Dental Implants Market Size, Share, Trends, Industry Analysis Report

: By Implant Type (Titanium Implants and Zirconia Implants), End User, and Region – Market Forecast, 2025–2034

- Published Date:Aug-2025

- Pages: 116

- Format: PDF

- Report ID: PM1112

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

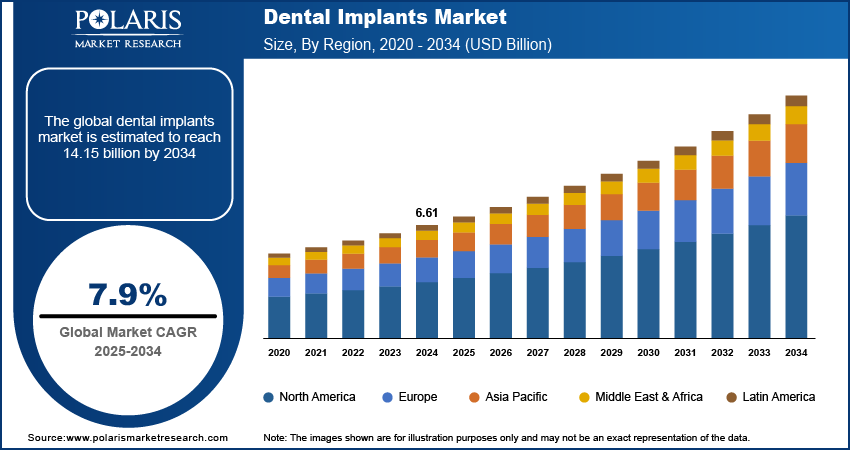

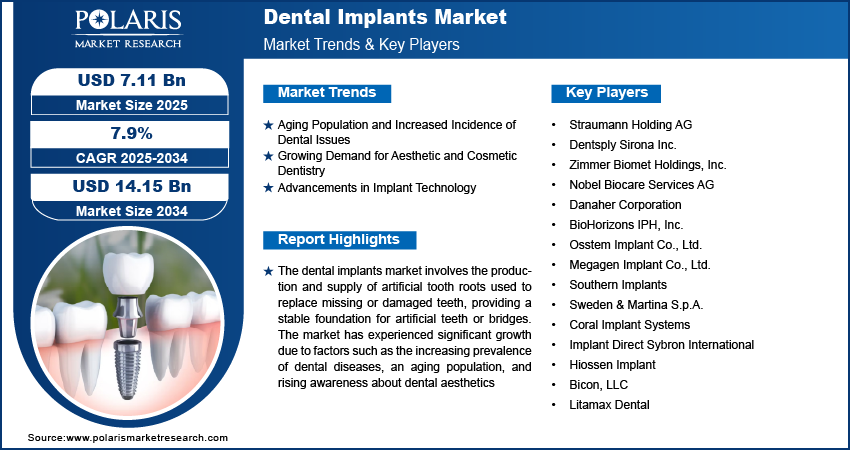

The dental implants market size was valued at USD 6.61 billion in 2024. The market is projected to grow from USD 7.11 billion in 2025 to USD 14.15 billion by 2034, exhibiting a CAGR of 7.9% during 2025–2034. The market is driven by the rising prevalence of tooth loss, increasing demand for aesthetic dentistry, advancements in implant technology, growing aging population, and higher acceptance of dental procedures supported by improved healthcare infrastructure and disposable income.

Key Insights

- Titanium implants led the market in 2024 due to excellent biocompatibility, durability, and long-term success rates.

- Solo practices held a major share in 2024, supported by numerous independent dental specialists.

- DSO/group practices are fastest-growing segment during the forecast period, benefiting from operational scale and competitive pricing.

- North America dominated in 2024, driven by advanced healthcare, high income, and strong demand for aesthetic dentistry.

- Dental awareness, an aging population, and a robust healthcare infrastructure fuel Europe’s market growth.

Industry Dynamics

- Rising demand for dental implants is driven by increasing tooth loss, growing aging population, and rising awareness of oral health and cosmetic dentistry.

- Market expansion is supported by technological advancements, such as 3D imaging and digital implants, along with increasing dental care expenditure and accessibility.

- Challenges like high procedure costs, risk of implant failure, and lack of skilled professionals in some regions may limit market growth.

- Innovations in biomaterials, implant surface technologies, and minimally invasive procedures are enhancing implant success rates, patient comfort, and recovery times.

Market Statistics

- 2024 Market Size: USD 6.61 billion

- 2034 Projected Market Size: USD 14.15 billion

- CAGR (2025-2034): 7.9%

- North America: Largest market in 2024

AI Impact on Dental Implants Market

- AI analyzes patient dental scans and bone density data to assist in precise implant planning and customized treatment strategies.

- Integration of AI supports real-time surgical navigation, improving implant placement accuracy and reducing procedural risks.

- AI-powered tools enhance implant design by simulating biomechanical performance and predicting long-term durability in diverse clinical scenarios.

- AI optimizes inventory management and production workflows, ensuring timely availability of implants and reducing manufacturing costs.

To Understand More About this Research: Request a Free Sample Report

The dental implants market refers to the industry involved in the design, production, and supply of dental implants, which are artificial devices used to replace missing or damaged teeth. This market has witnessed significant growth due to factors such as an increasing aging population, rising awareness of dental aesthetics, and advancements in implant technology.

One of the major driving forces behind this growth is the expanding geriatric population, as older individuals are more prone to tooth loss due to age-related conditions such as periodontal disease and tooth decay. Additionally, the rise in disposable income and improvements in healthcare infrastructure, especially in developing countries, have made dental implants more accessible. Advancements in implant technology, including 3D printing, computer-aided design (CAD), and computer-aided manufacturing (CAM), have led to the development of more precise and efficient implant procedures, further propelling market growth. Moreover, the increasing preference for minimally invasive procedures and the introduction of zirconium-based implants, which offer enhanced biocompatibility and strength, are also contributing to the market’s expansion.

Market Dynamics

Aging Population and Increased Incidence of Dental Issues

The aging population is one of the key drivers of the market. The likelihood of tooth loss due to factors such as periodontal disease, decay, or accidents increases as people age. World Health Organization stated that by 2030, 1 in 6 people in the world will be aged 60 years or over. This demographic shift is fueling the demand for dental implants as a long-term solution for tooth replacement. Additionally, age-related conditions such as bone loss often require more advanced dental treatments, further contributing to the market growth.

Growing Demand for Aesthetic and Cosmetic Dentistry

The rising focus on aesthetic appeal and the growing trend of cosmetic dentistry are contributing significantly to the market demand. Patients are increasingly seeking solutions that restore both function and appearance, driving the demand for implants over traditional dentures or bridges. According to the American Academy of Cosmetic Dentistry, more than 70% of adults in the US are interested in improving their smile, and dental implants are often considered the most effective option for restoring a natural-looking smile. The adoption of dental implants in cosmetic dentistry continues to grow as people become more conscious of their dental appearance.

Advancements in Implant Technology

Advances in dental implant technology have enhanced the efficiency, safety, and success rates of these procedures, further driving the market growth. Innovations such as 3D imaging, computer-assisted design (CAD), and robotic surgery have significantly improved the precision of implant placements, reducing procedure times and enhancing recovery. Additionally, the development of materials such as titanium alloys and ceramic implants has resulted in more durable, biocompatible, and aesthetically pleasing products. The increased availability of less invasive techniques, such as mini-implants and immediate loading implants, has also broadened the patient base for dental implants.

Segment Insights

By Implant Type Analysis

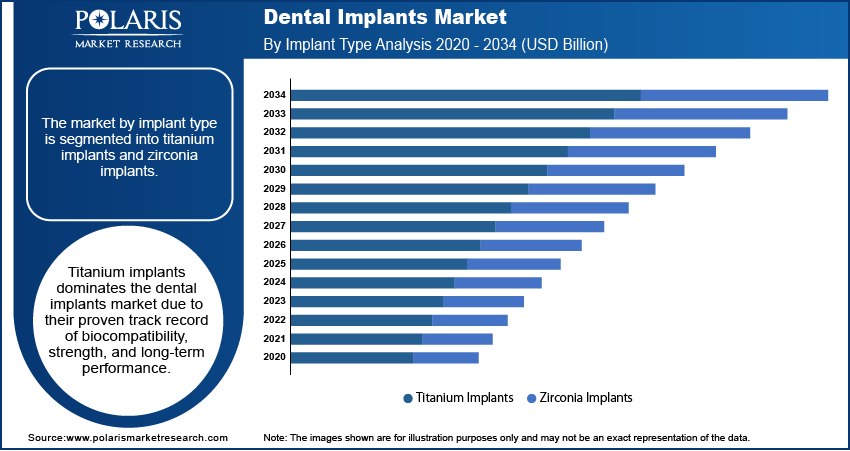

The dental implants market segmentation, based on implant type, includes titanium implants and zirconia implants. The titanium implants segment held the largest dental implants market share in 2024 due to its proven track record of biocompatibility, strength, and long-term performance. Titanium has been the material of choice for dental implants for decades, and its ability to fuse with bone through osseointegration has made it the standard for dental restoration procedures. The demand for titanium implants continues to grow, particularly in developed markets, owing to their reliability and cost-effectiveness. The segment is further supported by a well-established supply chain and widespread adoption among dental professionals, ensuring its position as the major implant type in the market.

Zirconia implants are experiencing significant growth, driven by increasing demand for aesthetic solutions and the preference for metal-free alternatives. Zirconia offers advantages such as superior aesthetics, biocompatibility, and resistance to corrosion, which appeal to patients seeking natural-looking results. The zirconia implant segment is further estimated to register higher growth rates, particularly in regions with a strong focus on cosmetic dentistry, as consumer preferences shift toward non-metal dental solutions.

By End User Evaluation

The dental implants market is segmented by end user into solo practices, DSO/group practices, and others. The solo practices segment accounted for major market share in 2024, driven by the significant number of independent dental practitioners who provide specialized services. These practices are typically more prevalent in regions where dental care is predominantly offered by small, independent practitioners. Solo practices benefit from a loyal patient base and the ability to offer personalized care, which helps drive the demand for dental implants. The segment continues to maintain a strong position in the market due to the consistent demand for implant procedures in local communities, as well as the flexibility that small practices have in adopting new technologies and treatments.

The DSO/group practices segment is registering the fastest dental implants market growth as these organizations scale operations and offer more competitive pricing. DSOs are increasingly growing due to their ability to consolidate multiple dental practices, streamline procurement, and standardize procedures. This model allows them to cater to a larger patient base, particularly in urban and suburban areas, and to provide comprehensive care with a more efficient business model.

Regional Analysis

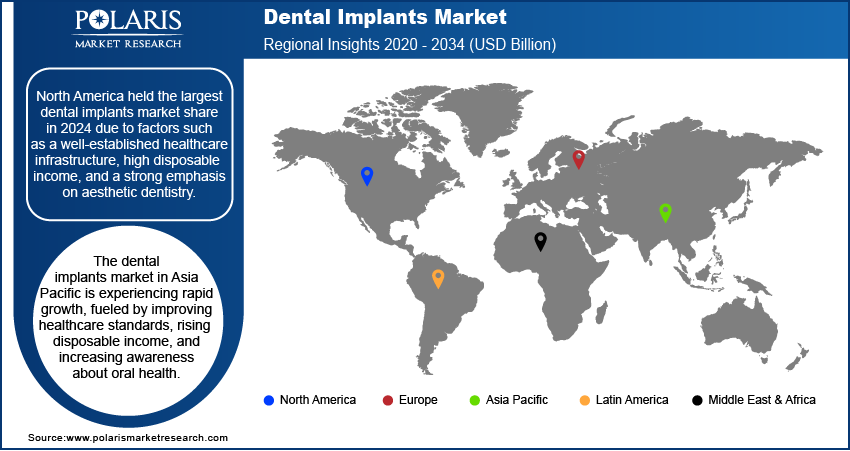

By region, the report covers North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. North America held the largest market share in 2024 due to factors such as a well-established healthcare infrastructure, high disposable income, and a strong emphasis on aesthetic dentistry. The region benefits from a high prevalence of dental issues, advanced technological adoption, and a significant number of dental professionals offering implant services. Additionally, North America's aging population and increasing demand for cosmetic dental procedures further boost market for dental implants.

The dental implants market in Europe is driven by a combination of factors, including a high level of awareness about dental aesthetics, an aging population, and advanced healthcare infrastructure. The region is home to a large number of dental professionals skilled in implant procedures, making it a key market for dental implants. Countries such as Germany, France, and the UK are significant contributors to the market, supported by both private and public healthcare systems that encourage access to advanced dental treatments. The demand for cosmetic and restorative dentistry continues to rise, particularly in Western and Northern Europe, where aesthetic procedures are highly prioritized.

The market in Asia Pacific is experiencing rapid growth, fueled by improving healthcare standards, rising disposable income, and increasing awareness about oral health. Additionally, the growing popularity of dental tourism in countries such as Thailand and Malaysia, where dental procedures are offered at a lower cost compared to Western markets, is contributing to the region's expansion. The increasing number of dental practitioners adopting advanced implant technologies further accelerates dental implants market growth in this region.

Key Players and Competitive Analysis Report

The key players in the market include Straumann Holding AG, which is known for offering high-quality dental implants and related products. Dentsply Sirona Inc. offers a range of dental implants with a focus on innovation and quality. Zimmer Biomet Holdings, Inc. is another major player, providing a wide range of dental implant solutions globally. Nobel Biocare Services AG, a subsidiary of Envista Holdings Corporation, offers dental implants with a strong focus on esthetics and functionality. Danaher Corporation operates through its subsidiary KaVo Kerr, which manufactures dental implants and tools for implantology. BioHorizons IPH, Inc., an established player in the market, is known for its cutting-edge technologies and implant solutions. Osstem Implant Co., Ltd. is another prominent company that provides dental implants in global markets, particularly in Asia. Megagen Implant Co., Ltd. specializes in innovative implant solutions and is expanding its market presence worldwide.

In terms of competitive analysis, the market is characterized by strong competition among these players, each of which offers a range of dental implant solutions. Companies such as Straumann Holding AG and Dentsply Sirona Inc. are known for their broad product portfolios and significant research and development investments. These companies often focus on offering advanced technologies and high-quality products to cater to the growing demand for dental implants. Meanwhile, companies such as Osstem Implant Co., Ltd. and Megagen Implant Co., Ltd. have seen increased adoption in markets where cost-effectiveness and reliability are key considerations. These players leverage cost-efficient solutions to compete with larger, more established brands.

The competitive landscape also reflects a trend toward innovation, with many companies prioritizing the development of implants that offer superior biocompatibility, ease of installation, and durability. Nobel Biocare Services AG and Zimmer Biomet Holdings, Inc. continue to lead in terms of product quality and technological advancements, including the adoption of digital tools and minimally invasive techniques. As demand for aesthetic and custom dental implants increases, companies are adapting their product offerings to meet these needs. BioHorizons IPH, Inc. and Sweden & Martina S.p.A. focus heavily on aesthetic dentistry, which is becoming an essential factor for consumers looking for both functionality and appearance in dental implants.

Straumann Holding AG is a Swiss company specializing in dental implants, instruments, prosthetics, biomaterials, and digital solutions. Founded in 1954, it has expanded its operations to over 100 countries, offering products and services to dental professionals and laboratories. The company's mission is to restore smiles and confidence through its comprehensive range of dental solutions.

Dentsply Sirona Inc. is an American company that designs, develops, manufactures, and markets a wide range of dental products and technologies. Established in 2016 through the merger of Dentsply International Inc. and Sirona Dental Systems, the company offers products in consumables, equipment, technology, and specialty products. Dentsply Sirona serves dental professionals worldwide and aims to improve oral health through its diverse product offerings.

List of Key Companies

- Bicon, LLC

- BioHorizons IPH, Inc.

- Coral Implant Systems

- Danaher Corporation

- Dentsply Sirona Inc.

- Hiossen Implant

- Implant Direct Sybron International

- Litamax Dental

- Megagen Implant Co., Ltd.

- Nobel Biocare Services AG

- Osstem Implant Co., Ltd.

- Southern Implants

- Straumann Holding AG

- Sweden & Martina S.p.A.

- Zimmer Biomet Holdings, Inc.

Industry Developments

- October 2024: Dentsply Sirona announced a voluntary suspension of sales and marketing for its Byte teeth aligners and Impression Kits. The company consulted with the US Food and Drug Administration to review certain regulatory requirements. Consequently, it halted shipments and processing of new and recent orders for these products.

- February 2024: ZimVie Inc., a global life sciences company in the dental and spine markets, announced the launch of the TSX Implant in Japan.

Market Segmentation

By Implant Type Outlook (Revenue-USD Billion, 2020–2034)

- Titanium Implants

- Zirconia Implants

By End User Outlook (Revenue-USD Billion, 2020–2034)

- Solo Practices

- DSO/Group Practices

- Others

By Regional Outlook (Revenue-USD Billion, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 6.61 billion |

|

Market Value in 2025 |

USD 7.11 billion |

|

Revenue Forecast by 2034 |

USD 14.15 billion |

|

CAGR |

7.9% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

How is Report Valuable for Organization?

Workflow/Innovation Strategy: The dental implants market has been segmented into detailed segments of implant type and end user. Moreover, the study provides the reader with a detailed understanding of the different segments at both the and regional levels.

Growth/Marketing Strategy: The growth and marketing strategies in the dental implants market focus on expanding product offerings, enhancing technological advancements, and increasing brand visibility. Companies are investing heavily in research and development to introduce innovative solutions, such as digital implants, 3D imaging, and minimally invasive techniques, to meet evolving patient demands. Strategic partnerships and collaborations with dental professionals and research institutions are also being pursued to expand market reach. Furthermore, expanding into emerging markets, particularly in Asia Pacific and Latin America, where the demand for dental implants is growing, remains a key strategy for market players. Digital marketing and educational campaigns are being employed to raise awareness about the benefits of dental implants and attract a broader patient base.

FAQ's

The dental implants market size was valued at USD 6.61 billion in 2024 and is projected to grow to USD 14.15 billion by 2034.

The market is projected to register a CAGR of 7.9% during the forecast period, 2025-2034.

North America had the largest share of the market.

The dental implants market key players include Bicon, LLC, BioHorizons IPH, Inc., Coral Implant Systems, Danaher Corporation, Dentsply Sirona Inc., Hiossen Implant, Implant Direct Sybron International, Litamax Dental, Megagen Implant Co., Ltd., Nobel Biocare Services AG, Osstem Implant Co., Ltd., Southern Implants, Straumann Holding AG, Sweden & Martina S.p.A., Zimmer Biomet Holdings, Inc.

The titanium implants segment accounted for the larger share of the market in 2024.

The solo practices segment accounted for the larger share of the market in 2024.

Dental implants are artificial tooth roots placed into the jawbone to support replacement teeth or bridges. These implants are typically made of titanium or zirconia and are designed to fuse with the bone in a process called osseointegration, providing a stable foundation for artificial teeth. Dental implants are used to replace missing or damaged teeth, offering a permanent solution compared to traditional dentures or bridges. They provide better functionality, aesthetics, and durability, making them a preferred option for many individuals seeking to restore their smile and improve oral health.

A few key trends in the market are described below: Increased Adoption of Digital Dentistry: Integration of technologies like 3D imaging, CAD/CAM, and computer-guided implant placement is improving accuracy and reducing treatment times. Minimally Invasive Procedures: Growing preference for less invasive, quicker recovery methods is driving demand for advanced implant techniques. Aesthetic Focus: Increasing demand for implants that offer natural-looking results, including ceramic and zirconia implants, to match the aesthetic needs of patients. Rise of Dental Tourism: Growing popularity of dental tourism, particularly in countries offering high-quality dental implants at competitive prices.

A new company entering the dental implants market could focus on offering innovative, cost-effective solutions while emphasizing biocompatibility and aesthetics. Investing in advanced technologies like 3D imaging, AI-driven treatment planning, and minimally invasive techniques could help differentiate the company by improving precision and patient outcomes. Additionally, focusing on emerging markets, where dental care awareness and disposable income are increasing, can provide growth opportunities. Offering personalized products, such as custom implants and prosthetics, along with excellent patient education and customer service, would help build brand loyalty and address specific market needs.

Companies manufacturing, distributing, or purchasing Dental Implants and related products, and other consulting firms must buy the report.