5G Smartphone Market Size, Share, Trends, Industry Analysis Report

: By Operating System (iOS, Android, Windows, and Others), Sales Channel, Sim Type, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025–2034

- Published Date:Jan-2025

- Pages: 128

- Format: PDF

- Report ID: PM1707

- Base Year: 2024

- Historical Data: 2020-2023

5G Smartphone Market Overview

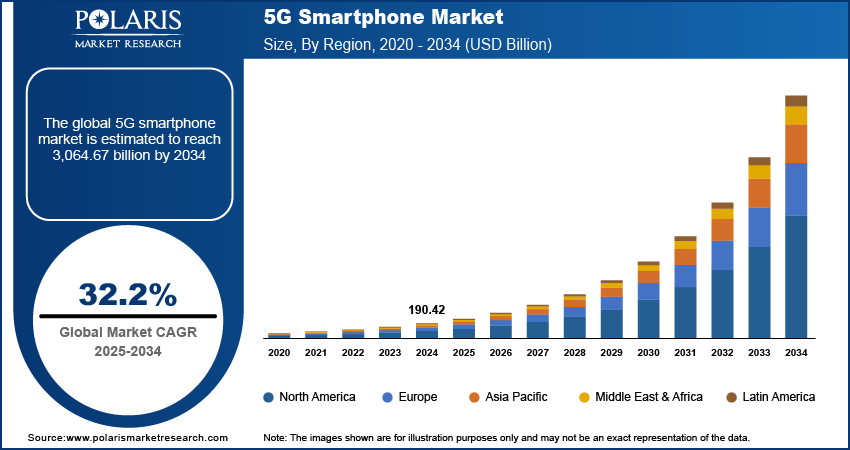

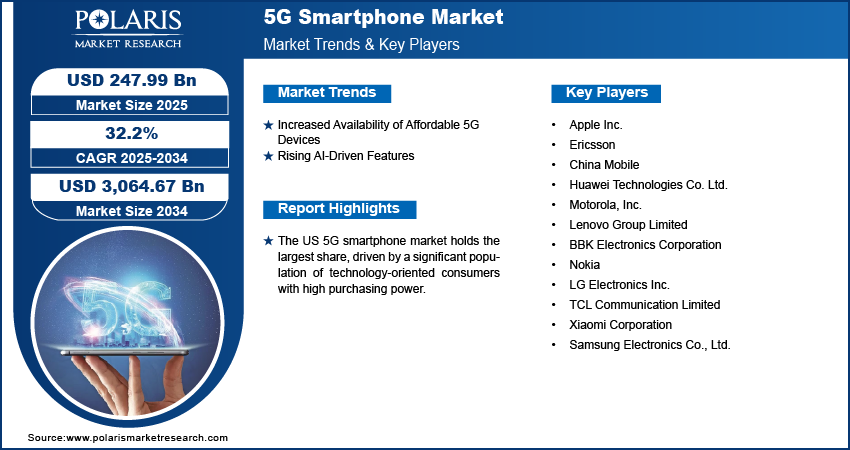

The 5G smartphone market size was valued at USD 190.42 billion in 2024. The market is projected to grow from USD 247.99 billion in 2025 to USD 3,064.67 billion by 2034, exhibiting a CAGR of 32.2% during the forecast period.

The 5G smartphone market refers to the global market for smartphones equipped with 5G (fifth-generation) network technology, enabling faster data speeds, lower latency, and enhanced connectivity compared to previous generations like 4G LTE. These devices are designed to leverage 5G networks for improved performance in various applications, from streaming and gaming to real-time communication and IoT integration.

The widespread deployment of 5G infrastructure globally is accelerating the adoption of 5G smartphones and driving market growth. Consumer demand for high-speed, low-latency mobile connectivity continues to boost the 5G-enabled devices, fueling market expansion. Moreover, the growing prevalence of data-intensive applications, such as streaming, gaming, and augmented reality, further highlights the need for 5G smartphones, significantly contributing to the market expansion. Furthermore, the introduction of competitively priced and affordable 5G models by various manufacturers is enhancing accessibility, leading to increased market share and rising demand.

To Understand More About this Research: Request a Free Sample Report

5G Smartphone Market Dynamics

Increased Availability of Affordable 5G Devices

The increased availability of affordable 5G devices is driving the demand for 5G smartphones. Introduction of budget-friendly models, 5G technology is no longer limited to premium flagship devices. Brands such as Xiaomi, Realme, and Samsung are leading this shift by offering competitively priced 5G smartphones that provide to a wider demographic, including price-sensitive consumers in both developed and emerging markets. This affordability factor is making 5G connectivity more accessible to the broader population, fostering widespread adoption and fueling the overall growth of the 5G smartphone market.

Rising AI-Driven Features

The integration of AI-driven features is becoming a significant trend in the 5G smartphone market, further enhancing user experience and driving market growth. The capabilities of 5G networks, AI technologies in smartphones are evolving rapidly, offering advanced functionalities such as real-time language translation, predictive text, personalized recommendations, and intelligent voice assistants. AI-powered cameras have become a hallmark of modern smartphones, utilizing machine learning algorithms for scene detection, enhanced image processing, and augmented reality applications. Additionally, AI optimizes device performance by managing power consumption, enhancing app performance, and adapting to user behavior, making smartphones more efficient and user-friendly. For instance, in November 2024, Ericsson ConsumerLab's recent research indicates that generative AI applications are influencing 5G user expectations in India, particularly in terms of differentiated connectivity. Users are increasingly seeking guaranteed, uninterrupted, and responsive performance during critical usage scenarios. Additionally, AI enhances connectivity by efficiently managing resources and ensuring seamless performance, leveraging the speed and low latency of 5G networks. These capabilities make AI a central selling point for modern 5G smartphones.

5G Smartphone Market Segment Insights

5G Smartphone Market Assessment by Operating System Outlook

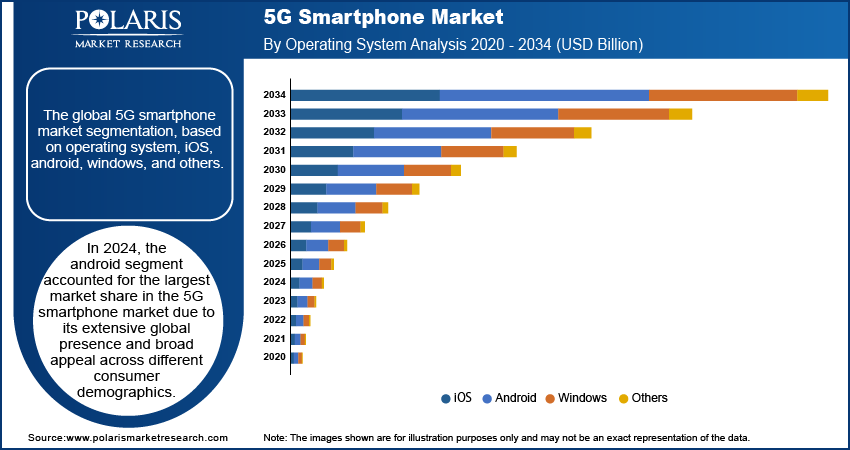

The global 5G smartphone market segmentation, based on operating system, includes iOS, Android, Windows, and others. In 2024, the android segment accounted for the largest 5G smartphone market share due to its widespread global adoption and ability to provide a diverse consumer base. This dominance is attributed to the Android's open-source platform, which enables manufacturers like Samsung, Xiaomi, Oppo, and Google to develop a broad spectrum of 5G smartphones, ranging from affordable entry-level models to high-end flagship devices. This extensive range appeals to technologically skilled premium users and also makes 5G technology accessible to cost-conscious consumers, particularly in emerging markets where affordability is a critical factor.

5G Smartphone Market Evaluation by Sales Channel Outlook

The global 5G smartphone market segmentation, based on sales channel, includes online and offline. The offline segment is projected to experience the fastest growth during the forecast period. Consumers in various regions still prefer in-store experiences that allow them to physically interact with devices, test their features, and receive expert guidance from sales representatives. Additionally, offline retail stores often provide opportunities for instant satisfaction, such as immediate product availability and hands-on demonstrations. Moreover, in emerging markets, where internet penetration and e-commerce infrastructure may be less developed, offline sales channels remain the primary mode of purchase. Physical retail also allows customers to benefit from promotions, trade-in options, and after-sales services, further boosting demand.

5G Smartphone Market Regional Insights

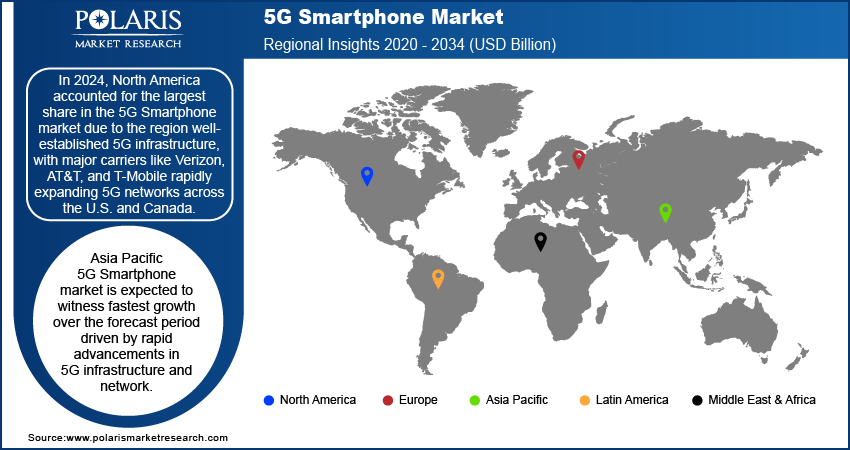

By region, the study provides 5G smartphone market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. In 2024, North America accounted for the largest market share due to the region’s well-established 5G infrastructure, with major carriers such as Verizon, AT&T, and T-Mobile rapidly expanding 5G networks across the US and Canada. For Instance, in October 2024, TCL launched a 5G connectivity device, TCL LINKPORT IK511, developed in collaboration with T-Mobile. This device enables laptops and tablets to access T-Mobile’s latest 5G RedCap milestone, powered by the Snapdragon X35 5G Modem-RF System. 5G RedCap offers a cost-effective, reliable, secure, and faster 5G experience, surpassing Wi-Fi and 4G LTE for users seeking an affordable entry into 5G connectivity. This extensive network coverage makes it easier for consumers to adopt 5G smartphones and experience the full potential of the technology, such as faster download speeds, low latency, and enhanced connectivity.

The 5G smartphone market in the US holds the largest share, driven by a significant population of technology-oriented consumers with high purchasing power. This demand for premium 5G smartphones is supported by major manufacturers such as Apple, Samsung, and Google, which have a strong presence in the market and are continuously launching innovative 5G models that cater to the preferences of US consumers.

The market in Asia Pacific is expected to witness the fastest growth over the forecast period, driven by rapid advancements in 5G infrastructure and network. Major countries including China, India, Japan, and South Korea are facilitating the widespread adoption of 5G technology. For instance, in March 2020, DOCOMO launched a limited 5G service in major Japanese cities. The company plans to invest over USD 7 billion to expand coverage to 97% of populated areas, installing 8,001 base stations in the 3.7GHz and 4.5GHz bands and 5,001 in the 28GHz band by 2025. The increasing demand for high-speed internet, coupled with the growing availability of affordable 5G-enabled smartphones, is further boosting market growth. Additionally, a large population and rising disposable incomes in emerging markets are contributing to a surge in demand for next-generation devices. The region’s strong manufacturing base for smartphones, coupled with government support for digital transformation, is also driving the growth of the 5G smartphone market in Asia Pacific.

China is expected to witness the fastest growth in the market over the forecast period due to the presence of major smartphone manufacturing companies. China has a well-established supply chain, allowing for the rapid production and distribution of 5G-enabled devices at competitive prices.

5G Smartphone Market – Key Players and Competitive Analysis Report

The competitive landscape of the 5G smartphone industry is rapidly evolving, driven by strategic partnerships and collaborations between industry giants, as well as significant mergers and acquisitions. The demand for faster, more reliable wireless connectivity continues to surge. As a result, companies are aligning with key players in the semiconductor, software, and telecommunications sectors to enhance their 5G capabilities. These partnerships allow firms to pool resources, share technological expertise, and expedite the development of next-generation devices. Furthermore, mergers between smartphone manufacturers and technology companies are reshaping the competitive dynamics, enabling the creation of more integrated solutions that cater to diverse consumer needs. This evolving landscape is marked by aggressive innovation, where firms are competing for market share and seeking synergies to establish leadership in the 5G ecosystem. Consequently, the market has witnessed a heightened focus on product differentiation, user experience, and seamless integration with broader 5G infrastructure, setting the stage for a more interconnected and competitive future in mobile communications. A few key major players are Apple Inc.; Ericsson; China Mobile; Huawei Technologies Co. Ltd.; Motorola, Inc.; Lenovo Group Limited; BBK Electronics Corporation; Nokia; LG Electronics Inc.; TCL Communication Limited; Xiaomi Corporation; and Samsung Electronics Co., Ltd.

Samsung Electronics Co., Ltd. is a South Korean multinational electronics company and a flagship subsidiary of the Samsung Group, headquartered in Suwon. Established in 1969, the company operates in the manufacturing of consumer electronics, semiconductors, and telecommunications equipment. Samsung's diverse product portfolio includes smartphones, televisions, home appliances, and various electronic components such as memory chips and displays. In 2012, Samsung was ranked as the highest Asian company in Interbrand's list of best global brands. The company operates on a global scale, with a presence in numerous countries across all regions. In April 2024, Samsung launched the Galaxy M15 5G and Galaxy M55 5G, two new additions to the Galaxy M series. These smartphones feature a Super AMOLED Plus display for enhanced visual quality, robust battery performance for extended use, and powerful processors for seamless multitasking.

Huawei is an international organization in information and communications technology (ICT) infrastructure and smart devices. The company's solutions cater to a user base of over three billion individuals worldwide, with a presence in over 170 countries and regions. Huawei's core business spans a wide range of products and services, including mobile network equipment, enterprise networking solutions, consumer devices, and cloud computing. The company's consumer business includes a diverse portfolio of smartphones, tablets, and wearables. Additionally, Huawei has developed its operating system, HarmonyOS, which has been deployed on over 220 million Huawei devices and has a growing ecosystem of over 2.2 million developers. In October 2024, Huawei launched its 5G-AA solutions to enhance network capabilities using advanced radio technologies.

Key Companies in 5G Smartphone Market

- Apple Inc.

- Ericsson

- China Mobile

- Huawei Technologies Co. Ltd.

- Motorola, Inc.

- Lenovo Group Limited

- BBK Electronics Corporation

- Nokia

- LG Electronics Inc.

- TCL Communication Limited

- Xiaomi Corporation

- Samsung Electronics Co., Ltd.

5G Smartphone Market Developments

September 2024: Apple launched the iPhone 16 Pro Max and iPhone 16 Pro, powered by the A18 Pro chip. This Pro lineup features larger displays, innovative pro camera capabilities, advanced Camera Control, and a substantial boost in battery life.

June 2022: Nokia extended its 5G agreement with Taiwan Mobile for one year to enhance the performance and capacity of its 5G and 4G/LTE networks.

October 2024: TCL launched the TCL LINKPORT IK511, a 5G connectivity device developed in collaboration with T-Mobile to enhance mobile connectivity.

5G Smartphone Market Segmentation

By Operating System Outlook (Revenue, USD Billion; Million Units; 2020–2034)

- iOS

- Android

- Windows

- Others

By Sales Channel Outlook (Revenue, USD Billion; Million Units; 2020–2034)

- Online

- Offline

By Sim Type Outlook (Revenue, USD Billion; Million Units; 2020–2034)

- Single SIM

- Multi Sim (e-sim)

By Regional Outlook (Revenue, USD Billion; Million Units; 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

5G Smartphone Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 190.42 billion |

|

Market Size Value in 2025 |

USD 247.99 billion |

|

Revenue Forecast by 2034 |

USD 3,064.67 billion |

|

CAGR |

32.2% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion, Volume in million units 2020–2034, and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global 5G smartphone market size was valued at USD 190.42 billion in 2024 and is projected to grow to USD 3,064.67 billion by 2034.

The global market is projected to register a CAGR of 32.2% during the forecast period.

In 2024, North America accounted for the largest share of the 5G Smartphone market due to the region’s well-established 5G infrastructure, with major carriers such as Verizon, AT&T, and T-Mobile rapidly expanding 5G networks across the U.S. and Canada

A few key players in the market are Apple Inc.; Ericsson; China Mobile; Huawei Technologies Co. Ltd.; Motorola, Inc.; Lenovo Group Limited; BBK Electronics Corporation; Nokia; LG Electronics Inc.; TCL Communication Limited; Xiaomi Corporation; Samsung Electronics Co., Ltd.

In 2024, the Android segment accounted for the largest market share in the 5G smartphone market due to its extensive global presence and broad appeal across different consumer demographics.

The offline segment is projected to experience the fastest growth during the forecast period, as consumers in various regions still prefer in-store experiences that allow them to physically interact with devices, test their features, and receive expert guidance from sales representatives.