U.S. Dental Consumables Market Size, Share, Trends, Industry Analysis Report

By Product (Dental Implants, Crowns & Bridges), By Specialty, By End Use – Market Forecast, 2025–2034

- Published Date:Aug-2025

- Pages: 129

- Format: PDF

- Report ID: PM6244

- Base Year: 2024

- Historical Data: 2020-2023

Overview

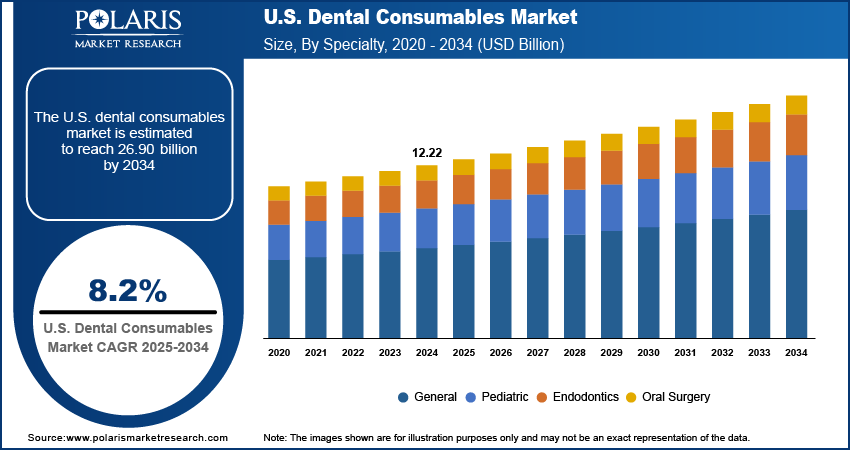

The U.S. dental consumables market size was valued at USD 12.22 billion in 2024, growing at a CAGR of 8.2% from 2025 to 2034. The market is driven by an aging population, rising prevalence of dental disorders, growing demand for cosmetic dentistry, increased oral health awareness, and adoption of advanced technologies like CAD/CAM and digital impressions.

Key Insights

- In 2024, the dental implants segment dominated with the largest share due to the rising demand for tooth replacements and the growing aging population needing long-term dental solutions.

- The endodontics segment accounted for significant growth in 2024, driven by an increasing number of root canal procedures and a growing awareness of tooth preservation.

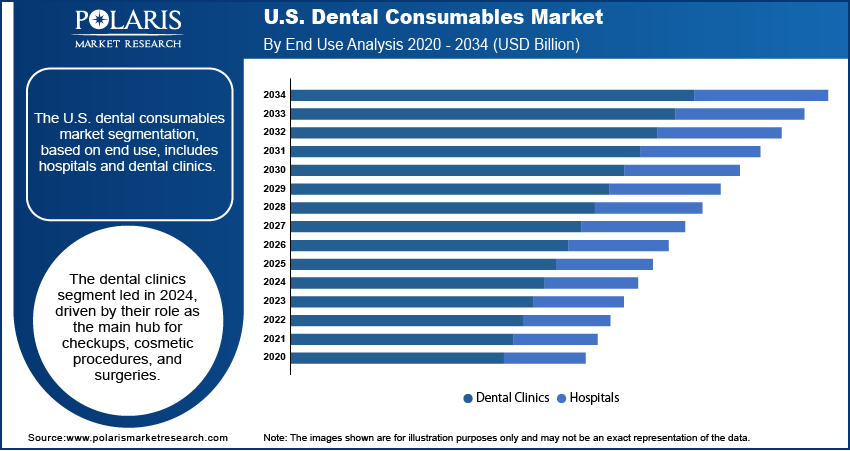

- The dental clinics segment dominated with the largest share as clinics remain the primary point of contact for most dental treatments, including routine checkups, cosmetic procedures, and surgeries.

- The hospital segment is expected to experience significant growth during the forecast period, driven by increasing hospital-based dental surgeries and a growing number of dental departments in larger healthcare facilities

Industry Dynamics

- Growing aging population drives the demand for dental consumables.

- Growing number of dental clinics and DSOs is fueling the industry growth.

- Rising technological advancements in the materials make it more durable, safer, and better looking.

- High costs of advanced dental treatments and limited reimbursement policies in some states limit the market growth.

Market Statistics

- 2024 Market Size: USD 12.22 billion

- 2034 Projected Market Size: USD 26.90 billion

- CAGR (2025–2034): 8.2%

AI Impact on U.S. Dental Consumables Market

- AI-enabled predictive modeling is used to tailor treatments and reduce costs and time for individual patients.

- AI software integrated into scanners and milling units provides real-time feedback, ensuring the right consumables are used for a precise fit.

- Dental clinics integrate AI with intraoral scanners, CAD/CAM systems, and 3D printing to streamline workflows and enhance restoration precision.

- Players operating in the dental consumable ecosystem adopt AI-driven predictive analytics to forecast demand, optimize stock, and reduce waste in clinics and supply chains, which transforms inventory management.

Dental consumables are products used by dental professionals during procedures for prevention, diagnosis, treatment, and restoration of oral health. These include materials such as fillings, impression materials, bonding agents, disinfectants, and dental cements. Unlike equipment, consumables are typically single-use or need regular replenishment.

More Americans have dental insurance through work, government programs, or private plans. Insurance helps cover the cost of cleanings, fillings, and other basic services. People are more likely to visit the dentist regularly when they have coverage. These visits require products such as sealants, fluoride, and cements. Insurance further helps patients afford more expensive care, which increases the use of dental supplies. Better coverage leads to more appointments and treatments, creating demand for dental consumables in clinics.

New types of dental materials are making treatments more effective and efficient. Today’s fillings, adhesives, and crowns are stronger, look more natural, and last longer. These improvements help dentists do their work more easily and give patients better results. Clinics that use modern materials often attract more patients. Stronger and safer materials reduce the need for repeat procedures, which builds trust. Dentists further need new tools and products to match the latest materials. This progress leads to more purchases of updated dental consumables, thereby driving the growth.

Drivers & Opportunities

Growing Aging Population: The number of older people in the U.S. is rising quickly. According to the World Bank, 18% of country’s population is more than 65 years old as of 2024. Older people often have more dental problems, such as gum disease, tooth loss, or the need for dentures. These issues lead to higher use of dental products such as fillings, crowns, and adhesives. Many seniors now want to keep their natural teeth longer, so they go to the dentist more often. This group needs regular cleanings and repairs, which increases the use of dental consumables. Dental clinics are seeing more older patients, which boosts the demand for materials used in treatments, thereby driving the growth.

Growing Number of Dental Clinics and DSOs: More dental clinics are opening across the U.S. Large groups called Dental Service Organizations (DSOs) manage many clinics under one system. According to the American Dental Association, 27% of dentists who graduated within 10 years are affiliated with DSOs in 2024. These groups buy supplies in large amounts, which increases demand for dental consumables such as cleaning agents, impression materials, and anesthetics. DSOs help bring dental care to smaller towns and busy areas alike. The need for everyday materials rises as the number of clinics rises. This growth in dental offices is driving the dental consumables industry in the U.S.

Segmental Insights

Product Analysis

The U.S. dental consumables market segmentation, based on product, includes dental implants, crowns & bridges, dental biomaterials, orthodontic materials, endodontic materials, periodontic materials, dentures, CAD/CAM devices, retail dental hygiene essentials, and others. In 2024, the dental implants segment dominated with the largest share due to the rising demand for tooth replacements and the growing aging population needing long-term dental solutions. Dental implants are preferred because they last longer and feel more natural than traditional dentures or bridges. Technological advancements and better implant materials have further made the procedure more accessible and reliable. The demand for dental implants is expected to remain strong as people continue to prioritize their oral care and appearance, thereby driving the segment growth.

Specialty Analysis

The U.S. dental consumables market segmentation, based on specialty, includes general, pediatric, endodontics, and oral surgery. The endodontics segment accounted for significant growth driven by an increasing number of root canal procedures and a growing awareness of tooth preservation. Endodontic treatments are essential for saving infected or damaged teeth rather than removing them. Innovations in endodontic instruments and techniques have improved the success rate and comfort level of these treatments, making them more popular among patients and dental professionals. Moreover, the rising dental care awareness and the desire to avoid tooth loss are fueling the segment growth.

End Use Analysis

The U.S. dental consumables market, based on end use, is segmented into hospitals and dental clinics. The dental clinics segment dominated with the largest share as clinics remain the primary point of contact for most dental treatments, including routine checkups, cosmetic procedures, and surgeries. Their wide availability, personalized care, and shorter wait times make them the preferred choice for many patients. Clinics further benefit from bulk purchases of consumables to support their day-to-day operations. Dental clinics play a major role in driving demand across all types of dental consumables with a consistent patient flow and focus on quality care, thereby fueling the growth.

The hospital segment is expected to experience significant growth during the forecast period, driven by increasing hospital-based dental surgeries and a growing number of dental departments in larger healthcare facilities. Hospitals handle complex dental procedures that require advanced equipment and skilled professionals, leading to higher usage of specialized consumables. Moreover, hospitals are expanding their dental care offerings and are integrating with broader healthcare services, contributing to their growth.

Key Players and Competitive Analysis

The U.S. dental consumables market is highly competitive, with key players focusing on innovation, product diversification, and strategic partnerships to strengthen their market positions. Leading companies such as 3M, Dentsply Sirona, and Envista Holdings Corporation (formerly part of Danaher) dominate due to their broad product portfolios and strong distribution networks. Companies such as Straumann and Zimmer Biomet specialize in dental implants, leveraging advanced technologies and research. Distributors such as Henry Schein and Patterson Companies play a vital role in supply chain efficiency and customer reach. Firms such as Benco Dental and GC Asia Dental emphasize customer service and tailored product offerings, while Ivoclar and Coltene are known for advanced restorative materials. Niche players, including Komet Dental and Prime Dental Products, contribute through specialized instruments and cost-effective solutions. The competitive landscape is driven by technological advancements, increasing dental procedures, and a growing focus on aesthetic dentistry, pushing companies to innovate and expand their market share.

Key Players

- 3M

- Benco Dental

- Coltene Group

- Dentsply Sirona

- Envista Holdings Corporation (Danaher Corporation)

- GC Asia Dental

- Henry Schein, Inc.

- Ivoclar

- Komet Dental (Brasseler GmbH & Co. KG group)

- Patterson Companies, Inc.

- Prime Dental Products Pvt. Ltd.

- Septodont Holding

- Straumann Holding

- Zimmer Biomet

Dental Consumables Industry Developments

In September 2024, Solventum launched 3M Clinpro Clear Fluoride and 3M Filtek Easy Match at the 2024 FDI World Dental Congress, showcasing innovations that enhanced efficiency and patient-centred care, building on 3M’s legacy in dental healthcare technology.

U.S. Dental Consumables Market Segmentation

By Product Outlook (Revenue, USD Billion, 2020–2034)

- Dental Implants

- Crowns & Bridges

- Dental Biomaterials

- Orthodontic Materials

- Endodontic Materials

- Periodontic Materials

- Dentures

- CAD/CAM Devices

- Retail Dental Hygiene Essentials

- Others

By Specialty Outlook (Revenue, USD Billion, 2020–2034)

- General

- Pediatric

- Endodontics

- Oral Surgery

By End Use Outlook (Revenue, USD Billion, 2020–2034)

- Hospitals

- Dental Clinics

U.S. Dental Consumables Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 12.22 Billion |

|

Market Size in 2025 |

USD 13.20 Billion |

|

Revenue Forecast by 2034 |

USD 26.90 Billion |

|

CAGR |

8.2% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The market size was valued at USD 12.22 billion in 2024 and is projected to grow to USD 26.90 billion by 2034.

The market is projected to register a CAGR of 8.2% during the forecast period.

A few of the key players in the market are 3M; Benco Dental; Coltene Group; Dentsply Sirona; Envista Holdings Corporation; GC Asia Dental; Henry Schein, Inc.; Ivoclar; Komet Dental (Brasseler GmbH & Co. KG group); Patterson Companies, Inc.; Prime Dental Products Pvt. Ltd.; Septodont Holding; Straumann Holding; and Zimmer Biomet.

The dental implant segment dominated the market share in 2024.

The hospital segment is expected to witness the significant growth during the forecast period.