U.S. Medical Plastics Market Size, Share, Trends, Industry Analysis Report

By Polymer Type (Thermoplastics, Elastomers, Biodegradable Polymers, Others), By Application, By Manufacturing – Market Forecast, 2025–2034

- Published Date:Aug-2025

- Pages: 129

- Format: PDF

- Report ID: PM6238

- Base Year: 2024

- Historical Data: 2020-2023

Overview

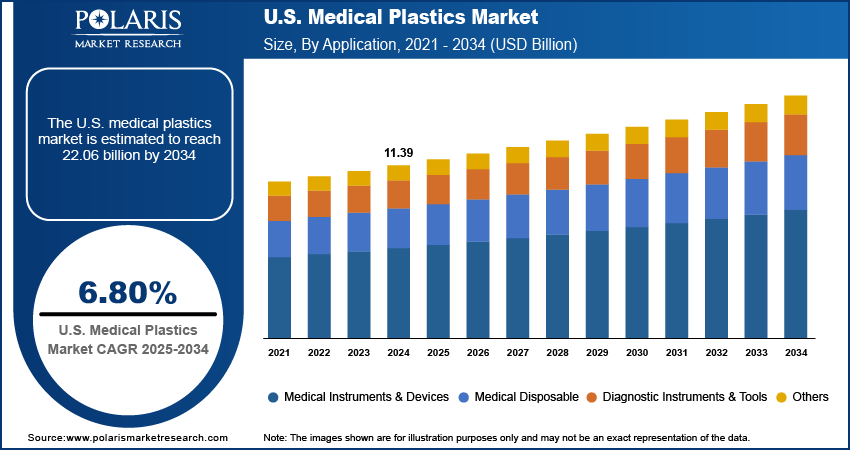

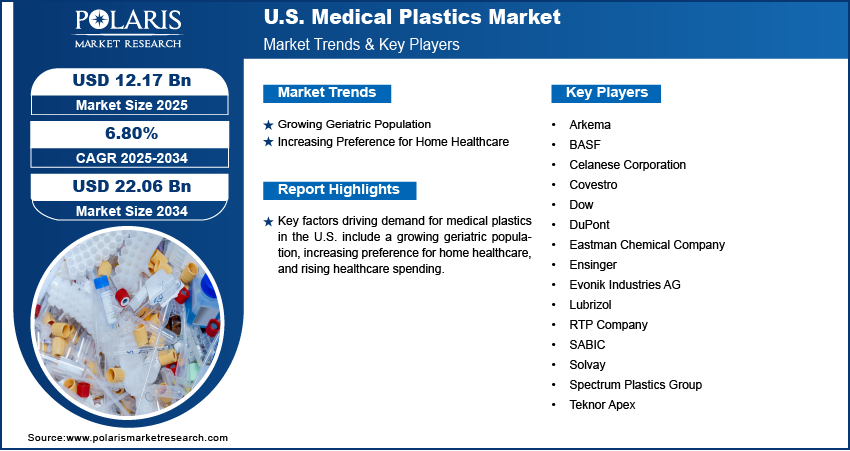

The U.S. medical plastics market size was valued at USD 11.39 billion in 2024, growing at a CAGR of 6.80% from 2025 to 2034. Key factors driving demand for medical plastics in the U.S. include a growing geriatric population, increasing preference for home healthcare, and rising healthcare spending.

Key Insights

- The thermoplastics segment accounted for 71.34% of the U.S. medical plastics market share in 2024 due to their ease of processing.

- The medical instruments & devices segment held 56.45% of the U.S. medical plastics market share in 2024 due to rising demand for surgical instruments, catheters, and prosthetics.

- The extrusion tubing segment dominated the U.S. medical plastics market, holding 42.78% of revenue share in 2024 due to the rising need for biocompatible tubing used in catheters.

Industry Dynamics

- The growing geriatric population is fueling the adoption of medical plastics, as older adults are prone to chronic conditions. To manage these conditions, there is a rising need for medical devices such as catheters, prosthetics, and orthopedic implants.

- The increasing preference for home healthcare is driving the market growth as home healthcare requires portable, easy-to-use devices such as insulin pens, nebulizers, and IV kits.

- The growing focus on sustainability is projected to create lucrative opportunities for the market during 2025–2034.

- The stringent regulatory compliance hinders the market expansion.

Market Statistics

- 2024 Market Size: USD 11.39 Billion

- 2034 Projected Market Size: USD 22.06 Billion

- CAGR (2025–2034): 6.80%

Medical plastics are specialized polymers designed for healthcare applications, offering sterility, durability, and biocompatibility. Various devices such as syringes, IV tubes, surgical instruments, implants, and packaging are made of medical plastics. These plastics resist chemicals, withstand sterilization, and reduce infection risks. Common types of medical plastics include PVC, polyethylene, polypropylene, and PTFE. The lightweight, cost-effective, and versatile nature of medical plastics makes them essential in diagnostics, drug delivery, and prosthetics.

The U.S. is a key country in the medical plastics industry, driven by advanced healthcare infrastructure and R&D. The market is growing due to high demand for disposable devices, surgical tools, and implantable materials. Regulatory standards by the FDA ensure the safety and performance of these medical plastics. Major applications of these plastics include catheters, wound care products, and diagnostic equipment. U.S. manufacturers focus on sustainability, developing recyclable and bio-based plastics. The market is projected to continue to grow with innovations such as smart polymers and 3D-printed medical devices.

The U.S. medical plastics market demand is driven by the increasing healthcare spending. American Medical Association, in its article, stated that health spending in the U.S. increased by 7.5% in 2023 to $4.9 trillion from 2022. This is driving healthcare providers to purchase additional medical devices, surgical tools, and disposable items, many of which rely on medical plastics for sterility, durability, and cost-effectiveness. Rising spending in healthcare infrastructure is also fueling the construction of new facilities, which require plastic-based equipment like IV bags, syringes, and packaging. Additionally, rising spending is supporting research into innovative medical solutions, further increasing the use of high-performance plastics in diagnostics, implants, and drug delivery systems. Therefore, growing investments in healthcare propel the demand for medical plastics to meet the need for efficient, safe, and scalable medical solutions.

Drivers & Opportunities

Growing Geriatric Population: Older adults require more frequent medical care, including surgeries, chronic disease management, and mobility aids, which is increasing the need for medical devices such as catheters, prosthetics, and orthopedic implants, many of these rely on durable and biocompatible plastics. Elderly patients also use more disposable medical products, such as syringes, wound care supplies, and diagnostic test kits, all made from medical plastics for safety and hygiene. Additionally, the rise in age-related conditions such as arthritis and cardiovascular diseases is driving demand for plastic-based drug delivery systems and surgical equipment. According to the Population Reference Bureau, the number of Americans aged 65 and above is projected to increase from 58 million in 2022 to 82 million by 2050. Therefore, as the elderly population expands, healthcare systems must scale up their use of medical plastics to meet the rising demand for efficient, cost-effective, and sterile medical solutions.

Increasing Preference for Home Healthcare: Home healthcare requires portable, easy-to-use devices such as insulin pens, nebulizers, and IV kits, which rely on lightweight, sterilizable plastics for safety and convenience. Patients and caregivers also depend on plastic-based wound dressings, syringes, and diagnostic tools to minimize infection risks in nonclinical environments. The shift toward home-based care is further driving demand for plastic packaging that ensures product sterility and extends shelf life. Hence, as more people opt for home treatments, manufacturers must produce more medical plastics to meet the need for affordable, hygienic, and user-friendly healthcare devices.

Segmental Insights

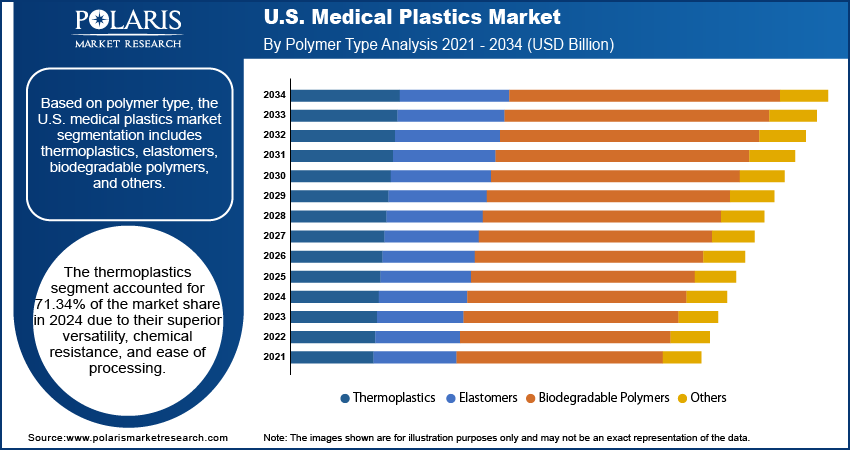

Polymer Type Analysis

Based on polymer type, the segmentation includes thermoplastics, elastomers, biodegradable polymers, and others. The thermoplastics segment accounted for 71.34% of the U.S. medical plastics market share in 2024 due to their superior versatility, chemical resistance, and ease of processing. Manufacturers across the healthcare sector preferred thermoplastics such as polypropylene, polyethylene, and polyvinyl chloride for producing diagnostic instruments, catheters, surgical tools, and IV components. These materials supported rigorous sterilization techniques while offering cost-effective solutions for mass production. The increasing demand for disposable medical devices, especially after the COVID-19 pandemic, further strengthened the dominance of thermoplastics, as hospitals and clinics prioritized infection control and patient safety through single-use equipment.

The biodegradable polymers segment is projected to register a CAGR of 8.5% from 2025 to 2034 due to increasing focus on sustainability and regulatory pressures to reduce medical waste. Biodegradable materials such as polylactic acid (PLA) and polycaprolactone (PCL) offer eco-friendly alternatives for applications such as drug delivery systems, tissue engineering scaffolds, and temporary implants. Advances in material science and the growing acceptance of bioresorbable devices among clinicians continue to drive adoption.

Application Analysis

In terms of application, the segmentation includes medical instruments & devices, medical disposables, diagnostic instruments & tools, and others. The medical instruments & devices segment held 56.45% of the U.S. medical plastics market share in 2024 due to high demand for durable, lightweight, and biocompatible materials used in surgical instruments, catheters, prosthetics, and implantable devices. Hospitals and clinics increasingly relied on plastic-based components due to their resistance to corrosion, ease of sterilization, and adaptability to complex geometries. The rapid growth of minimally invasive procedures and the continuous innovation in device design further boosted the use of engineered polymers in high-performance applications. Additionally, the aging population and rising prevalence of chronic conditions fueled the need for advanced medical equipment, strengthening the dominance of the segment.

The medical disposables segment is expected to register a CAGR of 7.4% from 2025 to 2034, owing to growing concerns around infection prevention and cost-effective patient care. The widespread adoption of single-use products such as gloves, syringes, tubing, IV bags, and surgical drapes is fueling the segment growth. Rising surgical volumes, increasing awareness of healthcare-associated infections (HAIs), and stringent hygiene protocols continue to support the segment growth. Moreover, advancements in polymer formulations have improved the performance of disposable products while maintaining affordability, making them essential in both hospital and home care environments.

Manufacturing Analysis

In terms of manufacturing, the segmentation includes extrusion tubing, injection molding, compression molding, and others. The extrusion tubing segment dominated the U.S. medical plastics market, holding 42.78% of revenue share in 2024 due to the increasing need for flexible, biocompatible tubing used in catheters, IV lines, and dialysis equipment. Healthcare providers expanded the use of plastic-based tubing in minimally invasive procedures, fluid management systems, and respiratory support applications. Advancements in multilayer extrusion technologies and stringent regulatory standards for safety and performance have pushed manufacturers to invest in precision extrusion processes. The rise in prevalence of chronic illnesses requiring long-term fluid delivery and the aging population’s growing reliance on home-based care solutions further propelled the demand for high-quality medical tubing.

The injection molding segment is estimated to register a CAGR of 7.0% from 2025 to 2034, owing to its ability to produce complex medical components at scale. Manufacturers are favoring this process for its efficiency in producing a wide range of critical medical parts, including syringes, housings, surgical instruments, and implantable devices. The method offers exceptional consistency, minimal material waste, and compatibility with high-performance medical-grade polymers. Its suitability for high-volume production made it crucial for meeting the rising demand for both reusable and disposable healthcare products across hospitals, clinics, and ambulatory centers.

Key Players & Competitive Analysis

The U.S. medical plastics market is highly competitive, with the presence of key players such as Arkema, BASF, Celanese Corporation, Covestro, and Teknor Apex driving innovation. These companies compete on material performance, biocompatibility, sterilization resistance, and regulatory compliance. Thermoplastics such as PVC, PE, PP, and high-performance polymers dominate applications in devices, packaging, and implants. Sustainability and recyclability are emerging differentiators, while mergers and R&D investments shape market dynamics. Regional manufacturers compete with global giants by offering cost-effective, customized solutions, intensifying rivalry in this high-growth sector.

A few major companies operating in the U.S. medical plastics industry include Arkema, BASF, Celanese Corporation, Covestro, Dow, DuPont, Eastman Chemical Company, Ensinger, Evonik Industries AG, Lubrizol, RTP Company, SABIC, Solvay, Spectrum Plastics Group, and Teknor Apex.

Key Companies

- Arkema

- BASF

- Celanese Corporation

- Covestro

- Dow

- DuPont

- Eastman Chemical Company

- Ensinger

- Evonik Industries AG

- Lubrizol

- RTP Company

- SABIC

- Solvay

- Spectrum Plastics Group

- Teknor Apex

U.S. Medical Plastics Industry Developments

In January 2025, Arkema partnered with ALBIS to distribute high-performance medical-grade polymers across Europe, North Africa, and the Middle East.

In February 2023, Covestro launched Makrolon 3638, a durable, versatile polycarbonate for healthcare and life sciences, offering high impact strength, chemical resistance, and biocompatibility.

U.S. Medical Plastics Market Segmentation

By Polymer Type Outlook (Revenue, USD Billion, 2021–2034)

- Thermoplastics

- Polypropylene (PP)

- Polyvinyl Chloride (PVC)

- Polyethylene (PE)

- Polycarbonate (PC)

- Polyurethane

- Acrylonitrile Butadiene Styrene (ABS)

- Others

- Elastomers

- Biodegradable Polymers

- Others

By Application Outlook (Revenue, USD Billion, 2021–2034)

- Medical Instruments & Devices

- Medical Disposables

- Diagnostic Instruments & Tools

- Others

By Manufacturing Outlook (Revenue, USD Billion, 2021–2034)

- Extrusion Tubing

- Injection Molding

- Compression Molding

- Others

U.S. Medical Plastics Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 11.39 Billion |

|

Market Size in 2025 |

USD 12.17 Billion |

|

Revenue Forecast by 2034 |

USD 22.06 Billion |

|

CAGR |

6.80% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2021–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The market size was valued at USD 11.39 billion in 2024 and is projected to grow to USD 22.06 billion by 2034.

The market is projected to register a CAGR of 6.80% during the forecast period.

A few of the key players in the market are Arkema, BASF, Celanese Corporation, Covestro, Dow, DuPont, Eastman Chemical Company, Ensinger, Evonik Industries AG, Lubrizol, RTP Company, SABIC, Solvay, Spectrum Plastics Group, and Teknor Apex.

The thermoplastics segment dominated the market share in 2024.

The injection molding segment is expected to witness the fastest growth during the forecast period.