Advanced IC Substrates Market Size, Share, Trends, Industry Analysis Report

By Type [Flip Chip Ball Grid Array (FCBGA) Substrates, Flip Chip Chip Scale Package (FCCSP) Substrates), By Technology, By Application, By Region – Market Forecast, 2025–2034

- Published Date:Jul-2025

- Pages: 128

- Format: PDF

- Report ID: PM5989

- Base Year: 2023

- Historical Data: 2020-2023

Market Overview

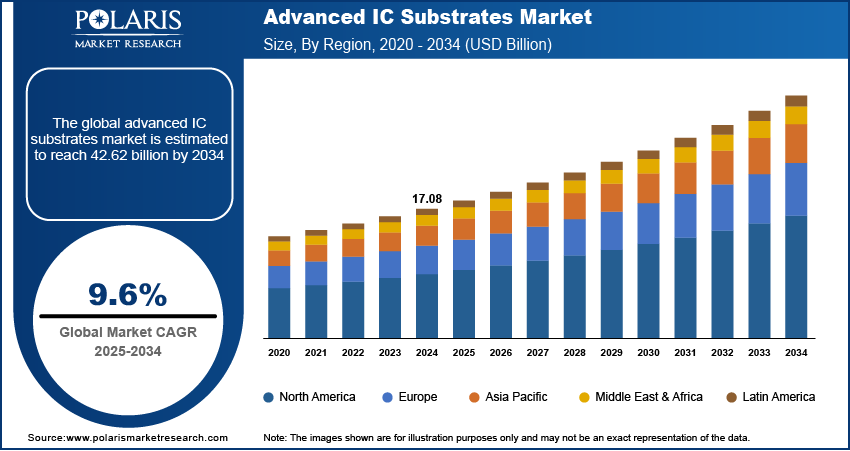

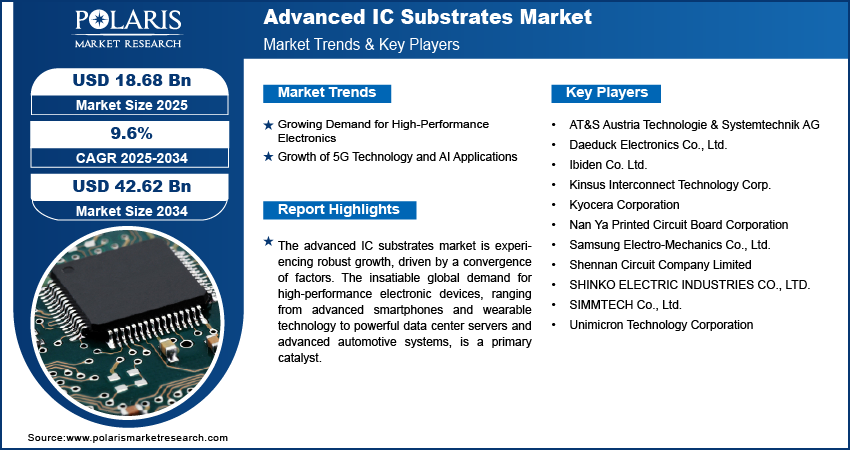

The global advanced IC substrates market size was valued at USD 17.08 billion in 2024 and is anticipated to register a CAGR of 9.6% from 2025 to 2034. The industry is growing due to the increasing demand for high-performance electronics, especially with the rise of 5G technology and AI applications.

Key Insights:

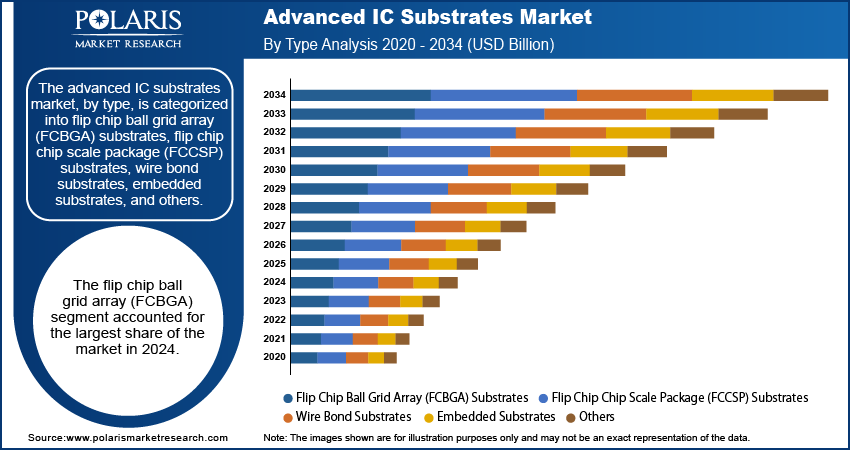

- By type, the Flip Chip Ball Grid Array (FCBGA) substrates segment held the largest share in 2024, due to their widespread use in high-performance applications such as CPUs and GPUs.

- By technology, the high-density interconnect (HDI) substrates segment held the largest share in 2024. These substrates are crucial for creating compact and highly integrated electronic devices such as smartphones and tablets, enabling finer lines and smaller vias to achieve miniaturization and enhanced electrical performance demanded by consumers.

- By application, the mobile & consumer electronics segment held the largest share in 2024. This segment's leading position is attributed to the enormous volume and rapid evolution of products such as smartphones, tablets, and wearables, which consistently drive the need for advanced IC substrates to support increasingly complex and miniaturized chip designs.

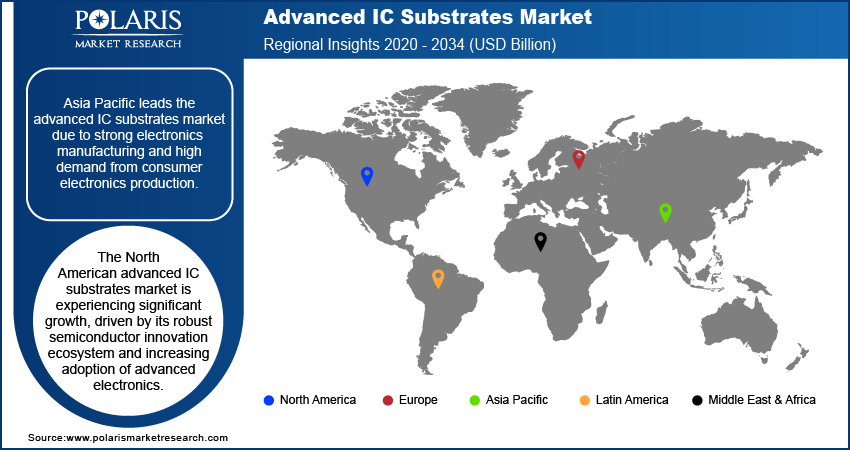

- By region, Asia Pacific is the leading market for advanced IC substrates, accounting for the largest share globally. This leadership is attributed to the region's vast electronics manufacturing capabilities and its central role in the production of a wide array of consumer electronics.

Advanced IC substrates are specialized baseboards used to package bare integrated circuit chips, providing essential functions such as structural support, electrical connections, and heat management for high-performance electronic devices. They are a critical link between the IC chip and the printed circuit board, enabling advanced features and miniaturization.

The increasing adoption of Internet of Things (IoT) devices across various sectors, from smart homes and wearables to industrial automation and healthcare, is significantly boosting the demand for advanced IC substrates. These devices often require highly integrated, compact, and energy-efficient electronic components, which advanced IC substrates are designed to enable. As the IoT ecosystem expands, there is a rising need for specialized substrates that support reliable connectivity, efficient data processing, and miniaturization in these smart devices.

Continuous innovation in semiconductor packaging, such as heterogeneous integration and chiplet-based architectures, is a major driver for the advanced IC substrates market. These advanced packaging methods enable the integration of multiple distinct chips or functionalities into a single package, leading to improved performance, reduced power consumption, and smaller form factors. This evolution in packaging directly drives the need for more sophisticated and high-density IC substrates that can facilitate the complex interconnections and thermal management required by these next-generation integrated circuits.

Industry Dynamics

- The continuous need for faster and more capable electronic devices, such as powerful computing systems and advanced consumer gadgets, necessitates advanced IC substrates that can handle complex designs and high data rates.

- The widespread deployment of 5G networks and the expansion of artificial intelligence (AI) across various sectors require advanced IC substrates to support the immense data processing, low latency, and high-frequency capabilities of these technologies.

- As consumers demand smaller and lighter electronic devices, there is a constant push for miniaturization, which directly drives the need for advanced IC substrates that enable high component density and compact packaging while maintaining or improving performance.

- Innovations in packaging, like heterogeneous integration and chiplet architectures, are driving the demand for advanced IC substrates that can support these complex multi-chip configurations, leading to improved performance and efficiency in next-generation integrated circuits.

Growing Demand for High-Performance Electronics: The rising need for electronic devices that can handle more complex tasks and process data faster is a significant driver for advanced IC substrates. Modern electronics such as powerful smartphones, advanced gaming consoles, and sophisticated automotive systems require substrates that can support higher circuit densities, better signal integrity, and improved thermal management. These high-performance requirements push manufacturers to develop more advanced and efficient substrate solutions.

The rising adoption of various digital health technologies, including wearable devices and remote monitoring systems, highlights the increasing demand for high-performance electronics in the healthcare sector. According to the World Health Organization's (WHO) Global Strategy on Digital Health 2020–2025, digital health solutions are aimed at improving health outcomes and strengthening health systems by accelerating the development and adoption of appropriate technologies. This broad initiative implies a growing need for the underlying advanced electronic components that enable such solutions. This continuous drive for enhanced capabilities in electronic devices is propelling the demand for advanced IC substrates.

Growth of 5G Technology and AI Applications: The widespread rollout of 5G networks and the rapid expansion of artificial intelligence (AI) applications are fueling a substantial demand for advanced IC substrates. Both 5G and AI require processors and supporting components that can manage incredibly high data rates, low latency, and significant computational power. This puts immense pressure on the packaging technology, making advanced IC substrates crucial for maintaining performance and reliability.

The proliferation of AI in various sectors, including medical devices, necessitates advanced electronic components capable of handling complex algorithms and massive datasets. Research highlighted in an article titled "Advances in wearable electronics for monitoring human organs: Bridging external and internal health assessments," published in Biomaterials in 2024, discusses the need for smaller, more efficient, and highly functional wearable devices for diagnostic purposes. These devices often incorporate AI capabilities for data analysis, directly increasing the demand for advanced IC substrates that can support such intricate designs. The ongoing development and deployment of 5G and AI are, therefore major forces driving the advanced IC substrates market demand.

Segmental Insights

Type Analysis

Based on type, the segmentation includes flip chip ball grid array (FCBGA) substrates, flip chip chip scale package (FCCSP) substrates, wire bond substrates, embedded substrates, and others. The flip chip ball grid array (FCBGA) substrates segment held the largest share in 2024. These substrates are widely used in applications that demand high performance and complex chip designs, such as central processing units (CPUs), graphics processing units (GPUs), and networking devices. FCBGA substrates offer excellent electrical performance, superior thermal dissipation, and high-density interconnects, which are crucial for today's powerful computing and communication systems. Their ability to manage a large number of input/output (I/O) connections in a compact form factor makes them indispensable for devices requiring significant processing power and data throughput.

The Flip Chip Chip Scale Package (FCCSP) substrates segment is anticipated to register the highest growth rate during the forecast period. This growth is driven by the increasing demand for smaller, lighter, and more power-efficient electronic devices, especially in the mobile and wearable technology sectors. FCCSP substrates offer a very small footprint while still providing robust electrical performance and thermal management, making them ideal for highly miniaturized products where space is at a premium. As consumer electronics continue to shrink in size without compromising on functionality, the need for compact packaging solutions such as FCCSP becomes critical.

Technology Analysis

Based on technology, the segmentation includes high-density interconnect (HDI) substrates, build-up substrates, coreless substrates, organic substrates, and ceramic substrates. The high-density interconnect (HDI) substrates segment held the largest share in 2024. These substrates are foundational for modern electronic devices that require compact designs and high levels of integration, such as smartphones, tablets, and wearable technologies. HDI substrates enable the creation of smaller and thinner devices by allowing for finer lines, smaller vias, and increased routing density compared to traditional printed circuit boards. Their widespread adoption is driven by the continuous consumer demand for increasingly sophisticated and miniaturized electronics, where efficient space utilization and enhanced electrical performance are paramount.

The build-up substrates segment is anticipated to register the highest growth rate during the forecast period. This growth is significantly fueled by the increasing complexity of semiconductor packaging, particularly for high-performance computing (HPC), artificial intelligence (AI) applications, and advanced packaging techniques such as chiplets. Build-Up substrates, often incorporating Ajinomoto Build-Up Film (ABF) or similar materials, allow for multiple layers of circuitry to be constructed sequentially, offering superior electrical performance, improved signal integrity, and better thermal management capabilities for highly integrated circuits. As processors become more powerful and sophisticated, requiring even finer line widths and greater interconnect density, build-up technology provides the necessary foundation.

Application Analysis

Based on application, the segmentation includes mobile & consumer electronics, automotive electronics, networking & communication devices, computing & data centers, and others. The mobile & consumer electronics segment held the largest share in 2024. This dominance is driven by the sheer volume of products in this category, including smartphones, tablets, laptops, and various wearable devices. These electronics are constantly evolving, with consumers demanding thinner, lighter, and more powerful gadgets. This continuous innovation directly translates into a high demand for advanced IC substrates that can accommodate increasingly complex and miniaturized chip designs while ensuring optimal performance and thermal management.

The automotive electronics segment is anticipated to register the highest growth rate during the forecast period. This surge is primarily attributed to the ongoing revolution in the automotive sector, characterized by the increasing adoption of electric vehicles (EVs), advanced driver-assistance systems (ADAS), and connected car technologies. Modern vehicles are becoming sophisticated computing platforms, integrating a vast array of electronic components for everything from infotainment and navigation to engine control and autonomous driving features. These advanced systems require highly reliable and robust IC substrates that can withstand harsh automotive environments and support complex data processing at high speeds.

Regional Analysis

The Asia Pacific advanced IC substrates market accounted for the largest share in 2024, due to its extensive manufacturing capabilities and the widespread presence of consumer electronics production. The region serves as a major hub for the design and manufacturing of a vast array of electronic devices, from smartphones and laptops to complex networking equipment. This high volume of production naturally translates into immense demand for advanced IC substrates, making Asia Pacific a leading region in terms of both consumption and supply. Continuous technological advancements and a large skilled workforce further solidify the region's strong position in the market.

China Advanced IC Substrates Market Overview

China is a significant country in the Asia Pacific market. The country's massive consumer electronics sector, coupled with its growing investments in developing indigenous semiconductor capabilities, fuels a substantial demand for advanced IC substrates. China's rapid technological progress in areas such as 5G infrastructure and artificial intelligence applications also contributes significantly to the need for high-performance and high-density IC substrates. The ongoing expansion of manufacturing facilities and the increasing focus on advanced packaging technologies within China are key factors propelling the demand for advanced IC substrates.

North America Advanced IC Substrates Market Overview

The North America advanced IC substrates market is experiencing significant growth, driven by its robust semiconductor innovation ecosystem and increasing adoption of advanced electronics. The region is home to numerous leading technology companies that are at the forefront of developing high-performance computing, artificial intelligence, and networking solutions. This creates a strong demand for advanced IC substrates that can support advanced chip designs and packaging technologies. Furthermore, the growing focus on domestic manufacturing and supply chain resilience in the semiconductor sector in North America is providing additional momentum for the advanced IC substrates market.

U.S. Advanced IC Substrates Market Insight

In North America, the U.S. is a pivotal hub for the advanced IC substrates market. The country's strong emphasis on research and development, coupled with substantial investments in semiconductor manufacturing capabilities, is a key driver. The demand for advanced IC substrates in the country is particularly high in sectors such as computing and data centers, where there is a constant need for more powerful and efficient processors. The presence of major technology firms and ongoing government initiatives aimed at boosting domestic semiconductor production further contribute to the adoption of the advanced IC substrates in the U.S.

Europe Advanced IC Substrates Market

The Europe market is showing steady expansion, primarily propelled by the region's strong automotive and industrial electronics sectors. The increasing complexity of electronic systems in modern vehicles, including electric vehicles and advanced driver-assistance systems, drives a significant demand for reliable and high-performance IC substrates. Additionally, Europe's focus on industrial automation and the growing adoption of IoT in manufacturing processes contribute to the need for advanced packaging solutions. Initiatives such as the European Chips Act are aimed at strengthening the region's semiconductor ecosystem, which supports the growth of the advanced IC substrates market by fostering local production and innovation.

The Germany advanced IC substrates market stands out as a major contributor. Its robust automotive sector, known for its innovation in electric vehicles and autonomous driving technologies, creates a substantial demand for sophisticated IC substrates. German manufacturers are at the forefront of developing advanced electronic systems for vehicles, requiring high-density interconnects and reliable packaging. Furthermore, Germany's strong industrial base and its investments in research and development in microelectronics play a crucial role in driving the market in the region.

Key Players and Competitive Insights

The advanced IC substrates market features several major players that are crucial to its competitive landscape. The competitive environment is characterized by intense focus on innovation, driven by the escalating demands for higher performance, greater miniaturization, and improved integration in electronic devices. Companies are heavily investing in research and development to create more advanced materials and manufacturing processes, especially to cater to the growing needs of applications such as AI, 5G, and high-performance computing.

A few prominent companies in the industry include Ibiden Co. Ltd.; Unimicron Technology Corporation; Samsung Electro-Mechanics Co., Ltd.; Kyocera Corporation; AT&S Austria Technologie & Systemtechnik AG; Kinsus Interconnect Technology Corp.; SHINKO ELECTRIC INDUSTRIES CO., LTD. (Fujitsu Ltd.); Nan Ya Printed Circuit Board Corporation (Formosa Plastics Group); Daeduck Electronics Co., Ltd.; Shennan Circuit Company Limited; and SIMMTECH Co., Ltd.

Key Players

- AT&S Austria Technologie & Systemtechnik AG

- Daeduck Electronics Co., Ltd.

- Ibiden Co. Ltd.

- Kinsus Interconnect Technology Corp.

- Kyocera Corporation

- Nan Ya Printed Circuit Board Corporation (Formosa Plastics Group)

- Samsung Electro-Mechanics Co., Ltd.

- Shennan Circuit Company Limited

- SHINKO ELECTRIC INDUSTRIES CO., LTD. (Fujitsu Ltd.)

- SIMMTECH Co., Ltd.

- Unimicron Technology Corporation

Industry Developments

April 2025: Shinko Electric Industries Co., Ltd. earned Intel's 2025 EPIC Supplier Award. This recognition highlights their strong performance as a supplier to a major semiconductor company.

March 2025: AT&S obtained a USD 250 million sustainability-linked loan from the International Finance Corporation (IFC), part of the World Bank Group, to support the construction of its advanced IC substrate facility in Kulim, Malaysia.

Advanced IC Substrates Market Segmentation

By Type Outlook (Revenue – USD Billion, 2020–2034)

- Flip Chip Ball Grid Array (FCBGA) Substrates

- Flip Chip Chip Scale Package (FCCSP) Substrates

- Wire Bond Substrates

- Embedded Substrates

- Others

By Technology Outlook (Revenue – USD Billion, 2020–2034)

- High-Density Interconnect (HDI) Substrates

- Build-Up Substrates

- Coreless Substrates

- Organic Substrates

- Ceramic Substrates

By Application Outlook (Revenue – USD Billion, 2020–2034)

- Mobile & Consumer Electronics

- Automotive Electronics

- Networking & Communication Devices

- Computing & Data Centers

- Others

By Regional Outlook (Revenue – USD Billion, 2020–2034)

- North America

- U.S.

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- Suth Korea

- Indnesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- Suth Africa

- Rest of Middle East & Africa

- Latin America

- Mexic

- Brazil

- Argentina

- Rest of Latin America

Advanced IC Substrates Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 17.08 billion |

|

Market Size in 2025 |

USD 18.68 billion |

|

Revenue Forecast by 2034 |

USD 42.62 billion |

|

CAGR |

9.6% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Insights |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 17.08 billion in 2024 and is projected to grow to USD 42.62 billion by 2034.

The global market is projected to register a CAGR of 9.6% during the forecast period.

Asia Pacific dominated the market share in 2024.

A few key players in the market include Ibiden Co. Ltd.; Unimicron Technology Corporation; Samsung Electro-Mechanics Co., Ltd.; Kyocera Corporation; AT&S Austria Technologie & Systemtechnik AG; Kinsus Interconnect Technology Corp.; SHINKO ELECTRIC INDUSTRIES CO., LTD. (Fujitsu Ltd.); Nan Ya Printed Circuit Board Corporation (Formosa Plastics Group); Daeduck Electronics Co., Ltd.; Shennan Circuit Company Limited; and SIMMTECH Co., Ltd.

The flip chip ball grid array (FCBGA) segment accounted for the largest share of the market in 2024.

The build-up substrates segment is expected to witness the fastest growth during the forecast period.