Sustainable economic development involves the integration of environment, social and corporate governance (ESG) into the financial system, which requires a long-term approach by the decision makers. This model is built on transforming an ecosystem for it to be responsive to concerns of system set global goals, such as beating climate change, conserving biodiversity and fostering sustainable economic growth. This goes beyond the boundaries of usual finance, which looks purely at estimates and statements, to understanding that such elements can fundamentally impact the company’s performance and risk profile.