Oral Care Market Share, Size, Trends, Industry Analysis Report

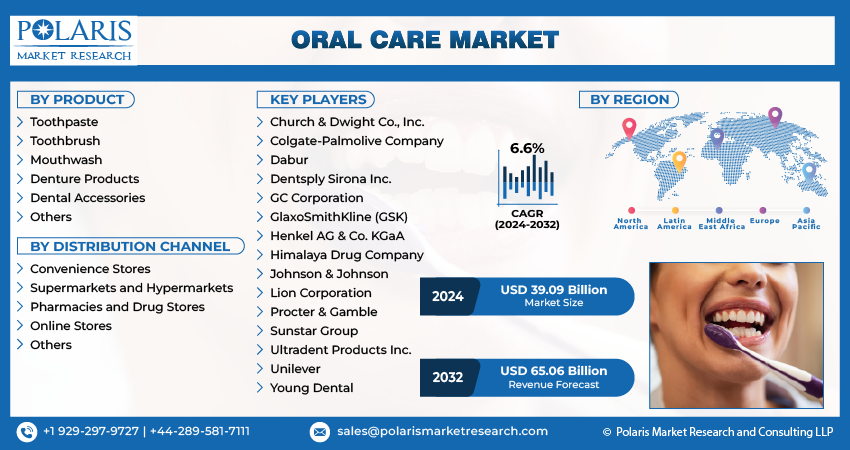

By Product (Toothpaste, Toothbrush, Mouthwash, Denture Products, Dental Accessories, Others); By Distribution Channel; By Region; Segment Forecast, 2024- 2032

- Published Date:Mar-2024

- Pages: 118

- Format: PDF

- Report ID: PM4700

- Base Year: 2023

- Historical Data: 2019 – 2022

Report Outlook

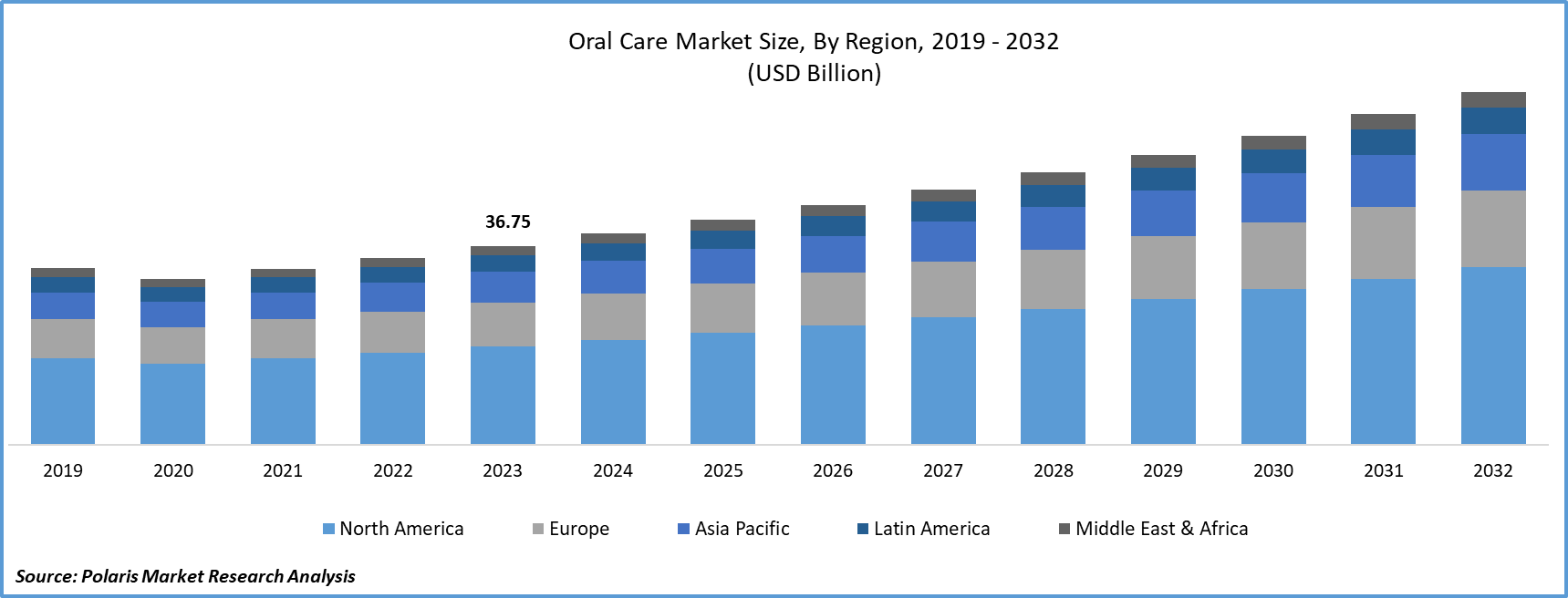

- Global oral care market size was valued at USD 36.75 billion in 2023.

- The market is anticipated to grow from USD 39.09 billion in 2024 to USD 65.06 billion by 2032, exhibiting the CAGR of 6.6% during the forecast period.

Market Introduction

The oral care market size is growing due to the increasing aging population worldwide. With demographics shifting towards older age groups, seniors are experiencing higher rates of oral health issues like periodontal disease and tooth decay. Factors such as reduced saliva production and medication use contribute to these problems. Maintaining oral health becomes crucial for overall well-being as people age, with poor oral health linked to systemic conditions. To address this, there's a focus on preventive oral care measures and tailored dental solutions for seniors, including regular check-ups, proper hygiene, and specialized products.

In addition, companies operating in the market are introducing new products to expand market reach and strengthen their presence.

To Understand More About this Research: Request a Free Sample Report

- For instance, in August 2023, WATERPIK unveiled the Sensonic Electric Toothbrush. This toothbrush utilizes cutting-edge sonic technology and a unique bristle arrangement tailored to the natural shape of teeth. These elements ensure a more thorough cleaning experience, reaching deeper into the contours of tooth surfaces.

Technological advancements in oral care products are revolutionizing the market share. Electric toothbrushes offer superior plaque removal with features like timers and pressure sensors. Water flossers provide efficient plaque removal with pulsating water streams. Tailored toothpaste formulations address specific needs like sensitivity and enamel protection. Integration of smart technology into oral care devices offers real-time feedback and personalized oral care routines via apps. These innovations not only enhance oral hygiene effectiveness but also drive market growth and innovation in the oral care industry.

Industry Growth Drivers

Increasing awareness of oral health is projected to spur the product demand

Growing awareness of oral health is propelling the market growth. Public health campaigns emphasize preventive dental care, educating individuals on the importance of regular brushing, flossing, and dental check-ups to prevent cavities and gum disease. Technological advancements, such as electric toothbrushes and water flossers, offer enhanced solutions, encouraging consumers to invest in premium products. Shifts towards natural and organic oral care products reflect concerns about synthetic ingredients. Additionally, the aging population and increased prevalence of dental disorders sustain market demand, prompting comprehensive oral care routines and investment in specialized treatments.

Rising prevalence of dental disorders is expected to drive oral care market growth

The market is growing due to increasing dental disorders worldwide. Factors such as poor oral hygiene, unhealthy diets, and aging populations contribute to rising issues such as cavities and gum diseases. Lifestyle changes, including sugary food consumption, also drive demand for oral care products. Preventive oral care practices like regular dental check-ups and proper hygiene are emphasized, boosting demand for products like toothpaste and mouthwash. Advancements in oral care technologies offer more effective solutions, highlighting the importance of the oral care market growth globally.

Industry Challenges

Regulatory constraints and compliance challenges are likely to impede the market growth

Regulatory constraints and compliance challenges significantly hinder market growth and innovation. Stringent regulations ensure product safety and efficacy but require extensive testing, documentation, and adherence to strict manufacturing practices, delaying product development and market entry. Additionally, compliance with diverse regulatory frameworks across regions adds complexity and costs to distribution. Evolving regulations demand continuous monitoring and adaptation, further increasing compliance burdens.

Report Segmentation

The oral care market analysis is primarily segmented based on product, distribution channel, and region.

|

By Product |

By Distribution Channel |

By Region |

|

|

|

To Understand the Scope of this Report: Speak to Analyst

By Product Analysis

Toothbrush segment held significant revenue share in 2023

The toothbrush segment held a significant revenue share in 2023 due to its essential role in maintaining oral hygiene. Toothbrushes, vital for plaque removal and gum health, ensure consistent demand. Their limited lifespan necessitates frequent replacement, creating a steady revenue stream. Advancements such as electric toothbrushes with timers and pressure sensors drive market growth by encouraging upgrades. Additionally, toothbrushes offer diverse options to cater to varied preferences and needs. Consumer education by dental professionals reinforces the importance of regular brushing, stimulating demand. Promotional campaigns, including endorsements by professionals and influencers, further increase awareness and drive sales.

By Distribution Channel Analysis

Supermarkets and hypermarkets segment held significant revenue share in 2023

The supermarkets and hypermarkets segment held a significant revenue share in 2023 due to their convenience, variety, and competitive pricing. Offering a one-stop shopping experience, they provide easy access to a wide range of oral care products for diverse consumer preferences. With extended operating hours and widespread locations, they cater to a large customer base. Competitive pricing strategies and promotional offers attract price-conscious shoppers, driving sales volume. Manufacturers prioritize marketing efforts in these outlets, enhancing brand visibility through eye-catching displays and promotions. Additionally, the convenience of bulk buying options for staple oral care items further contributes to their popularity among households.

Regional Insights

Asia-Pacific region accounted for a significant market share in 2023

In 2023, the Asia-Pacific region accounted for a significant market share due to its large and growing population, rising awareness of oral hygiene, and increasing disposable incomes. Economic development has boosted standards of living and affordability, driving demand for oral care products. Expanded retail infrastructure, including supermarkets and e-commerce platforms, ensures easy access to a wide range of products. Tailored product offerings and innovative solutions resonate with local preferences, further fueling market growth. Additionally, government initiatives promoting oral hygiene contribute to heightened awareness and product adoption among consumers, consolidating the region's market share.

The market share in North America thrives on robust growth and innovation. With a large and affluent population prioritizing personal health, there is a high demand for oral care products and services. Leading oral care companies and dental professionals continuously drive technological advancements and product innovation. Additionally, increasing awareness of oral health importance, coupled with high disposable incomes and healthcare spending, further boosts market growth. Consumers prioritize preventive dental care and invest in premium oral care products for optimal hygiene. Moreover, North America's well-established healthcare infrastructure and widespread access to dental services support market expansion.

Key Market Players & Competitive Insights

The oral care market players involves a diverse array of players, and the expected arrival of new contenders is poised to intensify rivalry. Established leaders continuously enhance their technologies to maintain a competitive advantage, emphasizing effectiveness, reliability, and safety. These firms prioritize strategic actions such as establishing collaborations, improving product portfolios, and participating in cooperative endeavors. Their aim is to outperform competitors within the field, securing a significant market share.

Some of the major players operating in the global oral care market include:

- Church & Dwight Co., Inc.

- Colgate-Palmolive Company

- Dabur

- Dentsply Sirona Inc.

- GC Corporation

- GlaxoSmithKline (GSK)

- Henkel AG & Co. KGaA

- Himalaya Drug Company

- Johnson & Johnson

- Lion Corporation

- Procter & Gamble

- Sunstar Group

- Ultradent Products Inc.

- Unilever

- Young Dental

Recent Developments

- In October 2023, BURST Oral Care launched the Pro Sonic Toothbrush and Curve Sonic Toothbrush to the market. These brushes with cutting-edge designs and advanced technology, were developed in collaboration with BURST's Ambassador network comprising over 35,000 dental professionals. This partnership offers high performance at affordable prices, catering to the needs of consumers.

- In November 2020, GSK Consumer Healthcare unveiled the global oral care and denture care brand Polident in India, marking its entry into the specialized denture care sector within the country.

- In November 2023, Prevest Denpro Limited introduced its new line of oral care products called Oradox. This product range addresses different aspects of oral health, including protection against cavities, gum health, enamel strengthening, and ensuring fresh breath.

Report Coverage

The oral care market report emphasizes on key regions across the globe to provide better understanding of the product to the users. Also, the report provides market insights into recent developments, trends and analyzes the technologies that are gaining traction around the globe. Furthermore, the report covers in-depth qualitative analysis pertaining to various paradigm shifts associated with the transformation of these solutions.

The report provides detailed analysis of the market while focusing on various key aspects such as competitive analysis, products, distribution channels, and their futuristic growth opportunities.

Oral Care Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 39.09 billion |

|

Revenue forecast in 2032 |

USD 65.06 billion |

|

CAGR |

6.6% from 2024 – 2032 |

|

Base year |

2023 |

|

Historical data |

2019 – 2022 |

|

Forecast period |

2024 – 2032 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2024 to 2032 |

|

Segments covered |

|

|

Regional scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, region and segmentation. |

FAQ's

The Toluene Market report covering key segments are product, distribution channel, and region.

Oral Care Market Size Worth $65.06 Billion By 2032

Global oral care market exhibiting the CAGR of 6.6% during the forecast period.

Asia-Pacific is leading the global market

key driving factors in Oral Care Market are Increasing awareness of oral health