Satellite Internet Market Share, Size, Trends, Industry Analysis Report

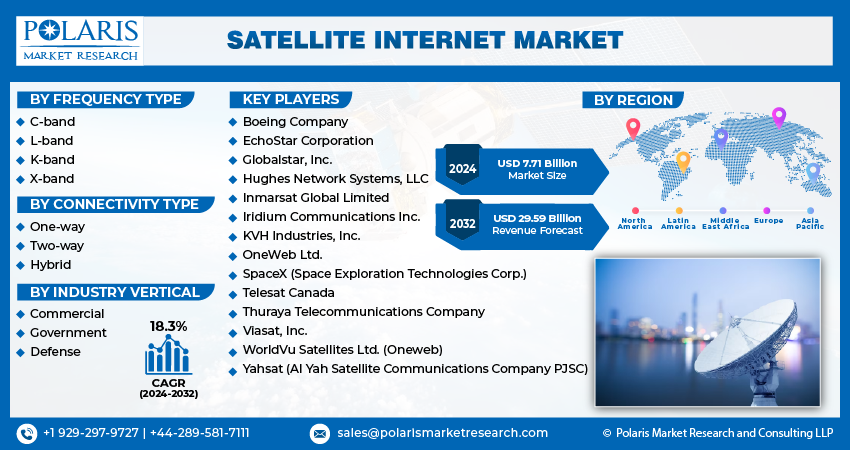

By Frequency Type (C-band, L-band, K-band, X-band); By Connectivity Type; By Industry Vertical; By Region; Segment Forecast, 2024 - 2032

- Published Date:Jan-2024

- Pages: 115

- Format: PDF

- Report ID: PM4065

- Base Year: 2023

- Historical Data: 2019-2022

Report Outlook

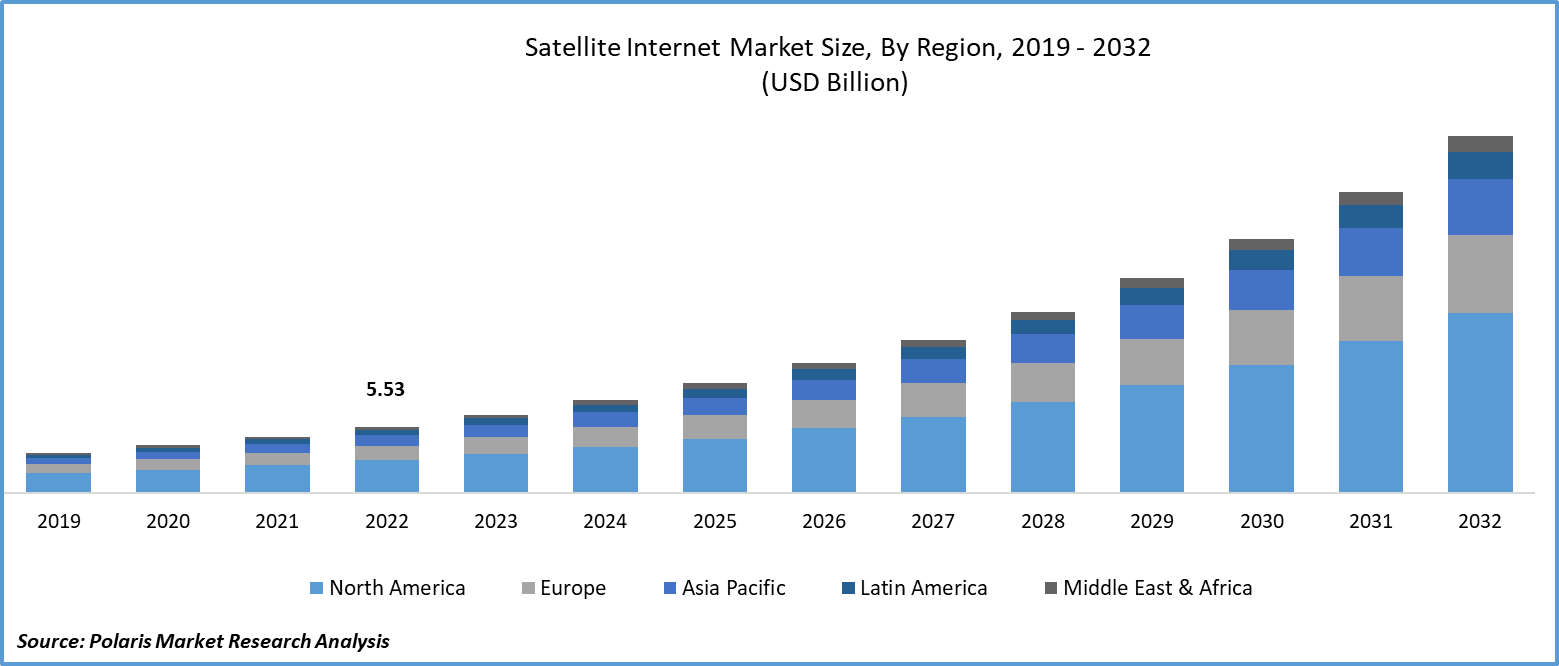

The global satellite internet market was valued at USD 6.53 billion in 2023 and is expected to grow at a CAGR of 18.3% during the forecast period.

Satellite internet delivers wireless connectivity via signals transmitted from satellites orbiting the Earth. This sets it apart from land-based internet options such as cable or DSL, which rely on wired infrastructure beneath the ground for data transmission. Given its nationwide coverage, satellite internet stands as a dependable means for numerous rural residences and businesses to access the online world.

Product innovations, technological advancements, and the introduction of regulatory policies have been detailed in the report to enable businesses to make more informed decisions. Furthermore, the impact of the COVID-19 pandemic on the Satellite Internet Market demand has been examined in the study. The report is a must-read for anyone looking to develop effective strategies and stay ahead of the curve.

Satellite internet is a kind of broadband connection that utilizes an orbiting satellite to acquire internet signals from the satellite internet donors to the device. It permits one to connect to selected devices to the internet similar to any type of internet. This kind of broadband connection is now a feasible alternative for distributing internet in many more areas than before. It is a good alternative for those in rural regions that want for essential framework for other kinds of connections.

Satellite internet operates by utilizing radio waves to interface with satellites orbiting the Earth. The satellite internet market size is expanding as the data is disbursed and recovered through a communication network that commences with devices and progresses through the modem and satellite dish stretching through a satellite in space, then reinstated on Earth to ground stations indicated as network operation centers. Then, data is advanced back through this framework out to space and is reinstated to the satellite dish on Earth to remit data onto the device.

To Understand More About this Research: Request a Free Sample Report

The demand for satellite internet has surged in rural areas due to the absence of alternative access options. Moreover, satellite internet extends connectivity to challenging terrains like deserts and hilly regions where conventional access proves difficult, further driving its demand in these areas. Notably, satellite technology now offers commendable internet speeds in remote locations.

Furthermore, advancements in satellite internet technology have led to improved speed and data capabilities, prompting swift adoption in emerging countries across LAMEA and Asia. This trend is propelling market expansion. Unlike the bulky systems of the past, modern satellite internet requires only a compact dish that can be easily installed on the user's property. This accessibility is particularly crucial for residents in remote areas, where it is economically impractical for traditional telecom providers to offer services. These factors collectively contribute to the growth of the satellite internet market in rural regions.

- For instance, in August 2023, The Tunisian Ministry of Communication Technology entered into a partnership with Starlink. This collaboration entails a three-month pilot project focused on deploying broadband satellite technology in designated regions. The primary objective of this initiative is to deliver high-speed and dependable internet connectivity to remote areas of the country.

However, higher infrastructure cost, and weather interferences are the factors hampering the growth of the satellite internet market. Launching and maintaining satellites in orbit is a costly endeavor. The expense involved in designing, manufacturing, and launching these sophisticated pieces of technology is substantial. Additionally, satellite internet providers must invest in ground stations and other supporting infrastructure to ensure seamless communication between satellites and users. These high capital costs can lead to higher subscription fees for consumers, making satellite internet less economically feasible compared to other forms of internet access. Moreover, the need for periodic satellite upgrades and replacements further adds to the long-term financial commitments of satellite internet providers.

Weather conditions can significantly impact the performance of satellite internet. Heavy precipitation, such as rain or snow, can absorb or scatter the radiofrequency signals traveling between the satellite and the user's dish, leading to signal attenuation. Severe storms or turbulent atmospheric conditions can further disrupt signal transmission, causing temporary outages or reduced connectivity. This susceptibility to weather interference is a distinct drawback of satellite internet, particularly in regions prone to inclement weather. Users may experience slower speeds or even complete loss of connection during adverse weather conditions, making satellite internet less reliable compared to wired or terrestrial wireless options. Despite technological advancements aimed at mitigating weather-related disruptions, it remains a key consideration for those considering satellite internet as their primary means of connectivity.

Growth Drivers

- Rapid technological advancement in satellite internet

The satellite internet industry is rapidly transforming due to significant technological advancements. Recent breakthroughs in satellite technology have ushered in a new era of global connectivity, offering remarkable improvements in performance and capabilities. State-of-the-art satellite designs have introduced higher bandwidth and significantly reduced latency, enhancing the overall user experience. The next-generation satellites operating in Low Earth Orbit (LEO) configurations, which have disrupted the industry with their remarkable performance, are particularly noteworthy. They rival even traditional terrestrial networks. These advancements have not only expanded internet access to remote and underserved regions but have also fortified the reliability and speed of satellite internet. This has solidified its position as a competitive and indispensable player in the modern digital landscape.

Innovations in signal processing and transmission techniques have substantially boosted data transfer rates. These advancements have paved the way for seamless high-definition video streaming and real-time applications, significantly enhancing the quality of online experiences. With LEO satellites coming into play, data transmission is faster and more efficient, reducing latency to levels previously deemed unattainable by satellite internet. These technological leaps are propelling the satellite internet market forward, making it a robust contender for meeting the growing connectivity demands of the digital age.

Report Segmentation

The market is primarily segmented based on frequency type, connectivity type, industry vertical, and region.

|

By Frequency Type |

By Connectivity Type |

By Industry Vertical |

By Region |

|

|

|

|

To Understand the Scope of this Report: Speak to Analyst

By Frequency Type Analysis

- X-band segment is expected to witness highest growth during forecast period

The X-band is projected to grow at a CAGR during the projected period. The X-band frequency range is dedicated primarily to marine, military, and government endeavors. Its demand is surging, attributed to its pivotal role in marine rescue missions, enabling precise tracking and exploration of specific targets.

Additionally, it facilitates broadband service and email access for operational and personnel needs through communication antenna systems, propelling its market growth in this sector. Recognizing its strategic importance, the International Telecommunications Union and the United Nations regulatory body for wireless spectrum have earmarked the X-band SATCOM for military missions. Its popularity has soared as governments increasingly opt for X-band SATCOM to bolster their military operations, notably evident in conflicts like those in Iraq and Afghanistan.

By Connectivity Type Analysis

- Two-way segment accounted for the largest market share in 2022

The two-way segment held the largest market share in 2022 and is expected to maintain its position throughout the forecast period. This segment is experiencing significant growth due to several crucial factors. Symmetrical data flow, with balanced upload and download speeds, is becoming increasingly important for applications such as video conferencing and cloud services. The two-way segment is meeting the growing demands of businesses and government entities that require reliable, high-performance internet connectivity, particularly in areas where terrestrial options are not available. Additionally, advancements in technology have increased the bandwidth capacity, thereby enhancing the overall performance of the segment. This increase in capabilities is making two-way satellite internet an attractive and viable option for a wide range of industries and users across the globe.

By Industry Vertical Analysis

- Government segment held the significant market revenue share in 2022

The government segment held a significant market share in revenue share in 2022. Governments worldwide are integrating satellite internet to manage smart cities. These urban centers are equipped with automated devices that promptly notify relevant authorities and continuously monitor water, electricity supply, and air quality levels in specific zones. A robust broadband connection is essential for these sensors to communicate and relay data to a centralized computer, which then processes sensor readings into actionable insights. While optical fibers cover urban regions, satellite internet serves as a reliable backup, especially during emergencies. This ensures uninterrupted connectivity for critical smart city operations.

Regional Insights

- North America region dominated the global market in 2022

The North America region dominated the global market with the largest market share in 2022 and is expected to maintain its dominance over the anticipated period. North America exhibits robust growth in the satellite internet market due to various factors. Its vast, sparsely populated regions, particularly in rural and remote areas, need more access to traditional broadband options. Satellite internet provides a viable solution, bridging this connectivity gap. Moreover, the region's dynamic industries, including maritime, aviation, and defense, heavily rely on satellite communication, further driving demand. Technological advancements, such as low Earth orbit (LEO) satellites, enhance performance, attracting more users. Government initiatives and partnerships with private providers also stimulate market expansion. These combined elements position North America as a prominent and lucrative market for satellite internet services.

The growth of the Asia-Pacific market is largely attributed to rapid technological growth in developing countries such as Singapore, India, Hong Kong, and Taiwan. Moreover, urbanization and population surges are other factors contributing to the growth. Asia is currently undergoing a swift urbanization process, witnessing millions of individuals migrating from rural to urban areas.

Key Market Players & Competitive Insights

The satellite internet market is fragmented and is anticipated to witness competition due to several players' presence. Major service providers in the market are constantly upgrading their technologies to stay ahead of the competition and to ensure efficiency, integrity, and safety. These players focus on partnership, product upgrades, and collaboration to gain a competitive edge over their peers and capture a significant market share.

Some of the major players operating in the global market include:

- Boeing Company

- EchoStar Corporation

- Globalstar, Inc.

- Hughes Network Systems, LLC

- Inmarsat Global Limited

- Iridium Communications Inc.

- KVH Industries, Inc.

- OneWeb Ltd.

- SpaceX (Space Exploration Technologies Corp.)

- Telesat Canada

- Thuraya Telecommunications Company

- Viasat, Inc.

- WorldVu Satellites Ltd. (Oneweb)

- Yahsat (Al Yah Satellite Communications Company PJSC)

Recent Developments

- In December 2022, Microsoft Corporation entered into a collaboration with the Viasat an international communications firm, with the aim of providing satellite internet access to 10 million individuals worldwide by the year 2025.

Satellite Internet Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 7.71 billion |

|

Revenue forecast in 2032 |

USD 29.59 billion |

|

CAGR |

18.3% from 2024 – 2032 |

|

Base year |

2023 |

|

Historical data |

2019 – 2022 |

|

Forecast period |

2024 – 2032 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2024 to 2032 |

|

Segments covered |

By Frequency Type, By Connectivity Type, By Industry Vertical, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Customization |

Report customization as per your requirements with respect to countries, region and segmentation. |

We strive to offer our clients the finest in market research with the most reliable and accurate research findings. We use industry-standard methodologies to offer a comprehensive and authentic analysis of the Satellite Internet Market. Besides, we have stringent data-quality checks in place to enable data-driven decision-making for you.

Browse Our Top Selling Reports

Induced Pluripotent Stem Cell (Ipsc) Market Size, Share 2024 Research Report

Smart Card In Healthcare Market Size, Share 2024 Research Report

Smart Stethoscope Market Size, Share 2024 Research Report

Research Antibodies Market Size, Share 2024 Research Report

Vitrification Market Size, Share 2024 Research Report