5G Enterprise Market Share, Size, Trends, Industry Analysis Report

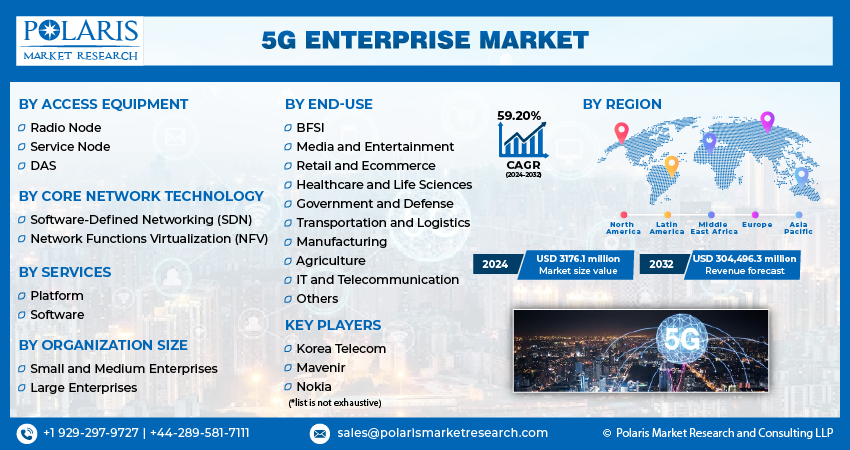

By Access Equipment (Radio Node, Service Node, DAS); By Core Network Technology; By Services; By Organization Size; By End-Use; By Region; Segment Forecast, 2025 - 2034

- Published Date:Sep-2025

- Pages: 124

- Format: PDF

- Report ID: PM1704

- Base Year: 2024

- Historical Data: 2020-2023

Industry Overview

The global 5G enterprise market was valued at USD 8.84 billion in 2024 and is expected to grow at a CAGR of 58.8% during the forecast period. The market is rapidly expanding, driven by increasing demand for ultra-reliable, low-latency connectivity, rising adoption of IoT and Industry 4.0 technologies, enhanced mobile workforce needs, and the push for digital transformation across diverse industries.

Key Insights

- The large enterprises segment holds the largest market revenue share and will likely continue its dominance over the forecast period, driven by increased investment in private 5G networks for secure, scalable operations.

- The manufacturing segment holds the majority of revenue shares of the market, fueled by the demand for real-time automation, robotics, and smart factory applications requiring ultra-low-latency connectivity.

- The North America 5G enterprise market is expected to grow significantly, with the highest CAGR during the forecast period, driven by strong digital infrastructure and enterprise adoption of advanced wireless technologies.

- The Asia Pacific region holds immense potential for development in the 5G market due to substantial 5G network installations by mobile carrier providers like ZTE, Huawei, and Ericsson, supporting rapid industrial digitalization.

Industry Dynamics

- Enterprises are adopting advanced 5G solutions to enable real-time applications, automation, and intelligent operations across industries like manufacturing, logistics, and healthcare.

- The need for ultra-reliable, low-latency connectivity to support IoT, AI, AR/VR, and autonomous systems is accelerating 5G enterprise deployment.

- Integration with existing IT/OT systems and managing network security and data privacy remain key challenges, increasing solution complexity and demand for expertise.

- Service providers offering tailored 5G solutions, including private networks and edge computing, are unlocking new revenue streams and creating competitive differentiation.

Market Statistics

- 2024 Market Size: USD 8.84 billion

- 2034 Projected Market Size: USD 897.59 billion

- CAGR (2025-2034): 58.8%

- North America: Largest market in 2024

AI Impact on 5G Enterprise Market

- AI optimizes network performance by dynamically managing bandwidth, traffic loads, and latency, ensuring efficient and reliable 5G connectivity for critical enterprise applications.

- It enhances predictive maintenance and operational efficiency by analyzing real-time data from connected devices, minimizing downtime and improving productivity.

- AI strengthens security by detecting anomalies, preventing cyber threats, and enabling adaptive responses across 5G-enabled enterprise networks.

- AI-driven analytics deliver personalized services, automate decision-making, and enable smarter business processes, maximizing the value of 5G investments.

5G technology, the fifth generation of wireless networks, promises faster speeds, lower latency, and increased capacity than its predecessors. These capabilities are expected to unlock many opportunities for enterprises across various industries.

The need for enhanced connectivity in the market with the proliferation of connected devices and the rise of the Internet of Things (IoT), businesses seek faster and more reliable wireless networks to support their operations. 5G provides the necessary infrastructure for seamless communication between devices, empowering enterprises to deploy IoT solutions at scale. This opens up avenues for applications such as smart factories, autonomous vehicles, remote monitoring, and augmented reality/virtual reality (AR/VR) experiences.

Moreover, 5G enables real-time data processing and analytics, facilitating enterprises' adoption of advanced technologies like artificial intelligence (AI) and machine learning (ML) platforms. With the low latency and high bandwidth offered by 5G networks, businesses can gather, analyze, and act upon data in near real-time, leading to improved decision-making and operational efficiency. This has implications across healthcare, transportation, logistics, and smart cities.

Furthermore, the 5G Enterprise Market offers opportunities for network slicing, a feature that allows operators to partition a single physical network into multiple virtual networks. This enables businesses to have dedicated and customized network slices tailored to their specific requirements, ensuring high reliability, security, and performance. Industries with stringent network demands, such as banking, defense, and manufacturing, can benefit significantly from this capability.

Industry Dynamics

Growth Drivers

The 5G enterprise market is witnessing a significant growth driven by the enhanced connectivity provided by 5G technology, with its faster speeds, lower latency, and increased capacity, which enables seamless communication between devices and supports the proliferation of connected devices and the Internet of Things (IoT). This drives the demand for reliable and high-speed connectivity for digital transformation, remote work, and the deployment of advanced technologies.

Enterprises across various industries actively embrace digital transformation to enhance operational efficiency, improve customer experiences, and gain a competitive edge. 5G networks are critical in facilitating digital transformation by providing the necessary infrastructure for technologies like cloud computing, edge computing, IoT, AI, and data analytics. The capabilities offered by 5G enable businesses to leverage these technologies effectively, driving the adoption of 5G.

Industry-specific use cases are a significant driver of the market. Different industries have specific requirements and can benefit from 5G technology uniquely. For example, manufacturing can leverage 5G to deploy smart factories with real-time monitoring and automation, while healthcare utilize 5G for remote patient monitoring and connected healthcare devices. The ability of 5G to cater to industry-specific needs fuels its adoption across sectors and contributes to market growth.

Additionally, the concept of network slicing, introduced by 5G, allows operators to partition a single physical network into multiple virtual networks. This enables businesses to have dedicated and customized network slices tailored to their specific requirements, ensuring high reliability, security, and performance. Furthermore, collaborations and partnerships between telecommunication providers, technology vendors, and enterprises drive the growth of the 5G Enterprise Market. These stakeholders work together to develop industry-specific use cases, testbeds, and solutions, while governments support deploying 5G infrastructure through regulatory frameworks that foster innovation and competition.

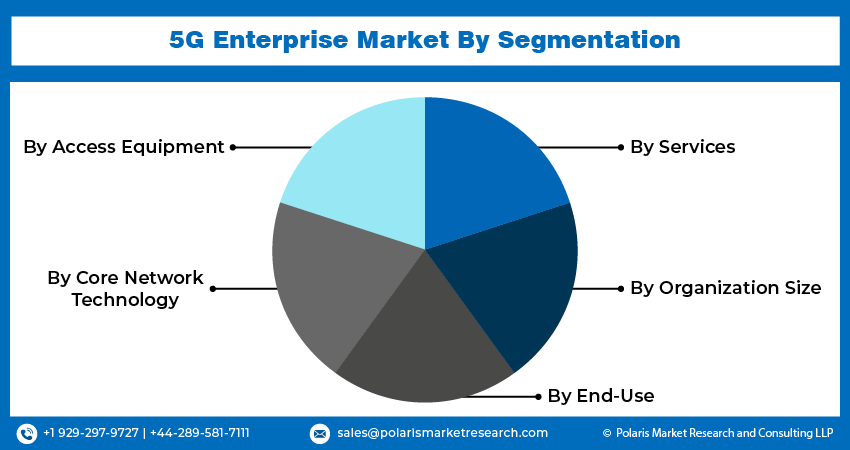

Report Segmentation

The market is primarily segmented based on access equipment, core network technology, services, organization size, end-use, and region.

|

By Access Equipment |

By Core Network Technology |

By Services |

By Organization Size |

By End-Use |

By Region |

|

|

|

|

|

|

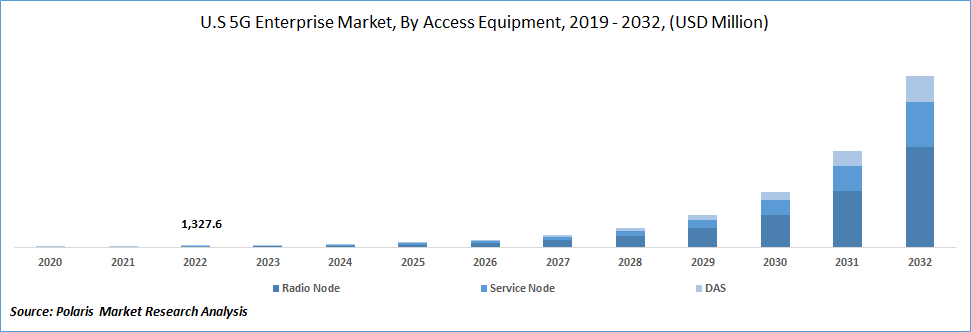

By Access Equipment Analysis

Radio node segment accounted for the largest market share in 2024

The radio node segment held the largest market share in 2024 and is projected to continue dominating throughout the forecast period. This significant market share can be attributed to the extensive deployments by major organizations and telecom operators.

The growth of this market is further supported by its numerous advantages. These include cost savings through reduced maintenance and operational expenses, flexibility in hardware options, the ability to enhance existing cloud-based technologies, and facilitating cross-domain innovation with minimal barriers. Its ability to provide a complete network with reduced maintenance and operational costs. By utilizing radio nodes, organizations can streamline their network infrastructure, resulting in lower expenses related to maintenance and operations. This cost reduction especially appeals to companies aiming to optimize their expenditure while ensuring efficient network connectivity.

By Organization Size Analysis

Large enterprises segment held the significant market revenue share in 2024

The large enterprises segment holds the largest market revenue share and will likely continue its dominance over the forecast period. These organizations drive market expansion through substantial investments in 5G networks and the growing need for high-speed internet connectivity.

However, small and medium enterprises experienced the highest growth in the market. This growth can be attributed to these businesses' increasing adoption of digitalization and the Internet of Things, which require fast and affordable Internet access. Consequently, this trend is fueling the global 5G enterprise market.

By End-Use Analysis

Manufacturing segment holds the majority of revenue shares of the market in 2024

The manufacturing segment holds the majority of revenue shares of the market. This sector is expected to grow fastest over the forecast period, driven by notable manufacturers like Gabler, who have already adopted augmented reality (AR) and virtual reality (VR) technology for training, repair, and maintenance. With the deployment of 5G networks, a seamless AR/VR experience is made possible as it can quickly provide a bandwidth demand of 100 Mbps, meeting the high bandwidth requirements of such applications.

Regional Analysis

North America anticipated to grow significantly during the forecast period

The North America 5G enterprise market is expected to grow significantly, with the highest CAGR during the forecast period. This expansion is fueled by the increasing demand for advanced technologies such as machine-to-machine connectivity, artificial intelligence, and connected vehicles, among others, driving the growth of the regional enterprise market.

While large carriers like Verizon and AT&T are actively promoting the benefits of 5G at a corporate level, other operators such as Sprint and T-Mobile strive to strike a balance by equally promoting their individual networks to companies and consumers.

The Asia Pacific region holds immense potential for development in the 5G market due to substantial 5G network installations by mobile carrier providers like ZTE, Huawei, and Ericsson. According to a November analysis by Ericsson, India is expected to have approximately 350 million 5G subscribers by 2026, accounting for approximately 27% of the overall wireless subscriptions, highlighting the significant growth opportunities in the region.

Key Market Players & Competitive Insight

The market has become intensely competitive, with major players like Ericsson, Nokia, Huawei, and Cisco vying for market dominance. These companies are aggressively expanding their 5G infrastructure and services offerings to cater to the growing demand from businesses for high-speed, low-latency connectivity. As industries increasingly adopt 5G to enable IoT, automation, and enhanced connectivity, the competitive landscape is expected to continue evolving, driving innovation, and fostering partnerships to capture a larger market share.

Some of the major players operating in the global market include:

- Affirmed Networks

- Airspan Networks

- American Tower

- AT&T Inc.

- China Mobile

- Ciena Corporation

- Cisco Systems Inc.

- Comba Telecom Systems

- CommScope

- EE Limited (BT Group)

- Ericsson

- Extreme Networks

- Fujitsu

- Hewlett Packard Enterprise

- Huawei Technologies Co.

- Juniper Networks

- Korea Telecom

- Mavenir

- NEC

- Nokia

- Qualcomm Technologies Inc.

- Samsung

- SK Telecom Co. Ltd.

- T-Mobile

- Verizon Communications

- VMware, Inc.

- ZTE Corporation

Recent Developments

- In March 2025, Alcatel-Lucent Enterprise, in partnership with Celona, launched a Private 5G solution offering secure, high-performance connectivity for complex enterprise environments, enhancing IoT, Industry 4.0, and mission-critical operations.

- In February 2023, Hewlett Packard Enterprise has acquired Athonet aiming to enhancing and broadening its edge-to-cloud and telecommunications portfolios.

- In March 2023, HFCL, in collaboration with Microsoft, has joined forces to introduce private 5G solutions specifically designed for enterprises. This partnership aims to leverage the expertise of both companies to provide advanced and tailored private 5G offerings.

5G Enterprise Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2025 |

USD 13.98 billion |

|

Revenue forecast in 2034 |

USD 897.59 billion |

|

CAGR |

58.8% from 2025 – 2034 |

|

Base year |

2024 |

|

Historical data |

2021 – 2023 |

|

Forecast period |

2025 – 2034 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Segments Covered |

By Access Equipment, By Core Network Technology, By Services, By Organization Size, By End-Use, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Customization |

Report customization as per your requirements with respect to countries, region and segmentation. |

|

For Specific Research Requirements |

Request for Customized Report |

FAQ's

The global 5G enterprise market size is expected to reach USD 304,496.3 million by 2032.

Key players in the 5G enterprise market are Affirmed Networks, Extreme Networks, Commscope, ZTE Corporation, Cisco Systems Inc., EE Limited (BT Group), NEC.

North American contribute notably towards the global 5G enterprise market.

The global 5G enterprise market is expected to grow at a CAGR of 58.8% during the forecast period.

The 5G enterprise market report covering key segments are access equipment, core network technology, services, organization size, end-use, and region.