U.S. C4ISR Market Size, Share, Trends, Industry Analysis Report

By Type (New Installation, Retrofit), By Component, By Application, By Vertical – Market Forecast, 2025–2034

- Published Date:Jul-2025

- Pages: 129

- Format: PDF

- Report ID: PM5902

- Base Year: 2024

- Historical Data: 2020-2023

Overview

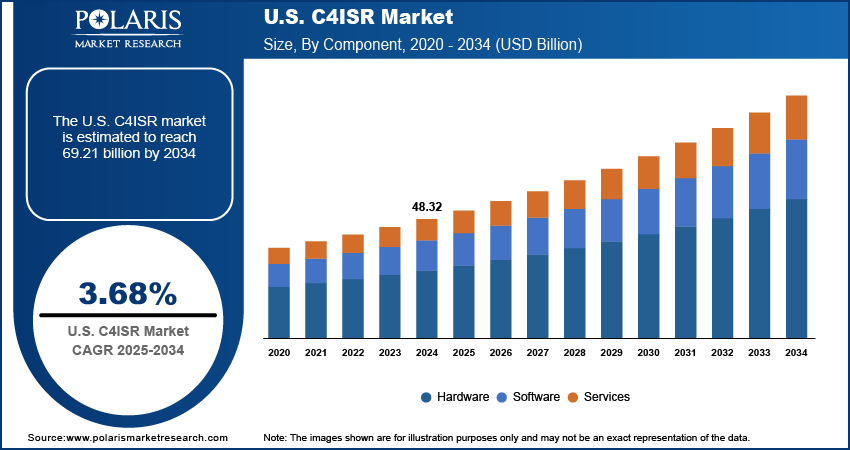

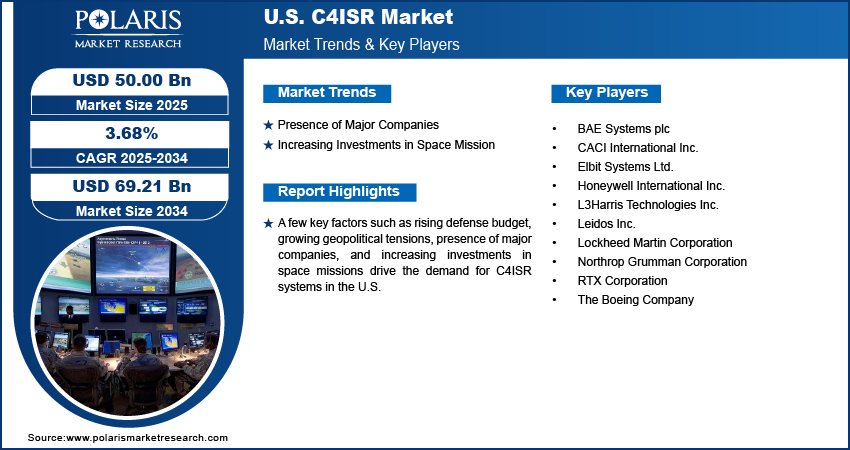

The U.S. C4ISR market size was valued at USD 48.32 billion in 2024, growing at a CAGR of 3.68% from 2025 to 2034. A few key factors driving demand for C4ISR systems include rising defense budget, growing geopolitical tension, presence of major companies, and increasing investments in space missions.

C4ISR stands for Command, Control, Communications, Computers, Intelligence, Surveillance, and Reconnaissance, and it plays a crucial role in modern military and defense operations. Defense forces use C4ISR systems to collect, process, and disseminate real-time data across units, enabling effective decision-making, situational awareness, and operational coordination on the battlefield. These systems integrate a range of technologies such as radar sensors, satellite imagery, drones, communication equipment, data analytics tools, and artificial intelligence to ensure that commanders gain a clear understanding of enemy movements, terrain, and operational risks. Military organizations rely on C4ISR to link strategic headquarters with frontline units, streamline mission planning, and support rapid response in combat scenarios.

The rising defense budget is driving the U.S. C4ISR market growth. Stockholm International Peace Research Institute stated that military expenditure in the Americas totaled $1,100 billion in 2024, an increase of 5.8% per cent from 2023. This increase in military expenditure is driving defense agencies to actively invest in integrated C4ISR platforms that combine surveillance, intelligence gathering, and advanced communication technologies to counter evolving threats. Moreover, higher spending also supports the procurement of advanced radar, satellite, and drone-based systems that feed critical data into C4ISR networks. Therefore, as the defense budget increases in the U.S., the demand for C4ISR also rises.

To Understand More About this Research: Request a Free Sample Report

In the U.S., the demand for C4ISR systems is driven by the rising geopolitical tension. Border disputes, power rivalries, and regional instability are pushing defense agencies to prioritize C4ISR integrated systems that deliver real-time situational awareness and secure communication. Nations are also expanding their space and cyber defense programs to counter modern hybrid warfare threats and geopolitical tension, which is increasing the need for C4ISR as space devices provide critical data for early warning, missile tracking, and global connectivity, all of which feed into C4ISR platforms for rapid analysis and action. Therefore, the rising geopolitical tension is propelling the U.S. C4ISR market growth.

Industry Dynamics

Presence of Major Companies

The presence of major defense and technology companies is boosting the growth of the U.S. C4ISR market by driving continuous innovation, large-scale production, and strategic collaborations. Industry leaders such as Lockheed Martin, Northrop Grumman, Raytheon Technologies, and General Dynamics are actively developing advanced C4ISR solutions that enhance command, control, and situational awareness capabilities for defense forces, leading market growth. The strong partnerships of these companies with the Department of Defense and other federal agencies are driving the rapid deployment of advanced C4ISR technologies that align with national security objectives.

Increasing Investments in Space Mission

The U.S. government and private sectors are launching more satellites for defense-specific applications, which improves global coverage and enhances real-time data transmission to military command centers. These space-based assets support early warning systems, missile tracking, secure communications, and reconnaissance, all of which rely on integrated C4ISR infrastructure. Agencies such as the U.S. Space Force and NASA are also collaborating with defense contractors to develop resilient space C4ISR architectures that strengthen national security. Therefore, the rising investment in space mission is fueling the U.S. C4ISR market expansion. For instance, in 2024, total investment in the US space sector reached $26 billion, marking a 30% year-over-year increase.

Segmental Insights

Type Analysis

Based on type, the U.S. C4ISR market segmentation includes new installation and retrofit. The new installation segment accounted for a major market share in 2024, due to the increasing investments by the Department of Defense in modernizing command and control infrastructure across all service branches. Additionally, large-scale procurement programs, including the U.S. Army’s Integrated Tactical Network (ITN) and the Air Force’s Advanced Battle Management System (ABMS), further fuel demand for new systems rather than upgrades to traditional platforms.

The retrofit segment is expected to hold a substantial market share in the coming years, owing to the military's need to extend the operational lifespan of existing platforms while ensuring compatibility with evolving digital warfare requirements. Ongoing geopolitical tensions have encouraged defense agencies in the U.S. to adopt a hybrid modernization approach, where they upgrade traditional systems with modular, software-defined, and cloud-enabled capabilities. The growing focus on cybersecurity resilience and the need to integrate traditional assets into joint and coalition operations are pushing agencies to retrofit older systems with advanced analytics, electronic warfare tools, and multi-domain communication interfaces.

Component Analysis

In terms of component, the segmentation includes hardware, software, and services. The hardware segment held the largest market share in 2024 due to the extensive deployment of mission-critical systems such as sensors, radars, communication equipment, and data processing units across defense platforms. The Department of Defense continued to invest heavily in advanced hardware to enhance surveillance, reconnaissance, and electronic warfare capabilities across all domains. Programs such as the Army's TITAN and the Navy’s Next Generation Jammer (NGJ) highlighted the emphasis on acquiring hardware to support real-time threat detection and situational awareness. The increasing adoption of unmanned aerial and ground systems further drove demand for ruggedized hardware capable of operating in complex and contested environments.

The software segment is projected to grow at a rapid pace in the coming years, owing to the growing shift toward digital transformation and the integration of artificial intelligence (AI), machine learning, and big data analytics into command and control systems. Defense agencies are planning to improve interoperability, automate decision-making processes, and enhance cyber resilience by deploying cloud-based, modular, and scalable software solutions. Initiatives such as the Joint Warfighting Cloud Capability (JWCC) and the development of open-architecture frameworks reflect the rising need for flexible software platforms that can support multi-domain operations and rapid technological upgrades.

Application Analysis

Based on application, the segmentation includes command & control; communications; computers; intelligence, surveillance, and reconnaissance (ISR); and electronic warfare. The intelligence, surveillance, and reconnaissance (ISR) segment dominated the market share in 2024 due to military’s growing need for real-time situational awareness and precision targeting capabilities. The Department of Defense prioritized ISR investments to enhance threat detection, monitor adversary movements, and support decision-making in both conventional and asymmetric warfare environments. Programs such as the Global Hawk and the expansion of satellite-based ISR platforms significantly contributed to segment growth. Additionally, the integration of high-resolution electro-optical sensors, synthetic aperture radar, and signal intelligence systems across airborne, space-based, and unmanned platforms ensured widespread ISR deployment across all operational areas.

The command and control segment is expected to grow at the fastest pace over the forecast period, owing to the shifting focus toward faster, coordinated, and decentralized decision-making across joint operations. The push for seamless multi-domain operations under initiatives such as Joint All-Domain Command and Control (JADC2) is creating demand for advanced command and control systems that allow real-time collaboration between land, sea, air, cyber, and space assets.

Vertical Analysis

In terms of vertical, the segmentation includes defense & military, government, and commercial. The defense & military segment accounted for a major market share in 2024 due to increased focus on modernizing battlefield networks, enhancing threat detection, and strengthening interoperability across armed forces. The increasing complexity of modern warfare, combined with rising geopolitical tensions pushed military forces to propel investments in advanced C4ISR systems. Programs such as the Army’s Project Convergence, the Air Force’s Advanced Battle Management System (ABMS), and the Navy’s Distributed Maritime Operations strategy highlighted the demand for integrated, resilient, and multi-domain command structures, leading to high adoption of C4ISR technologies.

.png)

Key Players and Competitive Analysis

The U.S. C4ISR market is highly competitive, dominated by established defense contractors and technology firms that provide advanced solutions for military and government applications. Major players such as Lockheed Martin, Northrop Grumman, RTX Corporation, and Boeing hold significant market share due to their extensive portfolios in integrated battle management systems, satellite communications, electronic warfare, and unmanned systems. These companies benefit from long-term contracts, strong R&D capabilities, and strategic partnerships with the U.S. Department of Defense (DoD). Market dynamics are influenced by increasing defense budgets, modernization initiatives such as Joint All-Domain Command and Control (JADC2), and the growing demand for interoperable, resilient systems against near-peer adversaries. Mergers, acquisitions, and collaborations continue to reshape the industry, ensuring dominance by firms that can deliver scalable, next-generation C4ISR capabilities.

A few major companies operating in the U.S. C4ISR industry include BAE Systems plc, CACI International Inc., Elbit Systems Ltd., Honeywell International Inc., L3Harris Technologies Inc., Leidos Inc., Lockheed Martin Corporation, Northrop Grumman Corporation, RTX Corporation, and The Boeing Company.

Key Players

- BAE Systems plc

- CACI International Inc.

- Elbit Systems Ltd.

- Honeywell International Inc.

- L3Harris Technologies Inc.

- Leidos Inc.

- Lockheed Martin Corporation

- Northrop Grumman Corporation

- RTX Corporation

- The Boeing Company

Industry Developments

May 2025: Raytheon, an RTX business, announced that has been awarded a $580 million contract from the U.S. Navy for the Next Generation Jammer Mid-Band (NGJ-MB) system to enhance electronic warfare capabilities on EA-18G Growler aircraft.

February 2025: L3Harris Technologies, a U.S.-based company, and Kalyani Strategic Systems Limited, a subsidiary of Bharat Forge Limited, signed a Memorandum of Understanding (MoU) to co-develop next-generation C4ISR and tactical communication solutions for the Indian Armed Forces.

U.S. C4ISR Market Segmentation

By Type Outlook (Revenue, USD Billion, 2020–2034)

- New Installation

- Retrofit

By Component Outlook (Revenue, USD Billion, 2020–2034)

- Hardware

- Software

- Services

By Application Outlook (Revenue, USD Billion, 2020–2034)

- Command & Control

- Communications

- Computers

- Intelligence, Surveillance, and Reconnaissance (ISR)

- Electronic Warfare

By Vertical Outlook (Revenue, USD Billion, 2020–2034)

- Defense & Military

- Government

- Commercial

U.S. C4ISR Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 48.32 Billion |

|

Market Size in 2025 |

USD 50.00 Billion |

|

Revenue Forecast by 2034 |

USD 69.21 Billion |

|

CAGR |

3.68% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The market size was valued at USD 48.32 billion in 2024 and is projected to grow to USD 69.21 billion by 2034.

The market is projected to register a CAGR of 3.68% during the forecast period.

A few of the key players in the market are BAE Systems plc, CACI International Inc., Elbit Systems Ltd., Honeywell International Inc., L3Harris Technologies Inc., Leidos Inc., Lockheed Martin Corporation, Northrop Grumman Corporation, RTX Corporation, and The Boeing Company.

The new installation segment dominated the market share in 2024.

The command and control segment is expected to witness the fastest growth during the forecast period.