U.S. Space Cybersecurity Market Size, Share, Trends, & Industry Analysis Report

By Offering (Solution, Services), By Platform, By End User, and By Country – Market Forecast, 2025–2034

- Published Date:Jul-2025

- Pages: 130

- Format: PDF

- Report ID: PM5905

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

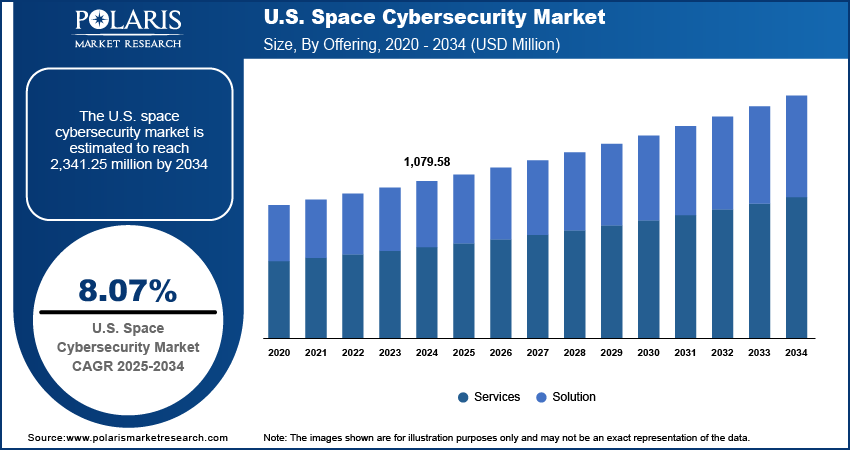

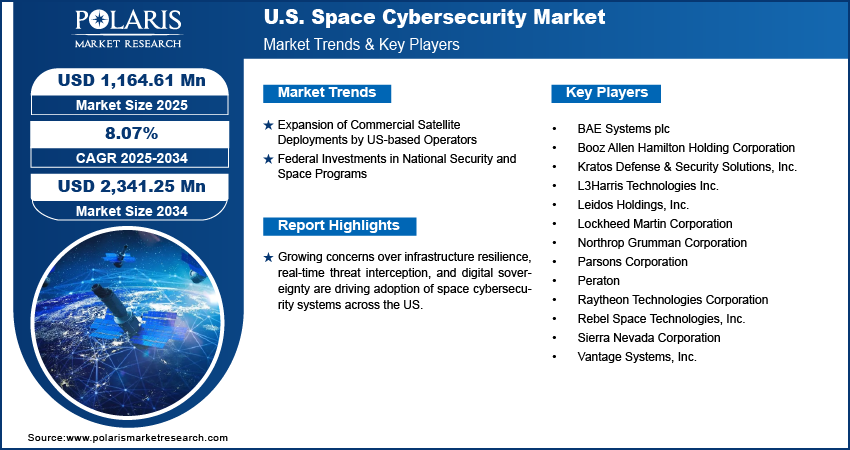

The US space cybersecurity market size was valued at USD 1,079.58 million in 2024, growing at a CAGR of 8.07% from 2025–2034. Expansion of commercial satellite deployments by US operators coupled with increasing federal investment in national security and space programs, is driving the demand for advanced space cybersecurity solutions.

US space cybersecurity solutions are designed to safeguard satellite internet, satellite ground stations, and space-based communication systems from digital threats. These systems integrate advanced encryption protocols, intrusion detection software, and secure command architectures within a unified framework to ensure operational integrity. Modular platforms allow for seamless upgrades and quick adaptation to emerging threat landscapes.

To Understand More About this Research: Request a Free Sample Report

Vendors across the US are prioritizing standardized security protocols, AI-driven anomaly detection tools, and remote incident response capabilities to enhance threat resilience. The use of radiation-hardened hardware, secure firmware updates, and tamper-resistant data links addresses critical requirements for mission assurance. Space cybersecurity systems are increasingly deployed across both low Earth orbit (LEO) and geostationary (GEO) operations, offering scalability, interoperability, and high-level protection. These solutions continue to evolve in line with government directives and national security programs focused on critical infrastructure protection.

Growing attention to critical infrastructure resilience and digital sovereignty is shaping the adoption of space cybersecurity solutions across the US. Recently, in April 2025, US Space Force (USSF) launched the Orbital Watch initiative to enhance space domain awareness and bolster cybersecurity for commercial space assets, aiming to safeguard satellite operations against emerging cyber and orbital threats. These systems are incorporated into military-grade communication networks, ground control centers, and scientific missions due to their modular architecture, secure design, and compatibility with emerging command protocols. System integrators and federal contractors are selecting solutions that offer rapid deployment, tamper-resistant hardware, and compliance with evolving cybersecurity frameworks tied to space operations.

Rising focus on secure supply chains and controlled component sourcing is improving system reliability while reducing vulnerabilities tied to foreign interference. Manufacturers are offering pre-validated security modules with built-in diagnostics to support streamlined deployment and certification processes. In critical research programs and inter-agency space initiatives, these systems ensure long-term continuity, secure data relay, and coordinated threat response. Their usage expanding under contingency planning protocols, where space cybersecurity solutions serve as essential safeguards for command-and-control continuity across defense, civil, and commercial missions. These developments are driving deeper integration of cybersecurity across US space infrastructure strategy.

Industry Dynamics

Expansion of Commercial Satellite Deployments by US-based Operators

Increasing commercial satellite activity across the US is generating sustained demand for robust space cybersecurity industry. As per the Ill-Defined Space, US launch providers carried out 154 launches, a 40% rise from 110 in 2023. These launches made up about 61% of all global orbital launches, averaging nearly 13 per month. Private sector operators are deploying small satellite constellations, Earth observation platforms, and communication relays to support applications ranging from broadband internet to climate monitoring. As mission volumes grow and orbits become more populated, the risk of unauthorized access, data interception, and system manipulation rises sharply. Thus, commercial entities are prioritizing embedded encryption systems, secure telemetry, and resilient communication protocols as part of standard satellite architecture to counter these risks.

Vendors are responding by offering modular cybersecurity tools that integrate directly with mission planning, satellite operations, and ground station management. These tools enable real-time threat detection, identity verification, and encrypted command exchanges across multiple orbital layers. The commercial segment focus on cost-efficiency and operational speed for the adoption of pre-certified, scalable security modules. With the US emerging as a global hub for commercial satellite innovation, cybersecurity requirements are embedded earlier in development cycles, ensuring compatibility with international regulatory expectations and cross-operator coordination standards.

Federal Investments in National Security and Space Programs

Federal funding allocated to space and defense initiatives is playing an important factor in driving the space cybersecurity solutions. The US Department of Defense (DoD), US Space Force, and other strategic agencies are investing in hardened communication infrastructure, secure orbital surveillance platforms, and anti-jamming capabilities to preserve mission integrity. As an example, in May 2024, the US DoD announced the FY2025 budget that includes USD 33.7 billion for space programs, with USD 2.4 billion for launch capabilities, USD 1.5 billion for stronger navigation systems, and USD 4.2 billion for secure satellite communications. These investments are boosting the development of resilient command systems, intrusion-resistant architecture, and advanced signal encryption tailored to military-grade operational conditions.

Programs under agencies such as National Aeronautics and Space Administration (NASA) and Defense Advanced Research Projects Agency (DARPA) are further contributing to research in quantum-resistant encryption, autonomous threat detection, and AI-based monitoring tools for space-based assets. Additionally, budget proposals continue to prioritize cybersecurity within multi-orbit missions and cross-domain coordination systems, ensuring protection across land, sea, air, and space operations. These efforts enhance national readiness and stimulate commercial innovation through technology transfer and procurement contracts, fostering a secure ecosystem that helps US dominance in space-related activities.

Segmental Insights

Offering Analysis

The segmentation, based on offering includes, solution and services. The solution segment is projected to grow substantially. This growth is due to heightened investment in advanced encryption, secure communication frameworks, and threat detection software integrated across space assets. The demand for mission-specific software, onboard cyber defense tools, and hardened firmware is rising among both government and commercial operators. These solutions offer scalable protection across satellite constellations, launch platforms, and command infrastructure, making them a preferred choice for securing complex and distributed space systems.

The services segment is projected to grow at a robust pace in the coming years, driven by the need for continuous monitoring, threat intelligence, risk assessments, and compliance consulting. As new space missions adopt more sophisticated cybersecurity standards, operators are turning to specialized service providers for ongoing support, incident response, and systems training. This trend is further reinforced by evolving federal cybersecurity guidelines, which mandate third-party audits, managed security services, and lifecycle-based vulnerability assessments.

Platform Analysis

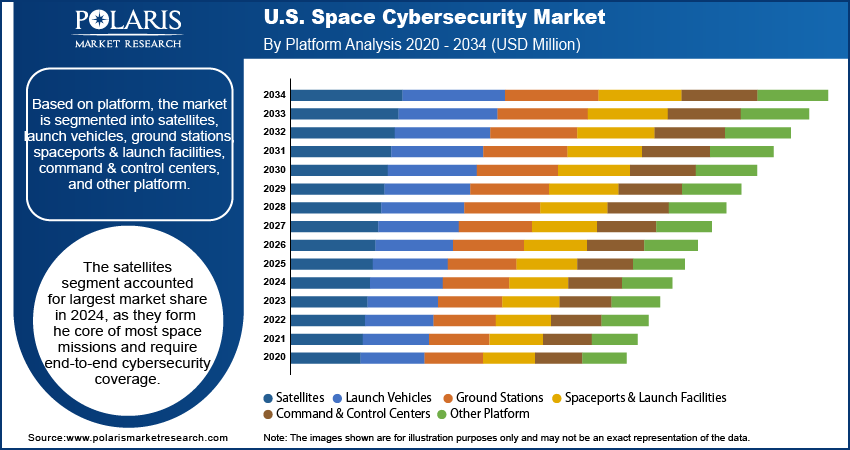

The segmentation, based on offering includes, satellites, launch vehicles, ground stations, spaceports & launch facilities, command & control centers, and other platform. The satellites segment accounted for largest market share in 2024, fueled by growing deployment of commercial and defense satellite constellations in low Earth orbit and geostationary orbit. These assets are exposed to a broad range of cyber risks, including signal interception, command spoofing, and malware intrusion. To mitigate these vulnerabilities, US operators are integrating secure communication layers, hardware-based authentication, and automated recovery mechanisms directly into satellite systems.

The command and control centers segment is projected to grow at a significant pace during the assessment phase, driven by their central role in managing telemetry, tracking, and secure mission execution. The concentration of high-value data, operational commands, and real-time decision-making processes made these facilities a priority for cybersecurity enhancement. Upgrades in access controls, network segmentation, and endpoint protection are rapidly adopted to secure critical nodes in the operational chain.

End User Analysis

The segmentation, based on end user includes, government & defense and commercial. The government and defense segment dominated the market share, in 2024, due to the presence of well-established agencies including the Department of Defense, US Space Force, and NASA are consistently funding advanced protective measures to safeguard national assets, classified data streams, and secure communications. For instance, in June 2025, the Pentagon proposed a USD 1.01 trillion budget for FY2026, focusing on cybersecurity and space systems to better protect satellites and U.S. assets from growing cyber threats. These efforts are backed by long-term contracts, defense-grade standards, and dedicated cybersecurity divisions focused on threat resilience in space operations.

The commercial segment is estimated to hold a substantial market share in 2034, as private companies expand their presence in satellite communications, Earth observation, and space-based research. These operators are increasingly investing in cybersecurity tools to meet regulatory compliance, protect proprietary data, and ensure operational reliability. The rapid onboarding of digital infrastructure and rising cyber risk awareness is pushing cybersecurity to the forefront of mission planning in the private space sector.

Key Players & Competitive Analysis Report

The space cybersecurity industry is highly competitive, shaped by rapid advancements in space technology, growing threat exposure, and expanding national security requirements. Companies operating in this domain are focusing on integrated solutions that combine satellite protection, ground infrastructure security, and encrypted communication systems. Development strategies are centered around real-time threat detection, AI-based anomaly monitoring, and modular cybersecurity platforms capable of supporting diverse mission profiles. There is a strong emphasis on systems that reduce cyber risk exposure, support interoperability across defense and commercial networks, and maintain operational continuity in high-risk environments.

Key companies in the US space cybersecurity industry include Lockheed Martin Corporation, Northrop Grumman Corporation, Raytheon Technologies Corporation, L3Harris Technologies Inc., Booz Allen Hamilton Holding Corporation, BAE Systems plc, Parsons Corporation, Leidos Holdings, Inc., Kratos Defense & Security Solutions, Inc., Peraton, Sierra Nevada Corporation, Rebel Space Technologies, Inc., and Vantage Systems, Inc.

Key Players

- BAE Systems plc

- Booz Allen Hamilton Holding Corporation

- Kratos Defense & Security Solutions, Inc.

- L3Harris Technologies Inc.

- Leidos Holdings, Inc.

- Lockheed Martin Corporation

- Northrop Grumman Corporation

- Parsons Corporation

- Peraton

- Raytheon Technologies Corporation

- Rebel Space Technologies, Inc.

- Sierra Nevada Corporation

- Vantage Systems, Inc.

Industry Developments

February 2024: BAE Systems acquired Ball Aerospace for USD 5.5 billion to enhance its defense and space portfolio, with a strategic focus on advancing space cybersecurity and strengthening secure satellite and mission systems against evolving threats.

June 2023: SpiderOak successfully demonstrated its space cybersecurity software in orbit, showcasing secure data protection capabilities for satellite communications.

June 2022: Booz Allen has been awarded NASA’s first-ever Cybersecurity and Privacy Enterprise Solutions and Services contract, aiming to strengthen the agency’s space cybersecurity framework and protect critical space missions from emerging digital threats.

US Space Cybersecurity Market Segmentation

By Offering Outlook (Revenue, USD Million, 2020–2034)

- Solution

- Network security

- Endpoint and IoT security

- Application security

- Cloud security

- Others

- Services

- Professional Services

- Managed Services

By Platform Outlook (Revenue, USD Million, 2020–2034)

- Satellites

- Launch Vehicles

- Ground Stations

- Spaceports & Launch Facilities

- Command & Control Centers

- Other Platform

By End User Type Outlook (Revenue, USD Million, 2020–2034)

- Government & Defense

- Commercial

US Space Cybersecurity Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 1,079.58 Million |

|

Market Size in 2025 |

USD 1,164.61 Million |

|

Revenue Forecast by 2034 |

USD 2,341.25 Million |

|

CAGR |

8.07% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Million and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The US market size was valued at USD 1,079.58 million in 2024 and is projected to grow to USD 2,341.25 million by 2034.

The US market is projected to register a CAGR of 8.07% during the forecast period.

A few of the key players in the market are Lockheed Martin Corporation, Northrop Grumman Corporation, Raytheon Technologies Corporation, L3Harris Technologies Inc., Booz Allen Hamilton Holding Corporation, BAE Systems plc, Parsons Corporation, Leidos Holdings, Inc., Kratos Defense & Security Solutions, Inc., Peraton, Sierra Nevada Corporation, Rebel Space Technologies, Inc., and Vantage Systems, Inc.

The satellites segment accounted for largest market share in 2024.

The services segment is projected to grow at a robust pace in the coming years.