Embedded Finance Market Share, Size, Trends, Industry Analysis Report

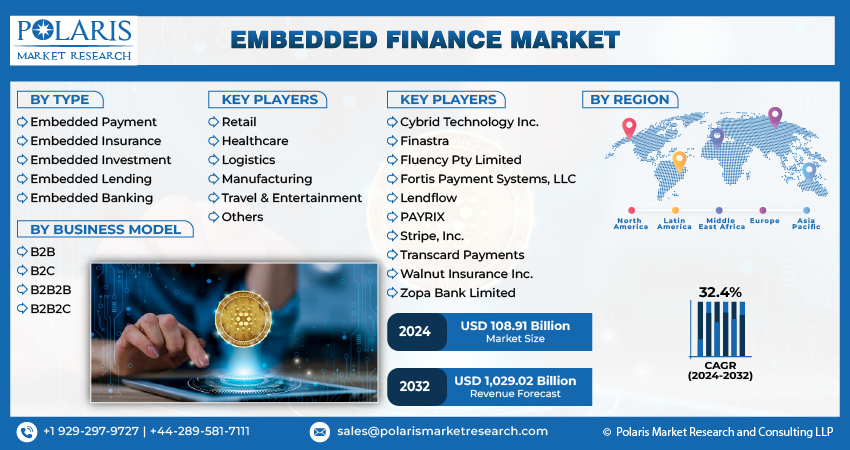

By Type (Embedded Payment, Embedded Insurance); By Business Model; By End-use; By Region; Segment Forecasts, 2024 - 2032

- Published Date:Mar-2024

- Pages: 118

- Format: PDF

- Report ID: PM4401

- Base Year: 2023

- Historical Data: 2019-2022

Report Outlook

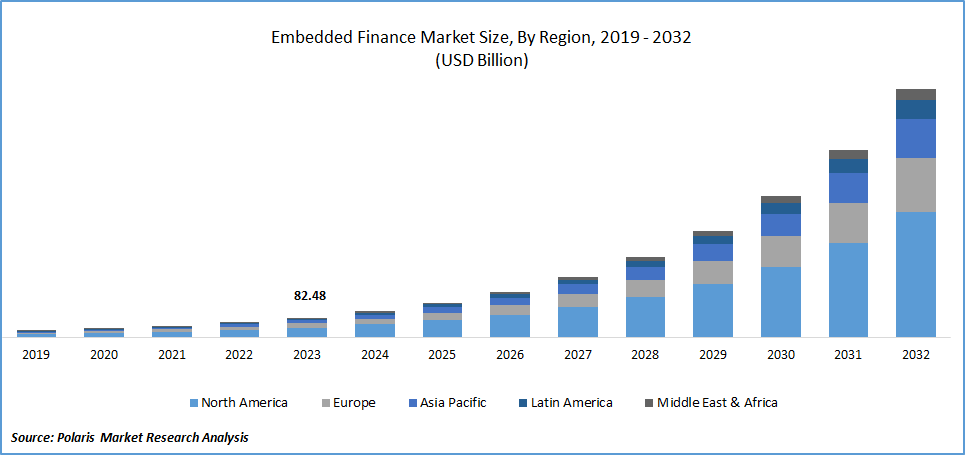

The global embedded finance market was valued at USD 82.48 billion in 2023 and is expected to grow at a CAGR of 32.4% during the forecast period.

Market growth is attributed to the widespread penetration of smartphones and the internet worldwide. The rising prevalence of internet usage and smartphone adoption contributes to the increased uptake of digital mobile-based financial services, positively impacting the embedded finance sector. Additionally, the ongoing digitalization in various industries, particularly in banking and finance, is expected to drive the expansion of the embedded finance industry in the forecast period.

Embedded finance stands out as one of the rapidly growing segments within the fintech industry. The growth potential is significant, particularly in countries like India, characterized by a large youthful population that actively engages with the internet. Over time, we can anticipate continuous innovation and the emergence of unique services catering to a diverse range of individuals and businesses. The global pandemic in 2020 accelerated digital transformations across all industries, compelling a shift from traditional in-person business practices. This transition included efforts to onboard hesitant or first-time digital payment users and exerted pressure on established banks and non-banking financial companies (NBFCs) to embrace and adapt to new-age digital banking practices.

To Understand More About this Research:Request a Free Sample Report

The embedded finance industry is poised for significant growth in the forecast period, driven by technological advancements in Artificial Intelligence (AI). The application of AI in embedded finance enables service providers to deliver more sophisticated and personalized services to customers, resulting in increased service utilization and revenue. Additionally, the widespread adoption of Application Programming Interfaces (APIs) facilitating data exchange between financial institutions and other businesses, leading to the creation of new financial products, is expected to contribute to the market's growth.

While the embedded finance industry is poised for growth in the forecast period, certain challenges may impede its progress. These challenges include compliance requirements and dependence on financial institutions. Additionally, the direct interaction between consumers and retailers or service providers in embedded finance may lack the involvement of traditional banks with customers. Banks may be hesitant to engage in partnerships with non-fintech entities where their role is less prominent for end-users. Despite these challenges, the market is expected to grow due to the benefits it offers, such as seamless customer experiences and increased consumer spending facilitated by services like Buy Now and Pay Later (BNPL).

Industry Dynamics

Growth Drivers

Integration of Finance into Non-Financial Platforms

The integration of finance into non-financial platforms has emerged as a pivotal driver propelling the growth of the Embedded Finance Market. This strategic fusion seamlessly embeds financial services within the ecosystem of non-financial platforms, fundamentally transforming the way consumers and businesses access and utilize financial tools.

In the wake of this integration, traditional boundaries between financial and non-financial sectors are blurred, offering users a comprehensive and unified experience. This approach enables non-financial businesses, such as e-commerce platforms, ride-sharing apps, and other digital service providers, to offer a spectrum of financial services directly through their interfaces. From payments and loans to insurance and investment options, users can now access a wide array of financial products without navigating away from their preferred platforms.

The driving force behind this trend lies in the enhanced user experience, convenience, and accessibility it provides. As consumers increasingly seek seamless, one-stop solutions, the Embedded Finance Market capitalizes on this demand by embedding financial functionalities where users already engage with services. This not only caters to the evolving preferences of digitally savvy consumers but also opens up new avenues for revenue generation and customer retention for non-financial businesses venturing into the financial services realm. The ongoing trajectory of finance integration into non-financial platforms signals a paradigm shift in the financial landscape, fostering innovation and inclusivity in the digital era.

Report Segmentation

The market is primarily segmented based on type, business model, end-use, and region.

|

By Type |

By Business Model |

By End Use |

By Region |

|

|

|

|

To Understand the Scope of this Report:Speak to Analyst

By Type Analysis

The Embedded Payment Segment Accounted for the Largest Market Share in 2023

The embedded payment segment accounted for the largest share. This dominance is attributed to the swifter and more efficient payment processing offered by embedded payments compared to traditional invoicing methods. Beyond providing businesses access to alternative funding sources, embedded payments streamline the purchasing process for customers, leading to heightened satisfaction and loyalty. As a result, businesses can anticipate a boost in revenue and the fortification of brand loyalty, driving the segment’s growth.

The embedded lending segment will grow rapidly. The rising demand for convenient and prompt access to funds fuels this acceleration. Findings from "The Future of Customer Experience in Embedded Lending" survey conducted in December 2022, encompassing 350 senior executives in the global lending industry, suggest that nearly 45% of loans could be availed of in non-financial scenarios over the next five years. Moreover, 93% of respondents expressed the belief that embedded lending would result in streamlined and effortless loan applications.

By Business Model Analysis

The B2B Segment Held a Significant Market Share in 2023

The B2B segment held a significant market share. The global proliferation of B2B embedded finance service platforms is anticipated to fuel the adoption of B2B embedded finance. For instance, in March 2023, SAP Fioneer introduced a B2B finance platform tailored for financial service institutions. The platform aims to assist these institutions in enhancing their services within the rapidly digitized trade environment and gaining a competitive edge.

The B2C segment is expected to gain a substantial growth rate. This anticipated growth is linked to the increasing adoption of B2C finance, driven by the imperative for businesses to deliver a seamless experience to their customers. Additionally, businesses seek to boost revenue by providing innovative financial products and services. Notably, various e-commerce companies, including Shopify & Amazon, actively participate in offering embedded finance services such as BNPL & wallet services.

By End-Use Analysis

The Retail Segment Held a Significant Market Share in 2023

The retail segment held a significant market share. Globally, retailers are making substantial investments in embedded finance platforms to provide a range of embedded finance services to their customer base. As per a May 2022 survey by Aion Bank, approximately 74% of European retailers have introduced embedded finance offerings for their customers. Moreover, 73% of these retailers indicated that their customers express a desire for embedded finance products. Notably, embedded finance services such as cashback loyalty schemes and credit & debit card payments serve as attractions for customers and contribute to retailers establishing loyal customer groups.

The travel & entertainment segment is expected to gain a substantial growth rate. Companies in the travel & entertainment sector are actively introducing various embedded finance services, including BNPL offerings. For instance, in January 2023, Kayak collaborated with Affirm to introduce a BNPL service for all eligible travelers using the Kayak website. This initiative provided travelers with payment flexibility through a BNPL option when booking their trips on KAYAK.com.

Regional Insights

North America Dominated the Global Market in 2023

North America dominated the global market share. The dominance of key market players in the region is anticipated to propel the growth of the market. Additionally, various embedded finance startups in the region are actively engaging in fundraising initiatives to expedite the adoption of embedded finance. For instance, in August 2022, Paraffin announced a successful Series B funding round, raising USD 60 million. This funding, led by GIC, Singapore's sovereign wealth fund, is earmarked for the introduction of new products catering to small businesses.

The Asia Pacific will grow at a substantial pace. This anticipated growth can be attributed to the proactive initiatives undertaken by various market players. For instance, in October 2022, KPMG Services announced the establishment of an embedded finance hub in Singapore. The launch of this hub aimed to expedite the adoption of embedded finance services in the country by providing support to financial institutions and enterprises. Additionally, the burgeoning e-commerce industry in the region aligns well with the growth trajectory of the embedded finance sector in the region.

Key Market Players & Competitive Insights

The market exhibits fragmentation owing to the presence of numerous significant players. Industry participants are actively pursuing strategies such as new product launches, acquisitions, and partnerships & collaborations to enhance their offerings and extend their reach. For example, in January 2023, Yes Bank forged a partnership with Falcon, a banking-as-a-service company, to venture into the embedded finance market. Similarly, in March 2023, Embedded Finance Limited, supported by a consortium of global investors such as Moneta VC, D Squared Capital, and Ventura Capital, acquired Rails, formerly known as Railsbank. This acquisition is intended to facilitate the expansion of the company's European customer base.

Some of the major players operating in the global market include:

- Cybrid Technology Inc.

- Finastra

- Fluency Pty Limited

- Fortis Payment Systems, LLC

- Lendflow

- PAYRIX

- Stripe, Inc.

- Transcard Payments

- Walnut Insurance Inc.

- Zopa Bank Limited

Recent Developments

- In August 2023, Google Workforce and Stripe entered a partnership that allows users to schedule appointments, make bookings, and process payments seamlessly through Google Calendar.

- In June 2023, Stripe introduced a charge card program through Stripe Issuing, creating additional revenue streams for the company. This card enables customers to make purchases on credit rather than utilizing the funds directly from their accounts.

Embedded Finance Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 108.91 billion |

|

Revenue Forecast in 2032 |

USD 1,029.02 billion |

|

CAGR |

32.4% from 2024 – 2032 |

|

Base year |

2023 |

|

Historical data |

2019 – 2022 |

|

Forecast period |

2024 – 2032 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2024 to 2032 |

|

Segments Covered |

By Type, By Business Model, By End-Use, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

Embedded Finance Market Size Worth $ 1,029.02 Billion By 2032.

The top market players in Embedded Finance Market include Cybrid Technology, Finastra, Fluenccy, Fortis Payment Systems.

North America is the region contribute notably towards the Embedded Finance Market.

The global embedded finance market is expected to grow at a CAGR of 32.4% during the forecast period.

Embedded Finance Market report covering key segments are type, business model, end-use, and region.