Virtual Power Plant Market Share, Size, Trends, Industry Analysis Report

By Technology (Demand Response, Distributed Generation and Mixed Asset); By Source; By End-User; By Region; Segment Forecast, 2023 - 2032

- Published Date:Feb-2022

- Pages: 118

- Format: PDF

- Report ID: PM2298

- Base Year: 2021

- Historical Data: 2018 - 2020

Report Outlook

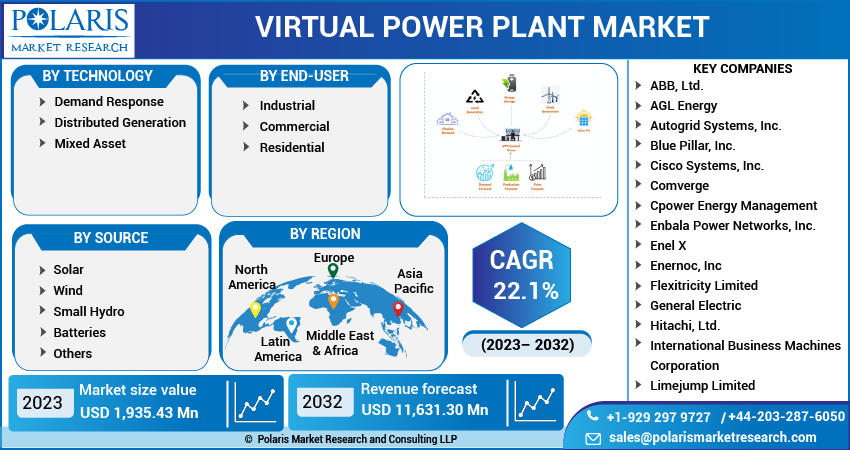

The global virtual power plant market was valued at USD 1,587.00 million in 2022 and is expected to grow at a CAGR of 22.1% during the forecast period. The market is experiencing significant growth during the forecast period due to several key factors. One of the primary drivers is the numerous benefits virtual power plants offer over conventional energy choices. These plants are cloud-based distributed energy systems integrating multiple energy sources, increasing energy generation while ensuring a consistent electricity supply. VPPs also simplify selling and trading energy in the electricity industry.

To Understand More About this Research: Request a Free Sample Report

In the evolving energy landscape, virtual power plants are gaining increasing attention and are expected to become a fundamental energy sector component in the coming years. These plants enable aggregators and utility companies to integrate energy generation from various distributed sources and plants, enhancing the efficiency and flexibility of the grid. With the shift towards decentralized energy systems, VPPs are important in maintaining a reliable and resilient power supply.

Government measures have also contributed to the growth of the market. National governments, facing financial strains and reevaluating the renewable energy transition, have taken steps to support the development of VPPs. For instance, Vietnam has set a target to launch a wholesale electricity industry by 2023, while Thailand's government has backed the establishment of a state-owned single-buyer utility. These measures demonstrate the increasing recognition of the importance of VPPs in driving the transition to a sustainable and efficient energy system.

Furthermore, significant investments in energy infrastructure further propel the virtual power plant market growth. Governments and private entities are making substantial investments in expanding and upgrading energy infrastructure to meet the growing energy demand and support the integration of renewable energy sources. These investments create a favorable environment for adopting and developing virtual power plants, as they can efficiently utilize and manage diverse energy resources.

For Specific Research Requirements, Request for a Sample Report

Industry Dynamics

Growth Drivers

The market is experiencing a significant boost from the increasing share of renewable energy in the power generation mix. As countries and industries strive to reduce greenhouse gas emissions and combat climate change, renewable energy sources such as solar, wind, and hydropower are prioritized. VPPs play a crucial role in integrating and maximizing the utilization of these renewable energy sources.

By leveraging advanced technologies and intelligent software platforms, VPPs enable the efficient management and coordination of distributed energy resources (DERs). These DERs, including solar panels, wind turbines, and energy storage systems, can seamlessly integrate into the VPP ecosystem. The VPP optimizes the generation and consumption of renewable energy, ensuring a reliable and stable power supply while reducing reliance on fossil fuels. This increased share of renewable energy in the VPP market supports the global sustainability agenda and opens up new opportunities for renewable energy project developers and operators.

Moreover, the growth of renewable energy in the market is driven by favorable government policies and incentives. Many governments have implemented renewable energy targets, feed-in tariffs, and subsidies to encourage the adoption of clean energy sources. These policies create a conducive environment for deploying VPPs, providing a framework for integrating and incentivizing renewable energy generation. As a result, the increasing share of renewable energy in the power generation mix propels the expansion and adoption of VPPs, contributing to a greener and more sustainable energy future.

Report Segmentation

The market is primarily segmented based on technology, source, end-user, and region.

|

By Technology |

By Source |

By End-User |

By Region |

|

|

|

|

For Specific Research Requirements: Request for Customized Report

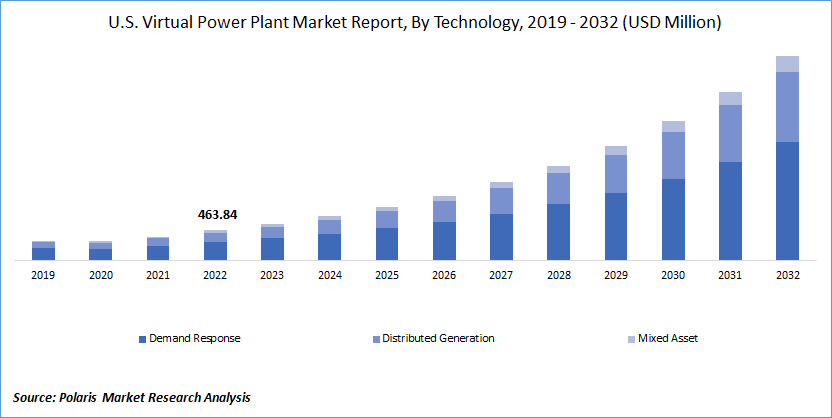

The demand response segment will dominate the market over the forecast period.

The demand response segment is expected to dominate the market due to growing investments in load management and the potential for end-users to earn incentives through participation in demand response programs.

Additionally, the distributed generation segment is gaining traction as the demand for renewable energy technologies increases. Integrating distributed power generation resources is essential for improving grid operations and accommodating the growing share of renewable energy sources. Both segments significantly enhance energy efficiency, grid stability, and the transition to a more sustainable energy landscape.

The industrial segment emerged as the dominant player in the market in 2022.

The industrial segment emerged as the dominant player in the market, capturing the largest market share. The industrial sector, comprising manufacturing facilities, large-scale commercial buildings, and industrial complexes, exhibited a significant adoption of VPP solutions. These entities recognized the immense benefits of VPPs, such as enhanced energy efficiency, reduced operational costs, and optimized power utilization.

The industrial segment's leadership position was driven by the need for effective demand response management, improved grid reliability, and integrating renewable energy sources. As a result, industrial players solidified their position as key contributors to the growth and expansion of the market in 2022.

North America exhibited the highest share in 2022

North America's VPP market exhibited the highest share in 2022. Technological advancements, policies targeting greenhouse gas emissions reduction, and the widespread adoption of grid-balancing solutions among commercial, residential, and industrial consumers are anticipated to influence the market's growth. The market’s growth is closely examined in the United States and Canada. In the United States, the extensive use of virtual energy units for optimal energy distribution is driving the expansion of the industry. The country's electricity generation relies on various energy sources, including renewables, fossil fuels, and nuclear energy.

Furthermore, the Asia Pacific region experienced a high CAGR in the global market in 2022. The region is characterized by significant potential for renewable energy and a rapidly growing residential and commercial sector, which is expected to drive market growth. Developing economies like China and India are grappling with increased energy demands, leading to a growing emphasis on smart metering, demand response, energy storage investments, and retail competition in the energy market of the Asia Pacific region. The market in the region is anticipated to expand further to meet the rising demand for decentralized energy generation.

Competitive Insight

Some of the major players operating in the global virtual power plant market include ABB, Ltd., AGL Energy, Autogrid Systems, Inc., Blue Pillar, Inc., Cisco Systems, Inc., Comverge, Cpower Energy Management, Enbala Power Networks, Inc., Enel X, Enernoc, Inc, Flexitricity Limited, General Electric, Hitachi, Ltd., International Business Machines Corporation, Limejump Limited, Next Kraftwerke., Olivene, Inc., Open Access Technology International, Inc., Osisoft, Robert Bosch., Schneider Electric, and Siemens.

Recent Developments

In September 2020, Tesla announced the launch of phase 3 of its virtual power plant in South Australia, connecting 4,000 homes with Powerwalls and solar panels. The project aims to enhance grid reliability and sustainability through residential solar generation and energy storage.

In November 2020, Siemens developed a business model to support energy optimization for the Carlsberg Group, an international brewing company based in Finland. This solution was implemented at Sinebrychoff's plant in the greater Helsinki area. The project utilized digitalization to optimize energy consumption, leading to potential energy savings and improved power supply quality.

Virtual Power Plant Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2023 |

USD 1,935.43 million |

|

Revenue forecast in 2032 |

USD 11,631.30 million |

|

CAGR |

22.1% from 2023 – 2032 |

|

Base year |

2022 |

|

Historical data |

2019 – 2021 |

|

Forecast period |

2023 – 2032 |

|

Quantitative units |

Revenue in USD million and CAGR from 2023 to 2032 |

|

Segments Covered |

By Technology, By Source, By End-Use, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Key Companies |

ABB, Ltd., AGL Energy, Autogrid Systems, Inc., Blue Pillar, Inc., Cisco Systems, Inc., Comverge, Cpower Energy Management, Enbala Power Networks, Inc., Enel X, Enernoc, Inc, Flexitricity Limited, General Electric, Hitachi, Ltd., International Business Machines Corporation, Limejump Limited, Next Kraftwerke., Olivene, Inc., Open Access Technology International, Inc., Osisoft, Robert Bosch., Schneider Electric, and Siemens. |

FAQ's

key companies in virtual power plant market are ABB, Ltd., AGL Energy, Autogrid Systems, Inc., Blue Pillar, Inc., Cisco Systems, Inc., Comverge, Cpower Energy Management, Enbala Power Networks, Inc.

The global virtual power plant market expected to grow at a CAGR of 22.1% during the forecast period.

The virtual power plant market report covering key segments are technology, source, end-user, and region.

key driving factors in virtual power plant market are increasing share of renewable energy in the power generation mix.

The global virtual power plant market size is expected to reach USD 1,587.00 million by 2032.