U.S. Plasmid Purification Market Size, Share, Trends, Industry Analysis Report

By Product & Service (Products, Services), By Grade, By Application, By End Use – Market Forecast, 2025–2034

- Published Date:Aug-2025

- Pages: 125

- Format: PDF

- Report ID: PM6250

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

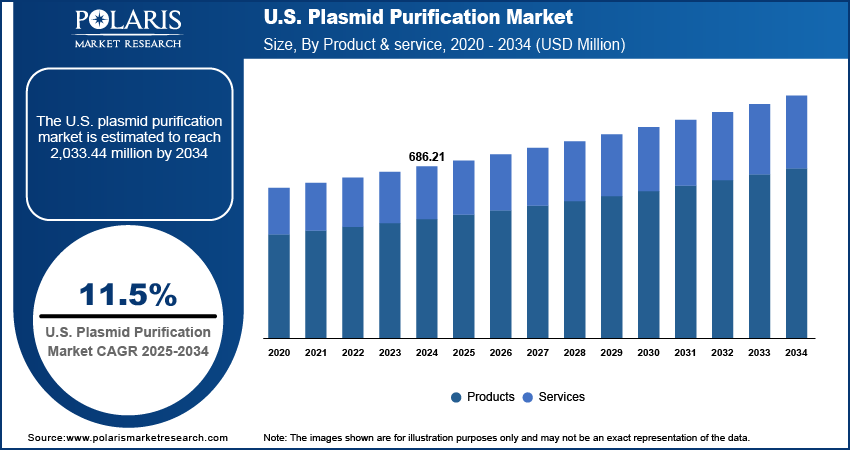

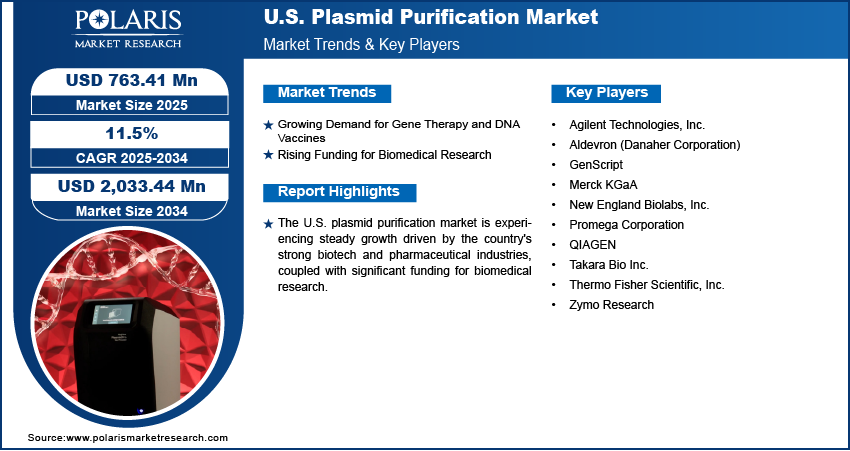

The U.S. plasmid purification market size was valued at USD 686.21 million in 2024 and is anticipated to register a CAGR of 11.5% from 2025 to 2034. The growing use of gene therapy and DNA vaccines is a key driver for the plasmid purification industry growth in the U.S. There is a strong need for high-purity plasmid DNA as a vital component for these advanced therapies. Additionally, increasing research and development spending, especially in molecular biology and genetic engineering, is boosting demand for plasmid purification products.

Key Insights

- By product & service, the products segment held the largest share in 2024, driven by the widespread and constant need for purification kits, reagents, and instruments in research and development activities across the U.S.

- Based on grade, the molecular grade segment held the largest share in 2024. Molecular grade plasmids are the preferred choice for a vast number of foundational research applications, such as basic cloning and gene expression studies, in academic and early-stage biotech labs across the country.

- By application, the cloning and protein expression segment held the largest share in 2024, due to its fundamental role in a broad spectrum of research and industrial activities, including the development of new diagnostic tools and the production of therapeutic proteins, which are a cornerstone of modern biotechnology in the U.S.

Industry Dynamics

- The increasing use of gene therapy and DNA vaccines is a significant factor in the demand for plasmid purification. As more of these advanced medical treatments are being developed and tested, there is a greater need for large amounts of high-purity plasmid DNA. This is a critical building block for creating the viral vectors and vaccines required for clinical trials and manufacturing.

- There are rising investments in research and development in fields such as molecular biology and genetic engineering. These research activities, often conducted by biotechnology companies and academic institutions, rely on plasmid DNA for experiments in cloning, gene editing, and protein expression, which drives the need for efficient purification methods.

- Technological advancements in purification methods and the move toward automated systems are boosting the market. These innovations, such as advanced chromatography and automated platforms, improve the efficiency and scalability of plasmid purification, making it easier to produce the high-quality DNA needed for both research and commercial applications.

Market Statistics

- 2024 Market Size: USD 686.21 million

- 2034 Projected Market Size: USD 2,033.44 million

- CAGR (2025–2034): 11.5%

AI Impact on U.S. Plasmid Purification Market

- Biotech suppliers in the U.S. are integrating artificial intelligence (AI) into automated chromatography and filtration platforms to enable faster plasmid purification cycles with higher yields.

- AI algorithms help adjust purification steps in real time based on in-process quality data, which minimizes human errors and reduces batch rejection rates.

- AI tools are used to monitor purification equipment performance, schedule service before failures occur, and reduce downtime in large-scale manufacturing facilities.

- Market players use AI to offer customized purification strategies for clients, developing personalized therapies, which strengthens partnerships

Plasmid purification is a key process in molecular biology used to isolate and purify plasmid DNA from bacterial cells, including nucleic acid isolation and purification. This process involves several steps to remove unwanted components like proteins, RNA, and genomic DNA, resulting in a clean and concentrated sample of plasmid DNA. High-purity plasmid DNA is essential for many downstream applications such as gene therapy development, DNA vaccines, and various genetic engineering experiments.

The increasing focus on personalized medicine is a key driver for the U.S. plasmid purification market expansion. As researchers work on therapies tailored to an individual's genetic makeup, they need reliable methods to produce custom plasmid DNA. This requires a high-quality purification process to ensure the therapeutic material is safe and effective. The rise of clinical trials for advanced therapies is also a significant factor, as each trial requires a steady supply of purified plasmid DNA to be used in treatments.

Another driver is the growing field of synthetic biology. This field involves the design and creation of new biological systems and functions, often using plasmid DNA as a building block. Synthetic biology researchers rely on efficient and reliable plasmid purification to construct and test their new designs. For example, the National Institutes of Health (NIH) supports research in synthetic biology that requires the use of purified plasmid DNA to engineer bacteria for specific tasks, such as producing biofuels or medicines.

Drivers and Trends

Growing Demand for Gene Therapy and DNA Vaccines: The increasing research and development activities in gene therapy and DNA vaccines are a primary factor driving the demand for plasmid purification. These advanced therapies rely heavily on high-quality, pure plasmid DNA and DNA sequencing as a key component for their production. The plasmid DNA acts as a carrier or template to deliver therapeutic genes into a patient's cells or to produce antigens that trigger an immune response. This critical role of plasmids means that as the pipeline for these new treatments expands, so does the need for efficient and large-scale purification methods.

A study in the journal Human Gene Therapy, titled "The estimated annual financial impact of gene therapy in the United States," published in 2023, found that there were 109 late-stage gene therapy clinical trials underway before January 2020. The article, available through the National Center for Biotechnology Information (NCBI), projected that annual spending on gene therapies could reach approximately $20.4 million under conservative assumptions. The increasing number of these clinical trials and the associated financial investment shows a clear upward trend in the development of these therapies, directly boosting the demand for purified plasmid DNA.

Rising Funding for Biomedical Research: Increased government and private funding for biomedical research, particularly in genetic engineering and molecular biology, is a significant driver. This funding supports a wide range of scientific activities that depend on plasmid DNA, including cloning, gene editing, and protein expression studies. As research institutions and biotech companies receive more grants and investments, they are able to conduct more experiments, which increases their need for reliable and high-quality plasmid purification products and services.

The National Institute of Neurological Disorders and Stroke (NINDS), an institute of the National Institutes of Health (NIH), announced in a July 2023 press release that it was awarding over $140 million to accelerate genome editing research. The initiative, called the Somatic Cell Genome Editing (SCGE) program, aims to remove barriers to bringing these techniques to the clinic. This type of substantial government investment highlights the growing commitment to genetic research, which is a core consumer of purified plasmids. This consistent and large-scale funding for genetic research and genome editing is creating a strong demand for plasmid purification tools and is directly driving U.S. plasmid purification market growth.

Segmental Insights

Product & Service Analysis

Based on product & service, the segmentation includes products and services. The products segment held the largest share in 2024, due to the widespread and continuous need for these tools in various research and development activities. Scientists in academic and biotechnology labs regularly use kits and reagents for their experiments, such as cloning and gene expression studies. The constant demand for these consumable items, along with the increasing use of advanced instruments such as automated purification systems, makes the products segment a leader. These products offer researchers the flexibility to perform purification tasks at different scales, from small-batch lab work to large-scale production, which is essential for the diverse needs of the biotechnology and pharmaceutical sectors. The availability of a wide range of products that cater to specific purity requirements and experimental workflows further strengthens this segment's position.

The services segment is anticipated to register the highest growth rate during the forecast period. This growth is driven by the rising trend of outsourcing specialized manufacturing and purification tasks. Many pharmaceutical and biotechnology companies, as well as academic institutions, are choosing to work with contract research and manufacturing organizations to meet their needs for high-purity plasmid DNA. This allows them to focus on their core competencies while relying on experts for tasks that require strict regulatory compliance and specialized equipment, especially for clinical-grade materials. The demand for these services is particularly strong for gene therapy and vaccine development, where the quality and consistency of the purified plasmid DNA are crucial. These service providers can offer scalability, cost-efficiency, and expertise that many individual labs or smaller companies may not have in-house, leading to a notable increase in this segment's share of the market.

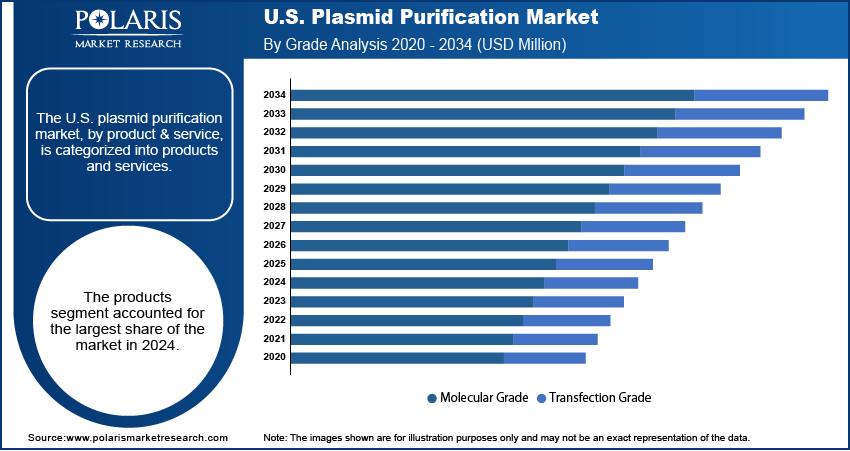

Grade Analysis

Based on grade, the segmentation includes molecular grade and transfection grade. The molecular grade segment held the largest share in 2024. Molecular grade plasmids are widely used for a variety of fundamental research applications in academic institutions and early-stage biotech companies. These applications include basic cloning, gene expression studies, and a range of experiments where the primary focus is on the DNA sequence and structure. While molecular grade plasmids are not held to the same strict purity standards as those used in clinical settings, their affordability, ease of use, and quick availability make them the go-to choice for most day-to-day laboratory work. The sheer volume of such research and development activities across the country ensures that this segment continues to be the dominant force in the market. The widespread use of these plasmids for initial proof-of-concept studies and for creating new constructs also adds to this segment's leading position.

The transfection grade segment is anticipated to register the highest growth rate during the forecast period. This accelerated growth is directly attributed to the rapid development of advanced therapies such as gene therapy and DNA vaccines. Transfection grade plasmids must meet very high standards of purity, including being endotoxin-free, as they are introduced directly into living cells for therapeutic purposes. The critical need for a clean and safe product for these sensitive applications is driving a surge in demand for transfection grade purification services and products. As more gene therapy candidates move from early-stage research to clinical trials and eventual commercialization, the need for Good Manufacturing Practice (GMP)-compliant, high-purity plasmids becomes essential. This strict requirement, coupled with the increasing number of clinical trials, is fueling the rapid expansion of this segment.

Application Analysis

Based on application, the U.S. plasmid purification market segmentation includes cloning & protein expression, transfection & gene editing, and others. The cloning & protein expression segment held the largest share in 2024 as these techniques are fundamental to a vast range of research and industrial activities. Academic institutions and biotech firms routinely use plasmid DNA for basic molecular biology experiments, such as replicating genes and producing specific proteins. These processes are essential for developing new diagnostic tools, manufacturing therapeutic proteins such as monoclonal antibodies, and creating genetically modified organisms. The widespread and ongoing use of plasmids in these applications, which form the backbone of much of modern biotechnology, solidifies this segment's leading position. The constant demand for plasmid purification products to support these frequent and high-volume workflows is a key reason for its market dominance.

The transfection and gene editing segment is anticipated to register the highest growth rate during the forecast period. This rapid expansion is directly linked to the boom in advanced therapies and personalized medicine. Transfection, the process of introducing purified plasmid DNA into living cells, is a critical step in both gene therapy and the use of gene editing tools such as CRISPR. As these advanced technologies move from the research bench to clinical trials and commercial production, the demand for high-purity, clinical-grade plasmid DNA is increasing significantly. This segment’s growth is fueled by the need for extremely clean and safe plasmids to avoid adverse effects in patients and to meet strict regulatory standards for new treatments. The rising number of gene-editing projects and clinical studies focused on developing new cures for genetic diseases and cancers are pushing this application segment to the forefront of the market.

End Use Analysis

Based on end-use, the U.S. plasmid purification market segmentation includes pharmaceutical & biotechnology companies, academic & research institutes, and contract research organizations. The academic & research institutes segment held the largest share in 2024. These institutions are the hubs of foundational research in molecular biology, genetic analysis, genetic engineering, and synthetic biology. Their constant need for purified plasmid DNA for experiments, from basic cloning to complex gene editing studies, creates a consistently high demand for purification products and services. University labs and government research centers, such as those under the National Institutes of Health (NIH), are at the forefront of early-stage discovery and development. They require a steady supply of both molecular and transfection-grade plasmids to support their diverse projects. The large number of these institutions and their ongoing commitment to scientific advancement give this segment a dominant market share.

The contract research organizations (CROs) segment is anticipated to register the highest growth rate during the forecast period. This rapid growth is driven by a strong industry trend toward outsourcing. Pharmaceutical and biotechnology companies are increasingly turning to CROs for specialized services, including the manufacturing and purification of clinical-grade plasmid DNA. This allows them to streamline their operations, reduce in-house costs, and leverage the expertise and advanced equipment of these specialized organizations. As the pipeline for cell and gene therapies expands, the need for GMP-compliant, high-purity plasmids for clinical trials becomes more critical, and CROs are uniquely positioned to meet this demand. Their ability to offer scalability, regulatory knowledge, and a focus on quality control makes them an indispensable partner for companies seeking to bring new therapies to market.

Key Players and Competitive Insights

The competitive landscape of the U.S. plasmid purification market is marked by the presence of several established players and a number of smaller, specialized companies. Major players such as Thermo Fisher Scientific, QIAGEN, and Promega Corporation offer a wide range of products, including kits, reagents, and instruments, for both research and clinical use. These companies often compete on the basis of product innovation, the breadth of their offerings, and their global distribution networks. Smaller firms and contract research organizations (CROs) often focus on niche areas, such as providing high-purity, clinical-grade plasmids or specializing in specific purification services for gene therapy and vaccine development. The market is also seeing increased strategic partnerships and collaborations as companies aim to expand their product portfolios and geographical reach, particularly in the fast-growing areas of advanced therapies.

A few prominent companies in the industry include Thermo Fisher Scientific, QIAGEN, Promega Corporation, Merck KGaA, Zymo Research, New England Biolabs, Takara Bio Inc, Agilent Technologies Inc., GenScript, Aldevron (Danaher), and Bio-Rad Laboratories, Inc.

Key Players

- Agilent Technologies, Inc.

- Aldevron (Danaher Corporation)

- GenScript

- Merck KGaA

- New England Biolabs, Inc.

- Promega Corporation

- QIAGEN

- Takara Bio Inc.

- Thermo Fisher Scientific, Inc.

- Zymo Research

U.S. Plasmid Purification Industry Developments

May 2025: Thermo Fisher Scientific launched the Applied Biosystems MagMAX Pro HT NoSpin Plasmid MiniPrep Kit in the U.S., designed to facilitate fast and automated plasmid DNA isolation for small-scale experimental workflows.

U.S. Plasmid Purification Market Segmentation

By Product & Service Outlook (Revenue – USD Million, 2020–2034)

- Products

- Services

By Grade Outlook (Revenue – USD Million, 2020–2034)

- Molecular Grade

- Transfection Grade

By Application Outlook (Revenue – USD Million, 2020–2034)

- Cloning & Protein Expression

- Transfection & Gene Editing

- Others

By End Use Outlook (Revenue – USD Million, 2020–2034)

- Pharmaceutical & Biotechnology Companies

- Academic & Research Institutes

- Contract Research Organizations

U.S. Plasmid Purification Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 686.21 million |

|

Market Size in 2025 |

USD 763.41 million |

|

Revenue Forecast by 2034 |

USD 2,033.44 million |

|

CAGR |

11.5% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD million and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Insights |

|

Segments Covered |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The market size was valued at USD 686.21 million in 2024 and is projected to grow to USD 2,033.44 million by 2034.

The market is projected to register a CAGR of 11.5% during the forecast period.

A few key players in the market include Thermo Fisher Scientific, QIAGEN, Promega Corporation, Merck KGaA, Zymo Research, New England Biolabs, Takara Bio Inc., Agilent Technologies Inc., GenScript, Aldevron (Danaher), and Bio-Rad Laboratories, Inc.

The products segment accounted for the largest share of the market in 2024.

The transfection grade segment is expected to witness the fastest growth during the forecast period.