Satellite Ground Station Market Share, Size, Trends, Industry Analysis Report

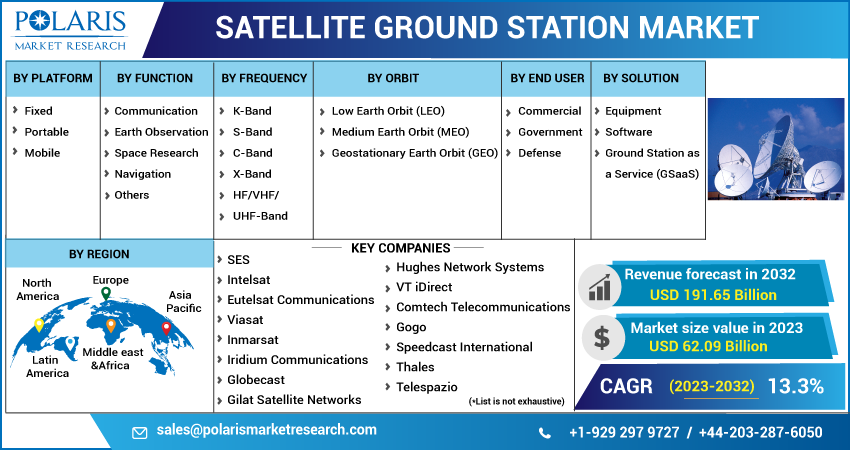

By Platform (Fixed, Portable, Mobile); By Function; By Frequency; By Orbit; By End User; By Solution; By Region; Segment Forecast, 2023 - 2032

- Published Date:Jul-2023

- Pages: 116

- Format: PDF

- Report ID: PM3582

- Base Year: 2022

- Historical Data: 2019-2021

Report Outlook

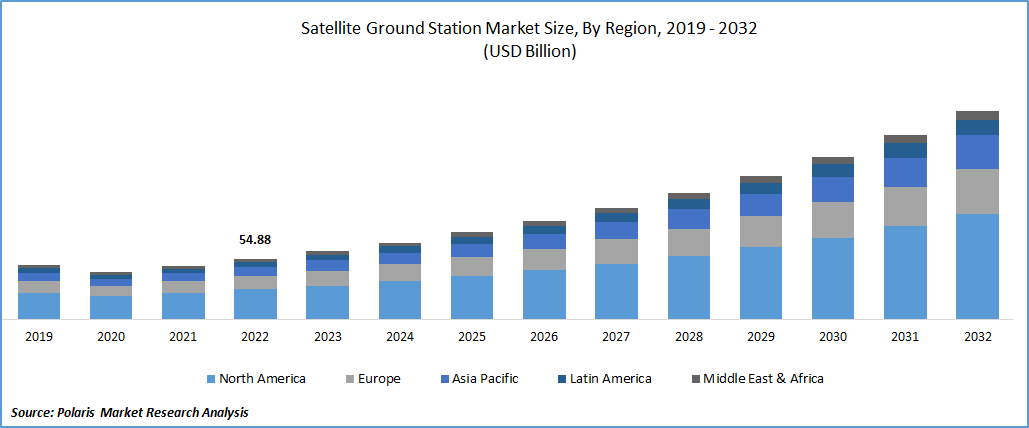

The global satellite ground station market was valued at USD 54.88 billion in 2022 and is expected to grow at a CAGR of 13.3% during the forecast period. An Earth station, also called a satellite ground station or ground control station, has the necessary equipment to communicate with satellites in space, such as antennas, receivers, and transmitters. It is a vital link between satellites orbiting the Earth and the operators or users on the ground.

To Understand More About this Research: Request a Free Sample Report

The primary function of a satellite ground station is to establish and maintain communication with satellites. It receives signals satellites transmit and processes them to extract information or data. Similarly, it transmits commands and data from the ground to satellites, enabling control and operation of the spacecraft.

Ground stations are essential for various applications, including telecommunications, remote sensing, weather forecasting, scientific research, and military operations. They are crucial in facilitating satellite-based services such as television broadcasting, internet connectivity, navigation systems, and Earth observation.

Ground stations are strategically located worldwide to ensure global coverage and uninterrupted satellite communication. They are typically equipped with multiple antennas to track satellites moving across the sky. These antennas can be fixed or mobile, depending on the requirements. With technological advances, ground stations have evolved to incorporate automation, advanced signal processing, and high-speed data handling capabilities. It enables efficient and reliable satellite communication, even in complex mission scenarios.

Collaborative efforts between satellite operators and technology providers lead to advancements in satellite capabilities and services. For instance, Intelsat, a renowned operator of integrated satellite & terrestrial networks has placed an order for a Mission Extension Pod (MEP) from the Northrop Grumman's Space Logistics. This MEP will be utilized to extend the operational lifespan of an Intelsat satellite, ensuring uninterrupted services for a multitude of customers. This highlights the industry's commitment to advancing satellite technology and finding innovative solutions. Technological advancements often drive investments in ground station infrastructure to support new satellite systems and features, contributing to the growth of the market.

For Specific Research Requirements, Speak With a Resaerch Analyst

Industry Dynamics

Growth Drivers

The deployment of many small satellites indicates a growing demand for ground station services. Ground stations are essential for establishing communication links with these satellites, receiving and transmitting data, and supporting their operations. As the number of small satellites increases, the need for ground station infrastructure to facilitate communication and data transfer is also increasing.

Fixed ground stations typically have large antennas and advanced equipment that provide broad coverage and handle high data capacity. They can support multiple satellite networks and accommodate significant data transmissions. This capability makes fixed-ground stations ideal for applications that require extensive coverage, such as broadcasting, data-intensive operations, and global communication networks. The ability to provide a broad range and high capacity drives the adoption of fixed-ground stations, fueling the growth of the fixed segment in the market.

Report Segmentation

The market is primarily segmented based on platform, function, frequency, orbit, end user, solution and region.

|

By Platform |

By Function |

By Frequency |

By Orbit |

By End User |

By Solution |

By Region |

|

|

|

|

|

|

|

To Understand the Scope of this Report: Speak to Analyst

Communication segment accounted for the largest market share in 2022

The communication segment held the largest market share for the market in 2022. There is a growing demand for global communication and connectivity. This component is crucial in meeting this demand by facilitating voice, data, and video transmission over long distances. Satellite ground stations are intermediaries between satellites and ground-based networks, enabling seamless global communication. The increasing need for reliable, high-quality, and efficient communication drives the segment's growth in the market.

C-Band segment is expected to hold the larger revenue share in the coming years

The C-Band segment will witness a larger revenue share in the coming years. C-Band frequencies offer wide coverage and high reliability for satellite communication. They balance signal attenuation due to atmospheric conditions and the ability to penetrate obstacles such as rain, foliage, and buildings. This makes C-Band suitable for long-distance communication and ensures consistent performance in diverse weather conditions. The wide coverage and reliability of C-Band frequencies drive their adoption in satellite ground stations, contributing to the growth of the C-Band segment in the market.

Geostationary Earth Orbit (GEO) segment is expected to witness higher growth during forecast period

The Geostationary Earth Orbit segment will grow more in the study period. GEO satellites operate at high altitudes and have large footprints, allowing them to support high-capacity communication channels. They offer a considerable bandwidth for data transmission, making them suitable for applications that require robust and reliable connectivity, such as broadband internet services and television broadcasting. To leverage GEO satellites' high capacity and bandwidth, ground stations need to be equipped with advanced technology and infrastructure, driving the market's growth.

Commercial segment is projected to witness significant growth in upcoming year

The commercial segment is expected to have significant growth. This sector has witnessed a considerable rise in the demand for satellite-based services, including communication, broadcasting, remote sensing, navigation, and earth observation. Commercial entities, such as telecommunications companies, media and entertainment providers, internet service providers, and geospatial data companies, heavily rely on satellite communication and data transmission. This growing demand for commercial satellite services drives the need for satellite ground stations to establish and maintain communication links with commercial satellites.

Ground Station as a Service (GSaaS) segment expected to witness significant revenue share during forecast period

Ground station as a Service segment will witness significant revenue share in the study period. It offers a cost-effective solution for satellite operators and users. Instead of investing in building and maintaining their ground station infrastructure, they can strategically leverage GSaaS providers who have already established and equipped ground stations. This eliminates the need for significant upfront capital investment and ongoing operational costs, making satellite communication more accessible and affordable for many users. The cost efficiency of GSaaS attracts satellite operators, particularly smaller companies and startups with limited resources, and contributes to the market's overall growth.

APAC registered with the highest growth rate in the study period

APAC is projected to witness a higher growth rate for the market. The growing space exploration and satellite deployment activities in the region drive the demand for satellite ground stations, contributing to higher market growth. In its 6th successful launch, ISRO's LVM3 launch vehicle sent 36 satellites from the OneWeb Group C for a 450 km circular orbit with an inclination of 87.4 degrees. This marks the completion of NSIL's contract to launch 72 OneWeb satellites into low Earth orbit. This is driving the growth of the satellite ground station market through increased satellite deployment, expansion of ground station infrastructure, technological advancements, market competition and opportunities, and regional space initiatives. These factors collectively contribute to the growth and development of the market in India, in turn, Asia Pacific.

North America is expected to witness a larger revenue share in the market. This region has extensive collaborations and partnerships with international space agencies and companies. The international cooperation and partnerships further enhance the revenue generation potential of the area in the satellite ground station market. Intelsat has initiated the delivery of educational, music, & arts content from the Public Broadcasting Service (PBS) across the continental United States. This development results from an exclusive satellite distribution agreement between Intelsat and PBS. Such partnerships create opportunities for joint ventures, increased investments, and technological advancements for the market in the United States and North America.

Competitive Insight

Some of the major players operating in the global market include SES, Intelsat, Eutelsat Communications, Viasat, Inmarsat, Iridium Communications, Globecast, Gilat Satellite Networks, Hughes Network Systems, VT iDirect, Comtech Telecommunications, Gogo, Speedcast International, Thales, Telespazio, Echostar, Asiasat, China Satcom, APT Satellite Holdings Limited, Satcom Global, Integrasys, ST Engineering iDirect, Advantech Wireless, Space Data, DLR, Kongsberg Satellite Services, Swedish Space Corporation, US Electrodynamics, Newtec, Azercosmos, Arab Satellite Communications Organization, Hispasat, MEASAT Satellite Systems, Optus Satellite, Sky Perfect JSAT, Sirius XM, ABS & Yahsat.

Recent Developments

- In May 2023, Collins Aerospace, a business division of Raytheon Technologies, unveiled its initiative to provide unlimited data services to customers of Vista, a prominent private aviation group.

- In April 2023, Intelsat, a global operator of integrated satellite & terrestrial networks introduced Intelsat 40e (IS-40e), a geo-synchronous satellite designed to deliver high-capacity services over the region.

Satellite Ground Station Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2023 |

USD 62.09 billion |

|

Revenue forecast in 2032 |

USD 191.65 billion |

|

CAGR |

13.3% from 2023 - 2032 |

|

Base year |

2022 |

|

Historical data |

2019 - 2021 |

|

Forecast period |

2023 - 2032 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2023 to 2032 |

|

Segments covered |

By Platform, By Function, By Frequency, By Orbit, By End User, By Solution, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Key companies |

SES, Intelsat, Eutelsat Communications, Viasat, Inmarsat, Iridium Communications, Globecast, Gilat Satellite Networks, Hughes Network Systems, VT iDirect, Comtech Telecommunications, Gogo, Speedcast International, Thales, Telespazio, Echostar, Asiasat, China Satcom, APT Satellite Holdings Limited, Satcom Global, Integrasys, ST Engineering iDirect, Advantech Wireless, Space Data, DLR, Kongsberg Satellite Services, Swedish Space Corporation, US Electrodynamics, Newtec, Azercosmos, Arab Satellite Communications Organization, Hispasat, MEASAT Satellite Systems, Optus Satellite, Sky Perfect JSAT, Sirius XM, ABS & Yahsat. |

FAQ's

key companies in satellite ground station market are SES, Intelsat, Eutelsat Communications, Viasat, Inmarsat, Iridium Communications, Globecast, Gilat Satellite Networks.

The global satellite ground station market is expected to grow at a CAGR of 13.3% during the forecast period.

The satellite ground station market report covering key segments are platform, function, frequency, orbit, end user, solution and region.

key driving factors in satellite ground station market are growing demand for ground station services.

The global satellite ground station market size is expected to reach USD 191.65 billion by 2032.