Catheter Market Size, Share, Trends, Industry Analysis Report

: By Product Type (Cardiovascular Catheters, Urology Catheters, Intravenous Catheters, Specialty Catheters, and Neurovascular Catheters), Lumen, Material, End Use, and Region – Market Forecast, 2025–2034

- Published Date:Sep-2025

- Pages: 117

- Format: PDF

- Report ID: PM1132

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

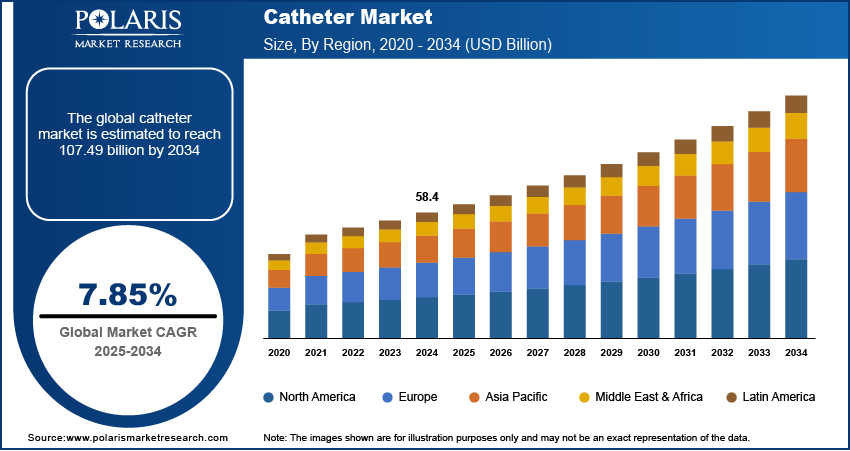

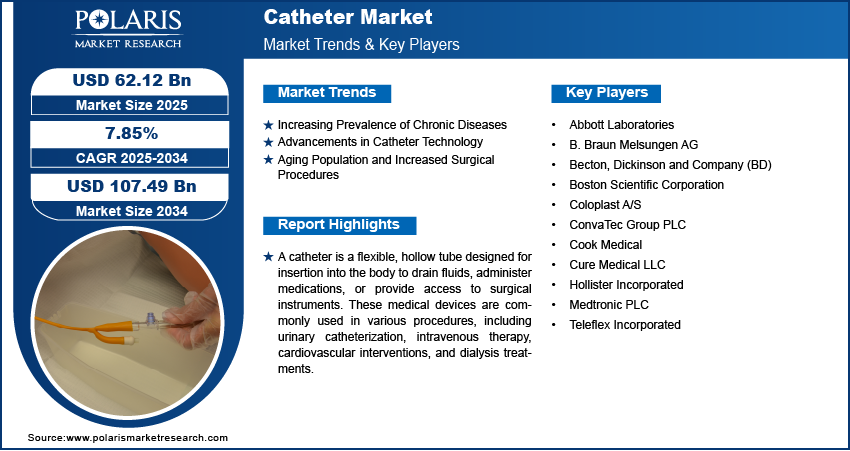

The global catheters market was valued at USD 58.4 billion in 2024 and is projected to grow at a CAGR of 7.85% from 2025 to 2034. This growth is driven by the increasing prevalence of chronic diseases, rising surgical procedures, and the growing demand for minimally invasive treatments.

Key Insights

- The cardiovascular catheters market was at the forefront in 2024, driven almost exclusively by its established leadership in both the diagnosis and treatment of cardiovascular diseases, largely due to the rising prevalence of these conditions globally.

- The double-lumen segment led the market in 2024 due to its increasing demand for advanced biomaterial-based devices that offer improved patient outcomes and reduced complications.

- The polyurethane catheters segment is experiencing significant growth due to its flexibility and biocompatibility, which have made it an ideal material for medical applications such as central venous and hemodialysis catheters.

- North America dominated the market in 2024 owing to the region's superior healthcare facilities and high incidence of chronic diseases.

- The Asia Pacific market is expanding at the fastest rate due to a large population suffering from kidney and cardiovascular diseases, improved medical facilities, and more accessible insurance coverage.

Industry Dynamics

- The growth in the prevalence of chronic diseases and the increasing need for catheter-based procedures in the treatment of various medical conditions are driving the market's expansion.

- Ongoing innovations in catheter technology, including antimicrobial coatings and AI-optimized solutions, are enhancing patient outcomes, comfort, and safety, thereby driving market expansion.

- The increasing demand for less invasive methods, combined with the development of new catheter technologies, offers significant growth opportunities for the catheter market.

- The severe risk of infection and complications associated with catheter use, as well as the high price of advanced catheter technologies, are major inhibiting factors in the market.

Market Statistics

2024 Market Size: USD 58.4 billion

2034 Projected Market Size: USD 107.49 billion

CAGR (2025-2034): 7.85%

North America: Largest Market Share

AI Impact on Catheter Market

- AI enhances catheter design by analyzing large datasets to develop better, more biocompatible materials that reduce the risk of infection.

- AI helps select the most suitable catheter for each patient by analyzing their data, resulting in more precise and effective treatment.

- AI detects impending complications, such as infection or obstruction, allowing for earlier intervention and improved patient outcomes. Anon.

- AI-powered automation is streamlining the production of catheters, enhancing the quality control, and minimizing costs.

- Real-time monitoring of AI-integrated catheters may also alert healthcare professionals to potential complications, enabling them to respond more promptly and deliver better care.

To Understand More About this Research:Request a Free Sample Report

This growth is driven by the increasing prevalence of chronic diseases, rising surgical procedures, and the growing demand for minimally invasive treatments.

The catheter market encompasses a wide range of medical devices used for fluid drainage, drug administration, and surgical procedures. These flexible tubes are widely utilized in hospitals, clinics, and home healthcare settings, catering to patients suffering from chronic illnesses, mobility issues, or those undergoing surgical treatments. The industry is expanding due to increasing healthcare needs, technological advancements, and a rising aging population that requires long-term medical care. Additionally, the demand for minimally invasive procedures has driven innovation in catheter design, leading to improved patient comfort and reduced risk of complications.

The rising prevalence of cardiovascular diseases, urinary disorders, and neurological conditions has significantly increased the need for catheter-based treatments. Furthermore, improvements in healthcare infrastructure, particularly in emerging economies, are expanding access to advanced medical procedures. The growing preference for home healthcare solutions is also contributing to catheter demand, as patients seek convenient and cost-effective treatment options. Additionally, continuous research and development efforts are introducing antimicrobial coatings and biodegradable materials, enhancing safety and effectiveness in medical applications.

Market Dynamics

Increasing Prevalence of Chronic Diseases

The rising prevalence of chronic illnesses, such as cardiovascular diseases, diabetes, and urological disorders, has significantly increased the demand for catheter-based interventions. For instance, a study published in the Journal of the American Medical Association in 2021 highlighted that approximately 25% of hospitalized adults require an indwelling urinary catheter during their hospital stay, underscoring the widespread need for these devices in managing various medical conditions. This growing patient population necessitates the use of catheters for both diagnostic and therapeutic purposes, thereby propelling the catheter industry growth.

Advancements in Catheter Technology

Continuous innovations in catheter design and materials have enhanced the safety, efficacy, and patient comfort associated with catheterization procedures. The development of antimicrobial-coated catheters has been instrumental in reducing the incidence of catheter-associated infections. For instance, in January 2025, Caltech developed an AI-optimized catheter tube that reduces bacterial upstream movement 100-fold in lab tests, without antibiotics or antimicrobial chemicals. The design physically hinders bacteria rather than relying on traditional drug-based methods. These technological advancements improve patient outcomes and also encourage healthcare providers to adopt newer catheter models, thereby stimulating the catheter market development.

Aging Population and Increased Surgical Procedures

The global increase in the elderly population has led to a higher prevalence of age-related health issues that often require catheterization. A 2023 UN DESA report projects the global population aged 65 and above will more than double, from 761 million in 2021 to 1.6 billion by 2050. The 80+ age group is growing at an even faster rate. Older adults are more susceptible to conditions such as urinary incontinence and cardiovascular ailments, necessitating the use of catheters for effective management. Additionally, the rise in surgical procedures among the elderly has amplified the need for catheters during perioperative care. Hence, the aging population and increased surgical procedures boost the catheter industry growth.

Segment Insights

By Product Type

The product type is segmented into cardiovascular catheters, urology catheters, intravenous catheters, specialty catheters, and neurovascular catheters. The cardiovascular catheters segment held the largest catheter market share in 2024. These medical devices are essential for diagnosing and treating various heart-related conditions, including coronary artery disease and cardiac arrhythmias. The widespread prevalence of cardiovascular diseases globally has led to an increased demand for these catheters. According to data released by the American College of Cardiology in July 2023, approximately 200 million individuals worldwide, including over 12 million in the US, are affected by peripheral artery disease (PAD). This high incidence underscores the critical role of cardiovascular catheters in facilitating minimally invasive procedures, thereby reducing the need for traditional surgical interventions and enhancing patient recovery times. Consequently, the significant burden of cardiovascular diseases continues to drive the growth of the cardiovascular catheter segment.

The specialty catheters segment is experiencing the highest growth rate. This surge is attributed to the increasing demand for minimally invasive procedures and the rising prevalence of specific medical conditions that require specialized catheter solutions. Advancements in catheter technology have led to the development of devices tailored for particular applications, such as wound drainage, oximetry, and thermodilution. For instance, in January 2024, the FDA cleared Nuwelli’s Dual Lumen Extended Length Peripheral Catheter (dELC), marking a substantial advancement in vascular access technology. This specialty catheter is designed to work seamlessly with the Aquadex ultrafiltration system, aiding in the management of patient fluid overload. Such innovations enhance patient outcomes and expand the applicability of catheters across diverse medical fields. The specialty catheters segment continues to witness robust growth within the market as healthcare providers increasingly adopt these advanced devices to improve treatment efficacy and patient comfort.

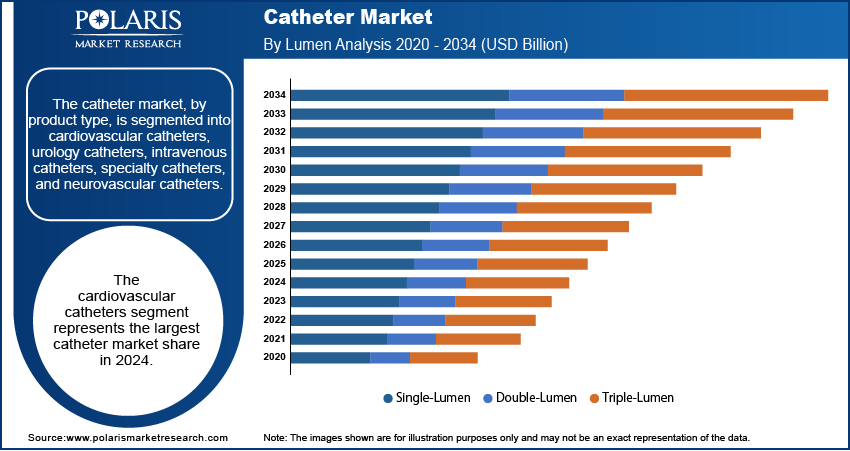

By Lumen

The lumen segment includes single-lumen, double-lumen, and triple-lumen catheters. The double-lumen segment held the largest share of the catheter market revenue in 2024. This growth is driven by the increasing demand for advanced biomaterial-based devices that reduce complications such as thrombosis and infections, thereby improving patient outcomes and healthcare efficiency. A notable example is the FDA clearance of the HydroPICC dual-lumen catheter by Access Vascular, Inc in May 2022. This device is designed with a biomaterial that significantly reduces complications compared to standard catheters, enhancing patient safety and hospital economics. Such advancements in catheter technology, coupled with the growing preference for minimally invasive procedures, are propelling the expansion of the double-lumen segment within the market.

By Material

The material is segmented into silicone catheters, polyurethane catheters, latex catheters, and others. The silicone catheters segment held the largest share of the market in 2024. Silicone's biocompatibility and inert nature make it suitable for long-term catheterization, reducing the risk of allergic reactions and enhancing patient comfort. Its flexibility and resistance to encrustation further contribute to its widespread adoption in various medical applications, including urinary and peritoneal dialysis catheters. The material's durability ensures a longer lifespan, decreasing the frequency of replacements and thereby improving patient compliance and reducing healthcare costs. These attributes collectively reinforce the dominance of silicone catheters in the catheter market.

The polyurethane catheters segment is experiencing the highest growth rate within the catheter market. Polyurethane's flexibility and biocompatibility make it a preferred choice for various medical applications, including central venous and hemodialysis catheters. Its ability to conform to the body's contours and withstand high-pressure conditions without compromising structural integrity enhances its utility in critical care settings. Additionally, polyurethane's reduced risk of causing thrombosis and its durability contribute to its increasing adoption. These factors collectively drive the rapid growth of the polyurethane catheter segment.

By End Use

Based on end use market is segmented into hospitals, ambulatory surgical centers, specialty clinics, and homecare settings. The hospitals segment held the largest market share in 2024. Hospitals perform a high volume of catheter-based procedures, including surgeries and minimally invasive interventions, necessitating a substantial and consistent demand for various types of catheters. The availability of advanced medical infrastructure and skilled healthcare professionals in hospitals ensures the effective utilization of these devices. Additionally, the increasing prevalence of chronic diseases and the subsequent rise in hospital admissions further contribute to the dominance of this segment.

The homecare settings segment is experiencing the highest growth rate. This growth is driven by a growing preference for home-based treatments, particularly among the elderly population and patients suffering from chronic conditions requiring long-term catheterization. Advancements in catheter design have led to the development of user-friendly and safe devices suitable for home use, empowering patients to manage their health more independently. This shift enhances patient comfort and satisfaction and also alleviates the burden on healthcare facilities, thereby propelling the expansion of the homecare settings segment.

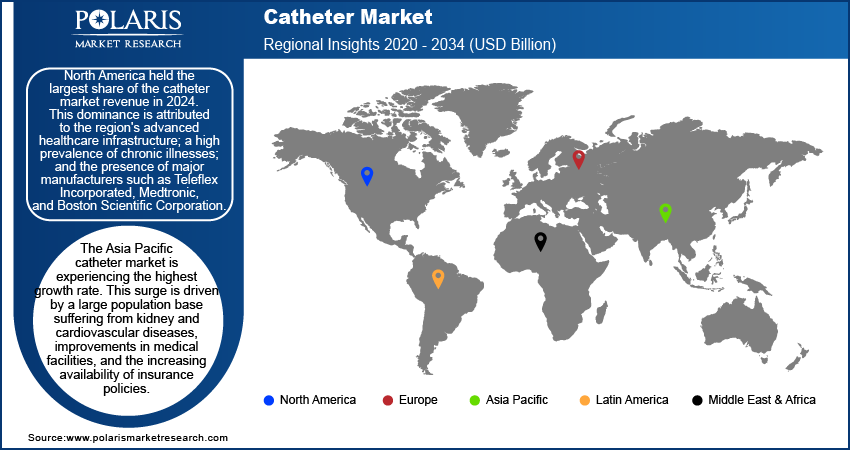

Regional Insights

The catheter market exhibits distinct regional variations, with North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa each contributing uniquely to the industry's landscape. Factors such as the prevalence of chronic diseases, healthcare infrastructure, technological advancements, and demographic trends influence the industry dynamics across these regions.

North America catheter market held the largest market share in 2024 attributed to the region's advanced healthcare infrastructure, a high prevalence of chronic illnesses, and the presence of major manufacturers such as Teleflex Incorporated, Medtronic, and Boston Scientific Corporation. Favorable government regulations, increased public awareness, and a substantial pool of skilled healthcare professionals further drive the growth of the catheter market in this region. The U.S. market, in particular, benefits from significant healthcare spending, which surpassed USD 1 trillion in 2023, fostering the adoption of advanced medical devices such as catheters.

The Asia Pacific catheter market is experiencing the highest growth rate. This surge is driven by a large population base suffering from kidney and cardiovascular diseases, improvements in medical facilities, and the increasing availability of insurance policies. Government initiatives aimed at enhancing healthcare standards, such as the introduction of guidelines for the prevention of catheter-linked infections, contribute to the development. Additionally, the region's growing need for technologically advanced and cost-efficient healthcare solutions presents significant opportunities.

Key Players and Competitive Insights

The catheter industry features several prominent companies actively providing a range of catheter products. A few notable players include B. Braun Melsungen AG; Boston Scientific Corporation; Hollister Incorporated; Medtronic PLC; Teleflex Incorporated; Abbott Laboratories; ConvaTec Group PLC; Coloplast A/S; Cook Medical; Cure Medical LLC; and Becton, Dickinson and Company (BD). These companies operate independently, without being subsidiaries of parent organizations, and offer a diverse array of catheter-related products across various medical applications.

The competitive landscape is characterized by a blend of well-established corporations and specialized firms, each striving to enhance their industry presence through innovation, strategic partnerships, and geographic expansion. Companies focus on developing advanced catheter technologies to meet the evolving needs of healthcare providers and patients. Collaborations with medical institutions and investments in research and development are common strategies employed to gain a competitive edge. Additionally, adherence to stringent regulatory standards and a commitment to quality assurance play pivotal roles in maintaining market position and consumer trust.

Boston Scientific Corporation, headquartered in Marlborough, Massachusetts, is a global medical technology company specializing in the development and manufacturing of devices for interventional medical specialties. The company’s portfolio spans cardiovascular, urological, gastrointestinal, and other applications, supporting minimally invasive procedures that align with the growing demand for such interventions. Boston Scientific is widely recognized for innovations like the Taxus Stent and its EMBLEM subcutaneous implantable defibrillator (S-ICD), which enhance patient outcomes in critical care scenarios. The company operates manufacturing facilities across the US, Ireland, Costa Rica, Brazil, Malaysia, and Puerto Rico, distributing its products worldwide through direct sales and a network of dealers. Its catheter offerings include advanced imaging systems like intravascular ultrasound catheters and fractional flow reserve tools, catering to structural heart and peripheral vascular treatments. Boston Scientific’s continuous investment in research and development ensures its leadership in the catheter market and broader medical device industry.

ConvaTec Group PLC, headquartered in London, England, focuses on medical products and technologies, specializing in advanced wound care, ostomy care, continence care, and infusion care. Established in 1978, the company has built a strong presence across the Americas, Europe, Asia Pacific, the Middle East, and Africa. ConvaTec manufactures approximately 900 million products annually through its seven manufacturing sites and serves nearly 90 countries globally. Its catheter portfolio includes urological solutions designed to manage urinary incontinence and related conditions, such as spinal cord injuries and multiple sclerosis. Products like GentleCath are tailored for patient comfort and ease of use. ConvaTec’s focus on innovation has enabled it to maintain a competitive edge while addressing the growing demand for chronic condition management. The company’s emphasis on infection prevention and improved patient outcomes aligns with broader healthcare trends favoring advanced medical technologies.

List of Key Companies

- Abbott Laboratories

- B. Braun Melsungen AG

- Becton, Dickinson and Company (BD)

- Boston Scientific Corporation

- Coloplast A/S

- ConvaTec Group PLC

- Cook Medical

- Cure Medical LLC

- Hollister Incorporated

- Medtronic PLC

- Teleflex Incorporated

Catheter Industry Developments

- In February 2025, the CEREGLIDE 92 Catheter System was launched by Johnson & Johnson MedTech in the U.S. It was developed to enhance neurovascular access during thrombectomy procedures and address anatomical challenges in acute ischemic stroke treatment.

- January 2025: Radical Catheter Technologies received FDA 510(k) clearance for its 8F Neurovascular Catheter. Built on Radical’s patented ribbon technology platform, the catheter features an expanded inner diameter to enhance therapeutic options in neurovascular procedures.

- January 2025: B. Braun Medical Inc. introduced the Clik-FIX Epidural/Peripheral Nerve Block (PNB) Catheter Securement Device. This new addition to the Clik-FIX family features a soft, low-profile design aimed at enhancing securement while minimizing the risk of catheter displacement during regional anesthesia procedures.

Market Segmentation

By Product Type Outlook (Revenue-USD Billion, 2020–2034)

- Cardiovascular Catheters

- Urology Catheters

- Intravenous Catheters

- Specialty Catheters

- Neurovascular Catheters

By Lumen Outlook (Revenue-USD Billion, 2020–2034)

- Single-Lumen

- Double-Lumen

- Triple-Lumen

By Material Outlook (Revenue-USD Billion, 2020–2034)

- Silicone Catheters

- Polyurethane Catheters

- Latex Catheters

- Others

By End Use Outlook (Revenue-USD Billion, 2020–2034)

- Hospitals

- Ambulatory Surgical Centers

- Specialty Clinics

- Homecare Settings

By Regional Outlook (Revenue-USD Billion, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- Suth Korea

- Indnesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- Suth Africa

- Rest of Middle East & Africa

- Latin America

- Mexic

- Brazil

- Argentina

- Rest of Latin America

Catheter Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 58.4 billion |

|

Market Size Value in 2025 |

USD 62.12 billion |

|

Revenue Forecast by 2034 |

USD 107.49 billion |

|

CAGR |

7.85% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Industry Insights |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

How is the report valuable for an organization?

Workflow/Innovation Strategy: The catheter market has been segmented into detailed segments of product type, lumen, material, and end use. Moreover, the study provides the reader with a detailed understanding of the different segments at both the global and regional levels.

Growth/Marketing Strategy: The catheter market growth and marketing strategy revolves around product innovation, strategic partnerships, and geographic expansion. Companies focus on developing advanced catheters with improved materials and infection-resistant technologies to enhance patient safety and comfort. Collaborations with healthcare providers and research institutions aid in expanding market reach and credibility. Additionally, investments in emerging markets, particularly in Asia Pacific and Latin America, help tap into the growing demand for affordable and high-quality medical devices. Digital marketing, regulatory approvals, and direct-to-consumer awareness campaigns further strengthen brand positioning and drive market expansion.

FAQ's

The catheter market size was valued at USD 58.4 billion in 2024 and is projected to grow to USD 107.49 billion by 2034.

The market is projected to register a CAGR of 7.85% during the forecast period.

North America held the largest share of the market in 2024.

A few key players in the catheter market include B. Braun Melsungen AG; Boston Scientific Corporation; Hollister Incorporated; Medtronic PLC; Teleflex Incorporated; Abbott Laboratories; ConvaTec Group PLC; Coloplast A/S; Cook Medical; Cure Medical LLC; and Becton, Dickinson and Company (BD).

The hospitals segment accounted for the largest share of the market in 2024.

A catheter is a thin, flexible tube inserted into the body to drain fluids or deliver medications, gases, or surgical instruments. It is commonly used in medical procedures such as urinary drainage, intravenous therapy, and cardiac interventions. Catheters are made from materials such as silicone, polyurethane, or latex, ensuring flexibility and biocompatibility. They are widely used in hospitals, specialty clinics, and homecare settings to manage conditions like urinary retention, cardiovascular diseases, and chronic illnesses requiring long-term fluid management.