CDMO Orthopedic Market Size, Share, Trends, Industry Analysis Report

By Service Type (Development Services, Manufacturing Services, Others), By Device Type, By Material Type, By Application, By Region – Market Forecast, 2025–2034

- Published Date:Jul-2025

- Pages: 129

- Format: PDF

- Report ID: PM5996

- Base Year: 2024

- Historical Data: 2020-2023

Overview

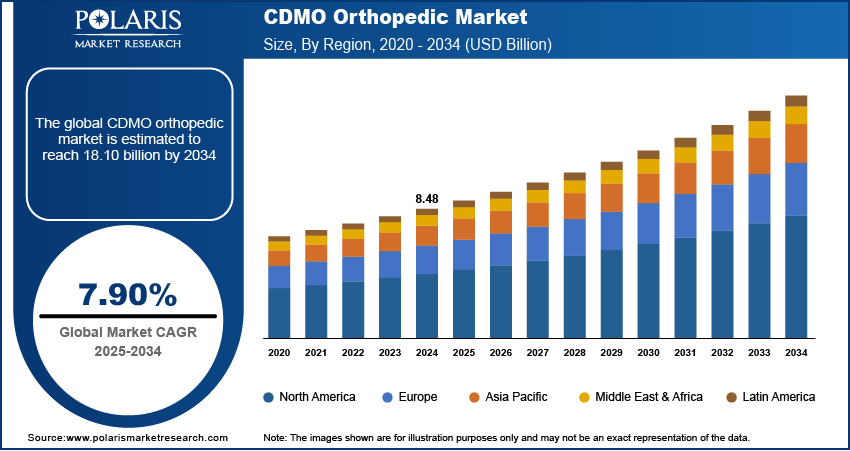

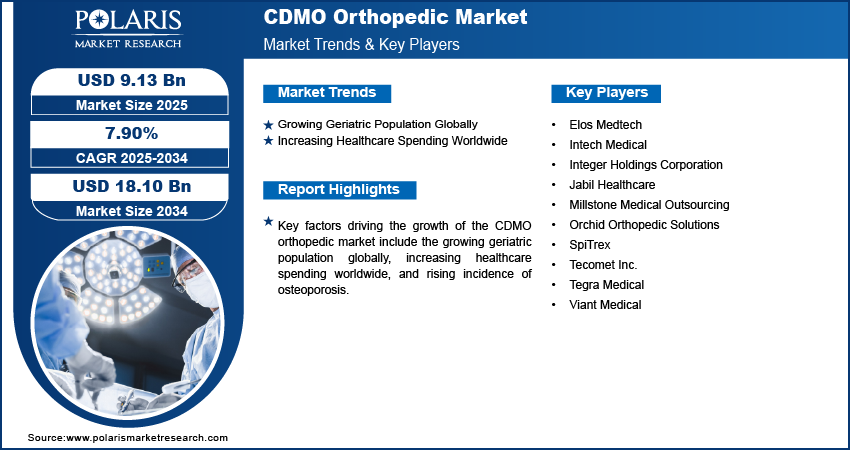

The global CDMO orthopedic market size was valued at USD 8.48 billion in 2024, growing at a CAGR of 7.90% from 2025 to 2034. Key factors driving market growth include growing geriatric population globally, increasing healthcare spending worldwide, and rising incidence of osteoporosis.

Key Insight

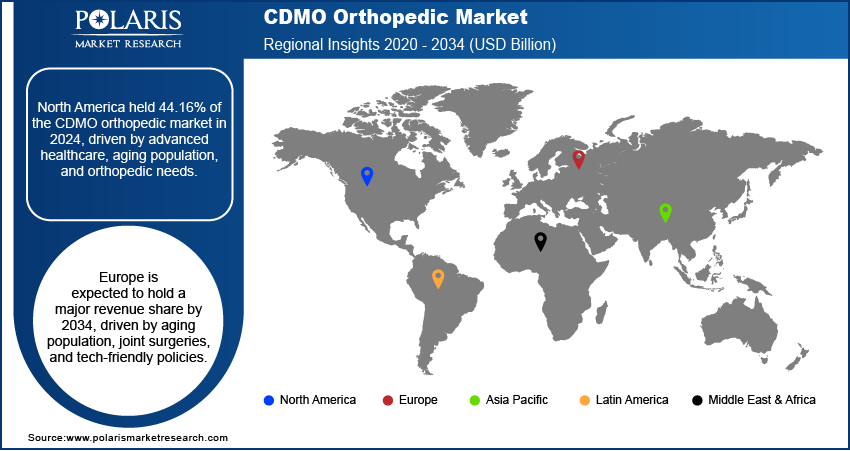

- North America CDMO orthopedic market accounted for 44.16% of global market share in 2024.

- The U.S. dominated the North American CDMO orthopedic landscape in 2024.

- The development services segment held the largest revenue share in 2024.

- The joint reconstruction segment held the largest revenue share in 2024.

- The market in Europe is projected to hold a substantial revenue share in 2034 due to an aging population, rising joint replacement surgeries, and government support for advanced medical technologies.

- Germany is a major hub for orthopedic CDMO demand. The country’s strong medical technology sector, combined with a high volume of knee and hip replacements, supports the need for outsourced manufacturing.

A contract development and manufacturing organization (CDMO) in orthopedics is a specialized partner that provides comprehensive services spanning the entire lifecycle of orthopedic medical devices, including implants, surgical instruments, and related components. Unlike traditional contract manufacturers, which focus solely on production, CDMOs offer integrated solutions that begin at the concept and design phase, move through prototyping and regulatory preparation, and extend to final manufacturing, packaging, and post-market support. This model allows orthopedic device companies to leverage the CDMO’s deep expertise in engineering, materials science, regulatory compliance, and advanced manufacturing technologies.

The demand for CDMO services in the orthopedic sector is driven by various factors such as the aging global population, rising prevalence of musculoskeletal disorders, and increasing need for personalized and minimally invasive solutions. CDMOs play a pivotal role in helping companies respond to these needs by offering scalable production, rapid prototyping, and the ability to integrate new technologies, such as 3D printing and robotic-assisted surgery tools. The services of CDMOs are especially valuable in navigating stringent regulatory requirements, optimizing material selection, and ensuring cost-effective, high-quality output. Furthermore, CDMOs often act as strategic partners, sharing risks and rewards with OEMs, and providing flexible capacity to address fluctuations in demand or supply chain disruptions.

The CDMO orthopedic market demand is driven by the rising incidence of osteoporosis worldwide. The International Osteoporosis Foundation, in its report, stated that osteoporosis is estimated to affect 200 million women globally, approximately one-tenth of women aged 60. Osteoporosis is creating the need for effective orthopedic treatments, implants, and surgical solutions. This is driving pharmaceutical and medical device companies to rely on CDMOs to develop and manufacture specialized orthopedic implants, such as bone grafts, joint replacement devices, and fracture fixation devices, to address this surge in demand. Additionally, the growing prevalence of osteoporosis-related fractures is pushing healthcare systems to seek cost-effective and efficient manufacturing partners, further driving the expansion of the CDMO orthopedic market.

Industry Dynamics

- Growing geriatric population globally is propelling the market growth by fueling pharmaceutical and medical device companies to rely on CDMOs to develop and manufacture orthopedic implants for geriatric people.

- Increasing healthcare spending worldwide is boosting the demand for CDMO orthopedic services by expanding access to advanced treatments and enhancing patient care, particularly in orthopedic and musculoskeletal therapies.

- Rising focus of OEMs on their core competencies is creating a lucrative market opportunity.

- Loss of direct control over production and intellectual property (IP) is hindering pharmaceutical and medical device companies from taking CDMO orthopedic services.

Growing Geriatric Population Globally: Geriatric people usually face a higher risk of musculoskeletal disorders, such as osteoarthritis, osteoporosis, and joint degeneration, increasing the need for orthopedic implants, joint replacements, and mobility aids. This is fueling pharmaceutical and medical device companies to rely on CDMOs to develop and manufacture orthopedic implants. The World Health Organization, in its report, stated that by 2030, 1 in 6 people in the world will be aged 60 years and above. Additionally, the rising demand for minimally invasive surgical techniques and innovative orthopedic devices, driven by the increasing geriatric population, is pushing healthcare providers to collaborate with CDMOs for efficient, cost-effective production. This demographic shift ensures that CDMO orthopedic services remain essential in meeting the healthcare needs of an aging global population.

Increasing Healthcare Spending Worldwide: Governments and private healthcare systems are allocating larger budgets to improve medical infrastructure, expand access to advanced treatments, and enhance patient care, particularly in orthopedic and musculoskeletal therapies, which is driving the demand for CDMO services in orthopedics. Additionally, higher healthcare spending supports the adoption of advanced technologies such as 3D-printed implants and personalized orthopedic devices, further increasing reliance on specialized CDMOs. This financial commitment to healthcare ensures sustained growth in demand for CDMO orthopedic expertise.

Segmental Insights

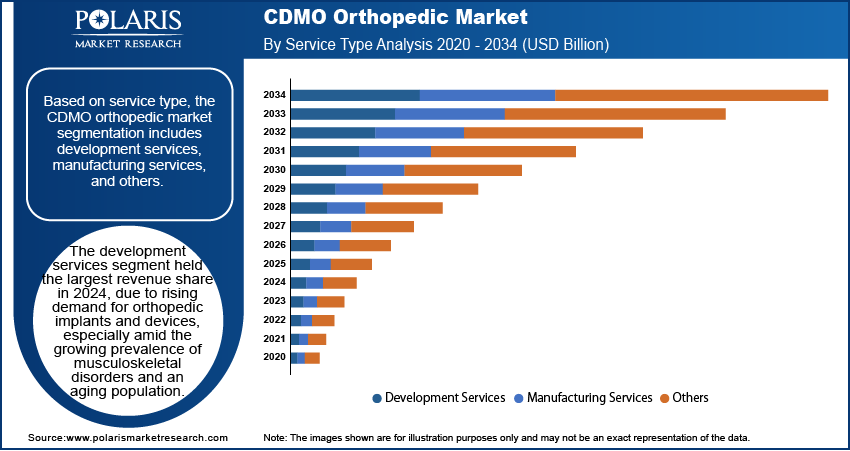

Service Type Analysis

Based on service type, the segmentation includes development services, manufacturing services, and others. The development services segment held the largest revenue share in 2024 due to rising demand for orthopedic implants and devices, especially amid the growing prevalence of musculoskeletal disorders and an aging population. Medical device companies increasingly outsourced production to CDMOs to reduce operational costs, streamline time-to-market, and leverage advanced manufacturing technologies such as additive manufacturing and computer numerical control (CNC) machines. Additionally, the imposition of stringent regulatory standards and the rising need for validated, high-quality output prompted many OEMs to rely on specialized manufacturing partners for development services.

Device Type Analysis

In terms of device type, the segmentation includes orthopedic implants, orthopedic instruments, and orthobiologics. The orthopedic implants segment dominated the market share in 2024, due to the rising incidence of orthopedic conditions such as osteoarthritis, traumatic fractures, and degenerative disc disorders, particularly among the elderly. Medical device companies increasingly partner with CDMOs to access precision engineering capabilities, regulatory expertise, and rapid prototyping services necessary for producing complex implants such as hip, knee, and spinal devices. The growing emphasis on minimally invasive surgeries and personalized implant solutions also fueled the outsourcing of implant manufacturing to reduce turnaround times and ensure high-quality outcomes.

The orthobiologics segment is projected to grow at a robust pace in the coming years, owing to the rising interest in regenerative medicine approaches that promote natural healing of bones and tissues. Orthobiologics, including bone graft substitutes, platelet-rich plasma (PRP), and stem cell-based materials, are gaining traction in both trauma and sports medicine applications. The demand for specialized facilities and stringent quality controls in biologics production is expected to continue driving outsourcing in the segment, particularly as regulatory pathways for these advanced therapies become more streamlined.

Material Type Analysis

In terms of material type, the segmentation includes metallic, polymeric, and others. The metallic segment accounted for a major revenue share in 2024 due to widespread use of metals such as titanium alloys, stainless steel, and cobalt-chromium in the production of orthopedic implants such as joint replacements, fixation plates, and spinal devices. These materials offer exceptional strength, durability, and biocompatibility, making them ideal for load-bearing applications. The growing adoption of additive manufacturing for custom metallic implants further accelerated the segment’s growth.

Application Analysis

In terms of application, the segmentation includes joint reconstruction, spinal surgery, trauma & fracture repair, and others. The joint reconstruction segment held the largest revenue share in 2024 due to the rising number of hip and knee replacement surgeries globally, driven by an aging population, increasing obesity rates, and a higher prevalence of osteoarthritis. Medical device companies rely heavily on CDMOs to support the development and production of advanced joint implants that comply with stringent performance, regulatory, and customization standards. The demand for high-precision components, including femoral stems, acetabular cups, and tibial trays, pushed OEMs to outsource both design and manufacturing to partners with expertise in complex geometries, wear-resistant materials, and surface modification technologies. Additionally, the adoption of robotic-assisted surgical systems and patient-specific instrumentation increased the need for agile and technologically equipped manufacturing partners.

The spinal surgery segment is projected to grow at a robust pace in the coming years, owing to the growing incidence of degenerative disc diseases, spinal deformities, and trauma-related spine injuries, coupled with advancements in minimally invasive and motion-preserving spinal procedures. Companies developing interbody fusion devices, pedicle screw systems, and dynamic stabilization implants increasingly seek CDMOs with capabilities in biologic integration, polymer-metal hybrid constructs, and sterilization validation. The shift toward outpatient spinal procedures and personalized implant solutions further intensifies the demand for rapid development cycles and scalable manufacturing, positioning the spinal surgery segment for sustained growth in outsourced orthopedic solutions.

Regional Analysis

The North America CDMO orthopedic market accounted for 44.16% of global market share in 2024. This dominance is attributed to the region's advanced healthcare infrastructure, high prevalence of orthopedic disorders, and an aging population requiring joint replacements and spinal surgeries. Additionally, the presence of major medical device companies and a strong focus on innovation in orthopedic implants and biologics fueled outsourcing to CDMOs for specialized manufacturing, regulatory expertise, and cost efficiencies. The U.S. FDA’s stringent regulatory environment also encouraged companies to partner with experienced CDMOs to produce orthopedic implants and ensure compliance.

U.S. CDMO Orthopedic Market Insight

The U.S. dominated the North American CDMO orthopedic landscape in 2024, driven by increasing demand for personalized and minimally invasive surgical solutions, as well as a surging outpatient orthopedic procedures. The rise of value-based care and the need for cost-effective manufacturing pushed medical device firms in the country to outsource production to CDMOs. Furthermore, advancements in 3D printing, robotic-assisted surgeries, and biocompatible materials propelled the need for specialized CDMO services. The U.S. also witnessed high R&D investments in orthobiologics and smart implants, further boosting CDMO partnerships.

Europe CDMO Orthopedic Market Trends

The market in Europe is projected to hold a substantial revenue share in 2034, due to an aging population, rising joint replacement surgeries, and government support for advanced medical technologies. The EU’s Medical Device Regulation (MDR) has increased compliance complexities, prompting orthopedic companies to rely on CDMOs with regulatory expertise. Countries such as Germany, France, and the UK are key contributors to the European CDMO orthopedic landscape, due to their well-established healthcare systems and increasing investments in orthopedic innovations.

Germany CDMO Orthopedic Market Overview

Germany is a major hub for orthopedic CDMO demand. The country’s strong medical technology sector, combined with a high volume of knee and hip replacements, supports the need for outsourced manufacturing. Germany’s emphasis on precision engineering and automation in implant production makes it a preferred location for CDMOs offering high-quality, scalable solutions. Additionally, the growing trend toward ambulatory surgical centers (ASCs) and minimally invasive techniques in Germany is increasing demand for specialized orthopedic devices, further driving CDMO growth.

Asia Pacific CDMO Orthopedic Market Outlook

The CDMO Orthopedic industry in Asia Pacific is expected to register the highest CAGR from 2025 to 2034, owing to rising healthcare expenditure, increasing orthopedic surgeries, and expanding medical tourism in countries such as India, China, and South Korea. Lower manufacturing costs and skilled labor make APAC an attractive outsourcing destination for global orthopedic companies. Additionally, the growing middle-class population and improving healthcare infrastructure are boosting demand for joint replacements and trauma devices. Governments in the region are also supporting local manufacturing, encouraging partnerships with CDMOs to enhance production capabilities while meeting international quality standards.

Key Players and Competitive Analysis

The contract development and manufacturing organization (CDMO) orthopedic market is highly competitive, with key players specializing in precision machining, implant manufacturing, and outsourced production of orthopedic devices. Major companies such as Tecomet Inc. and Integer Holdings Corporation dominate the market with their extensive capabilities in metals processing, additive manufacturing, and advanced implant solutions. Tecomet is known for its expertise in surgical instruments and implants, while Integer leverages its strong portfolio in electro-medical components and orthopedic devices. Viant Medical and Orchid Orthopedic Solutions are also major competitors, offering end-to-end contract manufacturing with a focus on joint reconstruction, trauma, and spinal implants.

A few major companies operating in the CDMO orthopedic industry include Elos Medtech, Intech Medical, Integer Holdings Corporation, Jabil Healthcare, Millstone Medical Outsourcing, Orchid Orthopedic Solutions, SpiTrex, Tecomet Inc., Tegra Medical, and Viant Medical.

Key Players

- Elos Medtech

- Intech Medical

- Integer Holdings Corporation

- Jabil Healthcare

- Millstone Medical Outsourcing

- Orchid Orthopedic Solutions

- SpiTrex

- Tecomet Inc.

- Tegra Medical

- Viant Medical

Industry Developments

April 2023: Intech, the company involved in the manufacturing of orthopedic medical devices, released a fully validated system for the U.S. and EU markets that enables a variety of access to the spine for medical device companies and hospitals.

December 2021: Integer Holdings Corporation announced the close of its acquisition of Oscor, Inc., a privately-held company that designs, develops, and manufactures a comprehensive portfolio of highly specialized medical devices, venous access systems and diagnostic catheters, and implantable devices.

March 2023: Millstone Medical Outsourcing, the industry's preferred partner for post-manufacturing and aftermarket services, announced the completion of its cleanroom space expansion.

CDMO Orthopedic Market Segmentation

By Service Type Outlook (Revenue, USD Billion, 2020–2034)

- Development Services

- Manufacturing Services

- Others

By Device Type Outlook (Revenue, USD Billion, 2020–2034)

- Orthopedic Implants

- Orthopedic Instruments

- Orthobiologics

By Material Type Outlook (Revenue, USD Billion, 2020–2034)

- Metallic

- Polymeric

- Others

By Application Outlook (Revenue, USD Billion, 2020–2034)

- Joint Reconstruction

- Spinal Surgery

- Trauma & Fracture Repair

- Others

By Regional Outlook (Revenue, USD Billion, 2020–2034)

- North America

- U.S.

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

CDMO Orthopedic Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 8.48 Billion |

|

Market Size in 2025 |

USD 9.13 Billion |

|

Revenue Forecast by 2034 |

USD 18.10 Billion |

|

CAGR |

7.90% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 8.48 billion in 2024 and is projected to grow to USD 18.10 billion by 2034.

The global market is projected to register a CAGR of 7.90% during the forecast period.

North America dominated the market in 2024.

A few of the key players in the market are Elos Medtech, Intech Medical, Integer Holdings Corporation, Jabil Healthcare, Millstone Medical Outsourcing, Orchid Orthopedic Solutions, SpiTrex, Tecomet Inc., Tegra Medical, and Viant Medical.

The development services segment dominated the market in 2024.

The spinal surgery segment is expected to witness the fastest growth during the forecast period.