Dupixent Market Size, Share, Trends, Industry Analysis Report

By Indication [Atopic Dermatitis (AD), Asthma, Chronic Rhinosinusitis with Nasal Polyps (CRSwNP)], By Distribution Channel, By Region – Market Forecast, 2025–2034

- Published Date:Jul-2025

- Pages: 125

- Format: PDF

- Report ID: PM5988

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

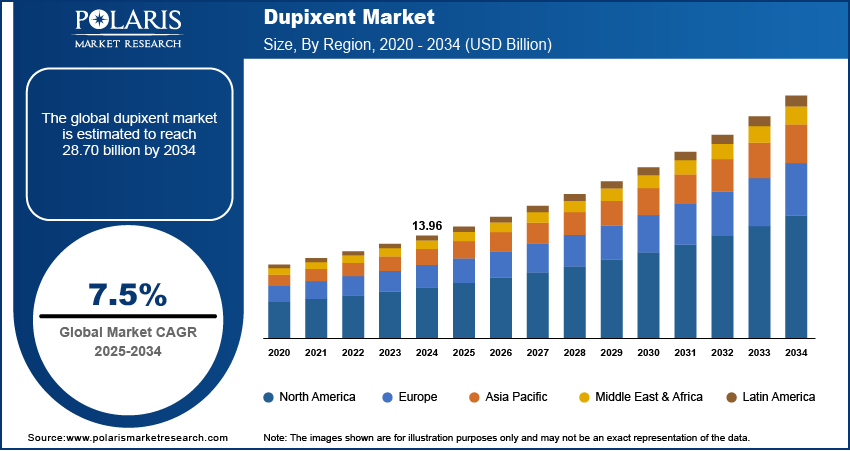

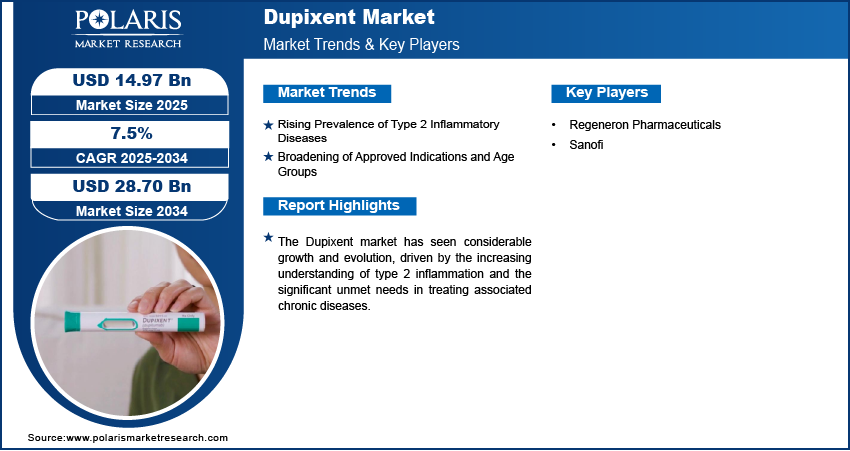

The global Dupixent market size was valued at USD 13.96 billion in 2024 and is anticipated to register a CAGR of 7.5% from 2025 to 2034. The demand for Dupixent is primarily driven by the increasing prevalence of chronic inflammatory conditions such as atopic dermatitis, asthma, and chronic rhinosinusitis with nasal polyps.

Key Insights:

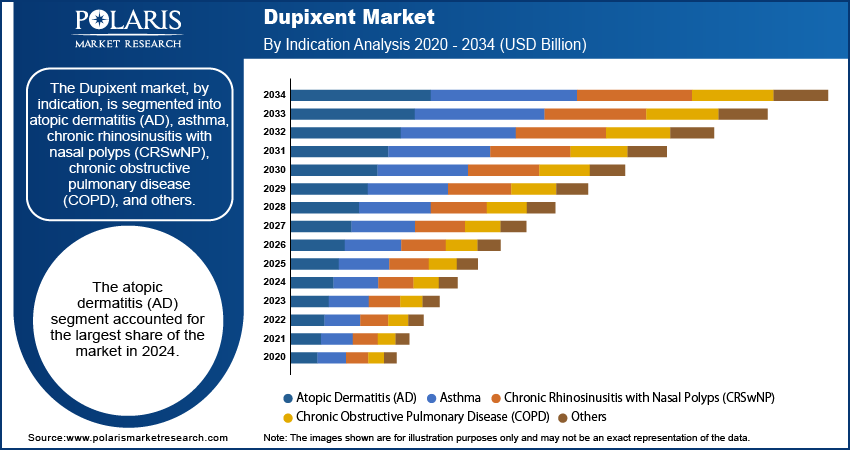

- By indication, the atopic dermatitis (AD) segment held the largest share in 2024. Its widespread prevalence and Dupixent's established efficacy in treating moderate-to-severe forms of this chronic skin condition have ensured its leading position.

- By distribution channel, the hospital pharmacies segment held the largest share in 2024. This is primarily because Dupixent, as a specialized biologic, often requires initial administration or close monitoring in a hospital setting.

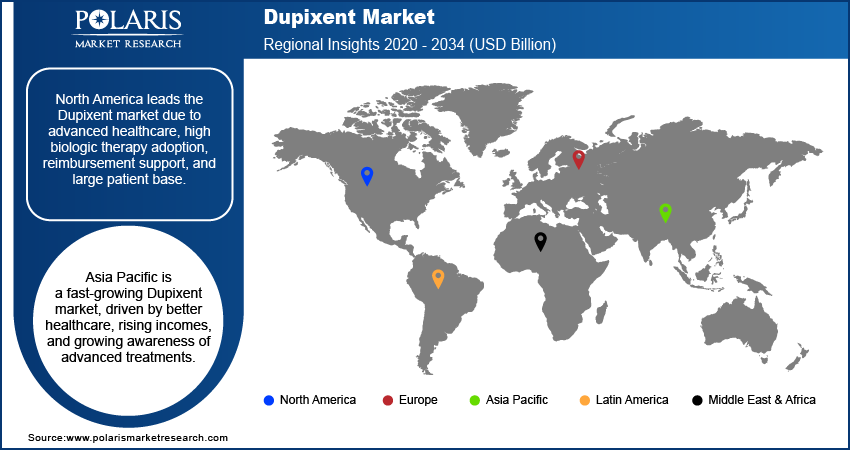

- By region, North America is leading the industry driven by its advanced healthcare infrastructure, high awareness and acceptance of innovative biologic therapies.

- Asia Pacific is rapidly emerging as a dynamic and high-growth region for the global market. This growth is propelled by several factors, including improving healthcare infrastructure, rising disposable incomes, and increasing awareness of advanced treatment options for chronic inflammatory diseases.

To Understand More About this Research: Request a Free Sample Report

The market includes the development, production, and sale of dupilumab, a biologic medication. It is primarily used to treat inflammatory conditions such as atopic dermatitis, asthma, chronic rhinosinusitis with nasal polyps, eosinophilic esophagitis, and prurigo nodularis. The market also covers the entire ecosystem from pharmaceutical companies to healthcare providers and the patients who receive this therapy.

A significant driver of the market growth is its ability to address substantial unmet medical needs in various inflammatory conditions where existing treatments are inadequate or carry significant side effects. Many patients with moderate-to-severe atopic dermatitis, severe asthma, or chronic rhinosinusitis with nasal polyps continue to experience debilitating symptoms despite conventional therapies or asthma treatment, leading to a poor quality of life. Dupixent offers a targeted approach that directly inhibits key drivers of type 2 inflammation, providing a more effective and often better-tolerated option for these individuals. This includes expanding into rarer or more challenging patient populations.

The favorable patient adherence associated with Dupixent, partly due to its convenient administration and improved safety profile compared to some older systemic therapies, is a key market driver. For chronic conditions, a treatment's long-term success heavily relies on patients consistently taking their medication as prescribed. Dupixent's subcutaneous injection, which can often be self-administered at home after initial training, offers a level of convenience that can enhance adherence compared to therapies requiring frequent clinic visits or having more burdensome side effects. High adherence rates lead to better clinical outcomes, which, in turn, reinforces prescriber confidence and encourages broader adoption.

Pipeline Analysis

The research and development strategy for Dupixent continues to focus on expanding its label across a range of inflammatory and immune-mediated conditions. Ongoing clinical trials target indications such as chronic prurigo nodularis, chronic obstructive pulmonary disease (COPD) with type 2 inflammation, and chronic sinusitis without nasal polyps. These studies represent an effort to move beyond Dupixent’s established indications in atopic dermatitis, asthma, and eosinophilic esophagitis, thereby widening its therapeutic footprint.

A major development includes late-stage trials in COPD, a significant area of unmet need. Phase 3 trials showed promising results in reducing exacerbations in a subset of COPD patients with high type 2 inflammation, potentially unlocking a large and previously untapped market. Simultaneously, pediatric studies in atopic dermatitis and asthma aim to extend Dupixent's use to younger populations, which could further strengthen its presence in chronic disease management.

Sanofi and Regeneron are investing in exploring Dupixent’s role in rare diseases such as eosinophilic gastritis and food allergies. These efforts diversify the product’s indication base and position Dupixent in markets with limited treatment options and high pricing flexibility. If approved, these new indications could drive long-term revenue growth and delay biosimilar erosion. Real-world data collection and health economic studies continue to reinforce Dupixent’s value proposition, supporting reimbursement and formulary access through 2033.

Market Concentration and Characteristics

Sanofi and Regeneron consistently expand clinical footprint of Dupixent. The successful LIBERTY-CSU CUPID trial and subsequent FDA approval for chronic spontaneous urticaria in 2025 mark a key milestone. Additional studies targeting pediatric populations and rare immunological disorders, such as bullous pemphigoid and eosinophilic gastritis, continue to broaden the eligible patient base. Dupixent’s dual inhibition of IL-4 and IL-13 distinguishes it mechanistically from other biologics in the Type 2 inflammation space. Real-world evidence strengthens its clinical credibility and position. The product's consistent expansion into high-burden, underserved indications supports its therapeutic value and long-term relevance.

High entry barriers define the biologics in which Dupixent competes. Research and development expenditures for monoclonal antibodies often exceed $1–2 billion, discouraging smaller firms from entering. Dupixent production process is complex, as it requires cGMP-compliant facilities, stringent cold-chain logistics, and significant scale. Regulatory requirements add further hurdles—extensive clinical trials and post-approval surveillance extend time-to-market and increase risk. With patent protection secured until 2033 in key areas such as the U.S. and Japan, the threat from biosimilars remains low. In addition, established distribution channels and provider confidence in Dupixent’s efficacy and safety profile reinforce the dominant position of Sanofi and Regeneron.

Regulatory factors play a crucial role in shaping Dupixent’s trajectory. Approvals by the FDA and EMA rely on robust clinical datasets, ensuring safety while delaying time-to-market. For instance, the 2024 approval in bullous pemphigoid followed multiple successful trials and post-trial evaluations. Orphan drug designations in rare diseases offer exclusivity extensions and tax credits, making such expansions commercially attractive. In Europe, strict health technology assessments require demonstrated cost-effectiveness for favorable pricing and reimbursement. Global alignment in regulatory pathways and increased reliance on real-world evidence may accelerate approvals and broaden access, especially in emerging areas.

Substitution risk for Dupixent remains low due to its unique mechanism of action and broad indication coverage. Common alternatives such as corticosteroids or topical therapies do not provide systemic control, especially in severe Type 2 inflammatory conditions. Other biologics such as tralokinumab and lebrikizumab target only IL-13 and demonstrate narrower efficacy. In asthma, conventional inhaled therapies are insufficient for patients having persistent eosinophilic inflammation. While bispecific antibodies are under investigation, most remain in early-phase development. Dupixent's robust clinical performance across indications and age groups minimizes the current threat from substitutes.

Industry Dynamics

- The rising prevalence of various type 2 inflammatory diseases globally is significantly increasing the requirement for effective treatment options such as Dupixent.

- The continuous broadening of Dupixent's approved indications and age groups by regulatory bodies consistently expands its potential patient base and reach.

- There is a high unmet medical need in severe forms of target diseases, and Dupixent provides a crucial therapeutic option where existing treatments are often insufficient.

- Growing awareness among patients and healthcare professionals, combined with improved diagnostic methods for allergic conditions, leads to earlier and more accurate identification of individuals who could benefit from Dupixent.

Rising Prevalence of Type 2 Inflammatory Diseases: The increasing number of people suffering from type 2 inflammatory conditions, such as atopic dermatitis, asthma, and chronic rhinosinusitis with nasal polyps, drives market growth. These chronic and often debilitating diseases affect a large population globally, creating a substantial demand for effective and targeted treatments.

The International Eczema Council's "Global Report on Atopic Dermatitis 2022" highlights that approximately 223 million people were suffering from atopic dermatitis in 2022, with a strikingly high prevalence in young children, including around 43 million aged 1–4. This widespread and increasing prevalence of atopic dermatitis and other type 2 inflammatory conditions strongly drives the demand for innovative therapies such as Dupixent.

Broadening of Approved Indications and Age Groups: The continuous expansion of Dupixent's approved uses to manage more inflammatory conditions and treat a wider range of patient age groups plays a crucial role in its expansion. Each new approval opens up the treatment to a larger segment of the patient population, increasing its overall potential. This strategic approach allows the drug to address a broader spectrum of unmet needs within the inflammatory disease landscape.

A recent instance of this expansion is the U.S. FDA's approval of Dupixent for the treatment of adult patients with bullous pemphigoid (BP) on June 20, 2025, as reported by Sanofi's press release. Additionally, Dupixent received FDA approval for chronic spontaneous urticaria (CSU) in patients aged 12 years and above on April 18, 2025, as noted in the article "FDA Approves Dupilumab (Dupixent) for Chronic Spontaneous Urticaria" published on HCPLive. These new approvals, alongside existing ones for atopic dermatitis and asthma in various age groups, significantly broaden Dupixent's reach and contribute to its strong demand.

Segmental Insights

Indication Analysis

Based on indication, the segmentation includes atopic dermatitis (AD), asthma, chronic rhinosinusitis with nasal polyps (CRSwNP), chronic obstructive pulmonary disease (COPD), and others. The atopic dermatitis (AD) segment held the largest share in 2024. This dominance is attributed to Dupixent's established efficacy and early approval in treating moderate-to-severe forms of this chronic inflammatory skin condition. Many AD patients experience persistent itching, painful skin lesions, and a significant impact on their quality of life, making the availability of an effective biologic therapy such as Dupixent highly valuable. The widespread prevalence of atopic dermatitis across different age groups, including children, adolescents, and adults, has created a substantial patient population seeking advanced treatment options. This foundational use in AD has cemented its leading position within the overall landscape, continuing to drive significant revenue.

The chronic obstructive pulmonary disease (COPD) segment is anticipated to register the highest growth rate during the forecast period. This projected rapid expansion is primarily attributed to the recent and impactful regulatory approvals for Dupixent in treating a specific subset of COPD patients characterized by type 2 inflammation. COPD is a widespread and progressive lung disease, and the introduction of a targeted biologic such as Dupixent for patients who have not adequately responded to conventional therapies represents a major therapeutic advancement. This unmet need in a large patient population, coupled with the novelty of Dupixent's mechanism of action for COPD, is expected to fuel a steep increase in adoption and penetration for this indication.

Distribution Channel Analysis

Based on distribution channel, the segmentation includes hospital pharmacies, retail pharmacies, and others. The hospital pharmacies segment held the largest share in 2024, largely due to the nature of Dupixent. Being a specialty biologic medication, it is often prescribed for severe and complex inflammatory conditions such as severe asthma or atopic dermatitis that may require initial administration or close monitoring in a hospital setting. Healthcare professionals in hospitals are well-equipped to handle the specific storage and administration requirements of biologic drugs, and they play a crucial role in educating patients on self-administration for ongoing treatment. Furthermore, many patients suffering from severe chronic conditions receive their initial diagnosis and treatment plan within hospital systems, making hospital pharmacies a natural first point of contact for obtaining such specialized medications.

The retail pharmacies segment is anticipated to register the highest growth rate during the forecast period. This projected rise is driven by several factors such as the increasing familiarity of patients and healthcare providers with Dupixent's long-term use and self-administration. As more patients transition from initial hospital-based care to managing their conditions at home, the convenience and accessibility offered by retail pharmacies become increasingly important. Additionally, the expansion of specialty pharmacy services within retail chains enables the proper handling and dispensing of complex biologic medications while providing necessary patient support, education, and adherence programs.

Regional Analysis

The North America Dupixent market accounted for the largest share in 2024, largely due to its advanced healthcare infrastructure, high awareness of innovative biologic therapies, and a substantial patient population suffering from type 2 inflammatory diseases. Favorable reimbursement policies and strong penetration strategies by the drug's manufacturers have also contributed to its widespread adoption across the region. The early and broad regulatory approvals for Dupixent to manage multiple indications, such as atopic dermatitis and asthma, across various age groups have allowed for rapid uptake. This region continues to be a key revenue generator due to strong prescribing patterns and patient access initiatives.

U.S. Dupixent Market Insight

In North America, the U.S. dominated the industry in 2024. The sheer volume of patients diagnosed with conditions such as atopic dermatitis, asthma, and chronic rhinosinusitis with nasal polyps, coupled with a healthcare system that generally supports access to advanced biologic treatments, drives this leading position. The U.S. FDA continues to approve Dupixent for an expanding range of indications, such as its approval for bullous pemphigoid in adults on June 20, 2025, as stated in a press release by Sanofi. The continuous expansion of approved uses and aggressive marketing efforts ensure high product visibility and physician prescribing confidence, making the U.S. a crucial hub for Dupixent's global performance.

Europe Dupixent Market

Europe represents a substantial and evolving market for Dupixent, driven by the high prevalence of allergic and inflammatory diseases across various European countries. The increasing diagnosis rates for conditions such as moderate-to-severe atopic dermatitis and severe asthma contribute to a steady demand for effective biologic treatments. Regulatory bodies, such as the European Medicines Agency (EMA), have consistently approved Dupixent for new indications and age groups, expanding its therapeutic reach within the region. This allows for broader patient access and supports the drug's continued demand across diverse healthcare systems and reimbursement landscapes found throughout Europe.

The Germany Dupixent market stands out as a major contributor in Europe. This is attributed to its robust healthcare system, high healthcare spending, and a strong emphasis on providing advanced medical treatments to its population. The country has a significant patient pool for Dupixent's approved indications, and the medical community actively adopts innovative therapies. The European Commission approved Dupixent as an add-on maintenance treatment for adults having uncontrolled chronic obstructive pulmonary disease (COPD) characterized by raised blood eosinophils on July 3, 2024, as announced by Regeneron Pharmaceuticals Inc. This broadens the treatable population in countries such as Germany, further solidifying its importance.

Asia Pacific Dupixent Market Overview

Asia Pacific is rapidly emerging as a dynamic and high-growth region for the market. This growth is propelled by several factors, including improving healthcare infrastructure, rising disposable incomes, and increasing awareness of advanced treatment options for chronic inflammatory diseases. As diagnostic capabilities improve and access to specialized care expands, more patients are being identified and treated with biologic therapies such as Dupixent. Furthermore, the region's large population base, coupled with a rising prevalence of allergic conditions in many countries, presents a significant untapped potential for expansion.

Japan Dupixent Market Insights

Japan is a key country demonstrating strong market performance for Dupixent. Japan has a well-developed healthcare system and a high adoption rate of innovative medicines. The drug has received multiple regulatory approvals for various indications in Japan. It is the first country globally to approve Dupixent for chronic spontaneous urticaria (CSU) in patients aged 12 years and above, as reported by Regeneron Pharmaceuticals Inc. on February 16, 2024. This early and broad approval, combined with a significant patient population suffering from allergic and inflammatory diseases, underpins Japan's strong contribution to Dupixent's presence and growth.

Key Players and Competitive Insights

Sanofi and Regeneron lead the Dupixent market through a strategic partnership that drives clinical development and global expansion. Their collaborative efforts focus on expanding indications, with recent FDA approvals for bullous pemphigoid and chronic spontaneous urticaria in 2025, supported by trials such as LIBERTY-CSU CUPID. Investments in real-world evidence and pediatric formulations enhance Dupixent’s penetration across North America, Europe, and Asia Pacific. Patient access programs and flexible pricing strategies address cost barriers in emerging areas such as Latin America and the Middle East & Africa. The partnership’s robust distribution networks and regulatory expertise ensure rapid access, positioning Dupixent as a leader in interleukin inhibitors.

Prominent companies in the industry include Sanofi and Regeneron Pharmaceuticals.

Key Players

Industry Developments

June 2025: The U.S. Food and Drug Administration (FDA) approved Dupixent for the treatment of adult patients suffering from bullous pemphigoid, making it the only targeted medicine for this condition.

February 2025: Sanofi and Regeneron announced that the FDA had accepted a supplemental Biologics License Application (sBLA) for Dupixent in the treatment of bullous pemphigoid under priority review, expediting the approval process. The submission was supported by Phase 3 trial data demonstrating notable improvements in disease management, further strengthening Dupixent’s regulatory trajectory.

Dupixent Market Segmentation

By Indication Outlook (Revenue – USD Billion, 2020–2034)

- Atopic Dermatitis (AD)

- Asthma

- Chronic Rhinosinusitis with Nasal Polyps (CRSwNP)

- Chronic Obstructive Pulmonary Disease (COPD)

- Others

By Distribution Channel Outlook (Revenue – USD Billion, 2020–2034)

- Hospital Pharmacies

- Retail Pharmacies

- Others

By Regional Outlook (Revenue – USD Billion, 2020–2034)

- North America

- U.S.

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- Suth Korea

- Indnesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- Suth Africa

- Rest of Middle East & Africa

- Latin America

- Mexic

- Brazil

- Argentina

- Rest of Latin America

Dupixent Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 13.96 billion |

|

Market Size in 2025 |

USD 14.97 billion |

|

Revenue Forecast by 2034 |

USD 28.70 billion |

|

CAGR |

7.5% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Insights |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 13.96 billion in 2024 and is projected to grow to USD 28.70 billion by 2034.

The global market is projected to register a CAGR of 7.5% during the forecast period.

North America dominated the market share in 2024.

Key players in the market include Sanofi and Regeneron Pharmaceuticals.

The atopic dermatitis (AD) segment accounted for the largest share of the market in 2024.

The retail pharmacies segment is expected to witness the fastest growth during the forecast period.