AI Workload Management Market Size, Share, Trends, Industry Analysis Report

By Component (Solutions, Services), By Organization Size, By Deployment, By Vertical, By Region – Market Forecast, 2025–2034

- Published Date:Oct-2025

- Pages: 126

- Format: PDF

- Report ID: PM6452

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

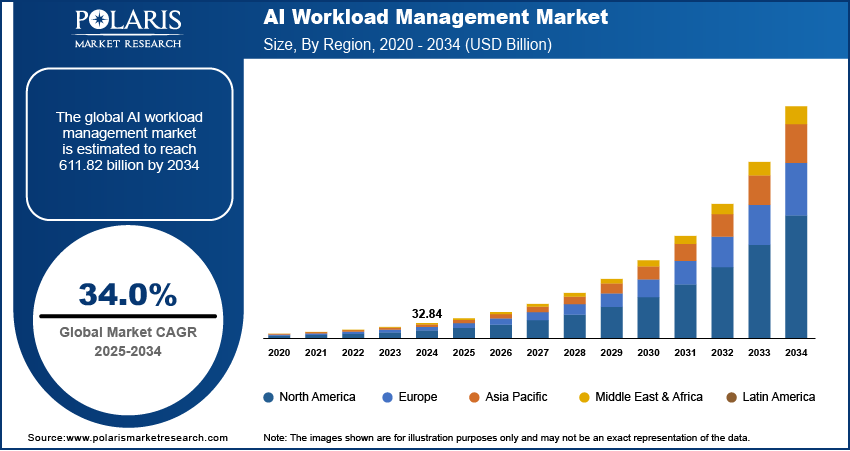

The global AI workload management market size was valued at USD 32.84 billion in 2024 and is anticipated to register a CAGR of 34.0% from 2025 to 2034. The increasing use of complex AI models and the rising data volumes are creating a need for efficient resource management. As a result, businesses are seeking solutions that can automate workload scheduling and improve operational efficiency.

Key Insights

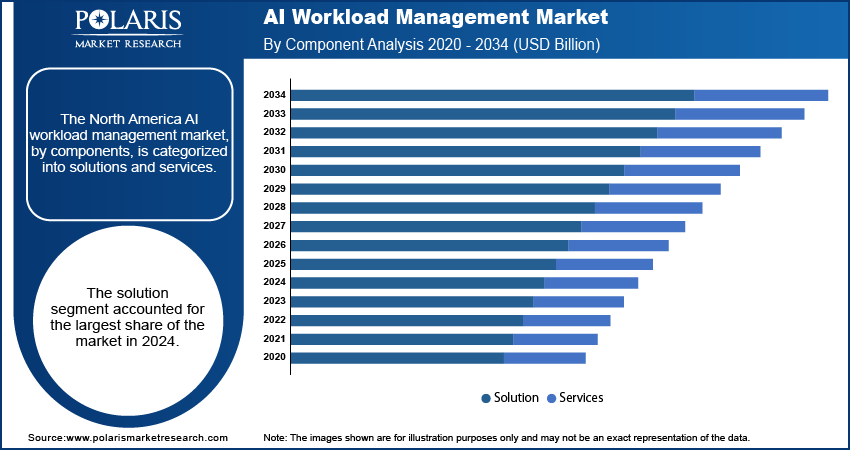

- By component, the solutions segment held the largest market share in 2024, as companies seek complete software platforms that can handle complex AI workloads.

- By organization size, the large enterprises segment dominated the industry in 2024, because these companies can invest a high amount in AI workload management solutions.

- By deployment, the on-premise segment accounted for a larger share in 2024, due to the high demand for data security.

- By vertical, the IT and telecommunications segment held the largest share in 2024, because companies in this industry were among the first to use AI.

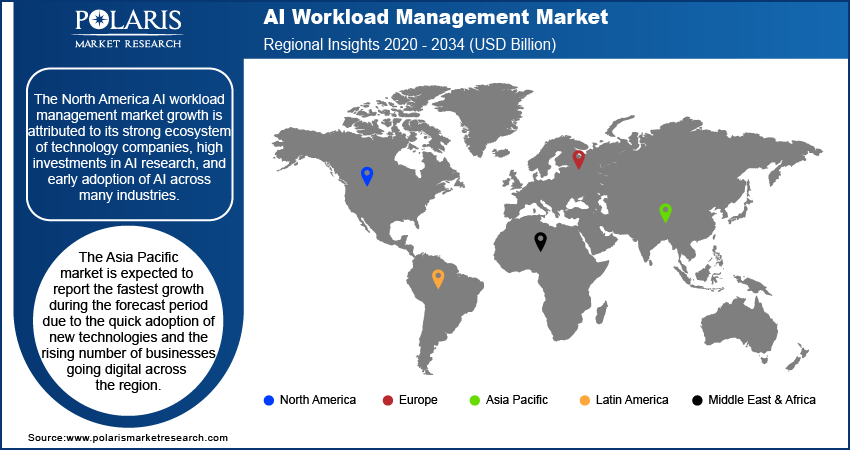

- North America led the global revenue share in 2024 due to its strong ecosystem of technology companies.

Industry Dynamics

- The increasing use of complex AI and machine learning (ML) models in various industries drives the industry expansion. Organizations adopt more advanced AI for various tasks such as predictive analysis and automation. Thus, they require specialized tools to manage the computing resources required for complex workloads.

- The growing use of cloud computing and hybrid IT setups propels the adoption of AI workload management. Businesses are moving their workloads to the cloud for better flexibility and scalability. As a result, there is a rising need for solutions to manage workloads across different environments, including public, on-premise, and private clouds.

- There is a strong focus on cost saving and operational improvements. Companies want to ensure their expensive computing resources, such as GPUs, are being used as well as possible. This need for better efficiency and cost control fuels the adoption of automated workload management solutions.

Market Statistics

- 2024 Market Size: USD 32.84 billion

- 2034 Projected Market Size: USD 611.82 billion

- CAGR (2025–2034): 34.0%

- North America: Largest market in 2024

AI workload management is the practice of overseeing and coordinating the tasks and processes of AI systems. It involves managing the use of computing resources, including servers, networking, and storage, to ensure AI workloads run efficiently. This includes handling various tasks such as data processing, model training, and real-time predictions.

The rising demand for better cost control drives the adoption of AI workload management. As AI and machine learning models get bigger, they need a lot of computing power and specialized hardware. This can be very expensive, so companies seek ways to use their resources more effectively. Workload management solutions help them get the most out of their hardware and lower their operational costs.

The need for more automation in IT contributes the market growth. The jobs of IT teams have become complex due to the wide use of AI and the shift toward hybrid cloud environments. AI workload management solutions help automate tasks such as resource scheduling and performance monitoring, which reduces the manual work for IT staff. This allows them to focus on more strategic projects instead of daily maintenance. According to a report from the World Health Organization (WHO), automated health systems can free up staff time to provide better patient care, which is similar to how these solutions help IT departments.

Drivers and Trends

Rise in AI Adoption Across Industries: The widespread use of AI across various sectors fuels the demand for AI workload management solutions. As more businesses integrate AI into their operations for various tasks such as data analysis, automation, and predictive modeling, they face the challenge of managing the massive computational resources required. This increasing AI adoption makes specialized management tools necessary to ensure cost-effective and efficient AI deployments. According to the "Public Health Data Strategy" from the CDC in 2024, the number of healthcare facilities using electronic case reporting upsurged from over 25,000 in early 2023 to more than 36,000 in 2024. This example illustrates the growing adoption of digital systems that utilize AI in critical sectors. This trend is expected to propel the need for better AI workload management.

Many government agencies use AI to improve public services. According to a 2025 report from the U.S. Chamber of Commerce, the majority of small businesses across all 50 U.S. states are embracing AI. This rapid and widespread adoption, even among smaller organizations, creates a huge need for scalable and efficient management systems. Without them, businesses would struggle to handle their AI workloads and face higher costs and poor performance. This broad adoption of AI across many different industries is driving the demand for efficient workload management solutions.

Proliferation of Big Data and Complex Models: AI-based systems process and analyze huge amounts of data. As this data grows, the demand for computing resources increases. Modern AI models, including large language models and advanced deep learning systems, are extremely complex. Also, the models require a lot of power to train and run. Managing these intense workloads without a dedicated solution is not practical. The "Artificial Intelligence Index Report" published in 2024 by a well-known university stated that the training costs for a single state-of-the-art AI model, such as Google's Gemini Ultra, cost an estimated $191 million. This shows the immense computational power and resources needed.

As organizations collect more data from different sources, they need robust systems to process it for AI insights. The "Public Health Data Strategy" from the CDC in 2024 highlights the rising need for faster data sharing between healthcare facilities and public health authorities. This shows a growing demand for systems that can handle large data sets in near real time. The combination of larger data sets and more complex models makes it essential to have advanced tools to manage AI workloads. Therefore, the growth of big data and the use of more complex AI models boost the development of AI workload management industry.

Segmental Insights

Component Analysis

Based on component, the segmentation includes solution and services. The solution segment held the largest share in 2024. This is because organizations need complete and powerful software to manage their AI operations. These solutions are comprehensive platforms that offer various features such as resource scheduling, performance monitoring, and cost optimization. They are crucial for businesses that want to get the most out of their expensive computing infrastructure, such as GPUs and other AI-specific hardware. As the use of AI grows in many industries, the demand for these ready-made solutions has increased as they help companies handle their complex workloads in a scalable and efficient way.

The services segment is anticipated to register the highest growth rate during the forecast period. This is attributed to the rising need for outsourcing the management and implementation of AI systems. Many companies, especially smaller ones, do not have the in-house knowledge or a large enough team to handle the complexities of AI development and deployment on their own. As a result, they are turning to external service providers for support. These services include everything from initial setup and strategy to ongoing maintenance, training, and custom model tuning. The fast growth of this segment shows a trend of businesses seeking expert help to integrate AI into their operations without investing heavily in their internal resources. This need for specialized support is a key driver for this segment's rapid expansion.

Organization Size Analysis

Based on organization size, the segmentation includes large enterprises and SMEs. The large enterprises segment held the largest share in 2024. These companies often have huge amounts of data and many different AI projects running at once. They need powerful and complete workload management solutions to handle these complex operations. This includes managing resources for everything from research and development to customer service and financial analysis. Large companies have the financial resources and the technical teams to invest in and implement these solutions on a large scale. Their goal is to improve efficiency and make sure their substantial AI investments are paying off. Owing to their need for control, efficiency, and better use of resources, large enterprises are the key users of advanced solutions such as AI workload management solutions.

The small and medium-sized enterprises (SMEs) segment would register the highest growth rate during 2025–2034. While they may not have the same financial strength as larger companies, more SMEs are witnessing the benefits of using AI. As AI solutions become more accessible and easier to use, SMEs are starting to adopt them for automating tasks, improving customer interactions, and gaining a competitive edge. The growth in this segment is also being driven by the availability of cloud-based and pay-as-you-go services. This makes AI workload management more affordable and less complex for smaller businesses. This enables them to get the benefits of AI without making a huge initial investment in a full IT setup.

Deployment Analysis

Based on deployment, the segmentation includes on-premises and cloud. The on-premises segment held the largest share in 2024. This dominance is attributed to the high-security and control needs of many companies, especially those in highly regulated industries such as banking and healthcare. These organizations often handle very sensitive data and need to keep it on their servers to meet strict security and compliance rules. By keeping their AI workloads in-house, they can have full control over their data, infrastructure, and operations. This gives them a sense of security that is hard to get with public cloud options. For a long time, this was the standard for big companies with a lot of data, and they have already invested a lot of money in their on-premise setups.

The cloud segment is anticipated to register the highest growth rate during the forecast period, owing to the various benefits of cloud-based solutions and cloud security such as great flexibility, quick scalability, and cost-effectiveness. The shift to the cloud has made it easier for companies of all sizes, especially smaller ones, to use AI. Cloud platforms let them quickly access the computing power they need for their AI projects without having to buy and manage their own expensive hardware. The pay-as-you-go model of the cloud also helps companies manage their costs and only pay for the resources they use. This makes it an appealing option for businesses that want to get into AI quickly and with lower upfront costs.

Vertical Analysis

Based on vertical, the segmentation includes retail & e-commerce, healthcare & life sciences, BFSI, government & public sector, IT & telecommunication, manufacturing, and others. The IT & telecommunication segment held the largest share in 2024. This is because companies in this industry were early adopters of AI and have large-scale, complex IT infrastructures. They use AI for many different things, from managing network operations and customer service to improving data security. The huge amounts of data and the constant need for faster, more efficient networks mean that these companies need powerful tools to manage their AI workloads. They are also looking to automate as many processes as possible to reduce costs and improve service. This widespread use of AI in core business functions and the continuous demand for innovation are the main reasons why this sector is the biggest.

The manufacturing sector is anticipated to register the highest growth rate during the forecast period. This is because of the growing trend of Industry 4.0, which involves using smart technologies to make manufacturing more efficient and productive. In manufacturing, AI is used for predictive maintenance, quality control, and supply chain optimization. The use of smart factories and interconnected systems is creating a huge need for solutions that can manage these new and complex AI workloads. These solutions help manufacturers improve their operations, reduce downtime, and make better use of their resources. As more manufacturers adopt these technologies, the demand for AI workload management tools is increasing rapidly across the manufacturing sector.

Regional Analysis

The North America AI workload management market accounted for the largest share in 2024. This is mainly due to the presence of many major technology companies and a strong focus on research and development. The region's businesses are adopting AI and machine learning for a variety of tasks, which is creating a high demand for solutions that can manage these complex workloads. The mature IT infrastructure in North America helps with the easy adoption of these new technologies. Significant investments from private and government sectors in AI research and development boost the regional market growth.

U.S. AI Workload Management Market Insights

The U.S. is a key contributor in the North America industry. The country has a high concentration of leading companies that are investing heavily in AI and related technologies. A lot of the innovation in the AI space comes from the U.S. This is happening because of a strong ecosystem that supports startups, a large talent pool, and significant funding. The government also plays a big part through initiatives that encourage the development and use of AI in different industries. This strong focus on technological progress and high investments in research make the U.S. a major contributor.

Europe AI Workload Management Market Trends

The AI workload management in Europe is showing steady growth. This is attributed to a growing awareness of the benefits of AI and a strong push from governments to support its use. Many European countries are making efforts to build a strong digital economy, and AI is seen as a key part of that. The region has a lot of diverse industries, from manufacturing to healthcare, and many of them are starting to use AI to improve their operations and save money. The increasing number of tech startups and the focus on research in European universities are also helping to drive the growth forward.

The Germany AI workload management market is witnessing growth due to the country's strong industrial base, especially in the automotive and manufacturing sectors. German companies are using AI for predictive maintenance and quality control in their smart factories. The government has also launched a national AI strategy to support the development and use of these technologies, which helps create a favorable environment for growth. This strong focus on industrial automation is making Germany a central player in Europe.

Asia Pacific AI Workload Management Market Overview

The Asia Pacific market is expected to witness the fastest growth during the forecast period. This rapid growth is mainly due to the quick adoption of new technologies and the rising number of businesses going digital across the region. Countries in this region are experiencing huge growth in the IT, telecommunications, retail, and manufacturing sectors. Governments of the region are also investing heavily in smart city projects and digital infrastructure, which is creating a huge demand for AI and its related management solutions. The growing number of tech startups is also helping to speed up growth.

China AI Workload Management Market Overview

China is a major contributor to the Asia Pacific market. China has become a global leader in AI development and use. It is known for its large-scale AI projects and a strong push for innovation. The government's support and investments in AI research and development have created a competitive environment. This has led to a fast rise in the number of companies using AI for everything from e-commerce to smart manufacturing. This focus on technological progress and a huge domestic makes China a key player in the region.

Key Players and Competitive Insights

The AI workload management market is highly competitive, with a mix of large technology companies and specialized providers. The competitive landscape is defined by constant innovation and partnerships aimed at creating comprehensive solutions that meet the evolving needs of businesses. Companies are focusing on improving their offerings to include features such as advanced automation, predictive analytics, and seamless integration with existing cloud and on-premise infrastructures. The players are also trying to meet the demand for better security and compliance in managing sensitive AI workloads.

A few prominent companies in the industry include Advanced Micro Devices, Inc.; Amazon Web Services, Inc.; Google LLC; Hewlett Packard Enterprise Development LP; International Business Machines Corporation; Microsoft Corporation; NVIDIA Corporation; and Oracle Corporation.

Key Players

- Google LLC

- Hewlett Packard Enterprise Development LP

- International Business Machines Corporation

- Microsoft Corporation

- NVIDIA Corporation

- Oracle Corporation

- Wrike, Inc.

AI Workload Management Industry Developments

July 2025: HPE completed its acquisition of Juniper Networks, a leader in AI-native networks. This deal aims to double the size of HPE's networking business and provide customers a more complete portfolio of networking solutions, which also helps with AI workloads.

November 2024: IBM and AMD announced a collaboration to use AMD Instinct MI300X accelerators on IBM Cloud.

AI Workload Management Market Segmentation

By Component Outlook (Revenue – USD Billion, 2020–2034)

- Solution

- Services

By Organization Size Outlook (Revenue – USD Billion, 2020–2034)

- Large Enterprises

- SMEs

By Deployment Outlook (Revenue – USD Billion, 2020–2034)

- On-premises

- Cloud

By Vertical Outlook (Revenue – USD Billion, 2020–2034)

- Retail & E-commerce

- Healthcare & Life Sciences

- BFSI

- Government & Public Sector

- IT & Telecommunication

- Manufacturing

- Others

By Regional Outlook (Revenue – USD Billion, 2020–2034)

- North America

- U.S.

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- Suth Korea

- Indnesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- Suth Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

AI Workload Management Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 32.84 billion |

|

Market Size in 2025 |

USD 43.92 billion |

|

Revenue Forecast by 2034 |

USD 611.82 billion |

|

CAGR |

34.0% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Insights |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 32.84 billion in 2024 and is projected to grow to USD 611.82 billion by 2034.

The global market is projected to register a CAGR of 34.0% during the forecast period.

North America dominated the market share in 2024.

A few key players in the market include Advanced Micro Devices, Inc.; Amazon Web Services, Inc.; Google LLC; Hewlett Packard Enterprise Development LP; International Business Machines Corporation; Microsoft Corporation; NVIDIA Corporation; and Oracle Corporation.

The solution segment accounted for the largest share of the market in 2024.

The small and medium-sized enterprises (SMEs) segment is expected to witness the fastest growth during the forecast period.