U.S. Small-Scale LNG Market Size, Share, Trends, Industry Analysis Report

By Mode of Supply (Trucks, Trans-shipment & Bunkering, Others), By Type, By Application – Market Forecast, 2025–2034

- Published Date:Jul-2025

- Pages: 130

- Format: PDF

- Report ID: PM5898

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

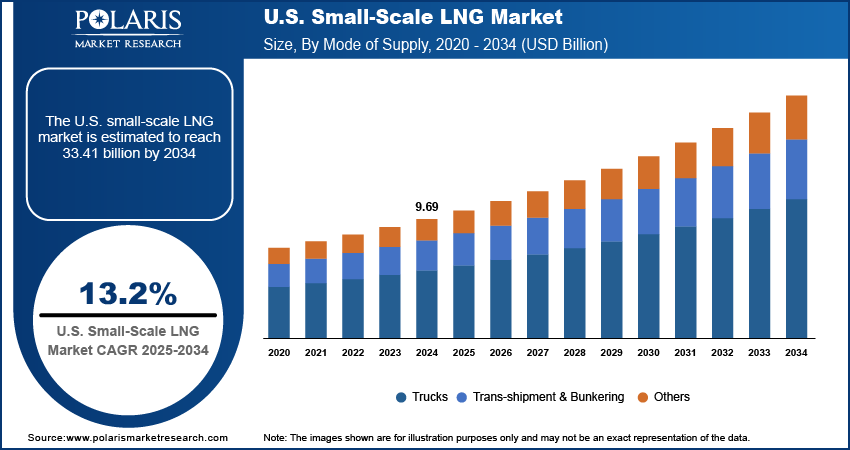

The U.S. small-scale LNG market size was valued at USD 9.69 billion in 2024 and is anticipated to register a CAGR of 13.2% from 2025 to 2034. The U.S. small-scale LNG market is growing due to increasing demand for cleaner, flexible, and decentralized energy sources. Key drivers include rising adoption in remote power generation, marine fuel, and transportation sectors, along with regulatory support for lower emissions and advancements in modular liquefaction and storage technologies.

The U.S. small-scale LNG market involves the production, storage, transport, and distribution of liquefied natural gas in smaller volumes compared to large-scale operations. This makes it a flexible and viable energy solution for various uses, especially in areas not connected to major gas pipelines.

Ongoing technological innovations are significantly driving the U.S. small-scale LNG market growth. Developments in modular liquefaction plants, compact LNG storage solutions, and efficient regasification technologies have made small-scale LNG projects more feasible and cost-effective. These advancements reduce the footprint and capital expenditure required for facilities, making them more attractive for deployment in diverse locations, including remote areas or those with limited space.

Supportive government policies and regulations play a crucial role in fostering the growth of the U.S. small-scale LNG market. Measures aimed at streamlining permitting processes, offering incentives for cleaner fuel adoption, and promoting energy independence can accelerate the development of small-scale LNG infrastructure and its applications. Such regulatory frameworks provide a stable environment for investments and encourage the shift toward natural gas as a versatile energy source.

To Understand More About this Research: Request a Free Sample Report

Industry Dynamics

Growing Demand for Cleaner Energy

The increasing focus on environmental sustainability and reducing carbon emissions is a significant driver. As industries and consumers seek cleaner alternatives to traditional fossil fuels, LNG stands out due to its lower emissions profile. It produces less sulfur oxide, nitrogen oxide, and particulate matter compared to coal and fuel oil, making it a more environmentally friendly option for various applications, including power generation, industrial use, and transportation. This shift toward cleaner fuels is encouraged by global and national efforts to combat climate change and improve air quality.

The U.S. Environmental Protection Agency (EPA) highlights that burning natural gas for energy results in fewer emissions of nearly all types of air pollutants and carbon dioxide compared to burning coal or petroleum products for an equal amount of energy. This inherent environmental benefit makes LNG an attractive option as the nation moves towards a greener energy mix. This growing demand for cleaner energy sources is a strong driver for the expansion of the small-scale LNG market.

Abundant Domestic Natural Gas Supply

The vast reserves and high production of natural gas in the U.S. serve as a fundamental driver for the small-scale LNG market. The "shale gas revolution" has significantly boosted domestic natural gas output, leading to a plentiful and relatively inexpensive supply. This abundance makes the liquefaction and distribution of natural gas in smaller volumes economically viable, allowing for wider access to energy in areas that may not be connected to large pipeline networks. The stable and accessible supply ensures consistent feedstock for small-scale LNG facilities and reduces reliance on imported energy.

The U.S. Geological Survey (USGS) reported on June 20, 2025, in their news release "USGS Releases Report on Oil and Gas Potential Beneath U.S. Public Lands," that technically recoverable resources of 391.6 trillion cubic feet of gas are estimated under federally managed public lands. This considerable reserve base, along with ongoing production, provides a strong foundation for the continued development of the small-scale LNG sector. The ample domestic natural gas supply thus significantly drives the growth and competitiveness of the U.S. small-scale LNG market.

Segmental Insights

Mode of Supply Analysis

The trucks segment held the largest share in 2024, due to the flexibility and reach that truck transport offers, enabling the delivery of LNG to various end users, including industrial sites, power plants, and vehicle refueling stations, especially in areas not connected to existing pipeline infrastructure. The ease of deployment and lower initial capital investments associated with truck-based distribution systems make it a preferred mode for many applications.

The trans-shipment & bunkering segment is anticipated to register the highest growth rate during the forecast period. This rapid growth is largely driven by the increasing adoption of LNG as a marine fuel. Stricter environmental regulations, such as those from the International Maritime Organization (IMO) aimed at reducing sulfur oxide and other emissions from ships, are pushing the maritime industry toward cleaner alternatives such as LNG. The development of new LNG bunkering facilities and the growing fleet of LNG-powered vessels are fueling this expansion.

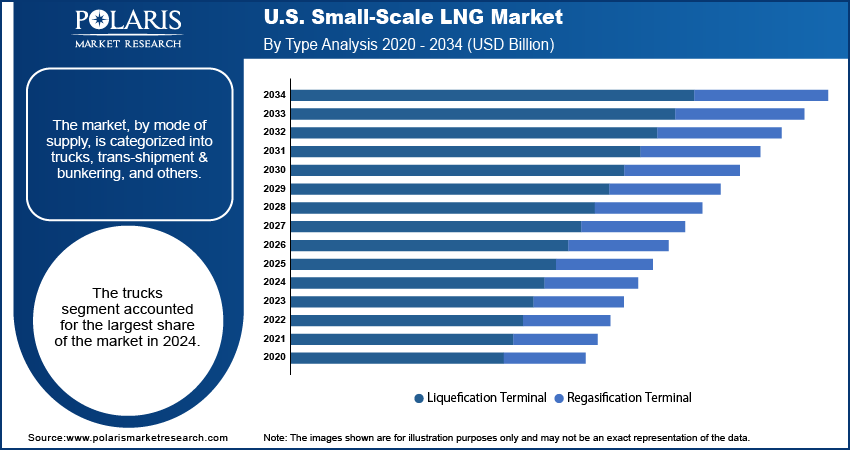

Type Analysis

The liquefaction terminal segment held the largest share in 2024, as liquefaction is the initial and crucial step in making natural gas transportable and storable as LNG in smaller volumes. The ability to convert natural gas into its liquid form allows for its efficient movement to various demand centers, especially those not served by pipelines. The increasing domestic natural gas production in the U.S. necessitates more liquefaction capacity to prepare the gas for distribution.

The regasification terminal segment is anticipated to grow at the highest growth rate during the forecast period. This growth is driven by the rising demand for natural gas at the consumption end, where LNG needs to be converted back into its gaseous state for use in power plant generation, industrial processes, and as fuel for vehicles. As more industries and consumers switch to natural gas for its cleaner burning properties, the need for efficient regasification at the point of use or distribution increases.

Application Analysis

The transportation segment held the largest share in 2024, owing to the increasing adoption of LNG as a cleaner fuel alternative for various vehicles, particularly heavy-duty trucks, buses, and marine vessels. The drive to reduce harmful emissions and achieve environmental targets has made LNG a more attractive option than traditional diesel and heavy fuel oil. For example, the U.S. Department of Transportation (DOT) has published studies, such as the Maritime Administration's (MARAD) "Liquefied Natural Gas Bunkering Study," highlighting the growing interest and infrastructure needs for LNG as a marine fuel.

The power generation segment is anticipated to register the highest growth rate during the forecast period. This surge is fueled by the demand for decentralized and off-grid power solutions, especially in remote areas or for backup power. Small-scale LNG facilities can provide a reliable and cleaner energy source for these specific needs, offering an alternative to more polluting fossil fuels. The Federal Energy Regulatory Commission (FERC) provides data on the expansion of various types of natural gas infrastructure, including those supporting power generation, which underscores the increasing role of natural gas in the nation's electricity mix.

Key Players and Competitive Insights

The U.S. small-scale LNG market features a competitive landscape characterized by a mix of established energy companies and specialized technology providers. These players are focused on developing innovative solutions for liquefaction, regasification, and distribution to cater to diverse applications and remote demands. The competition often revolves around efficiency, cost-effectiveness, and the ability to offer comprehensive, integrated solutions across the value chain.

A few prominent companies in the U.S. small-scale LNG market include Linde PLC; Wärtsilä Corporation; Honeywell International Inc.; Shell PLC; TotalEnergies SE; Chart Industries Inc.; Excelerate Energy, Inc.; Galileo Technologies; Prometheus Energy; and Nikkiso Co., Ltd.

Key Players

- Chart Industries Inc.

- Excelerate Energy, Inc.

- Galileo Technologies

- Honeywell International Inc.

- Linde PLC

- Nikkiso Co., Ltd.

- Prometheus Energy

- Shell PLC

- TotalEnergies SE

Industry Developments

June 2025: Linde is progressing with plans to build a new $400 million blue ammonia plant in the U.S., which includes projects that will leverage their expertise in gas processing.

U.S. Small-Scale LNG Market Segmentation

By Mode of Supply Outlook (Revenue – USD Billion, 2020–2034)

- Trucks

- Trans-shipment & Bunkering

- Others

By Type Outlook (Revenue – USD Billion, 2020–2034)

- Liquefication Terminal

- Regasification Terminal

By Application Outlook (Revenue – USD Billion, 2020–2034)

- Transportation

- Industrial Feedstock

- Power Generation

- Other Applications

U.S. Small-Scale LNG Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 9.69 billion |

|

Market Size in 2025 |

USD 10.94 billion |

|

Revenue Forecast by 2034 |

USD 33.41 billion |

|

CAGR |

13.2% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Insights |

|

Segments Covered |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The market size was valued at USD 9.69 billion in 2024 and is projected to grow to USD 33.41 billion by 2034.

The market is projected to register a CAGR of 13.2% during the forecast period.

A few key players in the market include Linde PLC; Wärtsilä Corporation; Honeywell International Inc.; Shell PLC; TotalEnergies SE; Chart Industries Inc.; Excelerate Energy, Inc.; Galileo Technologies; Prometheus Energy; and Nikkiso Co., Ltd.

The trucks segment accounted for the largest share of the market in 2024.

The regasification terminal segment is expected to witness the fastest growth during the forecast period.