Artificial Intelligence in Banking Market Share, Size, Trends, Industry Analysis Report

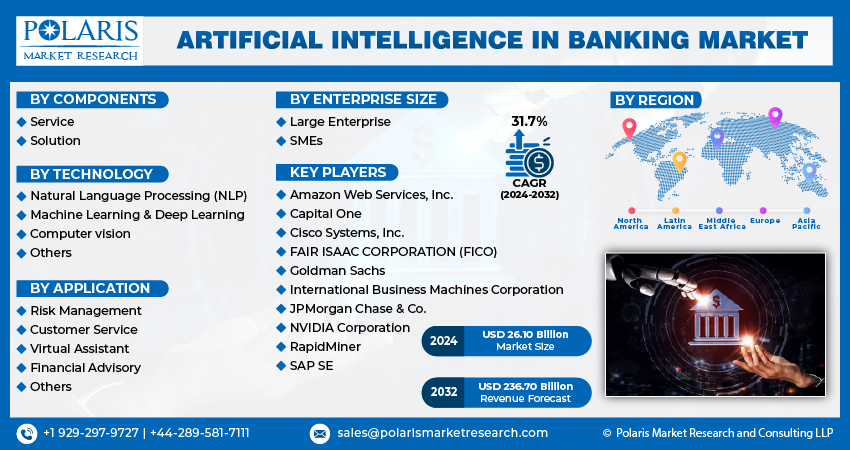

By Component (Service, Solution); By Technology; By Enterprise Size; By Application; By Region; Segment Forecast, 2024 - 2032

- Published Date:Feb-2024

- Pages: 116

- Format: PDF

- Report ID: PM4494

- Base Year: 2023

- Historical Data: 2019-2022

Report Outlook

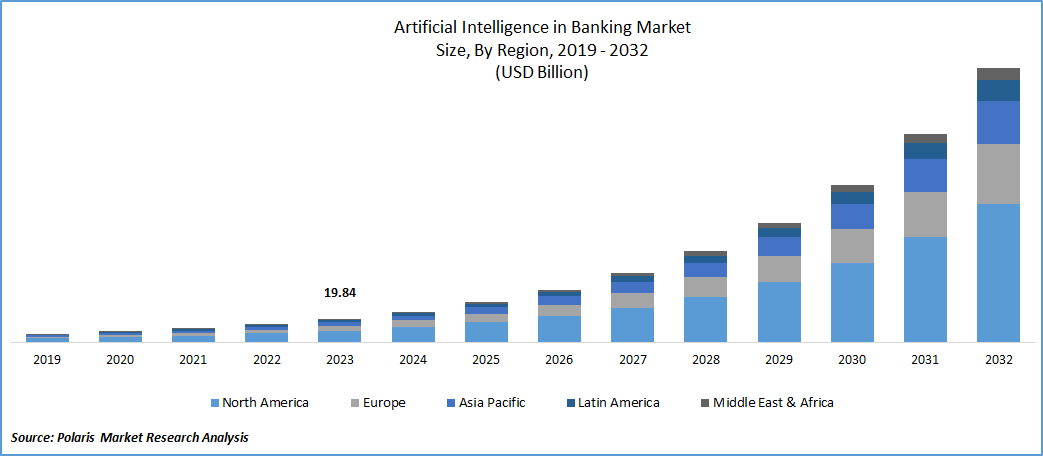

Artificial Intelligence in Banking Market size was valued at USD 19.84 billion in 2023. The market is anticipated to grow from USD 26.10 billion in 2024 to USD 236.70 billion by 2032, exhibiting the CAGR of 31.7% during the forecast period

Artificial Intelligence in Banking Market Overview

The evolution in data collection technology amidst the bank and financial institutions and the advancement of AI in the banking industry is driving the growth of the market. Furthermore, the market is growing owing to a surge in the investment of banks in AI and an increase in the consumer desire for personalized financial services.

To Understand More About this Research: Request a Free Sample Report

Artificial Intelligence (AI) is a branch of computer science committed to creating intelligent machines that can imitate human behavior. AI plays a crucial role by employing sophisticated data analytics to identify and prevent fraudulent transactions while enhancing compliance measures. A significant advancement in the banking sector involves the integration of AI, revolutionizing the customer experience through the application of advanced capabilities in contactless interactions. Leveraging extensive datasets, banks utilize AI to redefine the way businesses engage with customers and establish connections between various data points.

For instance, In May 2023, Kasisto, a U.S.-based company specializing in conversational artificial intelligence solutions for the finance sector, launched KAI-GPT, a large language model designed specifically for banking purposes.

Chatbots powered by artificial intelligence can analyze customer data and provide tailored recommendations and services to improve the overall banking experience. These systems facilitate operations, reducing costs by increasing productivity and leveraging data insights that outperform human decision-making abilities. Furthermore, sophisticated algorithms quickly detect fraudulent activity, significantly improving security measures in a matter of seconds. This technology marks an influential point in banking services, which prioritize efficiency and security.

The increase in day-to-day digital transactions, which consists of bill payments, online deposits, and withdrawals, requires banks to improve their fraud detection techniques. This growing demand drives the adoption of artificial intelligence in the banking industry. The importance of artificial intelligence, when combined with machine learning, lies in its ability to detect fraud, mitigate risks, uncover vulnerabilities in banking systems, and secure online financial transactions.

Banks are incorporating artificial intelligence (AI) into middle-office functions to detect, evaluate, and prevent payment fraud. They are additionally upgrading anti-money laundering (AML) procedures and carrying out regulatory checks to ensure know-your-customer (KYC) compliance. The use of artificial intelligence allows banks to create a more informed banking environment, providing clients with not only support and insights but also greater control over their financial assets and security. Many financial institutions are using AI to transform the client experience, enabling seamless and round-the-clock consumer interactions. The integration of AI bots, biometric fraud detection techniques, and digital payment advisors all contribute to higher service quality and a larger consumer base.

The incorporation of artificial intelligence in banking has been highlighted by ongoing advancements driven by rapid technological progress. This includes advances in machine learning algorithms, the availability of large amounts of big data, and increased computing power. This improvement opens up new AI applications, disrupting traditional banking methods and encouraging the development of innovative financial services and solutions.

For instance, In September 2023, Temenos, a Swiss-based software company, has unveiled an innovative and secure banking solution. This innovative solution uses Generative Artificial Intelligence (AI) to automate the categorization of customers' banking transactions.

The COVID-19 pandemic a positive impact on the artificial intelligence in banking market, The COVID-19 pandemic has accelerated the adoption of remote work culture, which caused companies to shift to a work-from-home model. Concurrently, the banking industry is rapidly integrating AI and machine learning tools into its operations. The surge in COVID-19 is anticipated to propel AI in the banking market, with increased demand for solutions related to money laundering prevention (AML) and fraud detection as a result of the ongoing pandemic. The advancement of digitalization has necessitated the use of artificial intelligence to reduce the load on bank servers. The pandemic has created a demand for AI-driven tools to manage increased customer requests effectively.

Artificial Intelligence in Banking Market Dynamics

Market Drivers

Rise in Investment by Banks in Artificial Intelligence will Drive the Growth of the Market

Banks are increasing investment in artificial intelligent solutions to transmute the management process of FinTech and to deliver superior services to their users. Furthermore, as the banking industry becomes more complex and competitive, there is a greater demand for specialized solutions tailored to its goals. As a result, in order to meet customer demands, many banking institutions and FinTech companies are investing in AI solutions, accelerating the growth of AI in the banking market. Furthermore, AI plays a crucial role in assisting financial institutions throughout the risk management process, including risk identification, measurement, estimation, and impact assessment.

Furthermore, the growth of the Artificial intelligence market in banking is being driven by increased investment from FinTech companies and banks. These investments aim to improve automation processes and offer customers a more efficient and personalized experience. Furthermore, major financial institutions are investing heavily in AI technology to develop automated investment advisors and train systems for detecting activities like money laundering. This proactive financial monitoring helps to prevent illegal techniques, which contributes to the overall growth of artificial intelligence in the banking sector.

Market Restraints

Data Security and Safety Concerns Hamper on the Growth of the Market

Banking professionals claim that privacy and security concerns are the main barriers to the adoption of AI technologies. Financial institutions are more vulnerable to cyber threats due to the use of AI platforms and solutions that extensively analyze customer data to extract valuable insights for informed decision-making and operational efficiency. Protecting data integrity for deep learning and machine learning algorithms presents a significant challenge. Nonetheless, governments' increasing efforts to enact AI-specific legislation and establish dedicated AI regulators charged with overseeing ethical and security issues are expected to address these challenges in the forecast period.

Report Segmentation

The market is primarily segmented based on component, technology, enterprise size, application, and region.

|

By Component |

By Technology |

By Enterprise Size |

By Application |

By Region |

|

|

|

|

|

To Understand the Scope of this Report: Speak to Analyst

Artificial Intelligence in Banking Market Segmental Analysis

By Component Analysis

The solution segment held the largest market share in 2023, owing to the rising demand od AI-powered tools in the market. These tools include automated customer service, personalized financial recommendations, and fraud detection. Furthermore, ongoing advancements in AI technology are resulting in more precise and tailored solutions that cater to specific banking needs, increasing accuracy and efficiency. Furthermore, as banks aim to modernize their operations, there is an increasing trend of investment in AI-based solutions. This investment is intended to streamline processes, improve decision-making capabilities, and provide superior customer experiences. The widespread use of AI solutions across various banking functions is driving the growth of the solution segment in the AI banking market.

The service segment witnessed for the fastest growth during the forecast period. Banks are increasingly acknowledging the significance of specialized guidance and assistance in the incorporation and assimilation of AI solutions into their current frameworks. As AI technology becomes more complex and specific, the demand for tailored consulting, training, and maintenance services has risen. Additionally, numerous financial institutions need to possess in-house proficiency in AI technologies, leading to a need for external services to navigate intricacies and enhance AI systems to meet specific banking needs.

By Technology Analysis

The natural language processing (NLP) accounted for the largest market share in 2023. The growing reliance on digital platforms for banking operations has resulted in a significant increase in unstructured textual data, such as customer inquiries, reviews, and social media interactions. Natural language processing (NLP) is critical for banks to extract valuable insights from unstructured data. This makes it easier to conduct customer sentiment analysis, provide personalized service, and gain a better understanding of customer needs and preferences. Furthermore, NLP-driven chatbots and virtual assistants help to improve conversational capabilities, resulting in more natural and effective interactions with customers and, ultimately, higher overall customer satisfaction.

The computer vision segment is witnessed for the fastest growth in the market. Computer vision is widely used in the field of security, with facial recognition and video analytics used to monitor and protect ATMs, branches, and online transactions. This application significantly improves fraud detection and prevention capabilities. Furthermore, Computer Vision optimizes document verification procedures by extracting and analyzing data from IDs, checks, and forms, reducing manual errors and speeding up administrative tasks. Its integration with mobile banking apps improves customer experiences by enabling features like image recognition for remote check deposits.

By Application Analysis

Based on application analysis, the market has been segmented on the basis of risk management, customer service, virtual assistant, financial advisory, and others. The evolving nature of financial fraud and cybersecurity threats necessitates advanced risk management tools driven by artificial intelligence. These tools play a crucial role in swiftly identifying and addressing fraudulent activities as banks expand their services and participate in increasingly complex transactions. The inherent risks associated with such activities are heightened. AI-driven risk management tools offer in-depth analysis and modeling features, aiding banks in effectively managing risks across a diverse range of intricate financial products and services.

The customer service segment is witnessed for the fastest growth in the market. The banking industry is increasingly emphasizing the delivery of personalized and efficient customer interactions. AI-powered solutions enable automated but highly personalized customer service via customized chatbots, virtual assistants, and voice recognition systems. This method effectively addresses individual customer requirements. With changing customer expectations, there is a greater need for 24-hour support and quick query resolution, and AI-powered customer service tools are well-equipped to meet these demands efficiently.

Artificial Intelligence in Banking Market Regional Insights

North America dominated the largest market in 2023

North America dominated the artificial intelligence in banking market, North America boasts a strong technological framework and extensive digitization of its banking processes, creating an ideal environment for the widespread adoption of AI technologies. Banks have led the way in adopting AI solutions, using them to improve customer experiences, provide tailored services, and perform sophisticated analytics. The involvement of major AI technology providers has also accelerated the early adoption of AI in the North American banking sector, hastening its integration and expansion.

Asia Pacific has witnessed for the fastest growth in the market. The AI in the Asia-Pacific banking sector is expanding, fueled by a thriving fintech industry, rapid digitalization efforts, and a sizable population gaining access to digital banking services. Primarily, China and India, among other emerging economies in the region, are rapidly integrating AI into their banking systems. The efforts of innovative fintech startups and strategic investments from well-established financial institutions are driving this growth. Furthermore, the increasing prevalence of smartphones, as well as a growing demand for streamlined and convenient banking services among a diverse consumer base, contribute to the widespread adoption of AI technologies across Asia-Pacific markets.

Competitive Landscape

The market is characterized by intense competition, with established players relying on advanced technology, high-quality products, and a strong brand image to drive revenue growth. These companies employ various strategies such as research and development, mergers and acquisitions, and technological innovations to expand their product portfolios and maintain a competitive edge in the market.

Some of the major players operating in the global market include:

- Amazon Web Services, Inc.

- Capital One

- Cisco Systems, Inc.

- FAIR ISAAC CORPORATION (FICO)

- Goldman Sachs

- International Business Machines Corporation

- JPMorgan Chase & Co.

- NVIDIA Corporation

- RapidMiner

- SAP SE

Recent Developments

- In November 2023, Amazon Web Services, Inc. has announced that the Bank of Ayudhya Public Company Limited (Krungsri) in Thailand is leveraging AWS to improve customer experiences and bolster financial inclusion efforts.

- In May 2023, Temenos, a software company from Switzerland, has partnered with Amazon Web Services, Inc. (AWS) to provide its core banking solutions through a Software-as-a-Service (SaaS) model, seamlessly integrating its application with AWS infrastructure.

- In September 2022, JPMorgan Chase & Co., a US-based financial services corporation, has acquired Renovite Technologies, Inc., a company that specializes in cloud-native payments technology. This acquisition enables JPMorgan Chase & Co. to expand its capabilities in developing a cutting-edge merchant acquiring platform, reinforcing its commitment to modernizing payments and facilitating a smooth transition to cloud-based solutions.

Report Coverage

The Artificial Intelligence in Banking Market report emphasizes on key regions across the globe to provide better understanding of the product to the users. Also, the report provides market insights into recent developments, trends and analyzes the technologies that are gaining traction around the globe. Furthermore, the report covers in-depth qualitative analysis pertaining to various paradigm shifts associated with the transformation of these solutions.

The report provides detailed analysis of the market while focusing on various key aspects such as competitive analysis, component, technology, enterprise size, application, and their futuristic growth opportunities.

Artificial Intelligence in Banking Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 26.10 billion |

|

Revenue forecast in 2032 |

USD 236.70 billion |

|

CAGR |

31.7% from 2024 – 2032 |

|

Base year |

2023 |

|

Historical data |

2019 – 2022 |

|

Forecast period |

2024 – 2032 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2024 to 2032 |

|

Segments Covered |

By Component, By Technology, By Enterprise Size, By Application, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Customization |

Report customization as per your requirements with respect to countries, region, and segmentation |

In today’s hyper-connected world, running a business around the clock is no longer an option. And at Polaris Market Research, we get that. Our sales & analyst team is available 24x5 to assist you. Get all your queries and questions answered about the Artificial Intelligence In Banking Market report with a phone call or email, as and when needed.

Browse Our Top Selling Reports

UV Nail Gel Market Size, Share 2024 Research Report

Radiation Dose Management Market Size, Share 2024 Research Report

Automotive Brake System Market Size, Share 2024 Research Report

Inhalation Anesthesia Market Size, Share 2024 Research Report

Sugar Substitutes Market Size, Share 2024 Research Report

FAQ's

The Artificial Intelligence In Banking Market report covering key segments are component, technology, enterprise size, application, and region.

The artificial intelligence in banking market size is expected to reach USD 236.70 Billion by 2032

Artificial Intelligence in Banking Market exhibiting the CAGR of 31.7% during the forecast period

North America regions is leading the global market

Rise in investment by banks in Artificial Intelligence will drive the growth of the market are the key driving factors in Artificial Intelligence In Banking Market.