Digital Banking Platforms Market Share, Size, Trends, Industry Analysis Report

By Component (Platforms, Services); By Deployment Type; By Banking Type; By Banking Mode; By Region; Segment Forecast, 2025-2034

- Published Date:Sep-2025

- Pages: 117

- Format: PDF

- Report ID: PM3312

- Base Year: 2024

- Historical Data: 2020-2023

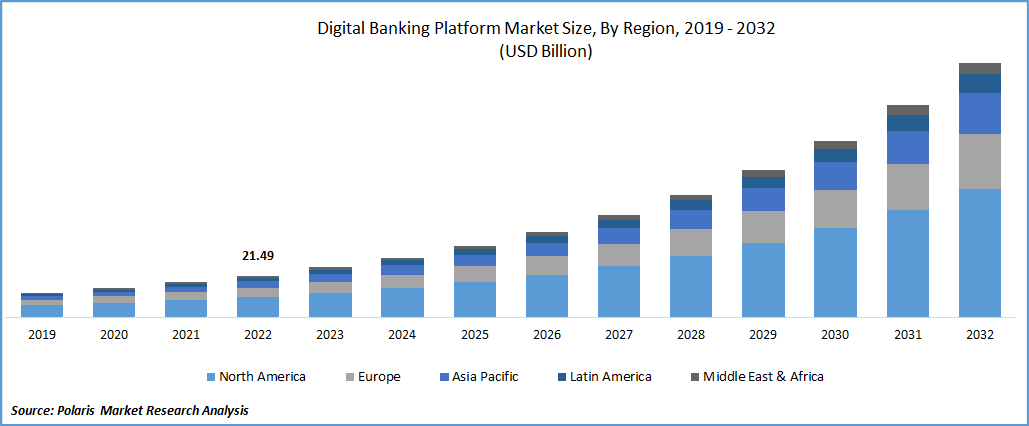

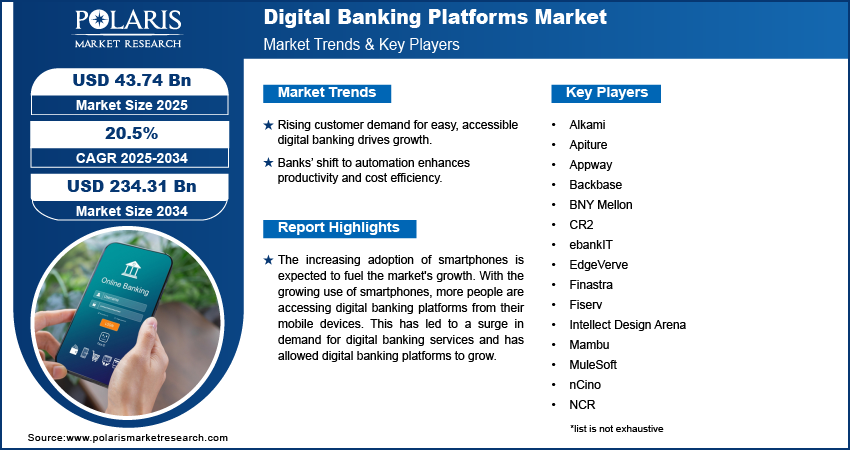

The global digital banking platforms market was valued at USD 36.38 billion in 2024 and is expected to grow at a CAGR of 20.5% during the forecast period. The increasing usage of smartphones is expected to continue fueling the growth of the digital banking platforms market as more consumers demand convenient, accessible, and secure banking services from their mobile devices.

Key Insights

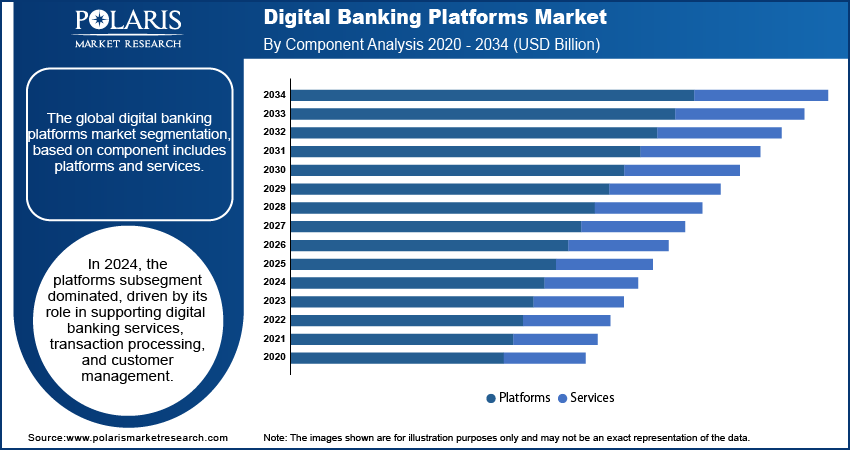

- By component, the platforms subsegment held the largest share in 2024. This is attributed to the foundation, which supports a plethora of digital banking services such as the processing of transactions and the management of customers.

- By deployment type, the cloud subsegment held the largest share in 2024, as it is the model that many financial institutions are adopting. This is mainly because of the numerous advantages the model tends to offer, which include flexibility, reduced costs, and the growing demand for scalability.

- By banking type, the retail banking segment held the largest share in 2024. This is due to the large customer base and high volume of transactions that generate strong demand for easy-to-use and convenient digital solutions.

- By banking mode, online banks held the largest share in 2024 as they have a strong prominence and multitude of use cases. This is primarily due to the strong legacy physical infrastructure and widespread adoption of the internet among traditional bank customers.

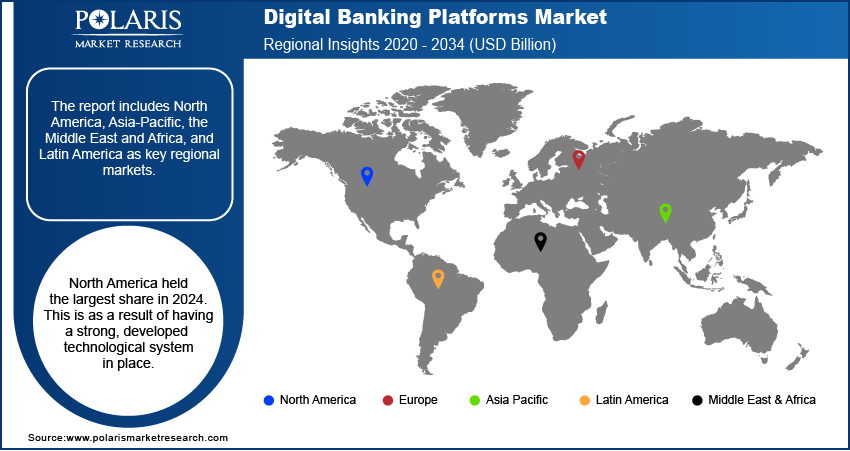

- By region, North America held the largest share in 2024. This is as a result of having a strong, developed technological system in place.

Industry Dynamics

- The strong demand from customers for bank services that are easy and accessible is a major fuel for growth. With the increasing demand for mobile phones and other digital technological devices, customers are now able to monitor their balances or manage their bank accounts from any place and at any time.

- For operational streamlining and cost optimization, banks are migrating from traditional manual practices to automated systems to enhance productivity in financially aided decision-making, real-time data utilization, and timely service delivery.

- The market growth has also been fueled by the fast incorporation of new technologies such as artificial intelligence, machine learning, and cloud computing.

Market Statistics

- 2024 Market Size: USD 36.38 billion

- 2034 Projected Market Size: USD 234.31 billion

- CAGR (2025-2034): 20.5%

- North America: Largest market in 2024

To Understand More About this Research: Request a Free Sample Report

AI Impact on the Digital Banking Platform Market

- AI helps to enhance customer experience through personalized services, predictive analytics, and real-time support across digital banking platforms.

- AI helps to analyze transaction patterns and flags suspicious activities with greater accuracy.

- AI-driven chatbots and virtual assistants streamline customer service, reducing operational costs and improving user satisfaction in digital banking.

- Intelligent automation powered by AI accelerates loan processing, compliance checks, and onboarding, boosting efficiency and reducing human intervention.

The increasing adoption of smartphones is expected to fuel the market's growth. With the growing use of smartphones, more people are accessing digital banking platforms from their mobile devices. This has led to a surge in demand for digital banking services and has allowed digital banking platforms to grow. Consumers are increasingly demanding convenient, personalized, and easy-to-use banking services. Digital banking platforms have provided this service and convenience, leading to increased adoption. According to online retailer Flipkart in the first half of 2022, premium smartphone demand increased by 25%, with Tier-2 towns driving growth.

Industry Dynamics

Growth Drivers

Rapid technological advancement has enabled digital banking platforms to provide customers with innovative and secure banking services. For example, using artificial intelligence, machine learning, and data analytics has enabled digital banks to offer personalized services to their customers. The need for cost optimization is fuelling the growth of the market. Traditional banks have high overhead costs, making offering competitive rates and fees difficult. Digital banking platforms have lower operating costs, making it easier for them to offer attractive rates and prices to their customers. Governments and regulatory bodies support the growth of digital banking platforms as they provide greater financial inclusion and access to banking services. This has led to increased investment and development in the sector.

Report Segmentation

The market is primarily segmented based on component, deployment type, banking type, banking mode and region.

|

By Component |

By Deployment Type |

By Banking Type |

By Banking Mode |

By Region |

|

|

|

|

|

For Specific Research Requirements: Request for Customized Report

Platforms segment is expected to witness fastest growth during forecast period

The platforms segment is projected to have a higher growth rate. Digital banking platforms provide open APIs (Application Programming Interfaces) that enable third-party developers to create applications and services that integrate with the platform. This allows for greater customization and flexibility for both banks and customers. This will propel the growth of the market. Digital banking platforms are designed to provide an intuitive and user-friendly interface that makes it easy for customers to navigate and use the forum. This includes features such as chatbots and virtual assistants that can answer customer questions and provide support. This offers a wide range of opportunities for the growth of the market.

Cloud segment accounted for the highest market share in 2024

The cloud segment accounted for the largest market share in 2024. The benefits of cloud-based deployment drive the development of the digital banking platforms market as more banks adopt digital banking platforms to improve their customer service, reduce costs, and stay competitive. The cloud segment also benefits from the increasing adoption of cloud computing technology across industries. As more businesses move their operations to the cloud, there is a growing demand for cloud-based digital banking platforms that integrate with other cloud-based systems.

Retail Banking is expected to hold the significant growth rate in upcoming years

The retail Banking segment is expected to grow more in the coming years. Retail banking provides financial services to individual consumers rather than businesses or other institutions. The development of retail banking has led to an increasing demand for digital banking services that can provide customers with easy access to their accounts, convenient payment options, and personalized financial advice. As more consumers switch to digital banking services, there is an increasing demand for digital banking platforms that deliver timely and customized experiences. For example, many banks now offer mobile payments, peer-to-peer (P2P) lending, and robo-advisory services to their customers through digital banking platforms.

Mobile Banking segment is expected to hold the significant revenue share during forecast period

The Mobile Banking segment is projected to witness a higher revenue share. With the growing popularity of smartphones, more consumers have access to mobile banking services. According to a report by Statista, the number of smartphone users worldwide is expected to reach over 3.8 billion in 2021, providing a large potential market for mobile banking services. Mobile banking offers a convenient and accessible way for consumers and businesses to manage their finances. With mobile banking, customers can access their accounts from anywhere and anytime, making checking account balances, making payments, and performing other banking tasks easier. This will fuel the growth of the market in the upcoming years.

The demand in Asia Pacific is expected to witness highest growth rate in coming years

Asia Pacific will witness a higher growth rate in the coming years. The Asia Pacific region is home to many fintech startups introducing innovative digital banking platforms and disrupting traditional banking models. Fintech has dominated India's investors, customers, and entrepreneurs over the past few years due largely to the smartphone revolution and affordable data plans. According to an EY analysis, India has a fintech adoption rate of 87%, a staggering 20% higher than the global average of 64%. According to the estimate, the Indian fintech business will be worth USD 200 billion overall by 2030. This is driving competition and innovation in the market and is contributing to the growth of the market in the region.

North America is expected to have the largest revenue share in the market due to the region's high level of technology adoption, strong customer demand for digital banking services, and large banks investing heavily in digital banking infrastructure. North America is one of the most technologically advanced regions in the world, with a high level of technology adoption among consumers and businesses. By 2025, 5G adoption is predicted to completely dominate the wireless services market in North America, according to GSMA Intelligence. This creates a favorable environment for the growth of digital banking platforms, which offer fast, efficient, and convenient financial services.

Competitive Insight

Some of the major players operating in the global market include Alkami, Appway, Backbase, BNY Mellon, EdgeVerve, Finastra, Fiserv, Mambu, MuleSoft, NETinfo, Oracle, SAP, Sopra Banking, TCS, Temenos, TPS, Velmie and Worldline.

Recent Developments

- In February 2025, Temenos reached an agreement to divest Multifonds to Montagu Private Equity for approximately USD 400 million, as part of its strategy to concentrate on core banking solutions.

- In January 2023, Apiture launched Data Direct, an enhancement to its Data Intelligence product. With the new service, banks and credit unions can now access a wide range of data points their organization produces.

- In December 2022, Alkami Technology announced that one of its clients, Ideal Credit, has introduced Segment data & marketing solutions via its “Alkami Platform” to give it a potent new way to connect members with the banking products they require most.

Digital Banking Platforms Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 36.38 billion |

| Market size value in 2025 | USD 43.74 billion |

|

Revenue forecast in 2034 |

USD 234.31 billion |

|

CAGR |

20.5% from 2025- 2034 |

|

Base year |

2024 |

|

Historical data |

2020- 2023 |

|

Forecast period |

2025 - 2034 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Segments covered |

By Component, By Deployment Type, By Banking Type, By Banking Mode, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Key companies |

Alkami, Apiture, Appway, Backbase, BNY Mellon, CR2, EdgeVerve, ebankIT, Finastra, Fiserv, Intellect Design Arena, Mambu, MuleSoft, nCino, NCR, NETinfo, Oracle, SAP, Sopra Banking Software, TCS, Technisys, Temenos, TPS, Velmie and Worldline. |

FAQ's

The digital banking platforms market report covering key segments are component, deployment type, banking type, banking mode and region.

Digital Banking Platforms Market Size Worth $131.65 Billion By 2032.

The global digital banking platforms market expected to grow at a CAGR of 19.9% during the forecast period.

Asia Pacific is leading the global market.

key driving factors in digital banking platforms market are increase in focus of organizations on digitalizing their financial services.